- New Zealand is no longer in recession, growing 0.2% in the March quarter

- The RBNZ last signaled interest rates are unlikely to decrease until H2 2025

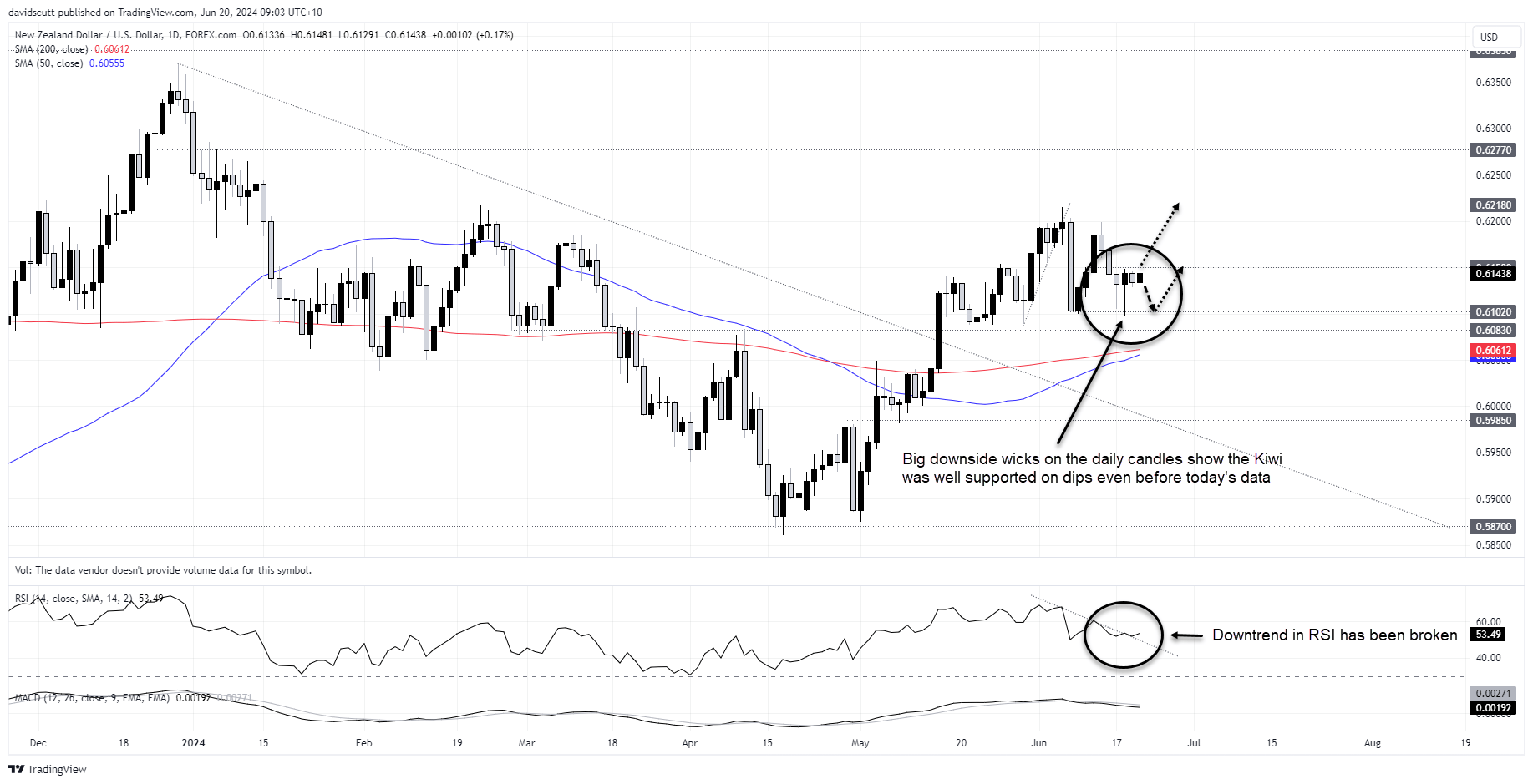

- NZD/USD was well supported on dips before the GDP data

New Zealand exits recession

New Zealand is no longer in recession with economic activity expanding 0.2% in the March quarter, leaving it 0.3% higher than a year earlier. Markets has been looking for slightly softer numbers of 0.1% and 0.2% respectively. The increase followed a 0.1% contraction in the December quarter last year.

Despite the headline increase, details were mixed beneath the surface with only 8 of 16 industry sectors expanding during the quarter, led by rental, hiring and real estate services, and electricity generation. Cyclical sectors underperformed with construction, business services, and manufacturing contracting over the same period.

Source: StatsNZ

Unlike most developed economies that focus on expenditure-based activity, New Zealand’s primary GDP measure tracks production levels. On an expenditure basis, growth came in slightly softer at 0.1% for the quarter.

Caveats for NZD/USD bulls

Like Australia, economic growth in New Zealand continued to be propelled by strong population growth with per capita GDP declining by another 0.3% in Q1 and 2.4% over the year. Per capita GDP has now fallen for six consecutive quarters.

Put simply, while the pie is getting larger overall, each person’s share has been getting incrementally smaller over the past 18 months, in part due to the Reserve Bank of New Zealand (RBNZ) continuing to run with extremely tight monetary policy settings to bring inflation back to acceptable levels.

At the margin, today’s slight beat may temper expectations for the RBNZ to bring forward the timing of rate cuts into the second half of 2024, rather than in late 2025 as indicated at its most recent monetary policy decision. However, it must be reminded that we’re talking about a period that ended nearly three months ago and the indicators since have been recessionary in nature, so the risk of the Kiwi economy decelerating quickly is remains a threat.

NZD/USD bid before GDP beat

NZD/USD had been well supported on dips heading into Thursday’s GDP release with big downside wicks on the prior three daily candles.

While the bounce post the GDP print stalled ahead of minor resistance at .6150, you get the sense from the recent price action that the path of least resistance may be higher near-term. RSI has broken its downtrend, although MACD is yet to generate a bullish signal to confirm a potential trend change.

In the interim, I’m more inclined to buy dips or breaks in the Kiwi. Should the price break above .6050, consider buying with a tight stop below targeting a push towards .6218, a level it has been rejected at on the prior three tests. Alternatively, should the price dip back towards .6102, consider buying with a stop below .6083 for protection. The initial target would be .6150.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade