Fed Interest Rate Key Points

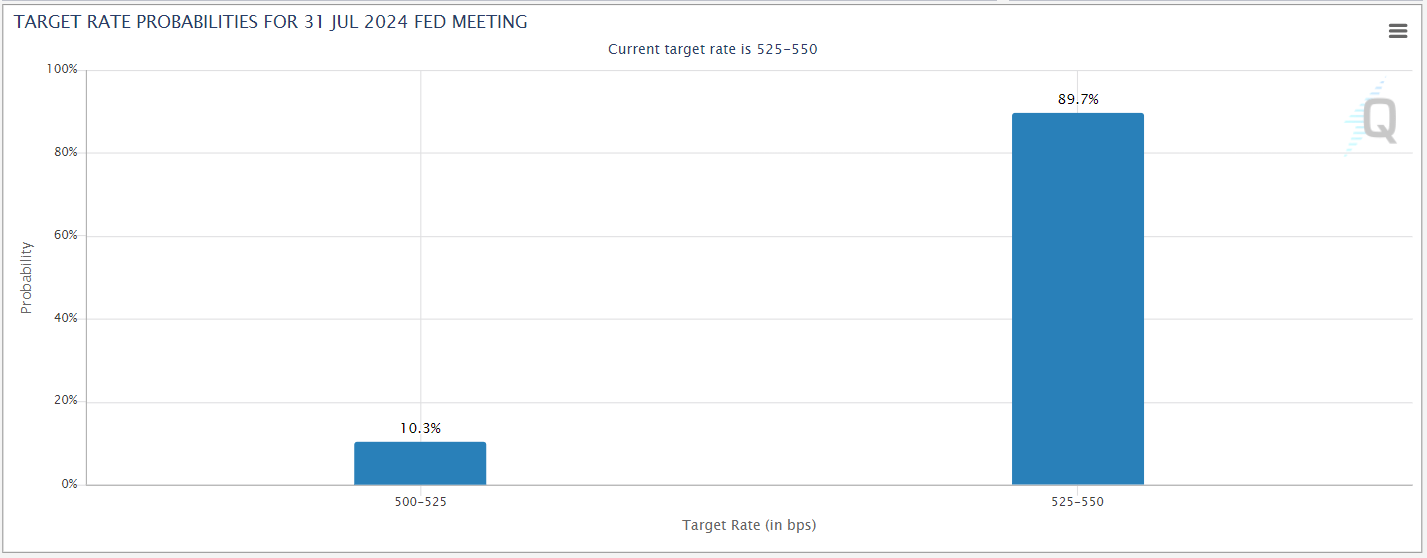

- Traders are pricing in just a 10% chance of a Fed rate cut in July, but there are at least four compelling reasons to consider a July rate cut.

- Inflation is running below the Fed’s target with timely measures of shelter inflation, jobless claims are ticking up, monetary policy is tight per the Taylor Rule, and the election is looming.

- Watch for a continued deterioration in US economic data and more dovish Fedspeak in the coming weeks.

Late last year, the title of this post would have been contrarian for the opposite reason. Traders were pricing in upwards of six interest rate cuts from the Federal Reserve as the central bank sought to stay ahead of an expected slowdown in the economy and continued disinflation. Instead, the US economy accelerated throughout the first quarter of the year and progress on inflation stalled, leading traders to, for a brief moment, price out any rate cuts whatsoever this year.

Now, after a couple of soft inflation readings and a slowdown in retail sales, the market is back to expecting 1-2 interest rate cuts by the end of the year, but barely any probability that those reductions will come before September:

Source: CME FedWatch

As the chart above shows, traders are pricing in just a 10% chance that Jerome Powell and Company will cut interest rates at its July meeting…and on the surface, that makes sense. After all, Fed Chairman Powell struck a relatively hawkish note in his press conference last week, highlighting that recent data has not yet given the Fed greater confidence that inflation is approaching its objective; this view was supported by an upward revision in the central bank’s inflation forecasts for 2024 (up to 2.8% Core PCE) and 2025 (2.3%).

Four Reasons for the Fed to Cut Rates in July

Despite some element of logic in the Fed’s conservative, higher-for-longer approach to interest rates, there are at least XX reasons to consider cutting interest rates at the July meeting:

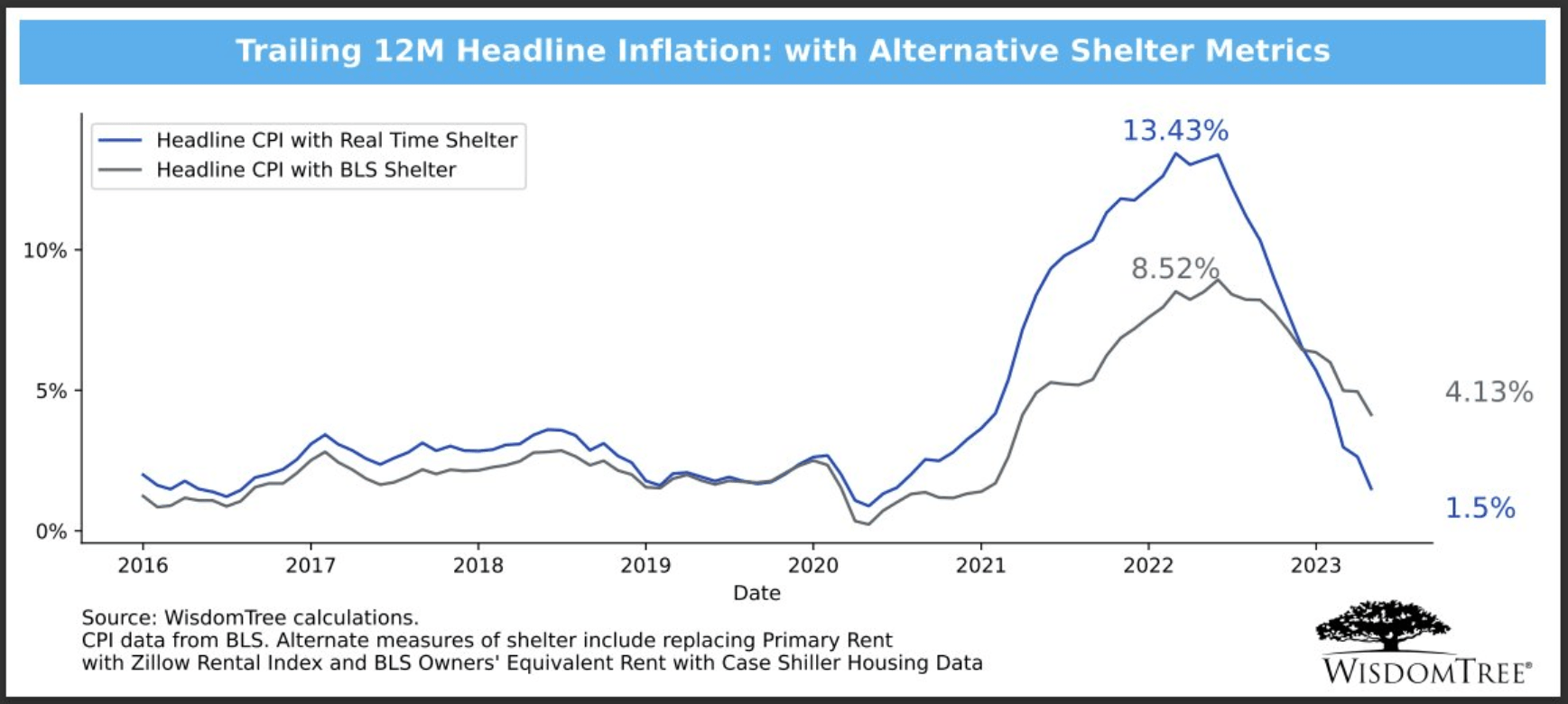

1) To the extent inflation is above target, it’s largely due to lagging estimates of shelter costs.

The archaic “Owner’s Equivalent Rent” estimate of housing pricing inflation that contributes to both CPI and Core PCE tends to trail substantially behind real-time measures of housing costs like the Case-Shiller index or the Zillow Rental Index. As the chart below shows, headline CPI would be running closer to 1.5%, below the Fed’s target, with these timelier measures of shelter inflation incorporated.

Source: WisdomTree

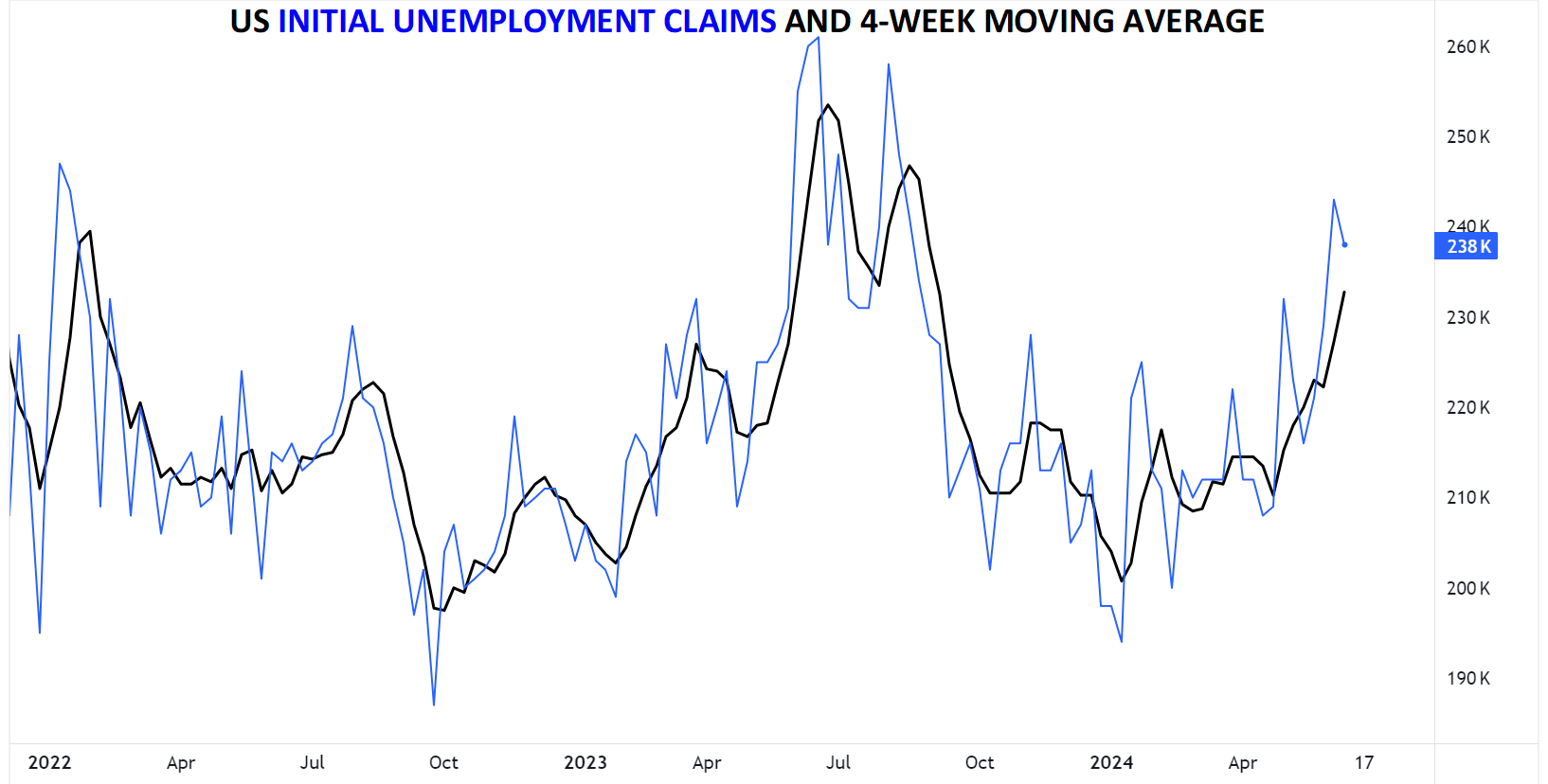

2) Jobless Claims are Rising

It’s been so long since we last had anything other than a spectacular jobs market, many traders have forgotten the second half of the Fed’s dual mandate. Now, for the first time since last September, the 4-week moving average of initial unemployment claims has bumped up above 230K, hinting at a deteriorating labor market.

Source: StoneX, TradingView

While still far from signaling an imminent recession, the loosening of the labor market should at least reassure Fed policymakers that another inflationary flareup is less likely.

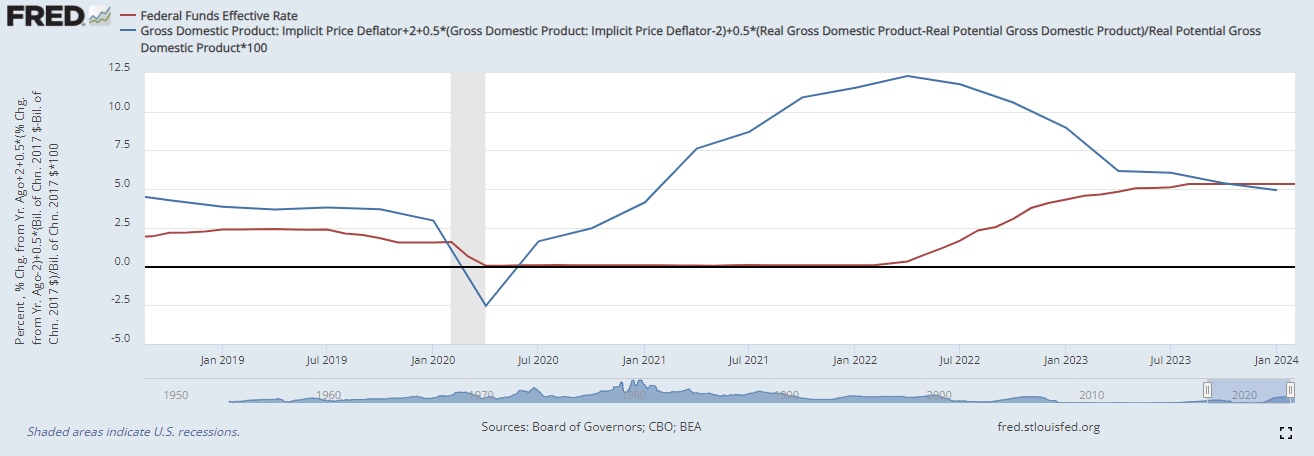

3) Monetary Policy is “Tight” for the First Time in 4+ Years

The historically opaque and seemingly subjective practice of manipulating interest rates to drive economic outcomes was permanently shifted to (slightly) more of a science with the creation of the “Taylor Rule” in 1993. That’s when Stanford economist John Taylor created a formula linking interest rates to inflation and a measure of economic slack.

As the chart below shows, the Taylor rule would have suggested that the Fed start raising interest rates in Q3 2020, a full 18 months before the Fed ultimately did, likely contributing to the big inflationary spike we saw in recent years. Now though, the Taylor Rule suggests interest rates are above the ideal target and likely to continue to fall over the rest of the year:

Source: FRED

4) The Election is Looming and the Fed Wants to Appear Apolitical

The last, but far from least important, argument for cutting interest rates in July is political…or rather, the Fed’s desire NOT to appear political. With what promises to be another tight US election looming in November, July may be the last realistic chance for the Fed to tweak policy without appearing political. As Cullen Roche at Discipline Funds notes, “Cutting in July also sets the precedent that they’re starting and so if they needed to cut again right before the election it wouldn’t look politically motivated. In other words, a move in July hedges lots of downside bets without risking a second runaway wave of inflation.”

While not impossible that the Fed could start cutting interest rates at its last pre-election meeting in September as many traders expect, there are also at least four compelling reasons to consider a July cut. Stay tuned in the coming weeks for a discussion of the potential market implications of a July rate cut if it starts to look more likely, starting with a continued slowdown in economic data and more dovish “Fedspeak”

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX