- Crude oil analysis: War risk premium fades

- OPEC+ cuts and reduced fears about Eurozone economy keep oil prices supported

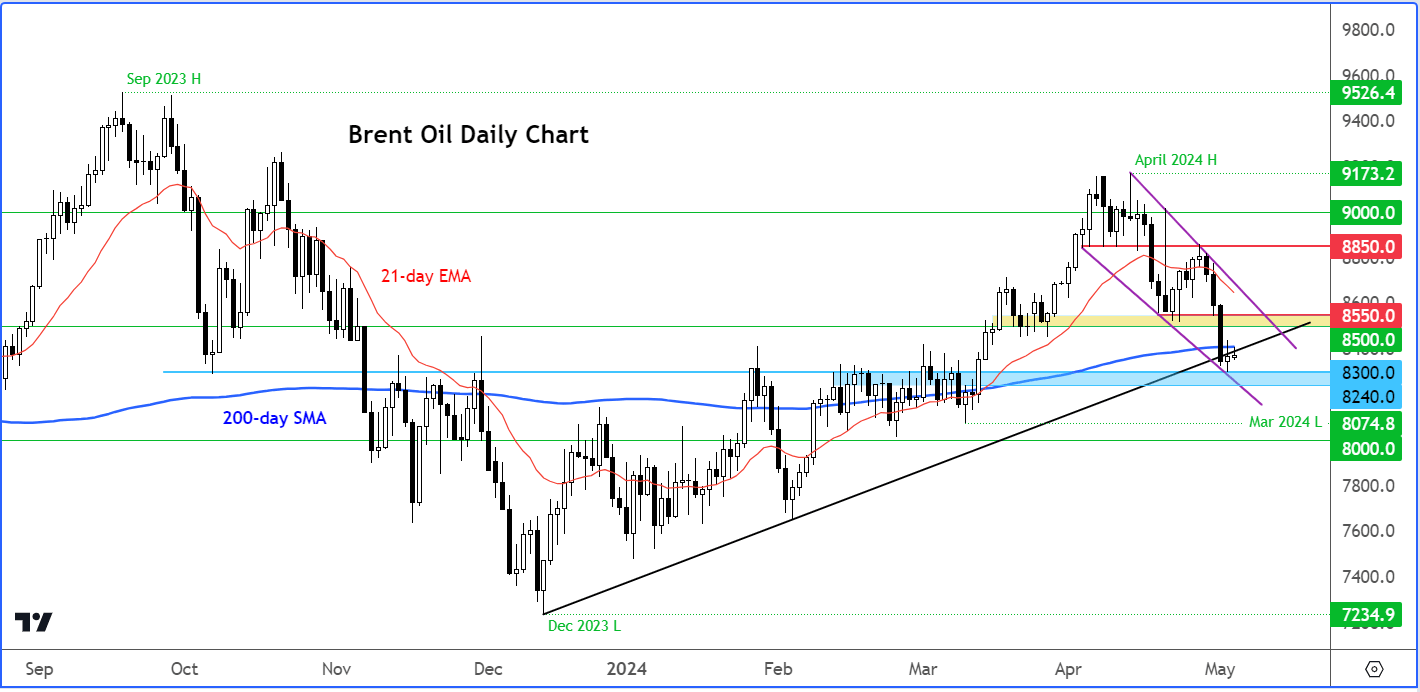

- Brent oil technical analysis suggest prices are now at key support zone

Crude oil analysis: After a near 10% drop, prices could rebound

Since peaking in mid-April, crude oil prices have slumped nearly 10% in the spaces of just a few weeks. The sharp drop reflects in part the removal of war risk premium that was slowly priced in as the tensions in the Middle East intensified with Iran and Israel attacking each other directly. But as tensions have eased and hopes for a ceasefire between Israel and Hamas have grown amid international pressure on Jerusalem, oil prices have basically given back all the gains made since early March. There is also some concern about demand in the US where commercial crude inventories have been building more than expected as the rate at which refiners process crude to crude products have dropped noticeably. Still, following the recent correction, the downside could be limited from here on. For one thing, there is still the risk of the Middle East conflict intensifying again. For another, economic data in Europe have improved while Chinese concerns have eased, lifting the demand outlook.

Crude oil analysis: US demand should pick up heading towards driving season

The bulk of this week’s drop in oil prices took place on Tuesday and Wednesday, evidently on the back of the stockpiles data from the US. The US Energy Information Administration reported a surprise 7.3 million barrels of crude into stockpiles during the week ended April 26. Inventories are now at their highest levels since June 2023. What’s more, the refinery utilisation rate dropped to 87.5%, which was significantly lower than 90.7% in the year-ago period. Apparently, demand for gasoline has dropped. On average, the daily gasoline demand was 8.5 million barrels per day last week. This was some 1.3% lower than the same period a year ago.

But the refinery rate should climb as we head towards the US driving season, unofficially starting on Memorial Day weekend on May 27, all the way through Labor Day in early September.

What’s more, ongoing supply cuts by the OPEC+ group is likely to continue in the background, limiting any bearish moves.

Crude oil analysis: Brent oil technical analysis

Source: TradingView.com

After the sizeable drop in the last few weeks, crude oil prices are now technically oversold on the 4-hour time frame when you look at the RSI indicator. The Daily RSI is near 35, so it is not quite in the 20 threshold yet.

Nevertheless, the underlying price of oil is at a key support zone. As you can see on the chart, the area around $83.00 to around $82.40 was the base of the breakout after a multi-week consolidation back in March.

As it happens, we have the bullish trend that goes back to December and the 200-day moving average also converge slightly ahead of this area near $84.00. Although we have seen Brent oil fall below both the trend line and moving average, it would be a bullish outcome if prices were to go back above these and hold there heading into the weekend.

Such a scenario could pave the way for further technical buying, at least towards the next area of trouble at $85.00 to $85.50, an area which was formerly support. Additional resistance is likely to be provided by the resistance trend of what looks to be a bull flag or falling wedge continuation pattern, near $86.50

For oil to make a complete bullish reversal, we will eventually need to climb out of the above-mentioned pattern.

For now, though, the key question is whether it will be able to find a bottom around the $83.00 area and reclaim the 200 day and the bullish trend line.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade