- Dow Jones Forecast: the 39000 support is closely monitored for a potential breakout

- Durable goods orders positively beat expectations, possibly favoring inflation levels

- FOMC Member Waller Speech is next today after hawkish FOMC Minutes

The market sentiment is torn between rate cut hopes and hawkish Fed outlooks, weighing heavily on key indices. The latest durable and core durable goods orders positively surpassed expectations, FOMC minutes leaned towards a hawkish stand, and the Fed’s favored inflation metric is on the horizon next week to crucially to piece up the inflation and monetary policy state puzzle.

Further rate sentiment volatility is expected later today with the FOMC member Waller’s upcoming speech. With uncertainties all around, technical levels can potentially define prices in a simpler manner:

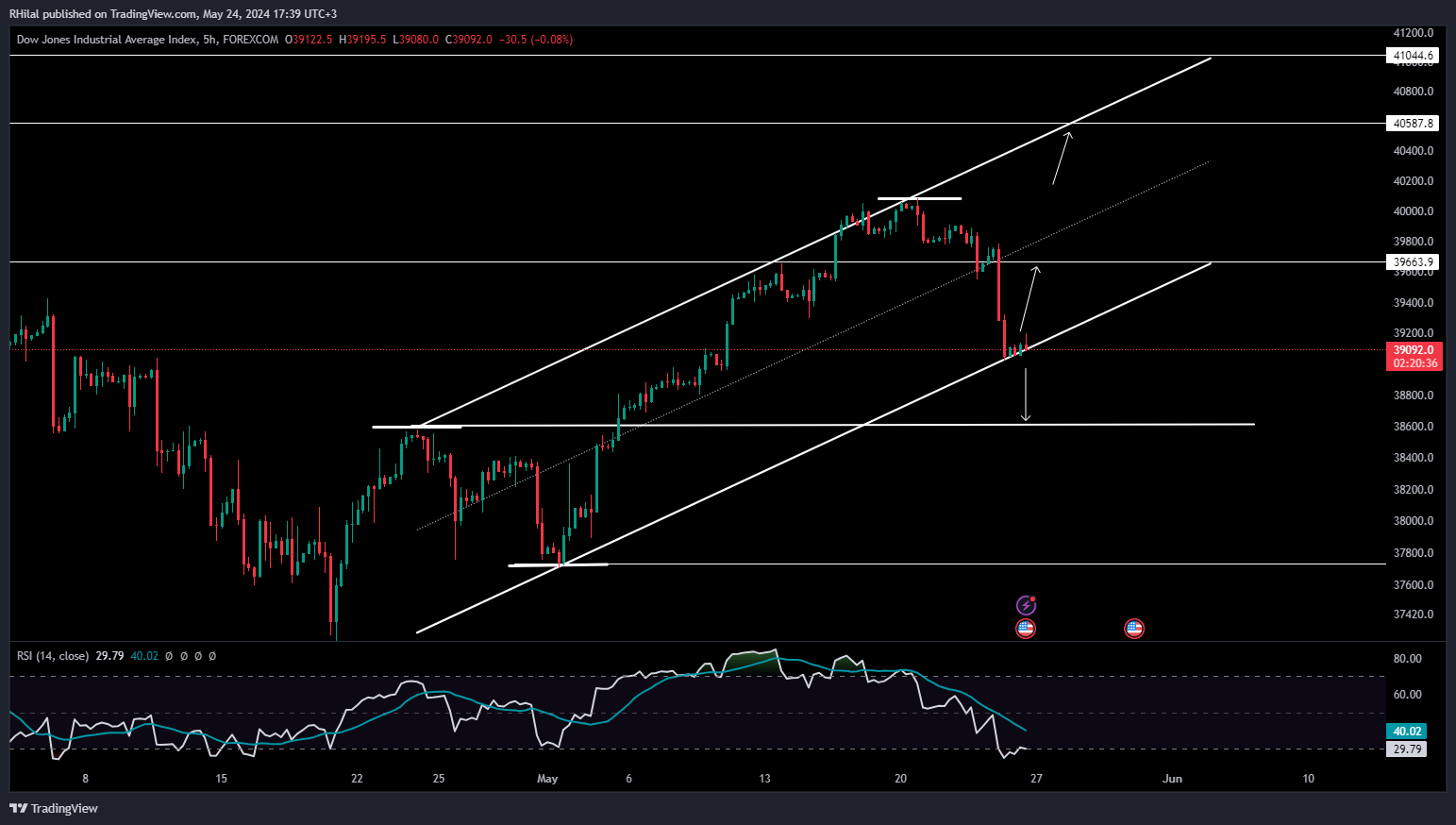

Dow Jones Forecast: 5H Time Frame – Logarithmic Scale

Yesterday’s drop was contained at a trendline parallel to that connecting the highs of April and May, reaching a low of 39052. From an Elliott wave perspective, a break below the 39000 barrier can potentially hold a strong support at the first wave high, near 38600. Conversely, if bullish sentiment sustains the 39000 level at the weekly close, a rebound can potentially be traced towards 39600 and 39900. This area represents the mid-channel zone and coincides with a 0.618 retracement of the drop from the 40000 high.

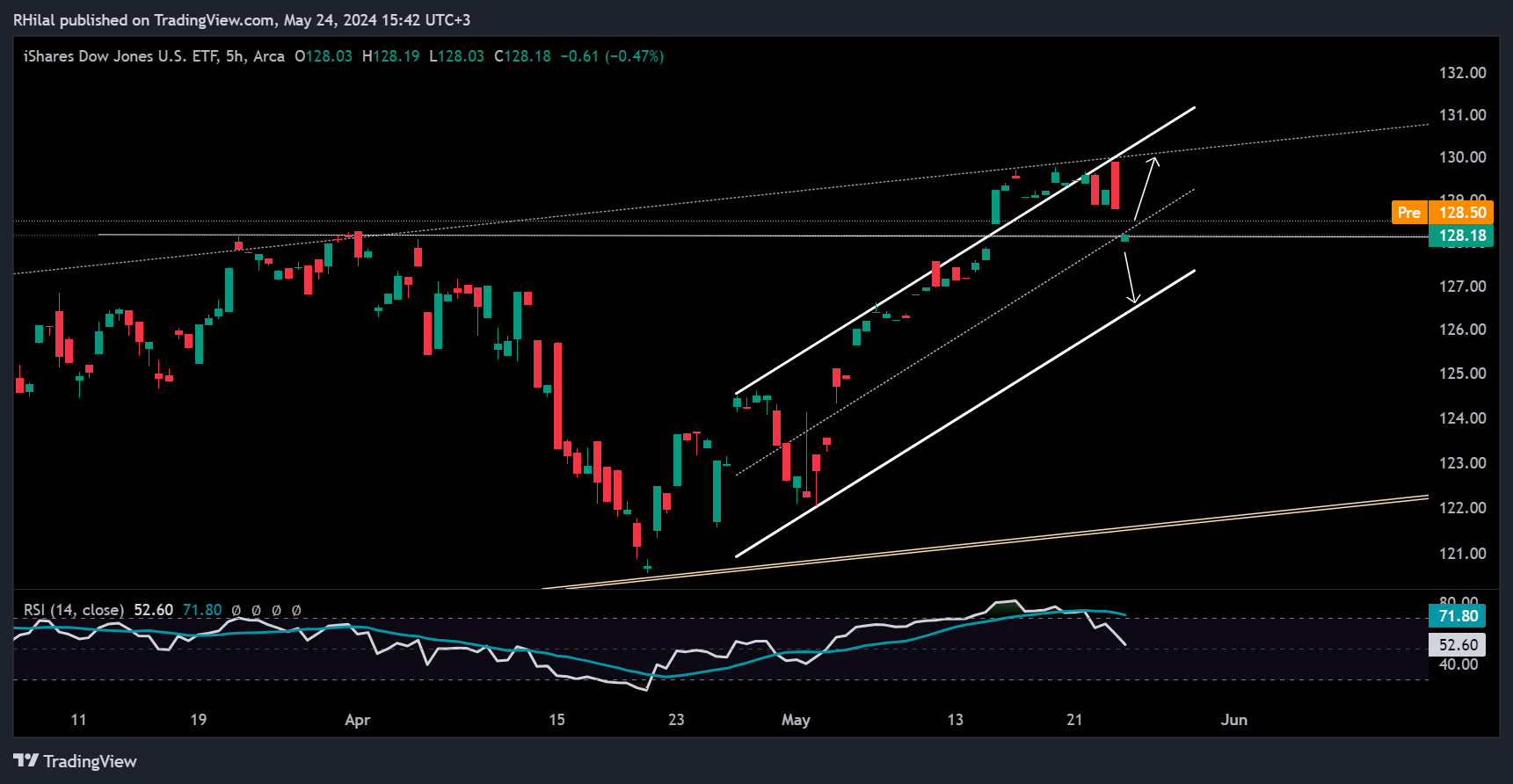

Dow Jones Forecast: iShares Dow ETF – 5H Time Frame – Logarithmic Scale

Yesterday's decline in the Dow's ETF saw a gap down towards the April highs, finding potential support at a mid-channel area and previously respected resistance. This parallel channel, though still forming, connects the trend highs and could determine the next levels for both the ETF and the index. Currently, the market lies in a state of uncertainty, with the relative strength index hovering around the neutral 50 level reflecting a balance between bullish hope and significant risk. Breakouts are awaited beyond the mid-channel area to likely guide the ETF's upcoming movements.