- Australian wage pressures undershot expectations marginally in Q1

- The result lessens the risk of a near-term RBA rate hike

- AUD/USD was disinterested. US CPI remains the only game in town on Wednesday

Australian wages growth softens

Australian wage pressures undershot expectation in the March quarter, further denting the prospect of another rate hike from the Reserve Bank of Australia.

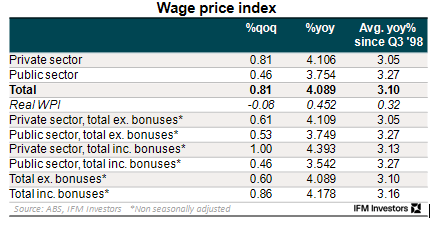

According to Australia’s Bureau of Statistics (ABS), wages rose 0.8% in the first three months of 2024, down a tenth on the 0.9% pace expected. The slight undershoot saw the annual growth rate slow to 4.1% from 4.2%. Markets were expecting an unchanged reading.

Taking inflation into account, real wages declined 0.08% over the quarter but rose 0.5% over the year.

Wages in the private sector grew 0.8% over the quarter, near double the 0.5% level seen for the public sector. Over the year, private sector wages rose 4.1% while those in the public sector increased 3.8%.

Source: X, IFM Investors

The wage price index measures changes over time in wages and salaries, looking at hourly pay rates. It does not consider changes in the type, amount or location of work performed, nor the characteristics of individual employees.

RBA rate hike risk lessens

The softer-than-expected data will be welcomed by policymakers at the Reserve Bank of Australia who stated earlier this month that wages growth looks to have peaked, helping limit the risk of a reacceleration in inflationary pressures.

It forecast the WPI would increase 4.2% in the year to June, so there are already downside risks to this view courtesy of today's report.

AUD/USD to be driven by US inflation report

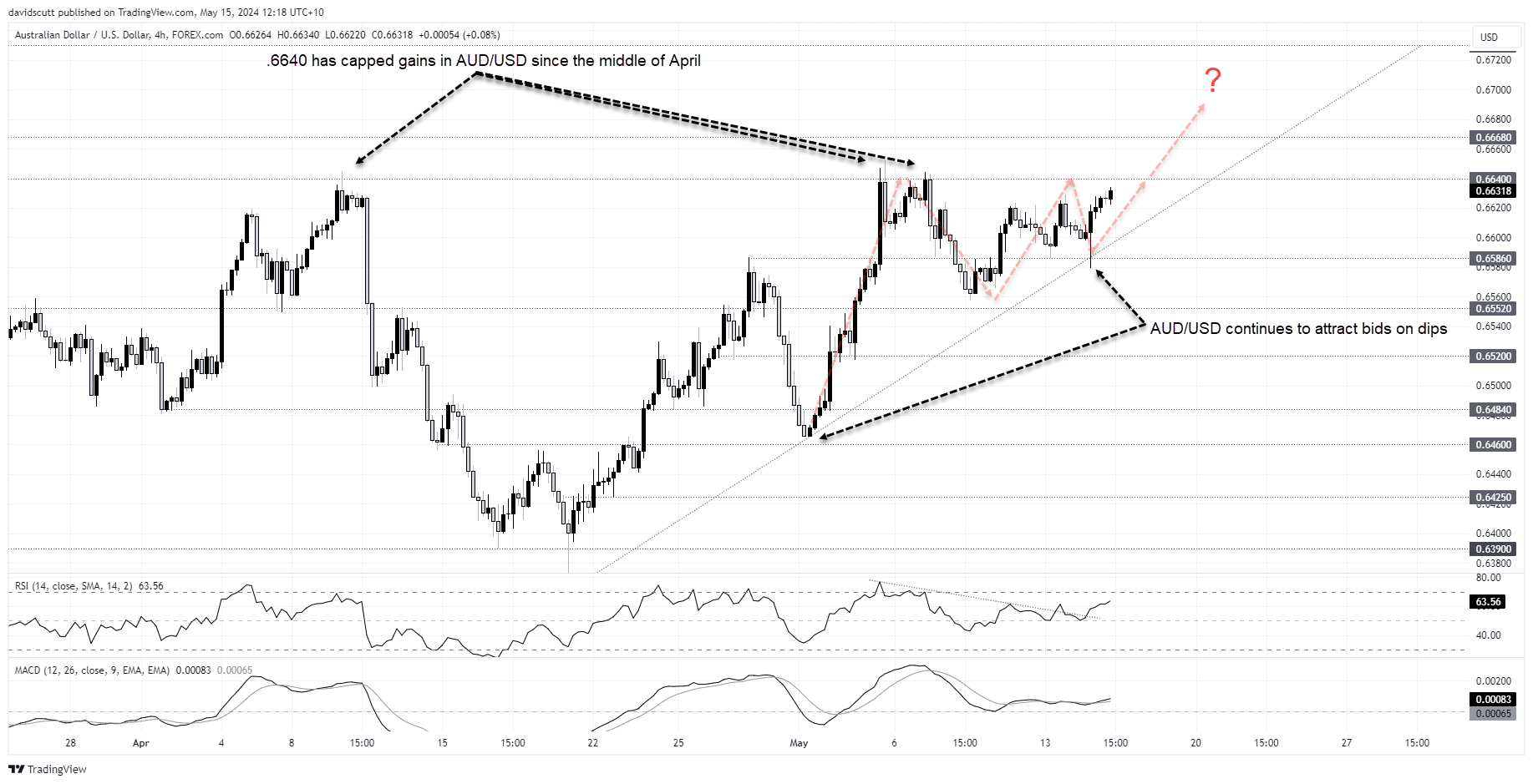

AUD/USD dipped momentarily on the news before rebounding to where it was trading prior to the release.

Ahead of the key US CPI report later Wednesday, AUD/USD is sandwiched between uptrend support and horizontal resistance at .6640. While it’s been stuck in this narrow range for much of May, you get the sense that may change in the coming hours.

In terms of levels to keep an eye on pre and post the inflation report, AUD/USD has done a lot of work either side of .6586 recently, making that the first support level of note. Below, .6552, .652, .6484 and .6460 have seen buying in the past.

On the topside, a break of .6640 would open the door to a test of the March high of .6668 with .6730 the next level after that.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade