- USD/JPY and US bond yields have been rising in 2024

- USD/JPY surged last week despite US bond yields remaining relatively stable

- The government’s reaction function to the divergent moves provides a big hint on what may prompt additional BOJ yen intervention

Warnings on speculative moves had been in the price for months

Japanese officials had been warning for months that speculative moves in the Japanese yen would not be tolerated without elaborating on what exactly constituted a ‘speculative’ move. However, following the suspected intervention from the Bank of Japan on Monday – the first episode during Asian trading hours since the global financial crisis in 2008 – we now have a far better understanding of what may prompt Japan’s Ministry of Finance to give the green light again.

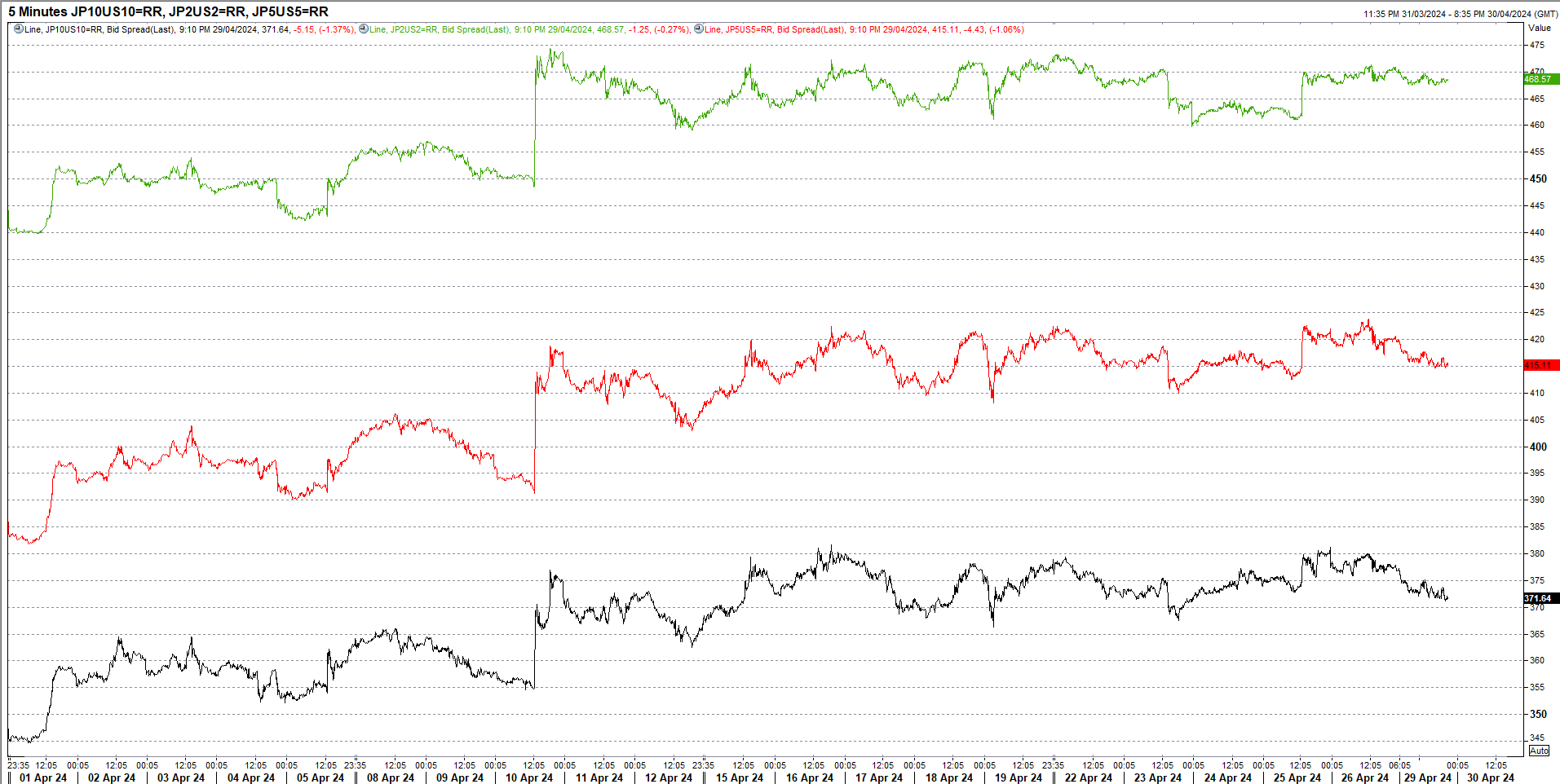

US bond yields, USD/JPY have been strongly correlated in 2024

Rather than levels, what made the runup to the latest intervention episode different was that it was not accompanied by similar moves in key market drivers of the yen. When we say key drivers, what we’re referring to is US bond yields.

Over the past quarter, USD/JPY had a rolling daily correlation with US two-year bond yields of 0.87. The relationship with US 10-year bond yields was even stronger at 0.91, indicating the vice-like grip Federal Reserve interest rate expectations had on USD/JPY during this period. When Fed rate cut expectations were pared back, USD/JPY typically rallied.

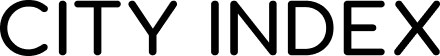

US bond yields have been relatively stable for weeks

Prior to Monday’s suspected intervention episode, there was not discernable shift in yield differentials between the United States and Japan with the gap between the two, five and 10-year bonds sitting at 467, 415 and 371 basis points respectively, around the same levels they had been trading dating back to April 10.

Source: Refinitiv

USD/JPY surged 800 pips despite this

Despite no major shift in rates markets, USD/JPY was surging, adding 800 pips over the same period, 500 of which came in less than 24 hours of trade prior to the suspected intervention episode which saw USD/JPY traded volume explode to multiples of average daily turnover on EBS despite a public holiday in Japan.

Source: Refinitiv

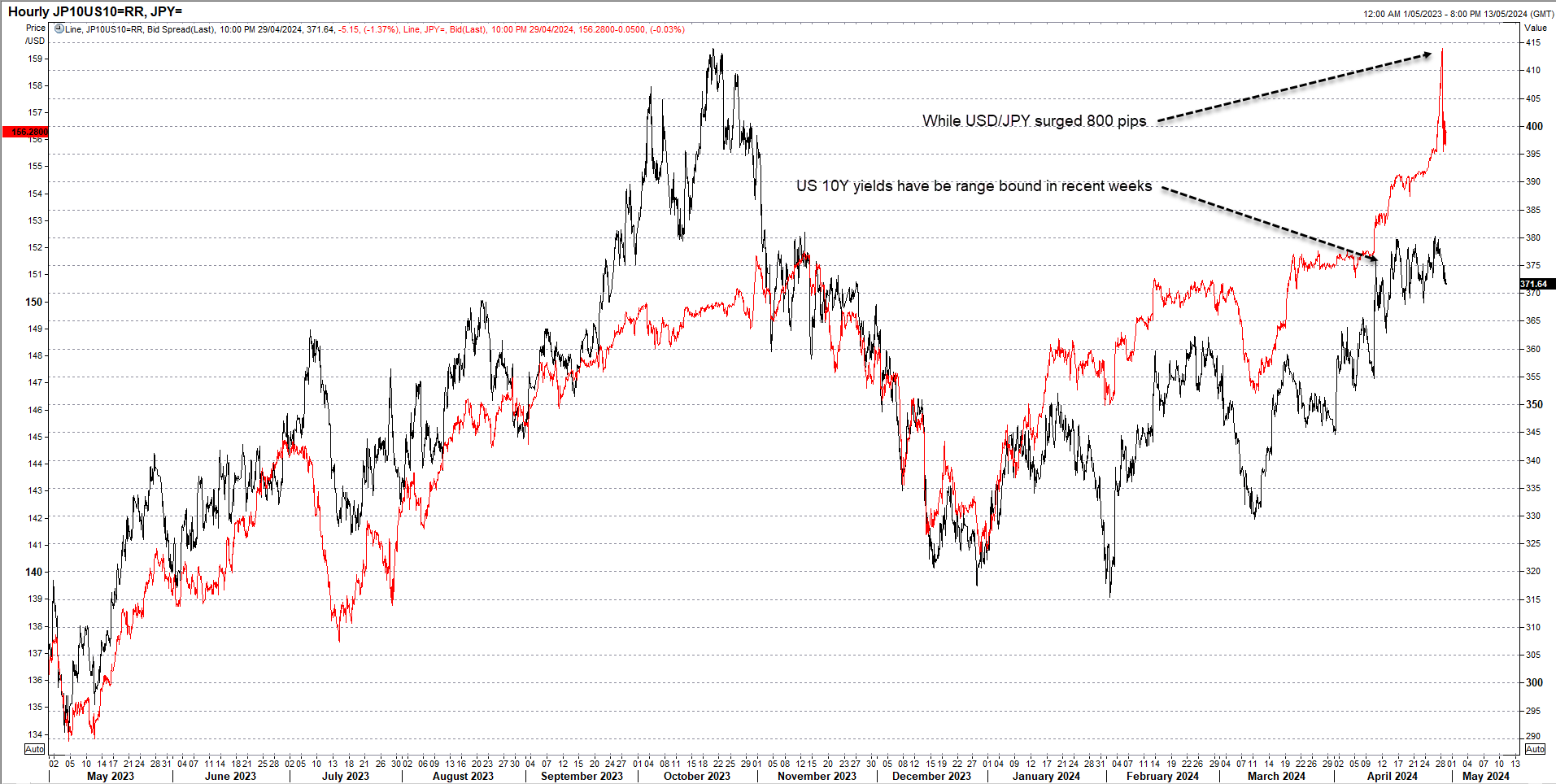

We now have greater clarity on what is deemed a speculative move

Looking through the volatility, traders may have been delivered a message on what constitutes a speculative move in the eyes of the Japanese government: one that is rapid and not underpinned by interest rate markets.

In a week where there are significant risk events for US bond markets, including April non-payrolls, ISM non-manufacturing PMI, details of the US Treasury Q2 borrowing schedule and the Fed’s May FOMC meeting, it suggests movements in USD/JPY need to be evaluated against those in rates markets when gauging the risk of further market intervention.

Watch US yields to gauge BOJ intervention risk

What’s noteworthy from the price action in USD/JPY is the suspected intervention episode looks like it concluded when the pair returned roughly to the same levels it was trading prior to the Bank of Japan’s monetary policy meeting last Friday, providing a range to build trade setups around.

While it was breached on multiple occasions on Monday, the price never closed below the uptrend dating back to early April during the session, continuing to attract bids ahead of Friday’s low around 155. So, dips towards that level over the coming days could be used to reset longs, allowing for stop-loss orders to be set below the level.

Should USD/JPY rally, whether to buy or fade the move should be influenced by what US bond yields are doing. If yield differentials push higher it may limit the risk of market intervention. However, if yield differentials are static or declining, recent history suggests it may prompt a fresh wave of BOJ dollar selling.

For those trading USD/JPY, the key topside levels to watch are 158.45 and the 34-year high of 160.22 set Monday.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade