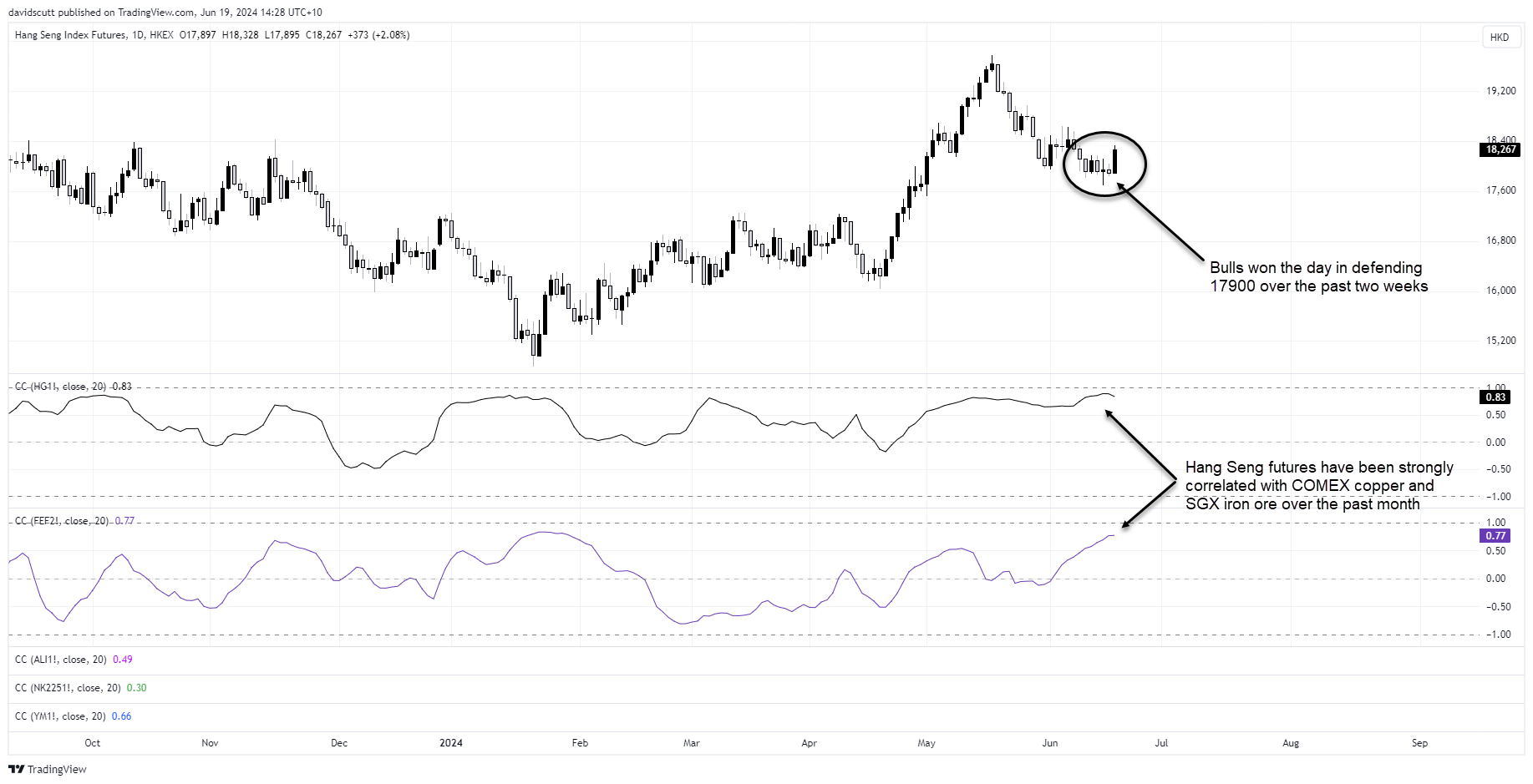

- Hang Seng futures have been correlated with industrial metals prices recently

- Hang Seng futures attracted buyers below 17900 over the past fortnight

- Copper, Hang Seng futures may in the process of bottoming

Hang Seng futures have been something of a proxy for industrial metals markets lately, so perhaps it shouldn’t come as surprise to see the Hong Kong market surging higher on Thursday after the rally in commodity markets overnight.

Hang Seng a play on commodity prices?

It’s only a hunch but the strong, positive correlation with COMEX copper and SGX iron ore futures, sitting at 0.83 and 0.77 respectively over the past month, suggests some traders are using the Hang Seng as a mechanism to speculate on the outlook for Chinese industrial activity, especially the housing market.

But we’ve seen plenty of buying bursts on the Hang Seng that fizzled as quickly as they began. And when you talk to commodity market experts, many are likely to tell you about weak domestic demand and bloated inventory levels, adding to reasons to be cautious about the price action over just one session.

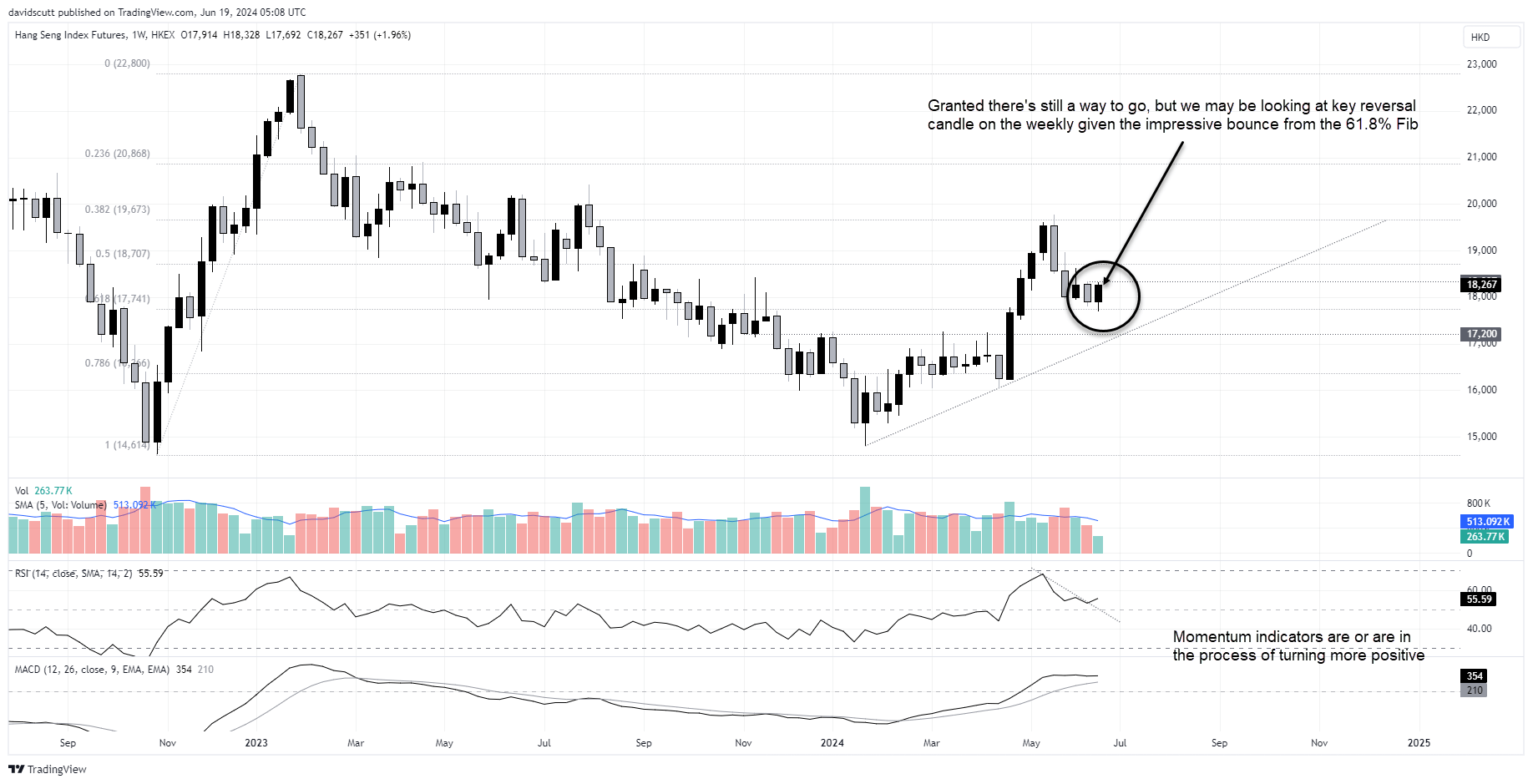

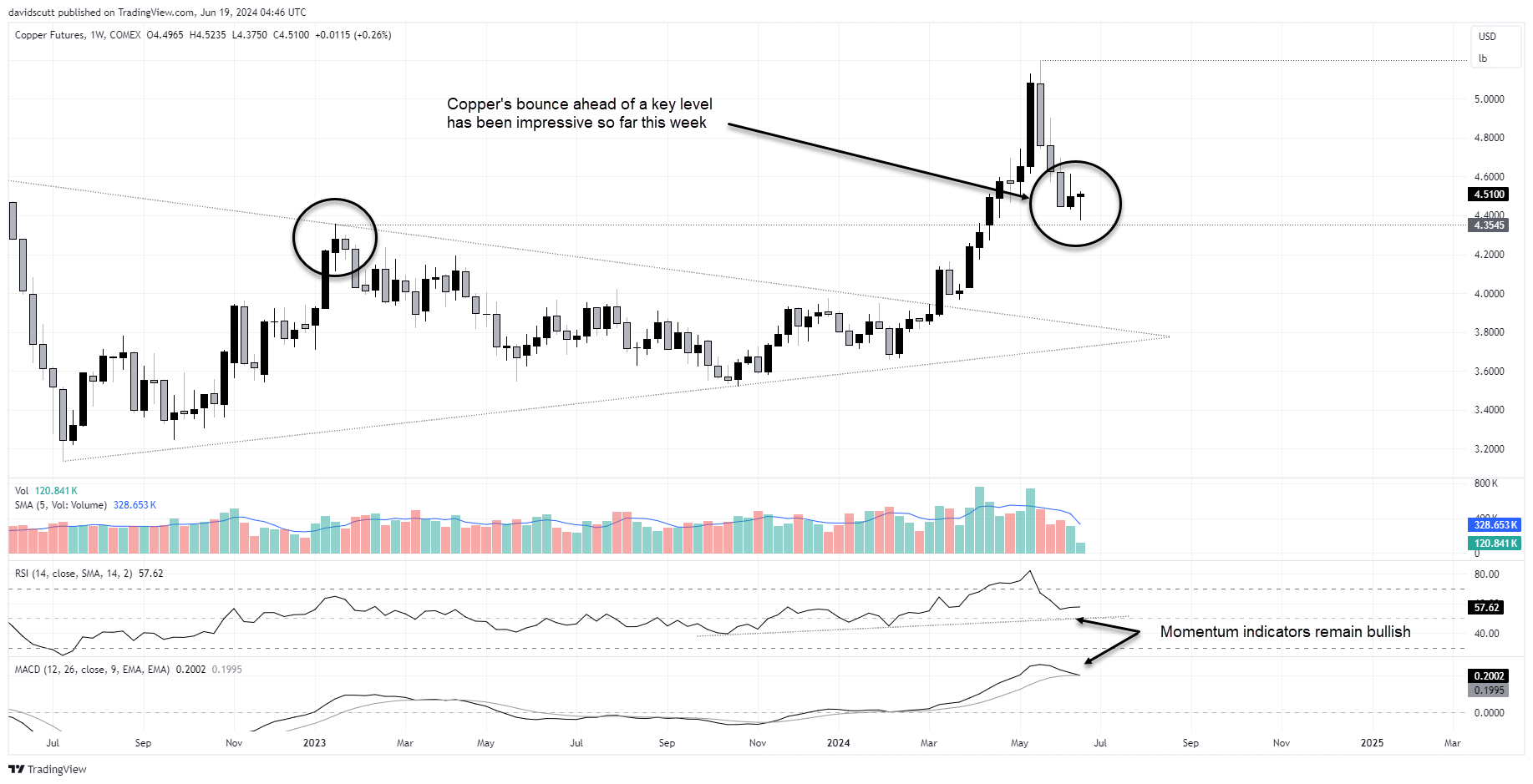

Rather than chase the gains today, it may be advantageous to sit it out while zooming out. Because when you look at the weekly charts for Hang Seng and COMEX copper, both are forming what may end up being bullish price signals. But we won’t know until the final trade tickets are written Friday.

Hang Seng finding bids below 17900

Starting with the Hang Seng, futures bounced strongly from the 61.8% Fib retracement of the October-January low-high earlier this week. Should futures finish with a flourish heading into the weekend, we’ll be looking at a key reversal candle, pointing to a potential neat-term bottom, bolstered by the relentless bid below 17900 seen in the middle of June. If accompanied by a lift in trading volumes, it would bolster the case for initiating long positions.

If we get price signal from futures, I’ll do a follow-up trade idea early Monday with specific levels.

Copper bears baulk at downside test

It’s a similar story for COMEX copper which bounced strongly after contemplating testing major support at $4.3545, the level where gains accelerated after being broken in March. While there’s a lot of trades to go through this week, the long downside wick suggests buyers maybe starting gain to get the upper hand. With momentum indicators remining bullish, a strong finish to the week, coupled with a pickup in volumes, may sow the seeds for a more meaningful bounce.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade