- USD/CNH hits highest level since November 2023

- PBOC refrains from pushing back aggressively against market forces

- USD/CNH trend likely higher until Fed rate cut risk materialises

Chinese yuan weakening may have global consequences

The People’s Bank of China (PBOC) continues to loosen its grip on the Chinese yuan, sending USD/CNH highs not seen since late 2023 on Thursday. Given the influence the yuan has on emerging market and other Asian currencies, the technical break may have global ramifications should it stick.

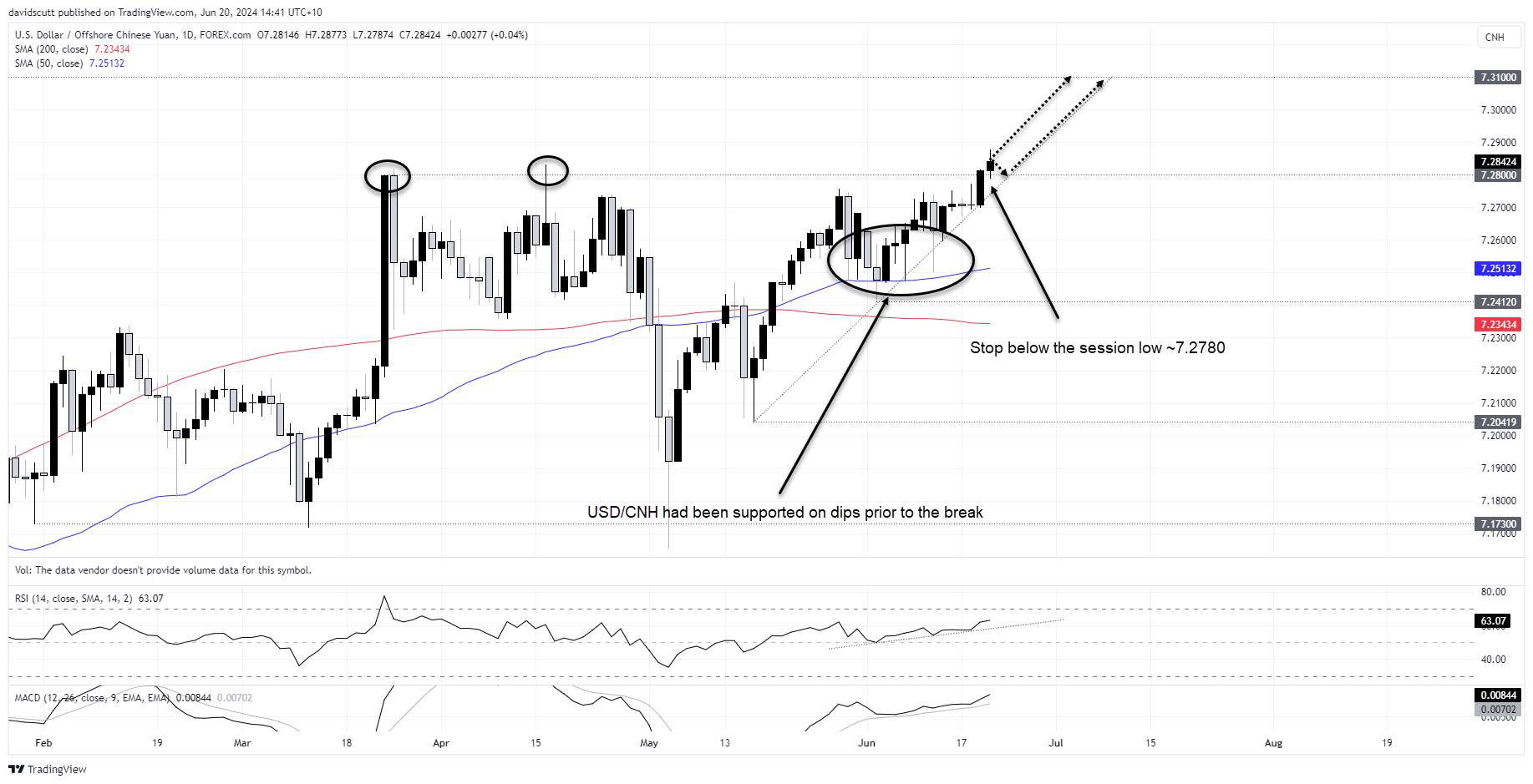

USD/CNH had been squeezing higher against uptrend support for weeks prior to the break, attracting buyers on dips below and towards the 200-day moving average.

Having pushed and closed above 7.2800 on Wednesday, it has gone on with the move after the PBOC set the starting point for the onshore-traded yuan at 7.1192 on Thursday. Not only was it the weakest fixing since November but also the largest deviation from the prior session's starting point since the middle of April.

PBOC allows market forces have a go

While the PBOC still fixed the USD/CNY at a stronger level than market forced imply, the difference today is that it didn’t push back aggressively, differentiating it from other periods this year where it acted aggressively to counteract downside pressure on the yuan.

Prior to the fix, the PBOC left benchmark lending rates for one and five year terms unchanged in June, as expected. The reluctance from Beijing to lower borrowing costs suggests it remains concerned about potential capital flight that may weaken the currency further.

USD/CNH trade setup

Now we’ve seen the bullish break take place, the question now is will it stick? Mirroring the price action, indicators like RSI and MACD continue to point to strengthening upside momentum. Until the evidence becomes compelling that the US Federal Reserve will begin cutting rates, it’s likely to remain that way.

Those keen to take on the long trade could enter around these levels, or even perhaps a touch lower, with a stop below 7.2780 for protection. The initial trade target would be 7.3100, the high set in November last year.

From a fundamental perspective, the biggest risk for the trade would be the PBOC suddenly moving aggressively to counteract the yuan weakness, or another big increase in US initial jobless claims that could see timing for the Fed’s first expected rate cut pushed forward.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade