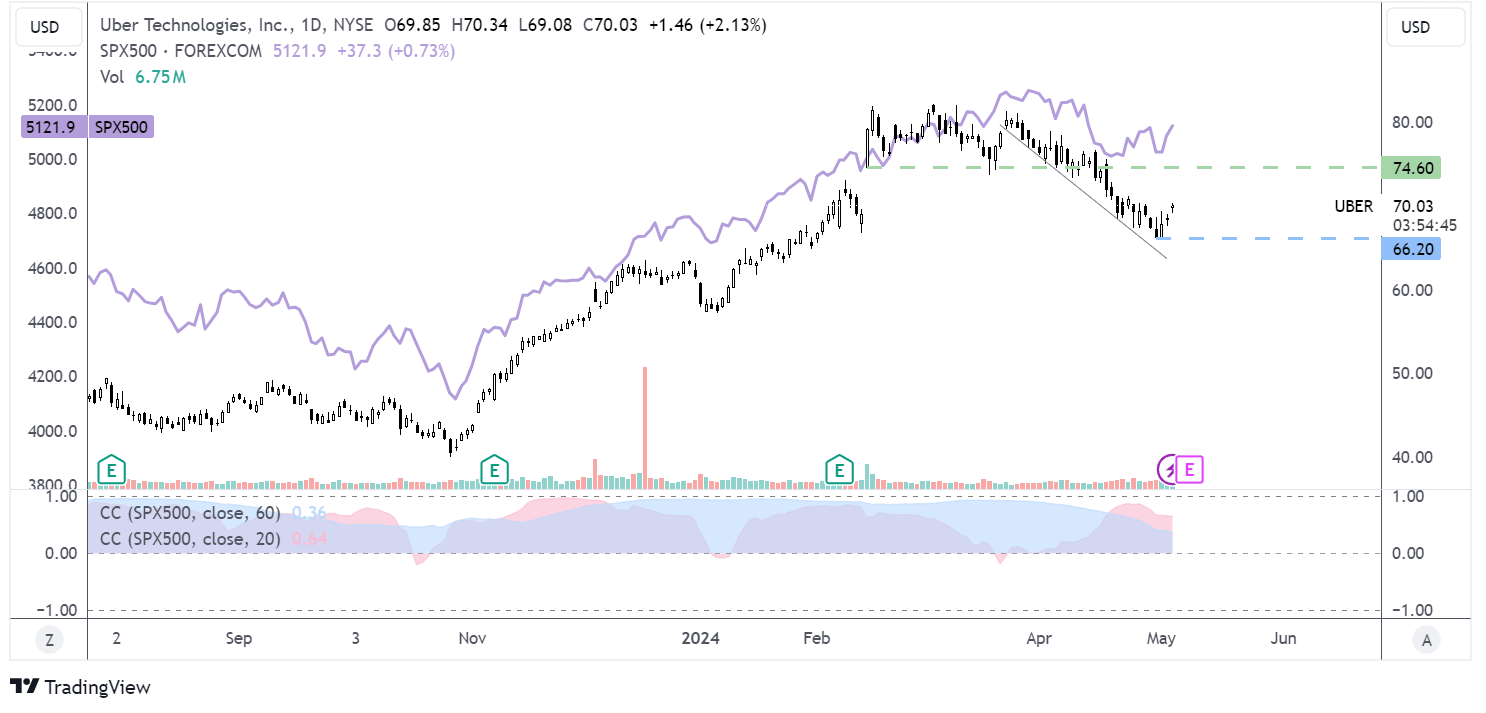

- Disney Q2 earnings Tuesday, May 7

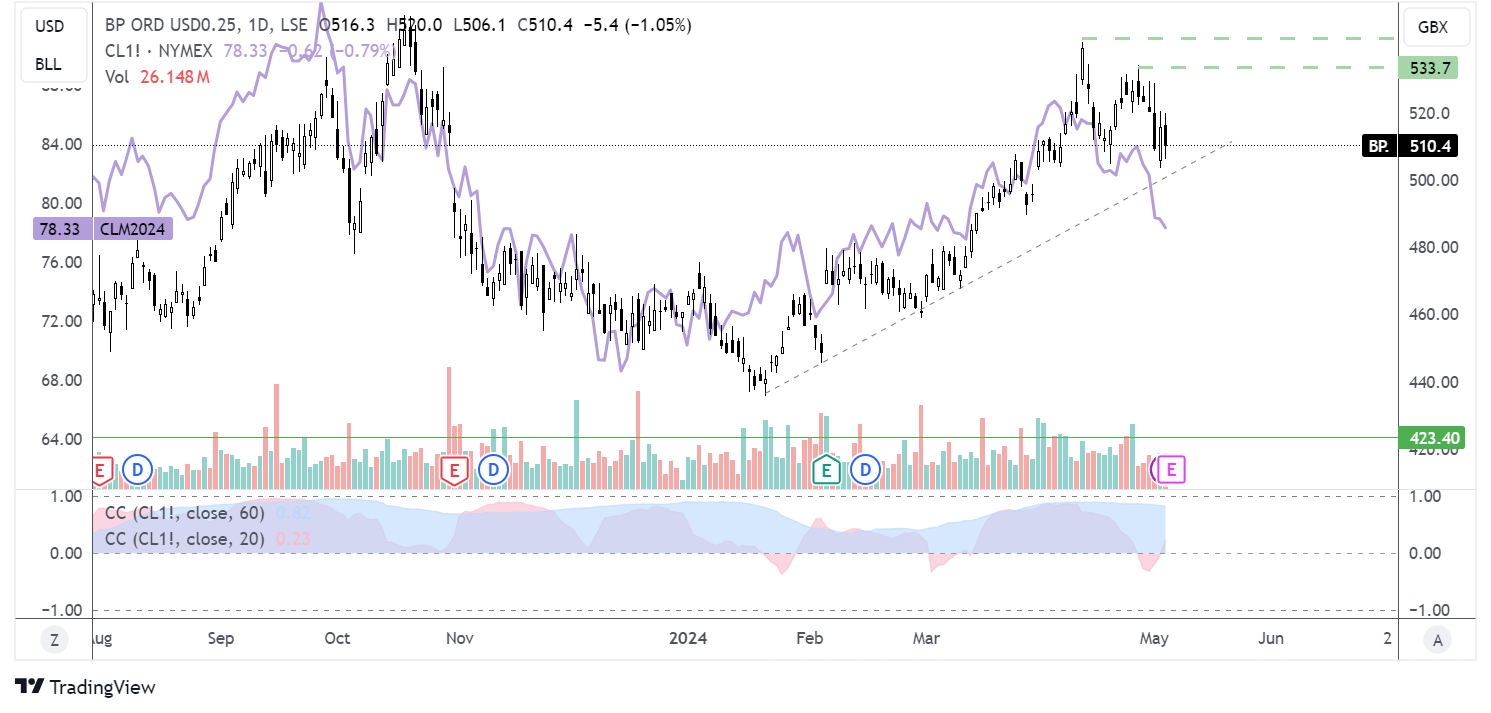

- BP Q1 earnings Tuesday, May 7

- Uber Q1 earnings Wednesday, May 8

The S&P 500 booked a modest gain last week after the Federal Reserve calmed fears of a rate hike but warned that rates could remain higher for longer. A weaker-than-expected non-farm payroll report boosted stocks at the end of the week as investors brought forward Fed rate cut expectations.

Looking ahead, this week is a quieter week for US economic data. At the end of the week, the main focus will be on US Michigan's confidence. Amid a quiet economic calendar, attention will be on earnings as the earnings season rolls on.

So far, Q1 earnings have been relatively strong, with companies faring well compared to analysts' estimates. This fundamental strength could support equities as the market weighs up when the first Fed rate cut may come.

The earnings recovery is broadening from the Magnificent seven, bringing attention to other stocks.

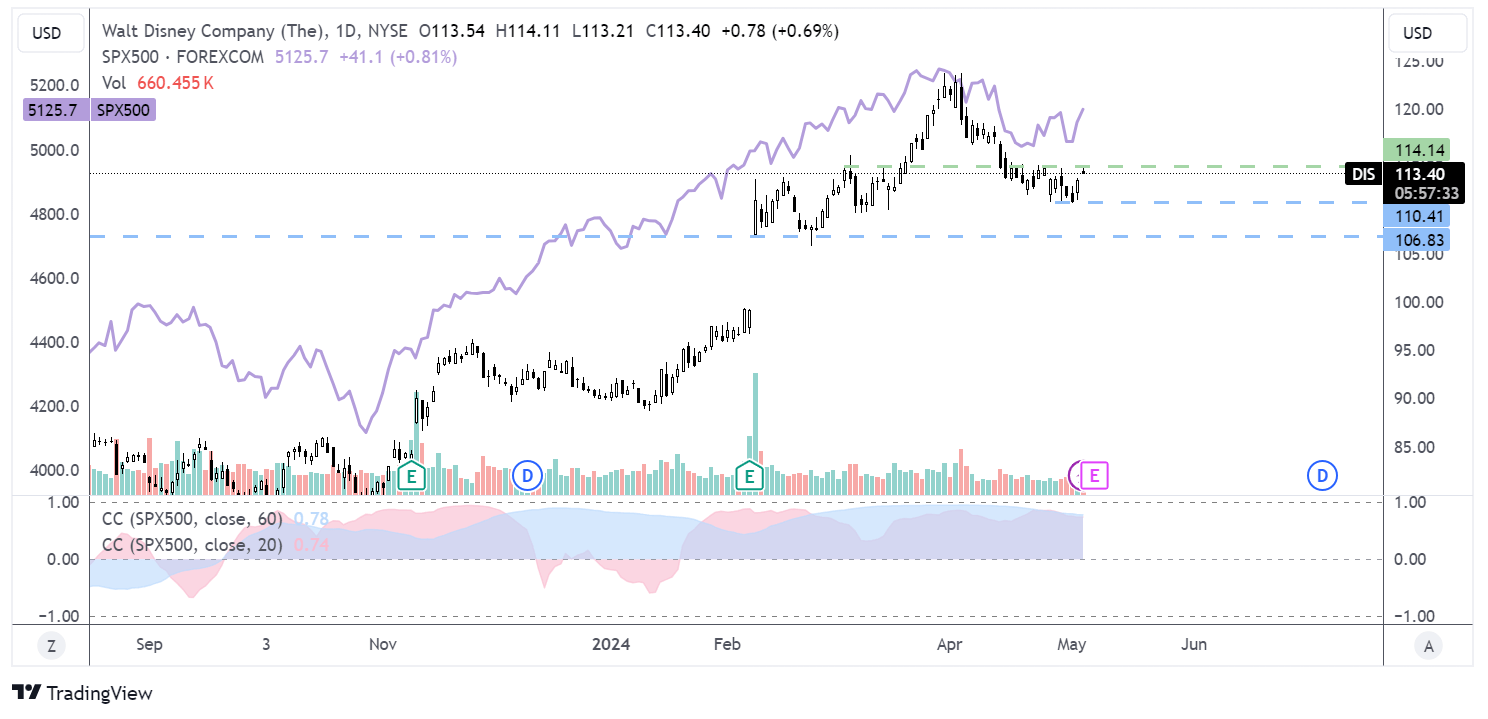

Disney Q2 earnings preview

Wall Street expects Disney to post revenue of $22.2 billion, marking an almost 2% rise annually. Earnings are expected to be $1.11 per share, an 18% rise. The focus has been on the Disney Parks in recent quarters after international parks saw higher attendance. Rising attendance and sounding at the Shanghai and Hong Kong parks could overshadow softness on the domestic side due to higher costs and tough comparables given the 50th anniversary a year ago. US consumer confidence has been declining, dropping to its lowest level in 18 months in April, which could impact domestic demand. To put some perspective on the number of international parks, revenue rose 35% in Q1 compared to 4% domestically.

The streaming business will be monitored closely as competition mounts and amid price increases. Disney+ subscribers declined by 1.3 million in the past quarter, although average revenue per user rose. Subscribers are expected to rise 4.7 million in this quarter.

The results come as Disney’s share price trades 25% higher this year, outperforming the S&P 500, which has gained 8.25%. Walt Disney is trading highly correlated to the S&P 500 over both a monthly and three-monthly period. The price is testing $115, and a rise above this could encourage bulls to extend gains towards $125.00.

BP Q1 earnings preview

BP is expected to report lower profits, in a trend seen across the sector, as oil and gas prices are lower than they were. Oil prices have risen throughout the first quarter of this year amid disruption in the Red Sea and owing to the risk premium from the Middle East war. However, they are down significantly from where they were in the months following Russia’s invasion of Ukraine and during the subsequent energy crisis. Oil prices have fallen sharply this week on concerns over the oil demand outlook.

Revenue is expected to be $ 49.3 billion, down from $56.9 billion in Q1 2023. Pre-tax profits are set to fall from $8.53bn to $6.37bn. Net debt will also be in focus, as BP has worked hard to cut its debt levels to $18 billion from a peak of $51 billion in 2020. Attention will also be on cash returns. In 2023, BP paid out $4.8 billion in dividends and $7.9 billion in share buybacks. The energy giant has already announced $3.5 billion of buybacks in the first half of 2024.

The chart shows the correlation between BP and oil prices. The 30-day correlation coefficient briefly turned negative last week for the first time in 2-months. Meanwhile, the 60-day correlation coefficient remains highly correlated.

Uber earnings preview

Wall Street expects UBER to post EPS of $0.21, marking a 362% year-over-year increase on revenue of $10.08 billion, up 14% from the same quarter last year. The results come after UBER posted its first annual operating profit in 2023, marking an inflection point in the ride-sharing stock’s history, thanks to solid demand for ride-sharing and deliveries and its growing advertising business.

The results come as Uber's share price has risen 19% YTD, outperforming the S&P500, which trades 8% higher this year. The stock was also added to the Dow Jones transportation average.

The 60-day correlation between Uber and the S&P500 is the weakest it has been since October last year.