Trade cryptocurrency CFDs

Trade crypto CFDs with City Index without needing to own the cryptocurrency itself. With competitive spreads on Ripple, Ether and Bitcoin CFDs.

-

Go long or short on CFDs

-

Get competitive spreads

-

Trade without the need for a digital wallet

Why trade crypto CFDs with City Index?

-

Leverage your trading

Gain full market exposure with just a percentage of the trade value.

Learn about CFD margin and leverage

-

Range of cryptocurrencies

Trade popular cryptos or choose from thousands of other markets.

Discover our markets to trade

-

A regulated global CFD broker

City Index is regulated in Australia since 2006.

Learn more about why you should choose City Index

-

Strength and security

We’re backed by Nasdaq-listed StoneX, a Fortune 100 company with over a century in the financial markets. Combined with our four decades of heritage, you’re in good hands.

Learn more about StoneX

What is a crypto CFD?

A Crypto CFD, or contract for difference, is a derivative that can be used to speculate on the underlying price of cryptocurrencies – including Bitcoin, Cardano and Ethereum.

How to trade crypto CFDs

2. Do your research on what moves cryptocurrency prices

3. Decide to go long or short

4. Plan your CFD strategy and risk management

5. Place your trade

Crypto market hours

Our crypto CFD markets

Competitive crypto CFD pricing

See the costs of CFD trading

Crypto news and analysis

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

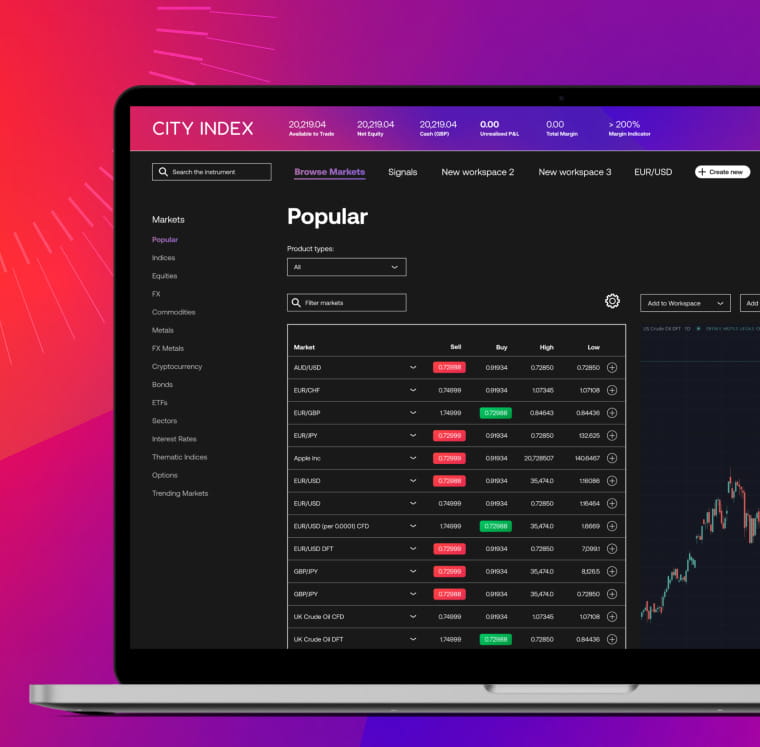

Crypto CFD trading platform

Your powerful new online trading platform, Web Trader, includes advanced charts with custom indicators, fast and reliable HTML5 technology, and customisable workspaces.

Fast, reliable and customisable trading platform

- Configure and personalise multiple workspaces

- Switch between workspaces with a single click

- Benefit from advanced trading charts and overlay multiple financial markets

Intelligent trading tools

- Smart trade tickets with advanced risk management tools

- Define stops and limits by points, P&L or price

- Real-time margin calculator informs your trade decisions

Market news and analysis

- Dedicated Market 360 pages to help identify trading opportunities

- Latest market news with charts and pricing

- Detailed market analysis from Reuters news

Cryptocurrencies: the key facts

Bitcoin was worth a fraction of a penny in 2010 but saw its value balloon to more than $68,000 a coin in November 2021 – via numerous downturns along the way.

Thanks to this…cryptocurrencies are known for being exceptionally volatile.

Cryptocurrencies are ‘mined’ from the blockchain, a type of technology that can create a permanent, public, transparent ledger system for compiling data.

Cryptocurrency mining releases new cryptocurrency into circulation and rewards the miner with tokens.

Buying Bitcoin vs Bitcoin CFDs

Wondering what the pros and cons are of owning a cryptocurrency vs trading it as a CFD?

Learn about buying vs trading cryptos

Crypto CFD FAQs

What is a crypto CFD broker?

A crypto CFD broker is a provider that enables you to speculate on the price of cryptocurrencies – such as Bitcoin – with contracts for difference. Instead of buying the digital currency, you’re taking a position on whether its price will rise or fall.

Learn more about CFD trading

What’s better: CFDs or crypto?

Buying cryptos means you’re taking ownership of the digital asset, so you’ll need an account with an exchange and a digital wallet to store the crypto in securely. When you trade crypto CFDs, you just need an account with a CFD provider, and as you won’t be taking ownership of the asset, you won’t need a digital wallet.

Learn how to trade CFDs