- RBA left cash rate unchanged at 4.35% in June, as expected

- Several hawkish clues were found in the policy statement

- It only discussed hiking or holding rates, not cutting

- AUD/USD, Australian bond yields rise, US retail sales important later Tuesday

RBA holds fire in June

The Reserve Bank of Australia (RBA) has received evidence to justify ongoing vigilance towards upside inflation surprises, vowing it will do what it is necessary to bring it back to the 2.5% midpoint of its target. But it’s not yet compelling enough to warrant lifting rates, retaining a neutral bias while leaving the cash rate unchanged at 4.35% in June.

“Inflation remains above target and is proving persistent”, the first headline read, setting the tone for a more hawkish statement than many had anticipated. It repeated “broader data indicate continuing excess demand in the economy” with conditions in the labour market remaining “tighter than is consistent with sustained full employment and inflation at target”.

It pointed to stimulatory fiscal settings as a factor that may add to demand and potentially underlying inflationary pressures.

As it has done throughout the year, it continued to hammer home the point that outlook for services inflation remained uncertain, linking progress in reducing it back to improvements in productivity.

“Although growth in unit labour costs has eased, it remains high. Productivity growth needs to pick up in a sustained way if inflation is to continue to decline,” the bank said.

Narrow path getting narrower

Summarising the document, the RBA acknowledged it had received evidence that justified continued vigilance towards upside inflation surprises, even with mixed economic data since the last meeting.

Ominously, in the final sentence of the statement, it repeated it “remains resolute in its determination to return inflation to target” but added it “will do what is necessary to achieve that outcome.” The latter phrase has not been seen since February, hinting the RBA may be moving towards hiking rates again rather than shifting further away.

In her media press conference following the decision, RBA Governor Michele Bullock said a lot needs to go the RBA’s way to get inflation back to target, adding the path to achieving that task was “getting narrower”.

She acknowledged the board only discussed holding or hiking rates in June, repeating the pattern seen in May.

AUD/USD bounces from range lows

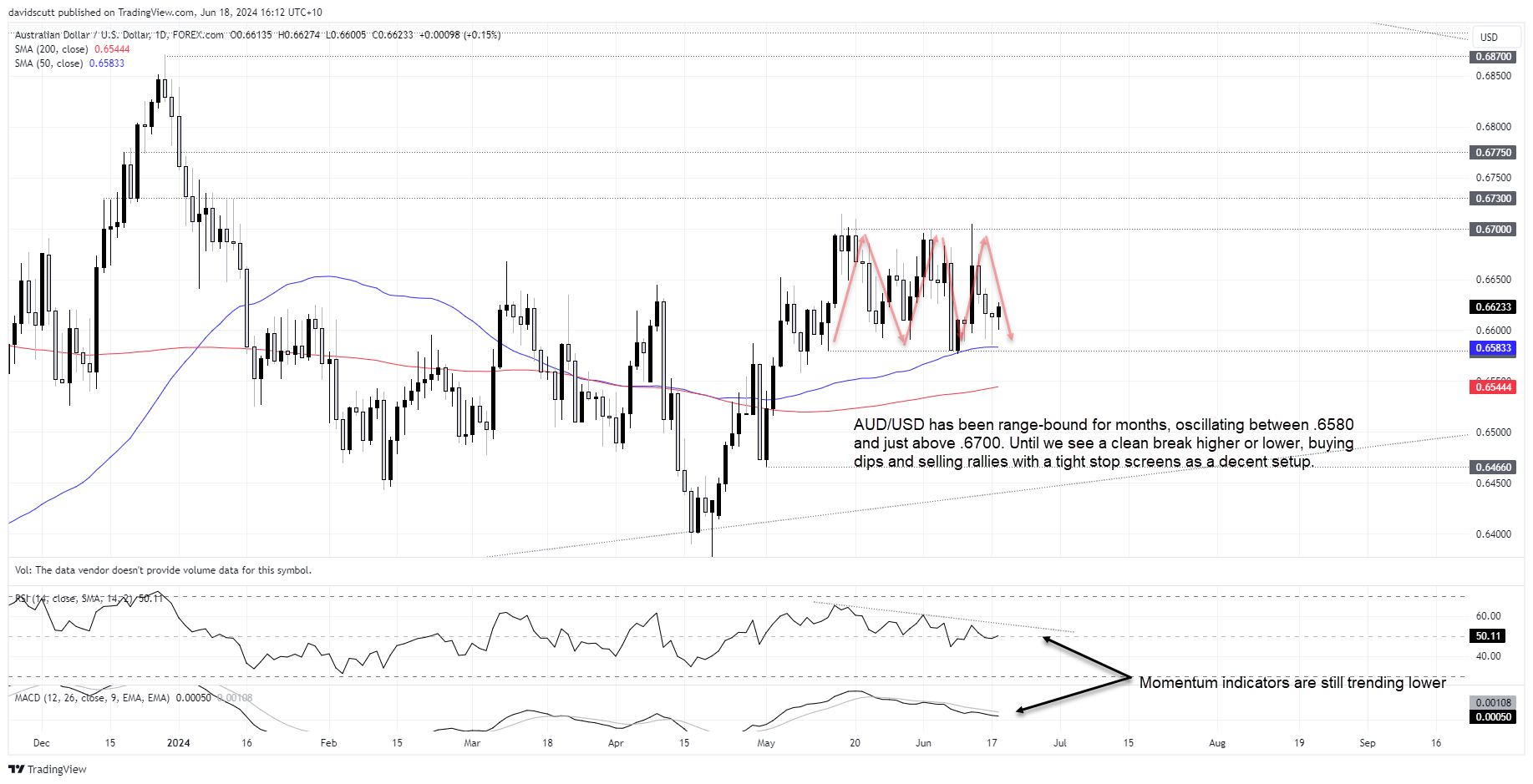

Australian three-year government bond yields spiked six basis points from the session lows following the announcement, contributing to a similar reversal in AUD/USD which had been trading lower heading into the event. Zooming out, AUD/USD has been rangebound for the better part of two months, attracting bids from .6580 with offers emerging above .6700.

While the hawkish hold from the RBA has seen it push higher, the US retail sales and industrial production prints will likely dictate near-term direction unless we see an unlikely shift in messaging from Fed speakers that it remains too soon to consider cutting rates.

Given how many dips have been bought below .6600 recently, should AUD/USD move back there later in the session, buying with a stop below .6580 screens as a decent setup for traders scouting for ideas.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade