USD/JPY Key Points

- US Treasury Secretary Yellen warned that the US expects “interventions to be rare and consultation to take place.”

- USD/JPY could once again be pressing against Japanese policymakers’ thresholds sooner rather than later.

- USD/JPY is bouncing between two previous supposed “lines in the sand” for Japan’s Ministry of Finance at 152.00 and 155.00, but the risks may be tilted to more upside from here.

After a whirlwind, (presumed) double-intervention week last week, the volatility in the Japanese yen was always going to decline this week as traders – and politicians! – digested the Bank of Japan’s dramatic moves.

The biggest headline came from US Treasury Secretary (and former Federal Reserve Chairmwoman) Janet Yellen, who cryptically opined that the US expects “interventions to be rare and consultation to take place.” In response, Japan’s top currency official, Masato Kanda, noted that “If the market is functioning properly, of course there’s no need for the government to intervene,” but if moves are disorderly, “there are times when the government needs to take appropriate action.”

Traders viewed this diplomatic sparring match as a sign that Japanese authorities would be hesitant to intervene to support the yen again unless rates started to approach last week’s multi-decade highs near 160.00, and as a result, we’ve seen the yen falling across the board (XXX/JPY crosses rising).

Ultimately there is still a stark interest rate spread across the Pacific, with the Fed’s benchmark rate near 5.5% and the Bank of Japan still offering a paltry 0.00-0.10%. That spread is expected to narrow slightly by the end of the year, but if US economic data remains strong and the BOJ keeps kicking the can down the road when it comes to raising rates, USD/JPY could once again be pressing against Japanese policymakers’ thresholds sooner rather than later.

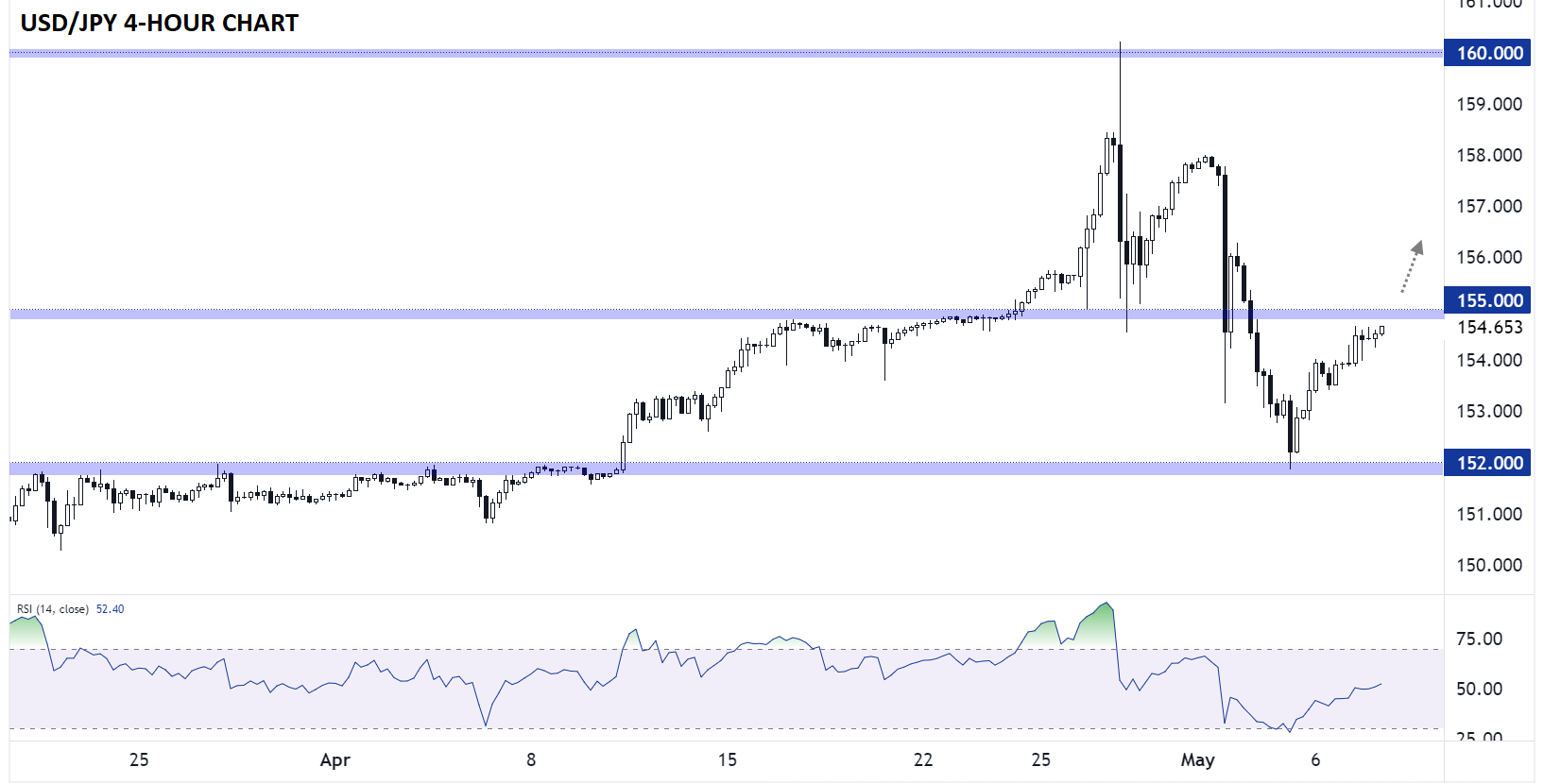

Japanese Yen Technical Analysis – USD/JPY 4-Hour Chart

Source: TradingView, StoneX

Turning our attention to the 4-hour chart above, USD/JPY is bouncing between two previous supposed “lines in the sand” for Japan’s Ministry of Finance at 152.00 and 155.00. While neither ultimately proved to be the level where the Bank of Japan intervened, the prolonged price action just below those round numbers create clear technical levels of support/resistance to watch moving forward.

After Treasury Secretary Yellen’s (political) warning about last week’s intervention episodes, traders may see USD/JPY as poised for further gains, especially if US yields turn higher from here. A break above 155.00 would leave little in the way of resistance until closer to 160.00, where the BOJ may feel compelled to intervene again. Meanwhile, as long as 152.00 holds as support, the downside in the pair may be limited.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX