US futures

Dow futures -0.23% at 36117

S&P futures -0.29% at 4557

Nasdaq futures -0.38% at 15777

In Europe

FTSE -0.35% at 7480

- Dax +0.44% at 16448

- ISM services & JOLTS job openings in focus

- Data comes ahead of Friday’s NFP

- Oil extends losses for a fourth day after China’s ratings downgrade

ISM services & JOLTS job openings in focus

U.S. stocks are pointing to a lower open, extending losses from yesterday as investors look ahead to key data points that could provide clues about the health of the economy and the outlook of the Federal Reserve’s monetary policy.

Investors have been acutely focused on the future path for interest rates ahead of next week's FOMC meeting, and with Fed speakers in the blackout, data is set to provide the clues.

The market has almost entirely priced in the Federal Reserve, leaving interest rates unchanged in December. Still, many will be hoping for some clues about when policymakers may start to think about cutting interest rates.

Last week, Federal Reserve chair Jerome Powell said any rate cut talk was premature. Even so, the market is still pricing in a 60% probability of a rate cut as soon as March next year. Investors will look to economic data this week to confirm whether the economy is starting to weaken and, therefore, support rate-cut bets or whether the economy remains resilient. This could see the market push back rate cut bets into Q2.

Looking ahead, attention is now on SM services PMI data, which is expected to tick higher to 52 in November, up from 51.8 in October.

Meanwhile, JOLTS job openings are expected to ease to 9.3 million, down from 9.55 million.

A modest decline in job openings and stronger services PMI could see trades rein in rate cut expectations.

Corporate news

CVS is rising after the healthcare giant forecast 2024 revenue above expectations and is set to benefit from its expansion into healthcare and due to strength in its insurance business.

Johnson & Johnson is rising after projecting revenue growth of 5-6% next year as demand for cancer treatments Darzalex and Carvykti are expected to ramp up.

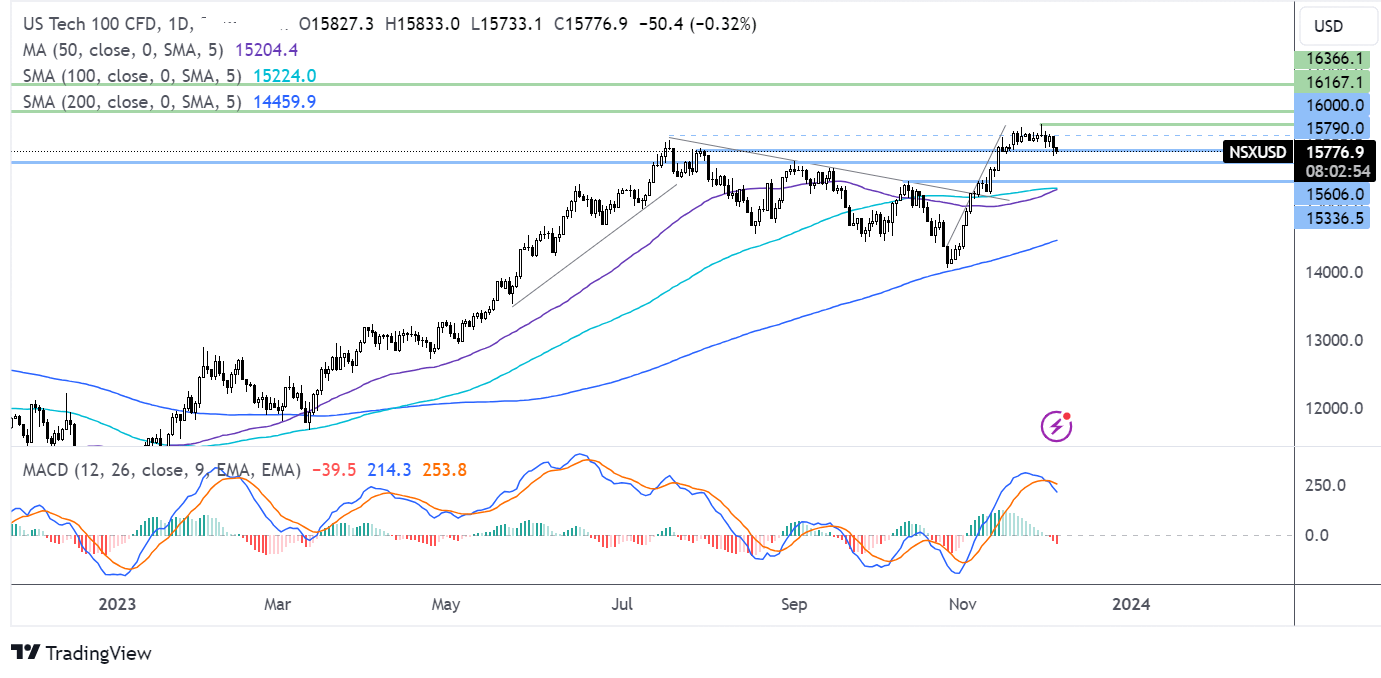

Nasdaq 100 forecast – technical analysis

The Nasdaq 100 is falling away from 16168, the 2023 high, falling below 15850, and the August high, which, combined with the bearish crossover on the MACD, keeps sellers hopeful of further declines. Support can be seen at 15630, the September high, ahead of 15340, the October high. A recovery would look for a rise back above 15850 and 16000 to bring 16168 back into target ahead of 16365 the March ’22 high.

FX markets – USD rises, EUR/USD falls

The USD is rising, adding to strong gains in the previous session as investors reassess the rate cut expectations. With no Fed speakers all eyes are on U.S. data ahead of next week's FOMC meeting.

EUR/USD is falling after dovish comments from ECB’s Isabel Schnabel, who said that rate hikes are down and after eurozone PMI data remained in contraction. The composite PMI rose to 47.6, its highest level since July and up from October’s 35-month low of 46.5. The upward revision comes after services PMI was lifted to 48.7 from 48.1. The data hardly fuels optimism of a strong economic recovery in the near term but at least suggests that any downturn may be shallower than previously expected. Eurozone PPI fell 9.4% fueling bets the next move by the ECB could be a rate cut

GBP/USD is holding steady after UK services PMI returned to growth in November, rising to 50.9 from 49.5 in October, coming in ahead of estimates of 50.5 and also marking the highest reading since July. UK service providers are back into expansion thanks to slowly normalizing demand conditions. Sterling continues to find support from the BoE, pushing back on rate cut expectations.

EUR/USD -0.11% at 1.0825

GBP/USD -0.01% at 1.2630

Oil extends losses for a fourth day

Oil prices are falling for a fourth straight day amid ongoing uncertainty over the voluntary output cuts by OPEC+ and ahead of a meeting between Russia and UAE tomorrow.

Saudi Arabia's energy minister said that OPEC plus supply cuts could continue beyond the first quarter of 2024 which was lending some support to oil prices early in the European session; however, the Kremlin has warned that the cuts agreed by the OPEC plus group will take time to kick in.

Oil prices have remained broadly depressed following the OPEC+ meeting last week, where the group agreed on voluntary output cuts of 2.2 million barrels per day for Q1 next year. However, the voluntary element of the deal left the markets questioning whether the supply reduction would actually come into effect.

Meanwhile, rising concerns over the outlook for China is hurting the demand outlook. Moody’s rating agency downgraded the credit rating for the world’s largest oil importer. Analysts cited

WTI crude trades -0.8% at $73.50

Brent trades -0.8% at $7819