- AUD/USD and ASX 200 fell heavily in the wake of the latest US CPI report

- Odds of another Fed rate hike have increased, although November looks a stretch

- A weak US bond auction was a major catalyst behind broader market volatility

- Chinese inflation, trade and new loan data will be influential on Asian markets near-term

Dip-buyers in AUD/USD and ASX 200 were provided a reminder that the path of least resistance remains lower short-term with both hammered on the back of a hot US “supercore” services inflation number in September. For AUD/USD, the 1.55% slump came within a whisker of being the largest since March, only surpassed by a slightly larger fall at the start of August.

CPI wrongfoots AUD/USD, ASX 200 traders

The real story for the US September consumer price inflation (CPI) report was not the monthly reading coming in a tenth above estimates at 0.4%. Nor was it the core figure printing at 0.3%, seeing the annual increase slow to 4.1%, the smallest in over two years. No, the story was the scorching hot core services ex-shelter inflation number – known in markets as supercore – which printed at 0.61%, the largest monthly gain in over a year. That’s important because the supercore figure has been singled out by the Fed as an important measure of underlying inflation pressures given the linkages to wage demands for workers. A potential wage-price spiral gauge, of sorts.

While you cannot argue with the data – it is what it is – it’s worthwhile pointing out that shelter costs such as rent have been moderating in alternate data series, an important acknowledgement given these typically lead the official series. The acceleration in supercore is also at odds with several employee cost measures, such as average hourly earnings, which are well off the highs seen last year.

That underlines why the data should be treated with some caution, and likely keeps the Fed-on-hold narrative intact for at least another month. It needs to see corroborative evidence accumulate that inflationary pressures are reaccelerating, likely keeping a November hike off the table, especially when lead indicators are showing signs of rolling over. As things stand, probability of a 25 basis point increase in the funds rate the Fed’s December meeting is deemed a smidgen over 40%.

Hot supercore inflation, poor bond auction send yields spiraling higher

Regardless of interpretation, markets tend to overreact first and ask questions later, as demonstrated by the outsized moves in bond and FX markets. Long bonds were taken to the woodshed and walloped, hit not only by the supercore inflation print but also weak demand at an auction of $20 billion worth of 30-year Treasuries, mirroring a similar outcome at a 10-year note auction earlier this week. That saw 10 and 30-year yields post double-digit increases, hitting risk appetite in currencies and equities.

The AUD/USD and ASX 200 were among the hardest hit.

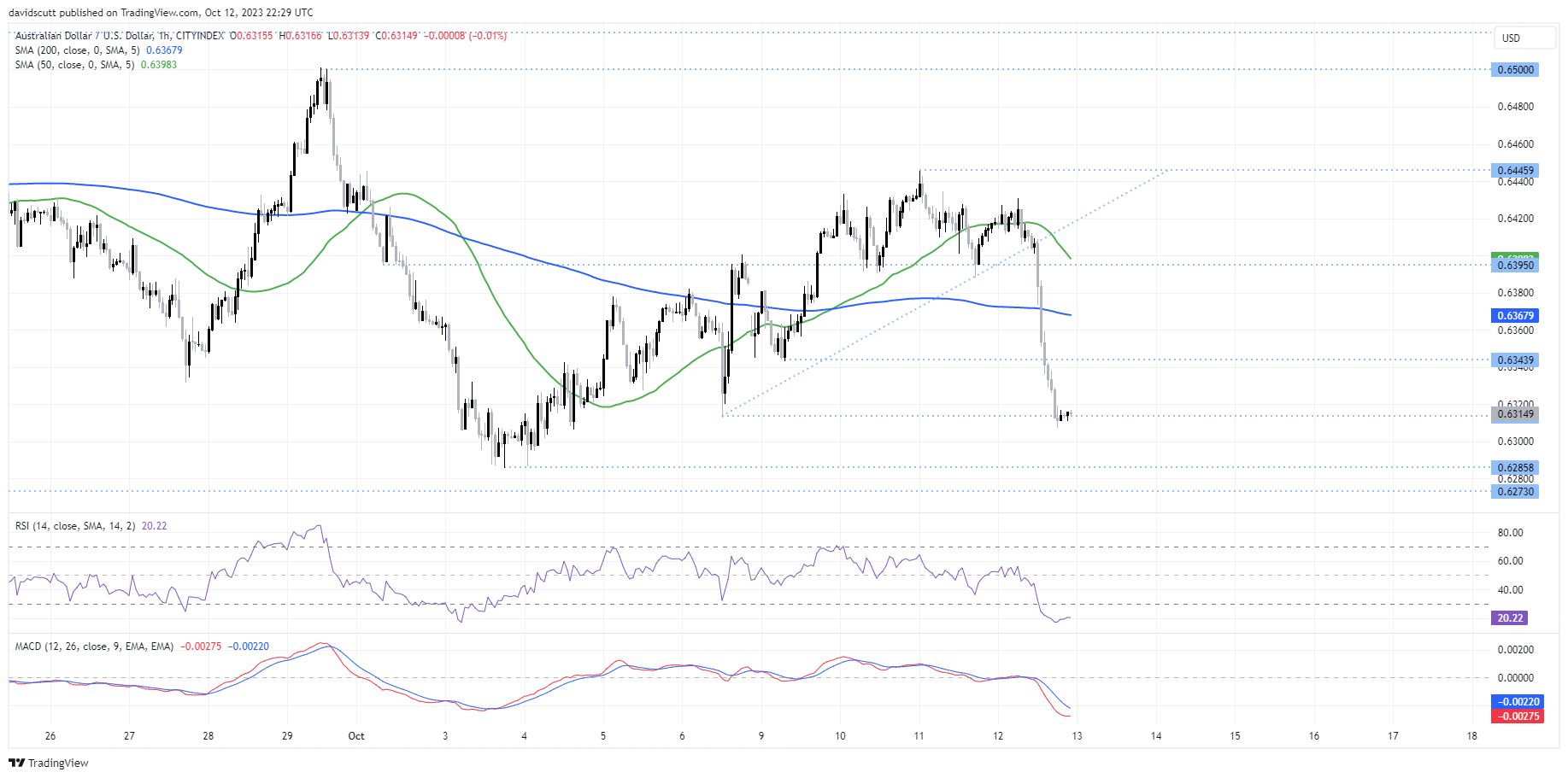

AUD/USD up via the stairs, down via the elevator

Looking at AUD/USD on the hourly, gains over the past fortnight were erased in the space of hours, seeing the pair fall back to support located around .6315. While oversold in the short-term, likely explaining stability in the latter parts of the US session, bears will undoubtedly be eyeing a retest of the year-to-date lows below .6300 hit in early October.

While it clearly remains a sell-on-rallies play, the Aussie has had far worse thrown at it in recent months and managed to hang tough, suggesting there may be plenty of willing buyers lurking should we see a re-test of the lows, especially when there’s so many question marks about the momentum in US inflation.

Should we see dips back towards .6300, some traders may be tempted to enter longs with a stop below .6285 or .6273, a support level running back to last year. .6395 looks a reasonable target to reassess the position, should it get there.

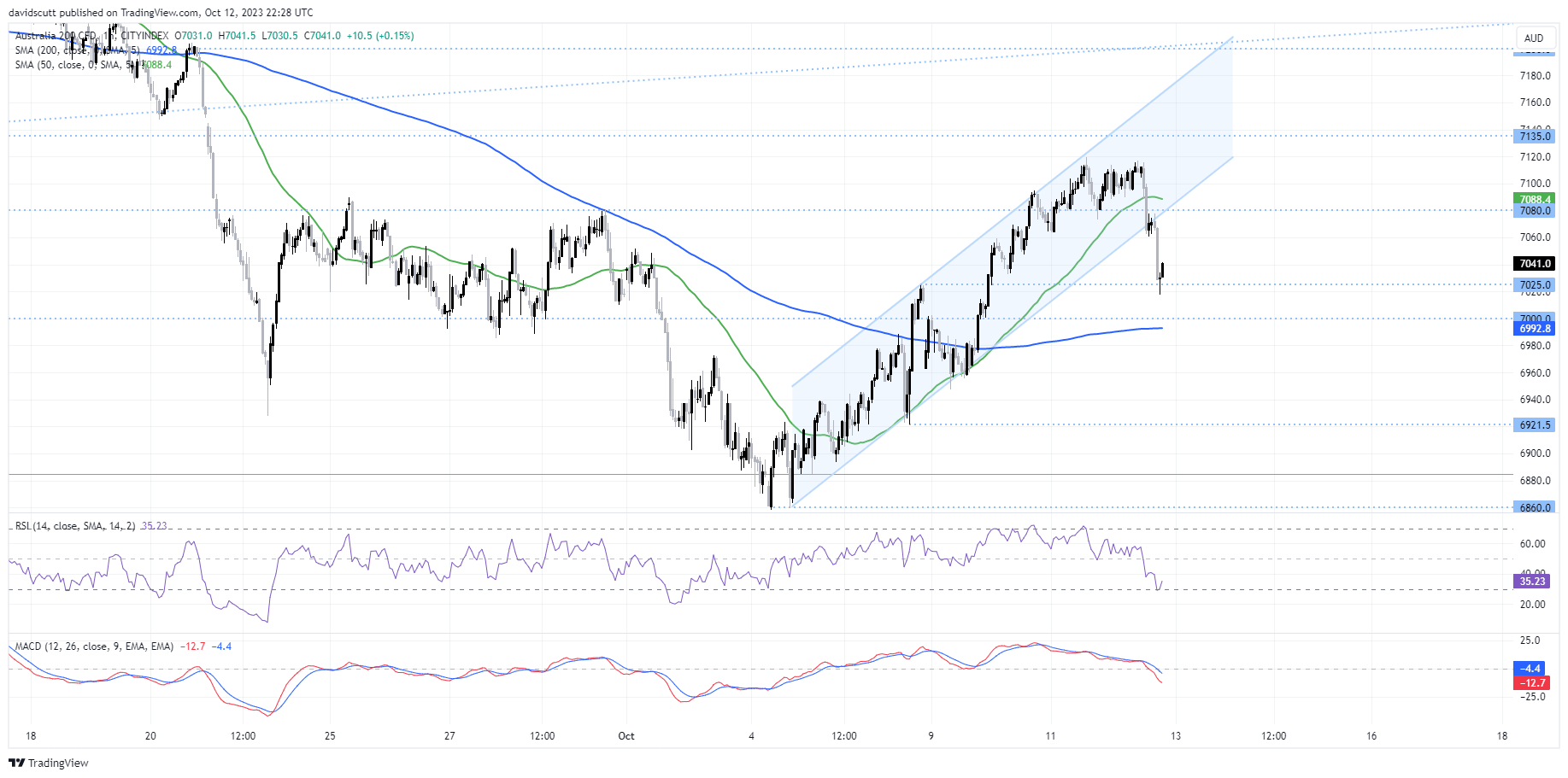

ASX 200 uptrend broken, buyers eyed below 7000

For the ASX 200, it was spared significant damage unlike the Aussie, perhaps cushioned by the former’s demise. Still, the uptrend over the past week is now cactus with the index falling below 7020 at one point during the US session before finding bids at a minor support level of .7025.

Much like AUD/USD, the ASX 200 was given every excuse to extend its downside last month and didn’t, a telling outcome which suggests buyers are lurking on probes below 7000. 7080 is the first upside level to watch, marking the intersection between the former uptrend and horizontal support. Above that, Thursday’s high of 7120 and 7135 would be next om the agenda.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade