US futures

Dow future 0.26% at 39255

S&P futures 0.02% at 5464

Nasdaq futures -0.23% at 19650

In Europe

FTSE 0.48% at 8278

Dax -0.40% at 18273

- US stocks start the week mixed

- US core PCE data on Friday is the key event

- Nvidia extends its selloff

- Oil rises on hopes of increase summer demand

Nvidia falls further, Friday's inflation data in focus

U.S. stocks point to a mixed open with the S&P 500 and the Dow edging higher whilst the NASDAQ pointed to a weaker start ahead of a key inflation data on Friday.

The US economic calendar is relatively quiet until Friday when the focus will be on core PCE, the Federal Reserve's preferred measure for inflation which is expected to show a slight moderation in price pressures.

The market is currently pricing in around two rate cuts this year with over a 65% probability of a rate cut in September. However the Fed’s latest projection points to just one at rate cut in In 2024. As a result the core PCE reading may be able to provide further evidence for a possible reconciliation between the Fed and market expectations.

Data comes after mixed data last week and ahead of comments from San Francisco Fed president Mary Daly. The market will be watching to see whether she put supports the view of keeping rates high for longer.

Looking out across the weak little city durable goods weekly jobless claims and Q1 GDP data along with earnings from FedEx Micron technology and Walgreens boots.

Corporate news

Apple is set to rise modestly on the open despite the European Commission accusing the tech giant of breaking EU competition rules by stifling competition on its App Store. If found guilty, the iPhone maker could face a penalty of up to 10% of global annual revenue.

Nvidia is set to fall 1.8%, continuing the sell-off seen late last week after the chipmaker briefly became the world's most valuable company.

Broadcom is set to rise 0.6% after reports that the chipmaker is working with Chinese tech firm ByteDance to develop an advanced AI processor. This comes as the US attempts to restrict the export of these chips to China, its main economic rival.

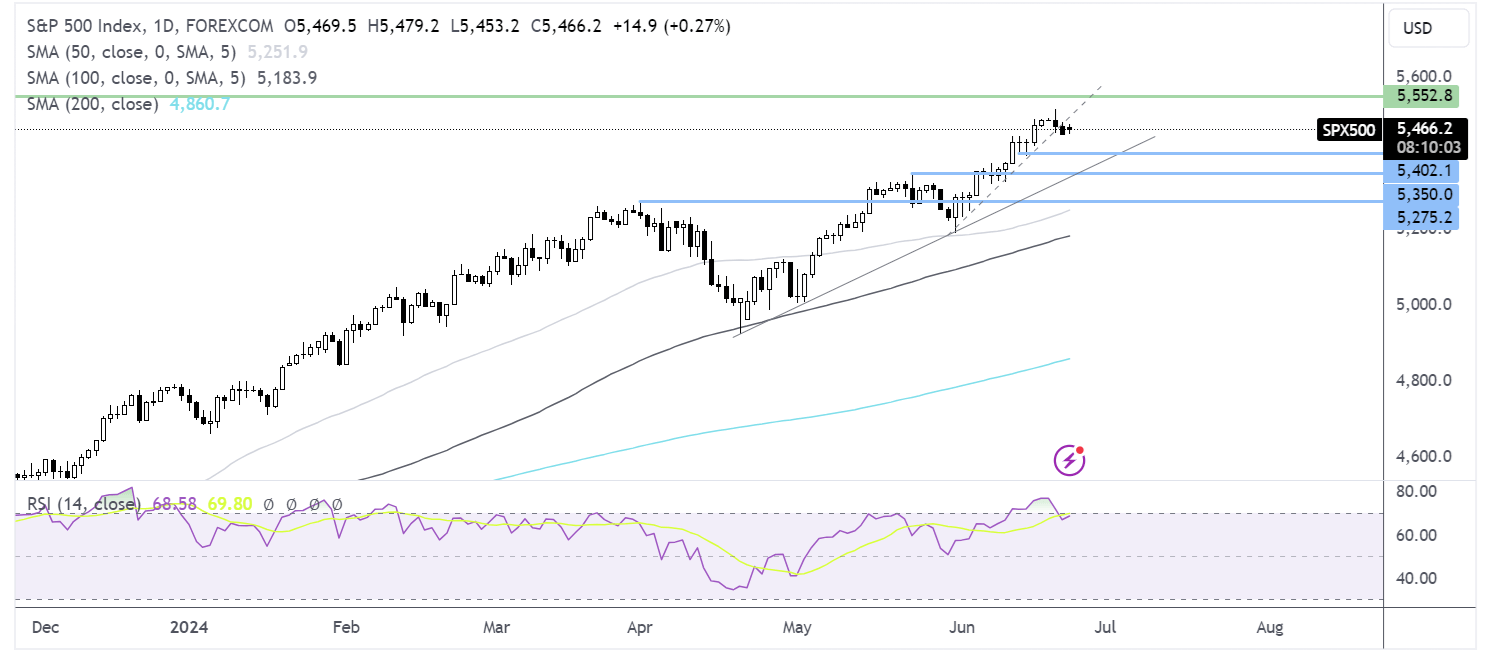

S&P 500 forecast – technical analysis.

The S&P 500 fell away from its all-time high of 5516, pulling the RSI out of overbought territory. The price has fallen below its rising trendline stalling at 5450. Support could be seen at 5400 round number and mid-June low. A break below here brings 3550, the May high, into focus. Meanwhile, buyers will look to extend gains towards 5516, and fresh ATHs,

FX markets – USD rises, GBP/USD falls

The USD is falling after strong gains last week, which marked the third straight weekly increase. Recent data has been mixed, with falling retail sales and high jobless claims but strong services PMI data. Federal Reserve members have pointed to interest rates remaining high for longer.

EUR/USD is edging higher, recovering from last week's lows despite deteriorating German business sentiment. The IFO German business climate unexpectedly declined to 88.6 in June, down from 89.7 in May, as businesses have more pessimistic expectations about the performance.

GBP/USD is rising but remains close to the monthly low reached on Friday. The pound has been pulled lower by expectations that the Bank of England could cut interest rates as soon as August. This week is a quiet week for UK economic data, and the focus will be on the elections on July 4th, where Labour is widely expected to win a majority. Given there is little room for fiscal maneuver, a change from a Conservative to a Labour government is unlikely to have a major impact on the FX market.

Oil rises on hopes of increased summer demand

Oil prices are rising, adding to gains in the previous week amid optimism regarding the summer demand outlook. This optimism, combined with escalating geopolitical tensions, offset a stronger U.S. dollar.

The market is growing quietly confident that global oil inventories could drop over the summer months in the northern hemisphere as seasonal demand for oil picks up across the driving season.

Meanwhile, geopolitical risks in the Middle East have ramped up as Ukraine carries out drone attacks on Russian refineries, creating some concerns over supply.

However, gains in oil are likely to be limited amid a stronger U.S. dollar. The US dollar index trades around a 6 week high, which makes the dollar-denominated commodity less attractive for holders of other currencies.