- USD/JPY upside may be difficult from here

- The threat of BOJ intervention cannot be ignored

- US bond yields look at or near their peak for the current cycle

- Non-farm payrolls, ISM services PMI likely to generate wild swings in USD/JPY on Friday

The suspected intervention from the Bank of Japan (BOJ) this week has changed the game for USD/JPY, placing a rather large barrier in the way of further upside at a time when US bond yields are looking toppy. As such, the modus operandi of buying dips may need to be put on ice, replaced by a foreign concept for many traders: selling rallies.

Yield differentials still driving USD/JPY moves

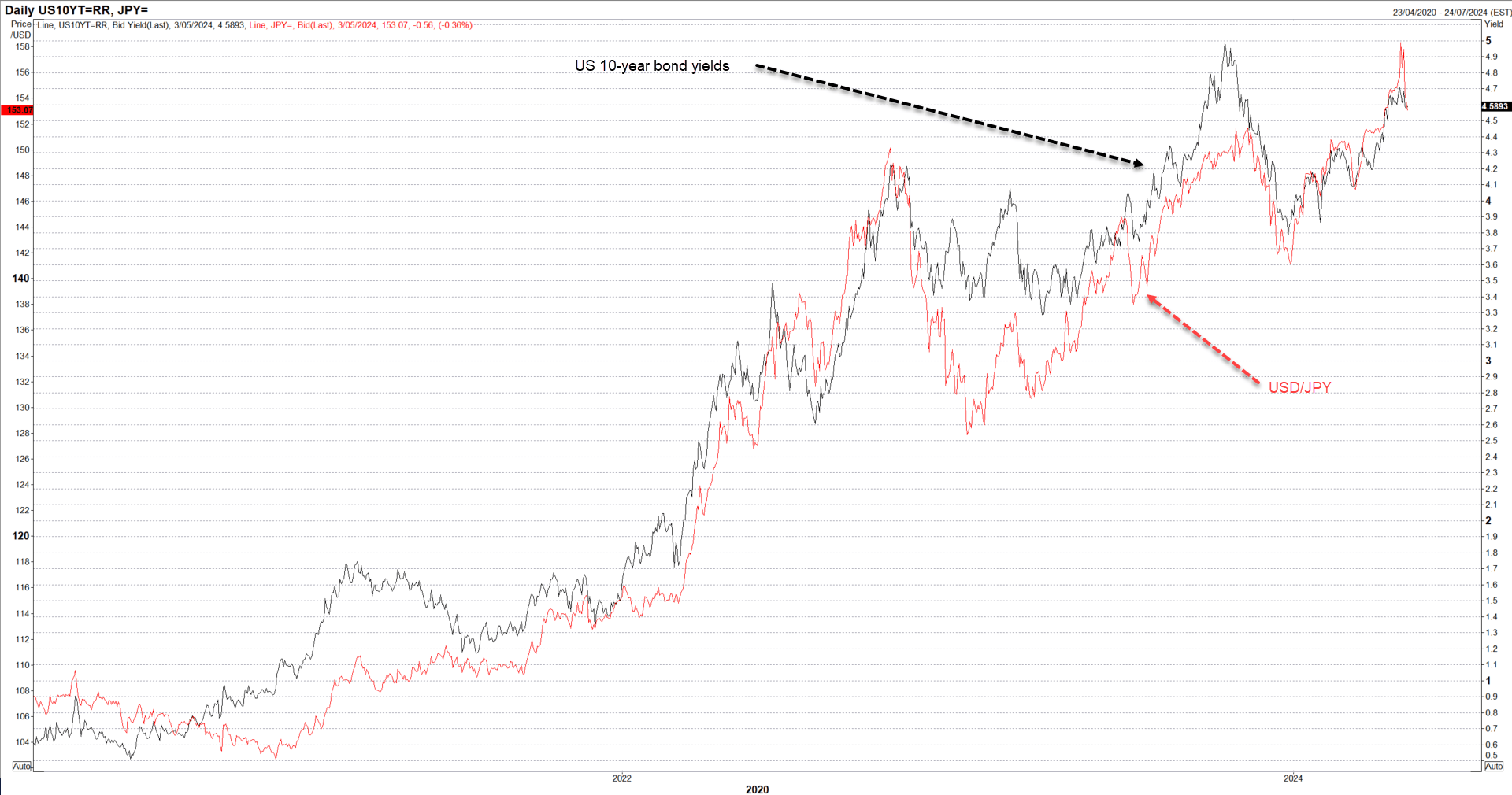

It’s no secret yield differentials play a significant role in determining the Japanese yen’s valuation, encouraging and discouraging capital flows in and out of Japan as spreads widen and contract. With the BOJ expected to increase overnight interest rates by around another 10 basis points this year, limiting movement in bond yields further out the curve, it’s meant the interest rate outlook outside of Japan continues to drive yield spreads,

The gap between US and Japanese bond yields has been no exception with the Fed’s rapid rate increases of 2022 and 2023 seeing spreads across multiple tenors blow out to multi-decade highs, helping to drive USD/JPY to levels not seen since the early 1990s.

Source: Refinitiv

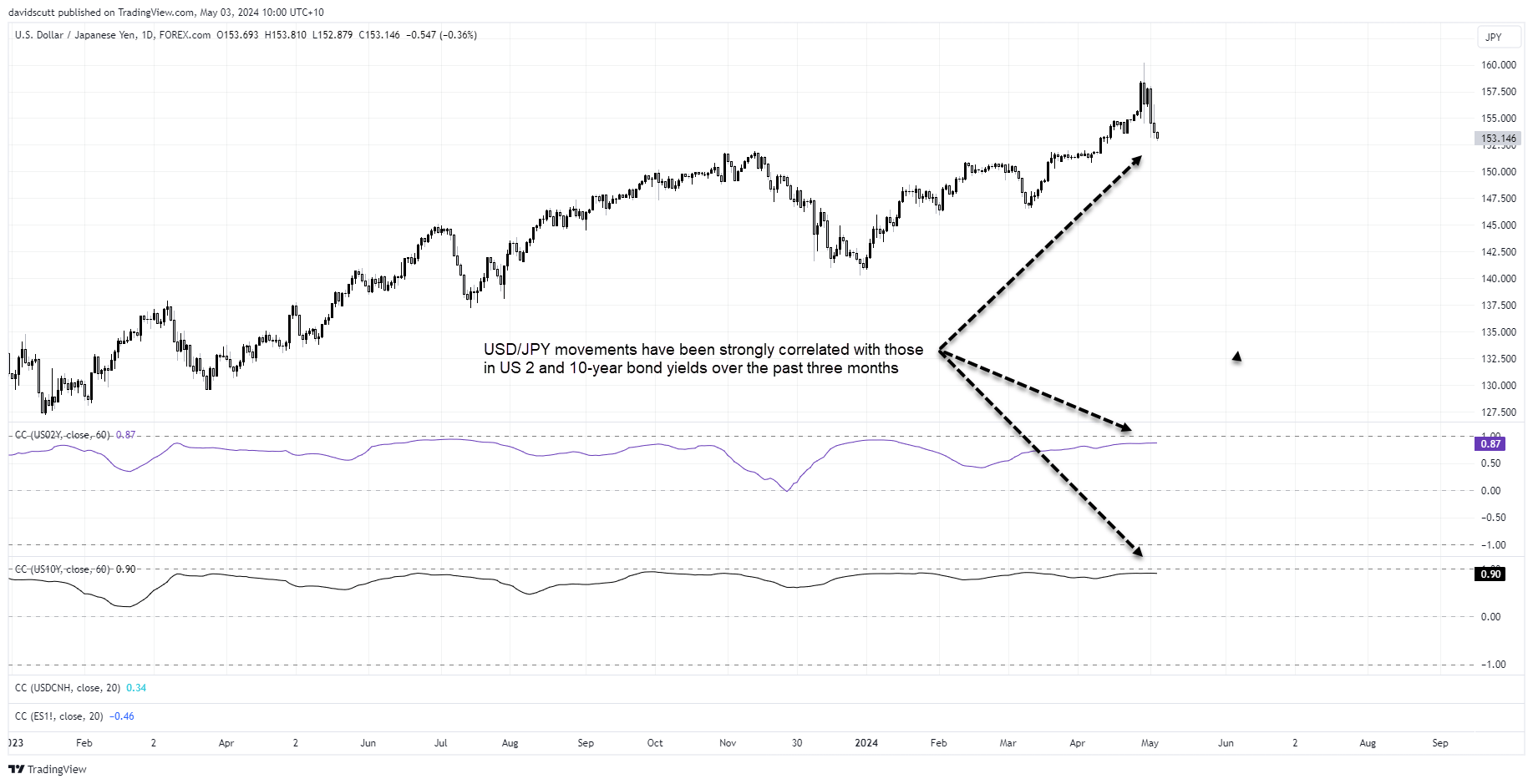

USD/JPY correlation with US yields strengthening

If the chart above wasn’t convincing enough to show how influential US bond yields have been on USD/JPY recently, the chart below will, showing that over the past quarter the rolling daily correlation between USD/JPY with US two and 10-year US bond yields has strengthened to 0.87 and 0.9 respectively. In a nutshell, where US yields move, USD/JPY typically follows.

Just as US two-year yields struggle to hold 5%

That makes the next chart interesting with US two-year bond yields struggling to break and hold above 5%, repeating the same trend seen prior to the GFC in the mid-2000s. Unless the Federal Reserve is forced to lift the funds rate again, it suggests the main factor driving USD/JPY upside may be nearing exhaustion point.

Source: Refinitiv

If yields can’t keep pushing higher in the States, will USD/JPY? The strong positive correlation suggests it will struggle. And that’ before we consider the threat posed by intervention from the BOJ on behalf of Japan’s Ministry of Finance, adding a significant barrier to yen weakness beyond that already seen.

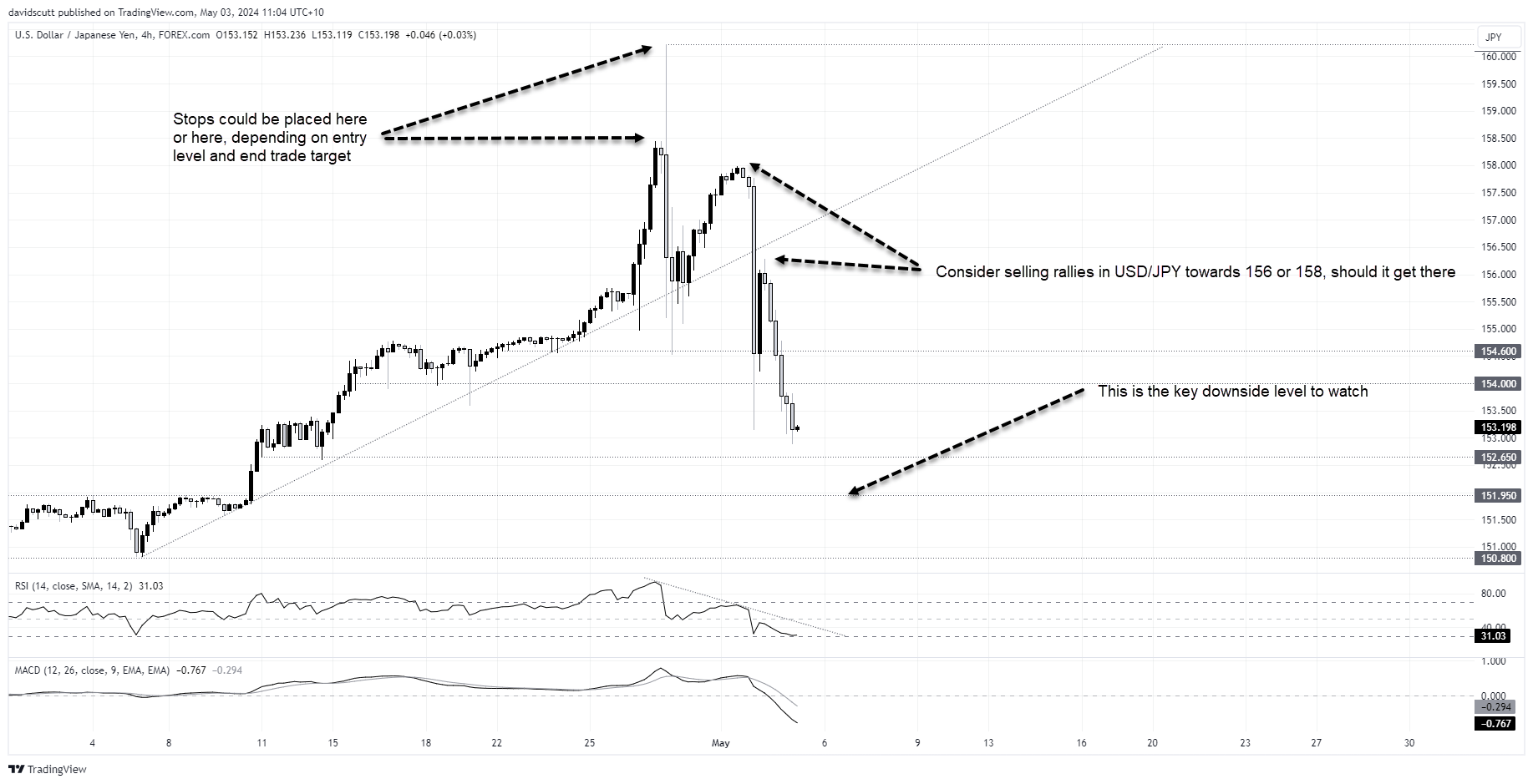

Selling rallies preferred as buying dips ditched

The backdrop of toppy US yields and BOJ intervention threat has changed the game for USD/JPY. Unless you think the Federal Reserve will be forced to start hiking rates again, the case to buy dips has been greatly weakened. Given relative valuations and interest rate risks, selling rallies is now arguably a better strategy, putting the prospect of renewed downside in play.

USD/JPY squeezes becoming progressively smaller

You can see the damage the suspected BOJ intervention episode on Monday did to former trendline supports, decimating level after level like they didn’t exist down to 153. While there have been some big bounces since, what’s noticeable is each topped out at lower levels, fitting with the sell rallies mantra.

For longer-term traders, unless we see US yields climb meaningfully above 5% again, consider selling rallies looking for a retest of former key horizontal resistance just below 152. Potential entry levels include 156 and 158, where USD/JPY squeezes topped out following Monday’s downside flush. Stops could be placed either above 158.50 or 160.25 for protection, depending on entry level.

If the trade target were to be reached, it may pay to see how the price interacts with this key level with a clean break likely to open the door to a far larger downside retracement.

Near-term trade considerations

There are several key US data points released later Friday that could significantly influence US yields and USD/JPY.

In the April non-farm payrolls report, pay particular attention to the unemployment rate and average hourly earnings as these are the key areas Fed policymakers will be watching when it comes to the inflation outlook.

While it won’t receive the same degree of media coverage, don’t discount the importance of the ISM non-manufacturing PMI released after the payrolls report. The separate services PMI released by S&P Global last week had a meaningful impact on US rates and dollar, revealing an unexpected slowdown in activity. Should the more impactful ISM survey confirm those findings, it could lead to broad declines in US yields and greenback.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade