Jerome Powell dangled a carrot in front of doves when he said the US is on a disinflationary path, although more data is needed before deciding on rate cuts. He sees a 4% unemployment rates still “very low” which again pushes back against the market’s bet of a 25 basis point (bp) in September, and places greater emphasis on the metric in this week's nonfarm payrolls report on Friday. Powell estimates inflation in one year from now should be in the mid to low two’s.

US bond yields were lower, low they can be seen as mere retracements against the two-day strong rally seen after the Biden-Trump debate last week. Markets becoming increasingly concerned that a trump presidency will simply bring another strong round of inflation which has been bad for bond prices but good for yields. Regardless, Wall Street climbed to a record high with Apple shares leading the way ahead of Independence Day in the US on Thursday, with major exchanges set to be closed. It also means liquidity will likely be lower for the remainder of the week, but the positive lead form Wall Street should make its way over to APAC markets today.

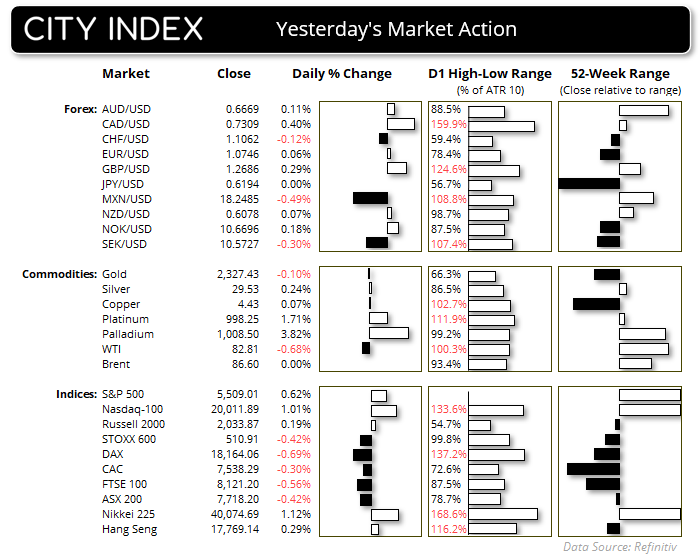

U.S. dollar index formed a bearish outside day with the upper range being a high wick. There seems to be a clear hesitancy to test 106 level with the host of US employment data coming out ahead of Fridays NFP report. The Canadian dollar was the strongest forex major supported by the rallying oil prices earlier this week.

USD/JPY made a mild attempt to reach for my 162 target before Powell's slightly dovish comments weighed on the US dollar, It failed to take out Mondays high, and instead formed a small doji, inside day. The MOF would do well to remember that actions speak louder than words, because markets are blatantly ignoring warnings of any intervention from the powers that be. The BOJ have continued to underwhelm in recent meetings, and that is seeing the yen simply drift to new lows unchallenged. As traders should have learned by now, the key to a weaker yen without intervention is to do it slowly. With that said, the MOF announced that they have replaced currency diplomat Kanda with Atsushi Mimura. So perhaps things are going to get spicy, with markets mostly ignoring verbal warnings from the MOF regarding the weaker yen.

China services PMI expanded a slightly slower pace at 53.4 versus 54 previously according to the Caixin survey. This follows on from lukewarm numbers from government official data over the weekend which showed the economy only slightly expanded with a composite print of 50.5.

Economic events (times in AEST)

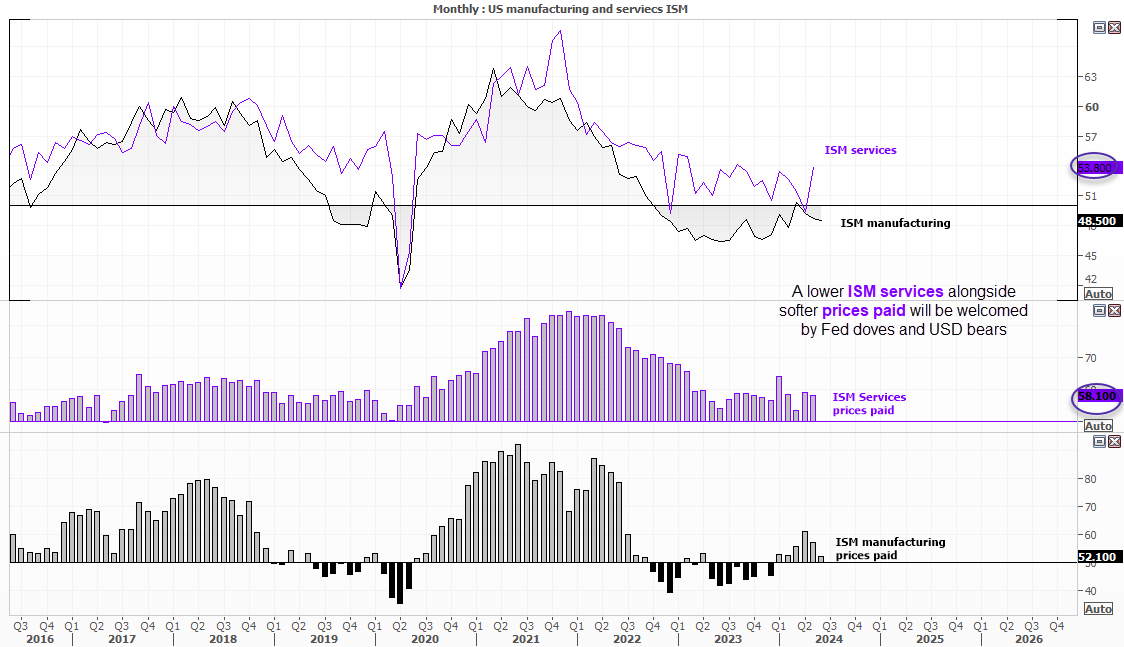

Fast level of economic data from the calendar for the next 24 hours most of his second tier. Final PMI's ready get the market moving much unless there's a large deviation from the prior reports, which there really is. But now Powell has dangled that dovish carrot in front of traders once again, expect them to lap up any signs of weak data from the US. That means keeping her close I on employment data which includes job layoffs Nash employment and jobless claims figures. Then the ISM services report, which is proven to be a decent market mover in recent months. Given manufacturing contracted and prices paid fell to six month low, it would be music to dovish ears if services inflation also dips alongside a weaker headline ISM number.

- 09:00 – Australian construction, manufacturing index (AIG), final manufacturing PMI (Judo Bank)

- 10:30 – Japan services PMI

- 11:30 – Australian building approvals, retail sales

- 11:45 – China services PMI (Caixin)

- 18:00 – Eurozone final PMIs

- 18:30 – UK finals PMIs

- 19:00 – Eurozone PPI

- 21:30 – US job layoffs (Challenger)

- 22:15 – US national employment (ADP)

- 22:30 – US jobless claims

- 23:45 – US final PMIs (S&P Global)

- 00:00 – ISM services PMI

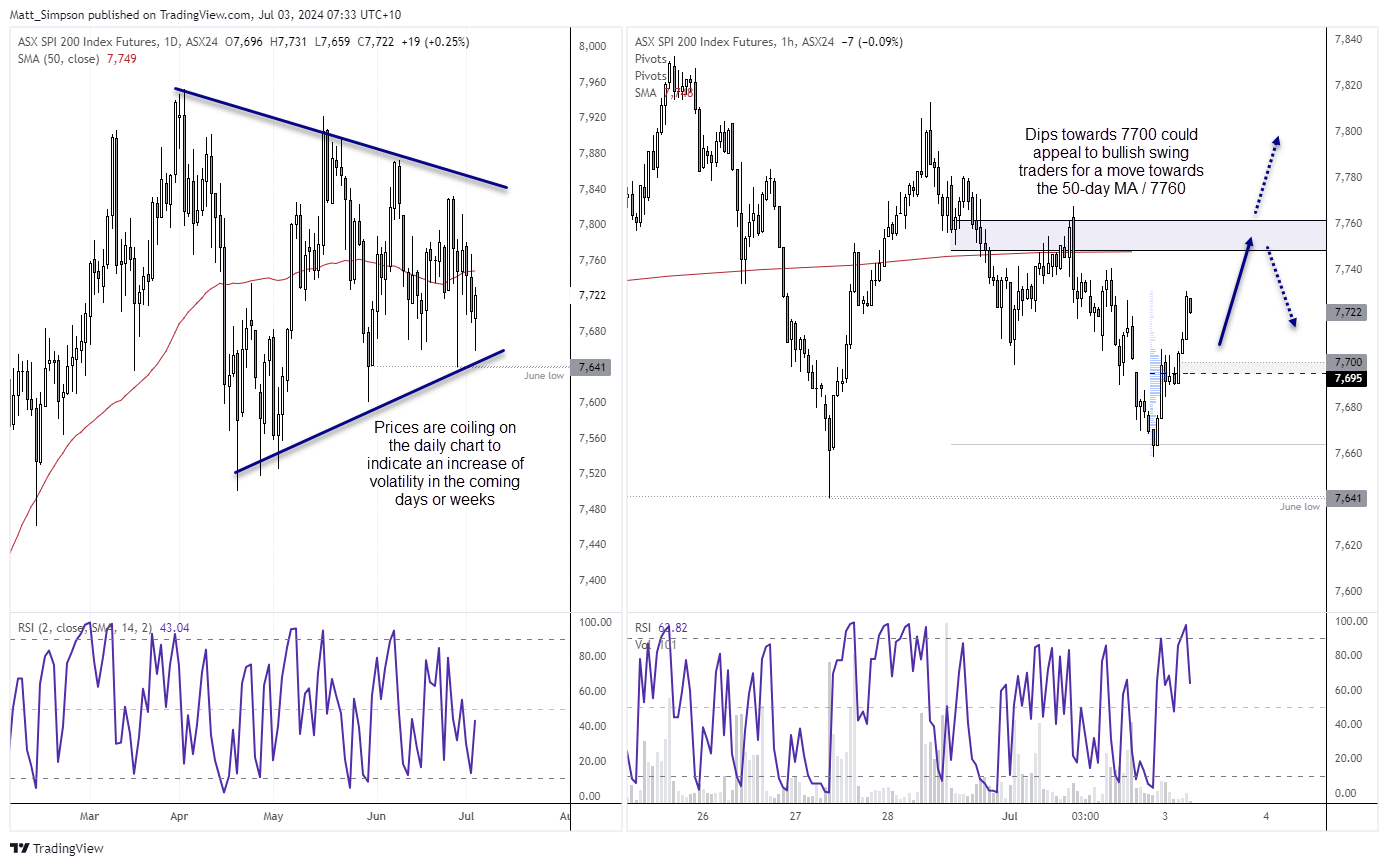

ASX 200 technical analysis:

It’s fair to say that price action on the ASX 200 has been very messy lately. Regardless, it is showing the potential for a swing low on the daily chart. The overnight low held above the June low before forming a small bullish day. If we step back, we can see that prices are coiling on the daily chart, indicating that volatility could increase in the coming days or weeks. While this itself provides no immediate directional clues, the series of lower wicks below 7700 suggests that the next move could be higher.

The one-hour chart shows a clear three-wave move down to 7660, near the weekly S1 pivot point. A strong reversal formed around that support area, so I’m now looking for a move up towards 7760, just above the 50-day average. Low volatility dips today are favoured for potential long setups.

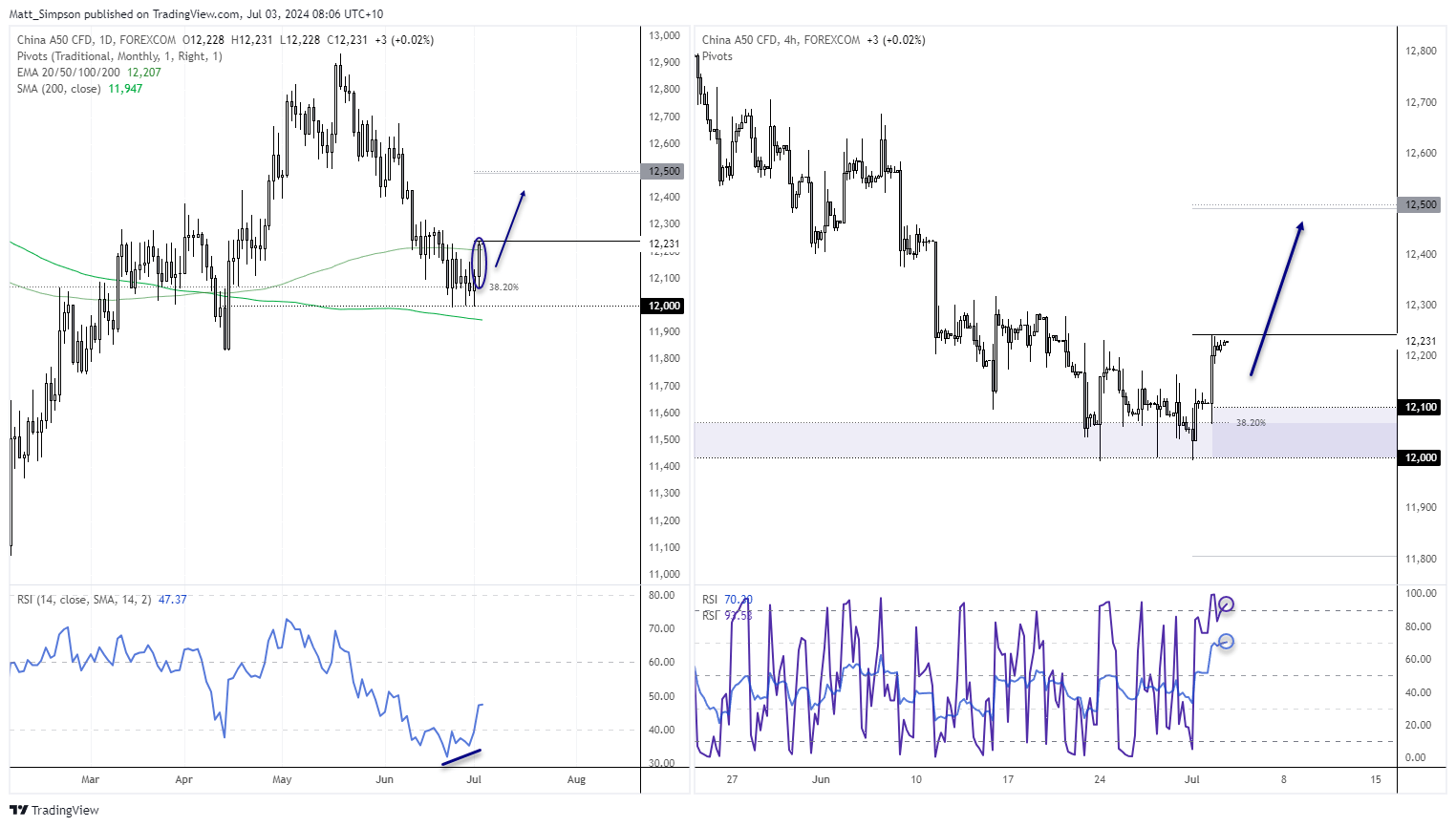

China A50 technical analysis:

Yesterday I outlined a potential bullish case for the China A50, on the assumption that the two largest stocks within the index (which had dragged the A50 lower) could stabilise or move higher over the near-term. So it was nice to see Kweichow Moutai form a bullish engulfing day from oversold levels and the China A50 print a convincing bounce from the 12k level.

The daily chart shows a triple bottom at 12,000, and the market held above the 200-day average whilst the 14-period RSI was oversold (which is beneath 40 during an uptrend). The China A50 also closed above the 200 day exponential moving average. Whilst yesterday's analysis had a conservative target around 12,300, yesterday's rally was convincing enough to consider a higher target around 12,500 / monthly S1 pivot. Ultimately, it's a market that looks good for dips in my personal view.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade