- Nasdaq 100 analysis: Tech earnings optimism underpins recovery for now

- US bond yields remain elevated ahead of a record $70 billion sale

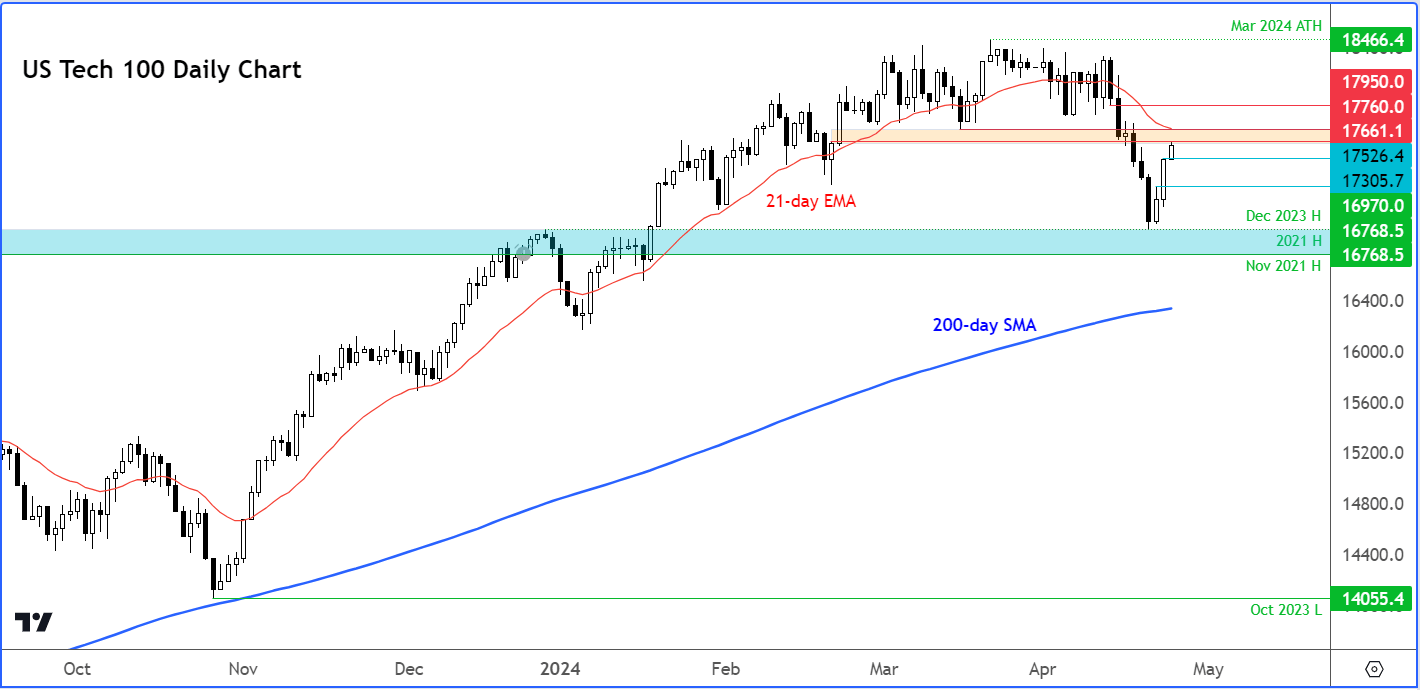

- Nasdaq 100 technical analysis shows index is testing key resistance

Following last week's big drop, the Nasdaq 100 has staged a rapid three-day rebound at the beginning of this week, somewhat diminishing the influence of bearish sentiment. Still, Wall Street was trading mixed at the time of writing, with technology-heavy index outperforming following Tesla’s double-digit surge, while the Dow and Russell were weaker. So, I certainly wouldn’t rule out the possibility of a renewed sell-off in stocks, as much of the existing macro worries are still there. Indeed, investors will shift their attention back to macroeconomics with key US data scheduled for release in the latter part of the week, including GDP and the core PCE price index. Unless these figures show weakness, there's a possibility that bond yields may push further higher as investors reassess the likelihood of interest rate cuts. Such a scenario could pose a downside risk for risk assets, although the performance of the Nasdaq this week will primarily hinge on earnings within the tech sector.

Nasdaq 100 analysis: US prepares $70 billion bond auction as interest payments continue to rise

One big source of worry for investors is the rising levels of interest payment by the US government, which is not going to be addressed any time soon. For now, bond investors are not too concerned about the possibility of a US default, although gold investors seem to think otherwise. The precious metal has risen to record highs recently despite the renewed rise in bond yields.

On Tuesday, the US government successfully auctioned $69 billion of two-year notes at a yield of 4.898%, slightly lower than the pre-auction yield, indicating higher-than-expected demand. Today, an additional $70 billion of five-year notes will be offered, followed by $44 billion of seven-year notes on Thursday.

Buoyed by strong economic data and persistent inflation, traders are seeking higher yields for holding government debt as they revise down their expectations of Federal Reserve rate cuts for the year.

However, higher yields and interest rates remaining elevated means the cost of servicing US Federal debt is becoming burdensome. The annual interest expense alone has reached a staggering $1.1 trillion, compared to less than half this amount just a few years ago. With interest rates elevated and debt levels reaching record highs due to ongoing deficit spending, the US is seemingly on an unsustainable fiscal trajectory. Implementing tax hikes and government spending cuts is the only viable solution to regain some semblance of control. Failure to address this issue could lead to a severe recession and have a significant impact on stocks.

Despite these risks, stock investors currently seem to be disregarding them, choosing instead to focus on company earnings. Speaking of…

Meta, Microsoft and Alphabet among earning to come this week

The optimistic atmosphere within the tech sector was also evident in Europe earlier in the day, as ASM International announced orders surpassing expectations. This follows a positive forecast from US counterpart Texas Instruments. Further earnings announcements are anticipated from companies on both sides of the Atlantic. Microsoft, Meta, and Alphabet are among those scheduled to release earnings this week. Bloomberg forecasts profits for the "Magnificent Seven" group to increase by approximately 40% in the first quarter compared to the previous year.

Focus turns to macroeconomics with GDP and Core PCE data to come

Investors will be refocusing on the broader economic landscape as key US data, including GDP and the core PCE price index, are slated for release later in the week. Unless these indicators exhibit weakness, there's a likelihood that bond yields could push further higher as investors recalibrate their expectations regarding potential rate cuts. Such a scenario could negatively impact risk assets, though the tech sector will remain primarily concerned with company earnings.

GDP is anticipated to show a 2.5% annualised growth for Q1, with the release scheduled for Thursday. This, coupled with the subsequent release of the core PCE price index on Friday, will refocus attention on interest rate expectations. Friday's core PCE data is projected to show another strong 0.3% month-over-month increase. If so, this would likely indicate that elevated interest rates will persist for longer. The PCE data will play a significant role in shaping the Fed's forthcoming policy decisions. Following a robust US CPI reading, the Fed will be anticipating, even hoping for, a softer print on the PCE measure of inflation.

Nasdaq 100 technical analysis

Source: TradingView.com

After a sharp recovery, the Nasdaq has broken above a couple of short-term resistance levels to loosen the bears’ control of price action. However, the index is still not back above the broken 21-day exponential moving average to signal a complete reversal back in the direction of the long-term bull trend. That may happen later this week, should the index get past a pivotal area between 17660 to 17760 area, which is now the most important resistance zone to watch. This area was previously support.

Until and unless the index reclaims the above area, and given the sharp two-day rally, I would proceed with a bit of extra care if I were a bull, as profit-taking has the potential to send the index back lower again. Short-term support now comes in around 17526, marking Tuesday’s high, followed by Monday’s high at 17305. It is essential that one of these support levels hold. Otherwise, we could see another dip into the longer-term support zone between 16768 to 16970 (the highs from 2021 and 20223). On Friday, the Nasdaq 100 tested the upper end of its long-term support range and bounced. Another test could be on the cards should we see the return of the bears, as I suspect we might.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade