WTI crude oil prices were a touch higher on Tuesday as the ceasefire in Gaza remains uncertain. Oil prices fell over 7% from the Friday April 26 high to last Friday low, and are now trapped beneath the 200-day average and above the December bullish trendline.

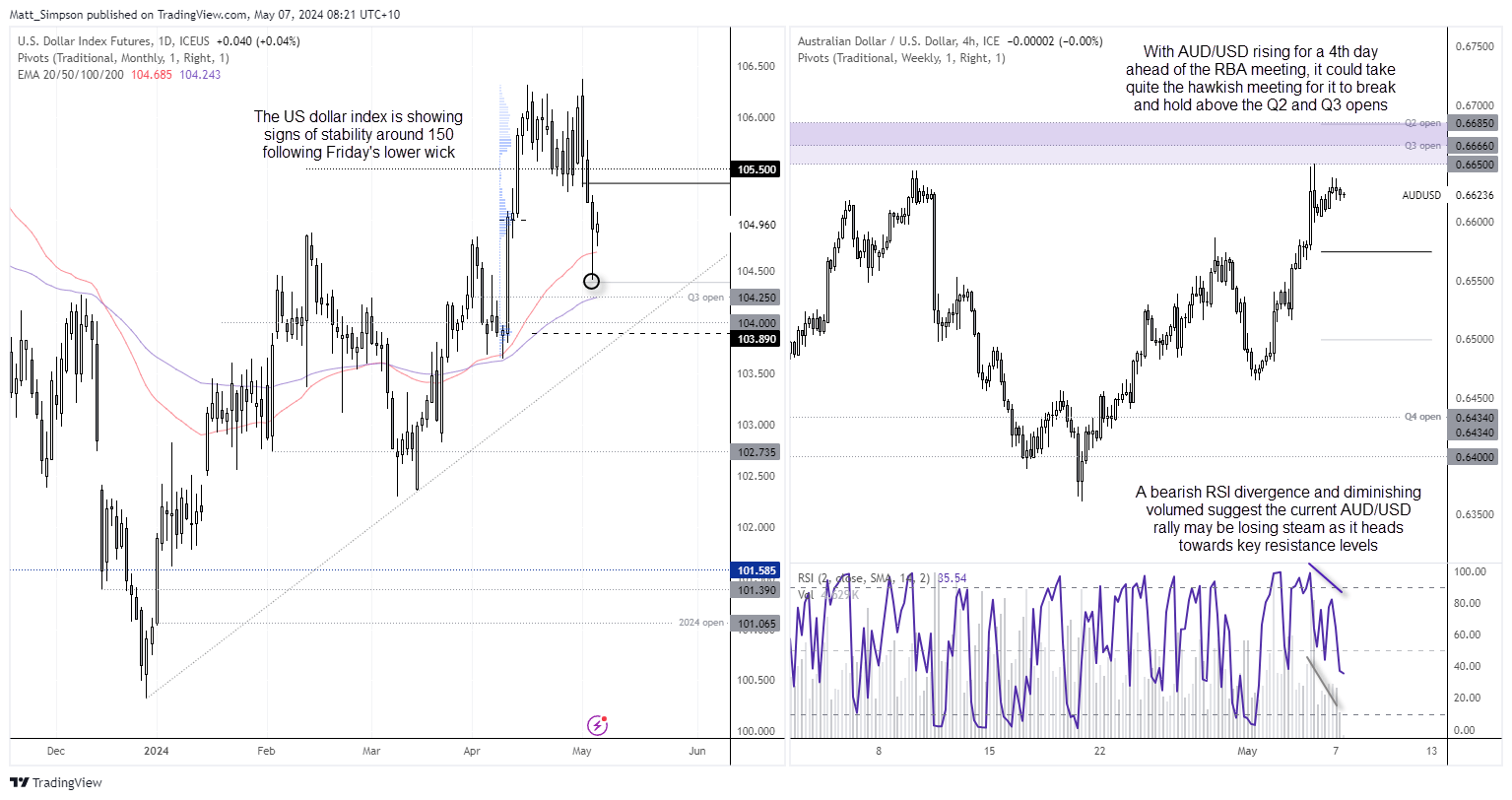

Fed Williams said that the net interest rate move is likely to be lower. The US dollar was little changed on the day and formed a small inside day (and doji) which closed back above 105, during a quiet days trade due to the UK public holiday.

AUD/USD rose for a fourth day yet upside volatility was relatively low. There has been a growing expectation that the RBA will reintroduce a tightening bias, although the consensus remains for them to hold today. And given AUD/USD is fast approaching resistance around the 0.6550 – 0.6660 zone then I am now questioning the upside potential for AUD/USD given the selloff on the US dollar index is showing signs of stability. Should the RBA implement a hawkish bias but little else, then perhaps we’ll see another pop higher before reversing around the Q2 or 3 opens, especially if the US dollar index finds some love around 105.

Economic events (times in AEST)

Today’s RBA meeting is clearly the big event in today’s Asian session. You can read my full view in the AUD/USD weekly outlook, but in a nutshell I suspect the RBA will hold rates and include a hawkish bias to their statement given the higher inflation print. And this is despite Monday’s reports that former governor Lowe said that he doesn’t think the fight against inflation is yet over, prompting some speculation that today’s meeting could be live.

- 09:50 – Japan foreigner stock/bond purchases

- 11:30 – Australia retail sales

- 14:30 – RBA cash rate decision

- 15:30 – RBA SOMP (statement on monetary policy) and press conference

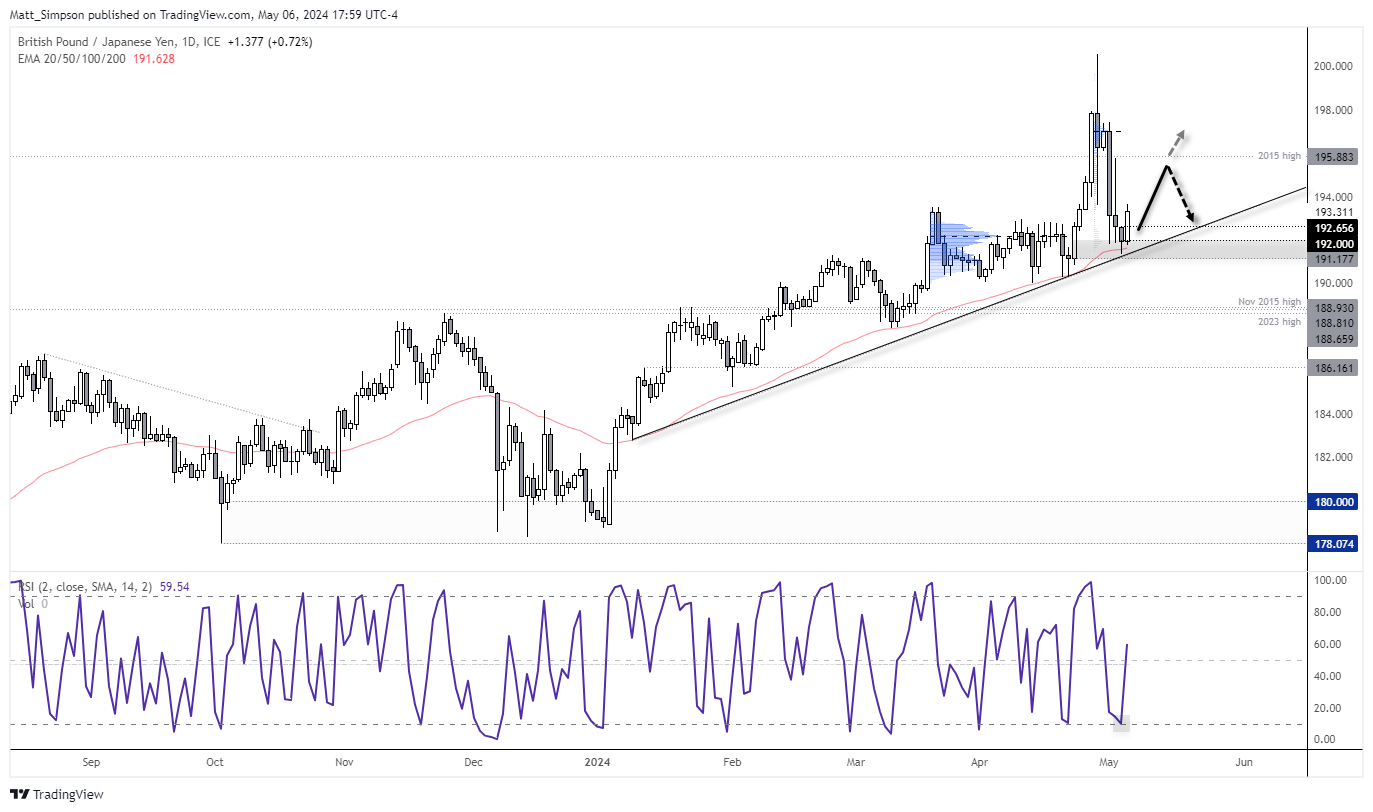

GBP/JPY technical analysis:

The daily chart shows an established uptrend on GBP/JPY, even if late-stage parabolic rally to 200 was met with an almighty thud. Yet bearish volatility receded on Friday before Monday snapped its 3-day losing streak, which suggests a swing low may have formed on Friday. RSI (2) was also overbought on that day, the lower wick failed to close beneath the 50-day EMA and prices are back above the high-volume node from a prior consolidation area.

Bulls could seek dis down to 192 with a stop beneath Friday’s low (or the trendline for extra wriggle room) in anticipation of a retest and potential break of 194. A move towards the 2015 high may not be out of the question, although things might get shaky given the potential for further intervention.

However, there is a reasonable chance that the BOE may not be as dovish as markets hope which could further support the British pound into the weekend.

Gold technical analysis:

Last week out I outlined a technical scenario for gold to bounce from $2300 on the assumption the weekly low had been seen. NFP figures had other plans and forced a marginal new low, but it now appears we can revisit the potential setup.

A doji formed on Friday and Monday’s bullish price action was part of a 3-bar bullish reversal (morning star). The cycle low formed around the 50% Fibonacci level and prior high-volume node to add weight to the potential swing low. From here, bulls can either enter at market or seek dips towards the $2300 handle with a stop below Friday’s low. $2350 makes a feasible near-term target, near the prior cycle highs.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade