The US dollar index traded in a tight range during a relatively quiet session on Monday and held above 105 for a second day. This follows on from a small bullish inside week to shows stability has been found after the prior bearish engulfing week temporarily slammed prices below 105.

Traders like binary outcomes as it can provide clarity for expectations and cleaner trends. Yet the pause of the dollar's demise may be attributed to the fact that traders are grappling with higher-for-longer rates alongside hopes of cuts.

Taking NFP as an example, perhaps traders were too quick to price in cuts given job growth is still knocking out 6-figure gains and unemployment remains low by historical standards. Yet inflation expectations are higher, even if confidence is softer. Mixed data calls for a mixed response.

For the wheels to truly fall off of the US dollar, incoming data needs to point to disinflation, not just pockets of weakness here and there. Overall, I believe the US dollar has topped for now and that inflation will eventually behave. But ewe might see some US dollar upside before its next leg lower materialises.

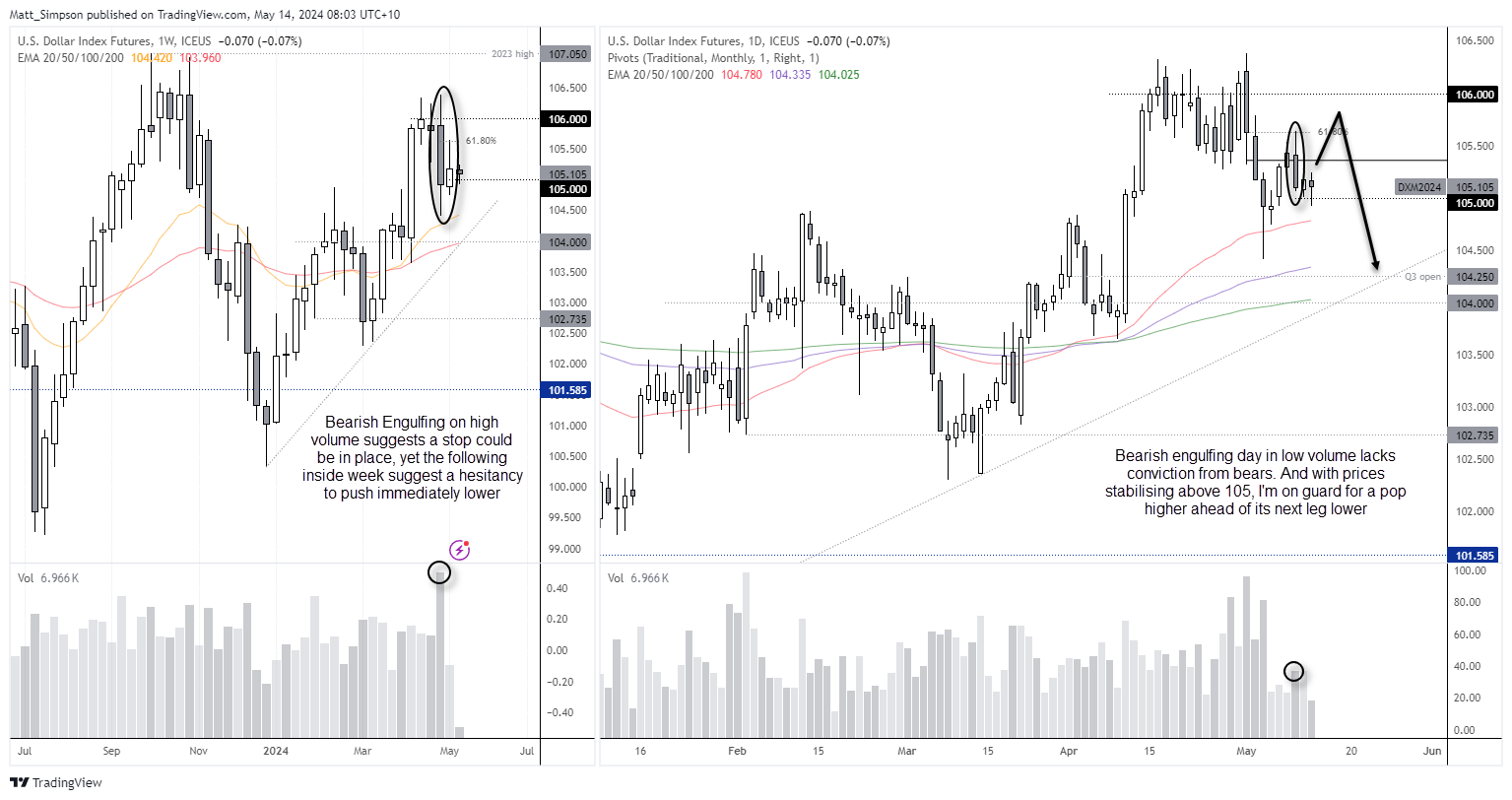

US dollar index (DXY) technical analysis:

The weekly chart shows a high-volume engulfing week and three failed attempts to close above 106. Yet the small bullish inside week shows a hesitancy to break immediately lower, and the daily chart shows prices holding above 105. Furthermore, Friday’s NFP bearish engulfing day was on relatively low volume, meaning bears lacked conviction on the day. Therefore, my bias is for the US dollar to pop higher from here and potentially see a false break above Friday’s high, before bearish momentum returns and prices head for at least 104.50, the bullish trendline or Q3 open.

Economic events (times in AEST)

We have two key themes to watch for today, which revolve around the BOE and Fed. UK earnings and employment data could provide some last minute bets for whether the BOE will hint at a June cut at Thursday’s meeting, where hotter figures could diminish expectations of a dovish tone and potentially send GBP/USD higher. We also have a talk from the BOE’s Chief Economist Hew which will include an economic outlook, making it a key event. The attention will then shift to US producer prices, which could set the tone for the key CPI report released tomorrow, or the warm-up act for Jerome Powell’s speech later today.

- 08:45 – New Zealand retail sales

- 09:50 – Japan producer prices

- 10:30 – Australian consumer sentiment (Westpac)

- 13:45 – Japan 5-year JGB auction

- 16:00 – UK earnings, employment

- 16:00 – Germany CPI

- 17:30 – BOE Chief Economist Hew speaks

- 20:00 – US small business optimism (NFIB)

- 21:00 – OPEC monthly report

- 22:30 – US producer prices

- 23:10 – Fed Governor Cook speaks

- 23:15 – ECB’s Schnabel speaks

- 00:00 – Fed Chair Powell speaks

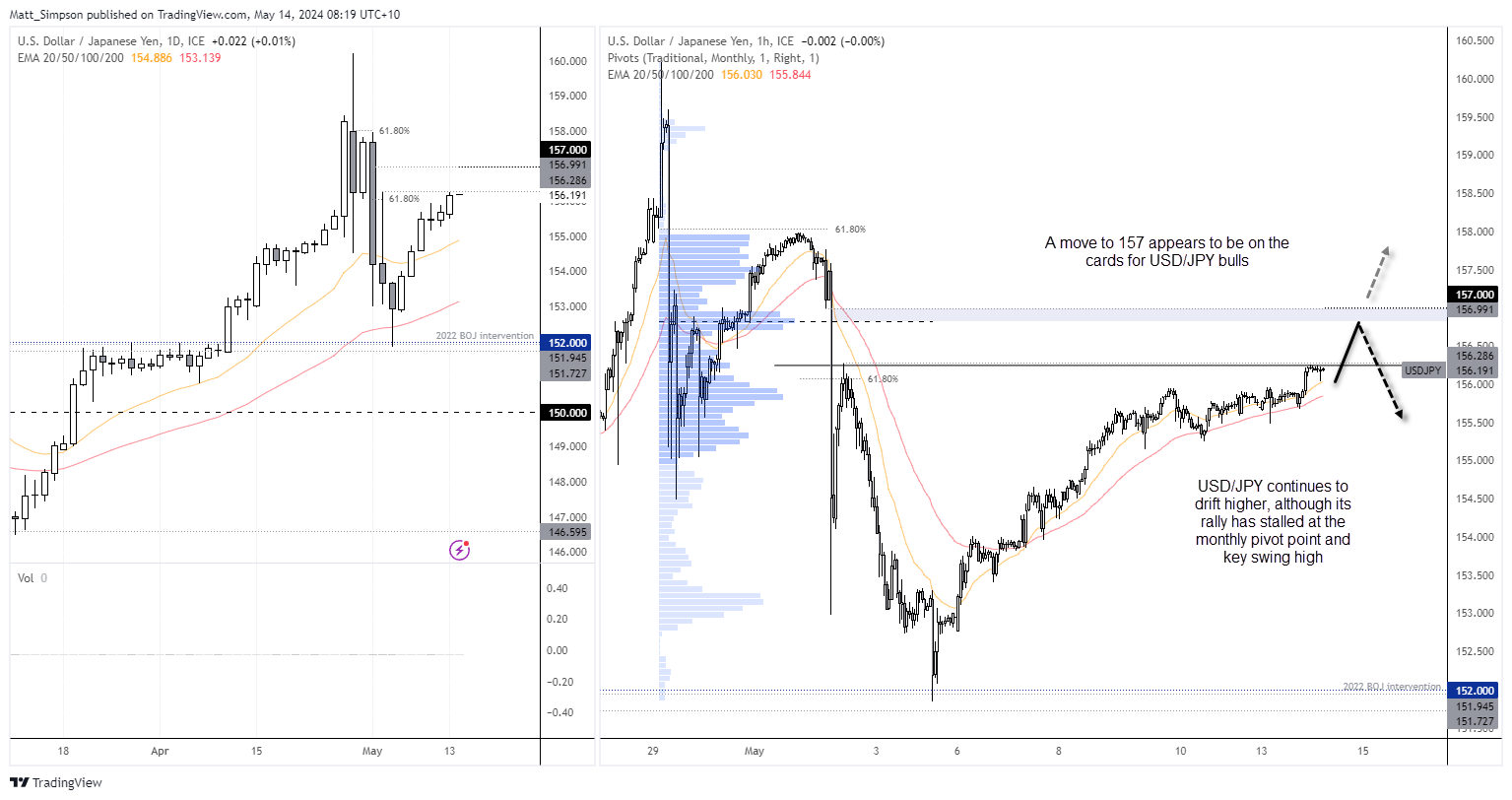

USD/JPY technical analysis:

The rise of USD/JPY is beginning to remind me of every stock-market rally hater miss out on. But like it or now, USD/JPY is rising, even if there is a growing concern the BOJ may intervene once more. But it has got this far, why not one final burst for 157?

A bullish trend is apparent on the 1-hour chart although prices have stalled just beneath monthly pivot point and key swing high (the third prominent leg lower). Perhaps we’ll see markets tease with a break of resistance today, which might provide some less-than-friendly price action and a pullback towards the 20 or 50-bar EMA. At which point dip buyers may be tempted to load up for the real break. But if we see a 1-hour close above resistance, bulls could seek to enter on lower timeframes (seek consolidation patterns) with a view on targeting the high-volume node or 157 handle.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade