- NZD/USD hits multi-month highs

- NZD/USD nears level that sparked bearish reversals earlier this year

- ECB rates decision, US nonfarm payrolls key risks to exuberant risk appetite

Rampant risk appetite fueled by lower US bond yields and a softer US dollar has NZD/USD on track to test of stubborn resistance zone it’s struggled to overcome in the past. Given the exuberant mood markets are in, if the Kiwi can’t break higher now, when will it ever?

NZD/USD a quasi-risk barometer

With nothing on New Zealand data calendar this week, Kiwi moves are being driven almost exclusively by global macro factors, especially gyrations in the US bond market. While there are a lot of moving pieces behind what’s going on, the message from the short end of the curve is that Fed rate cuts are back on the agenda this year.

US soft landing hopes return

This chart shows US two-year Treasury note futures, a market indicator that can be used to track both fundamental and technical views regarding the Fed rates outlook. The rally in bonds over the past week has been so strong that it’s pushed futures back into territory where riskier assets rallied hard earlier in the economic cycle, reflecting the impact lower yields have on relative valuations.

Source: Refinitiv

While the last two ventures into this zone didn’t last long, reversing back as Fed rate cut bets were pared, the fact it’s now testing this zone again goes someway to explaining why risk is rallying hard right now. Lower yields are acting to weaken the US dollar, loosening the shackles on assets suppressed by higher US rates and dollar.

The longer markets buy into the idea that Fed rate cuts are looming, and assuming sentiment towards global growth holds up, it’s an environment where risk should be flourishing. Doesn’t the Kiwi know it on Thursday, surging to multi-month highs against the US dollar.

NZD/USD bulls and bears set to battle

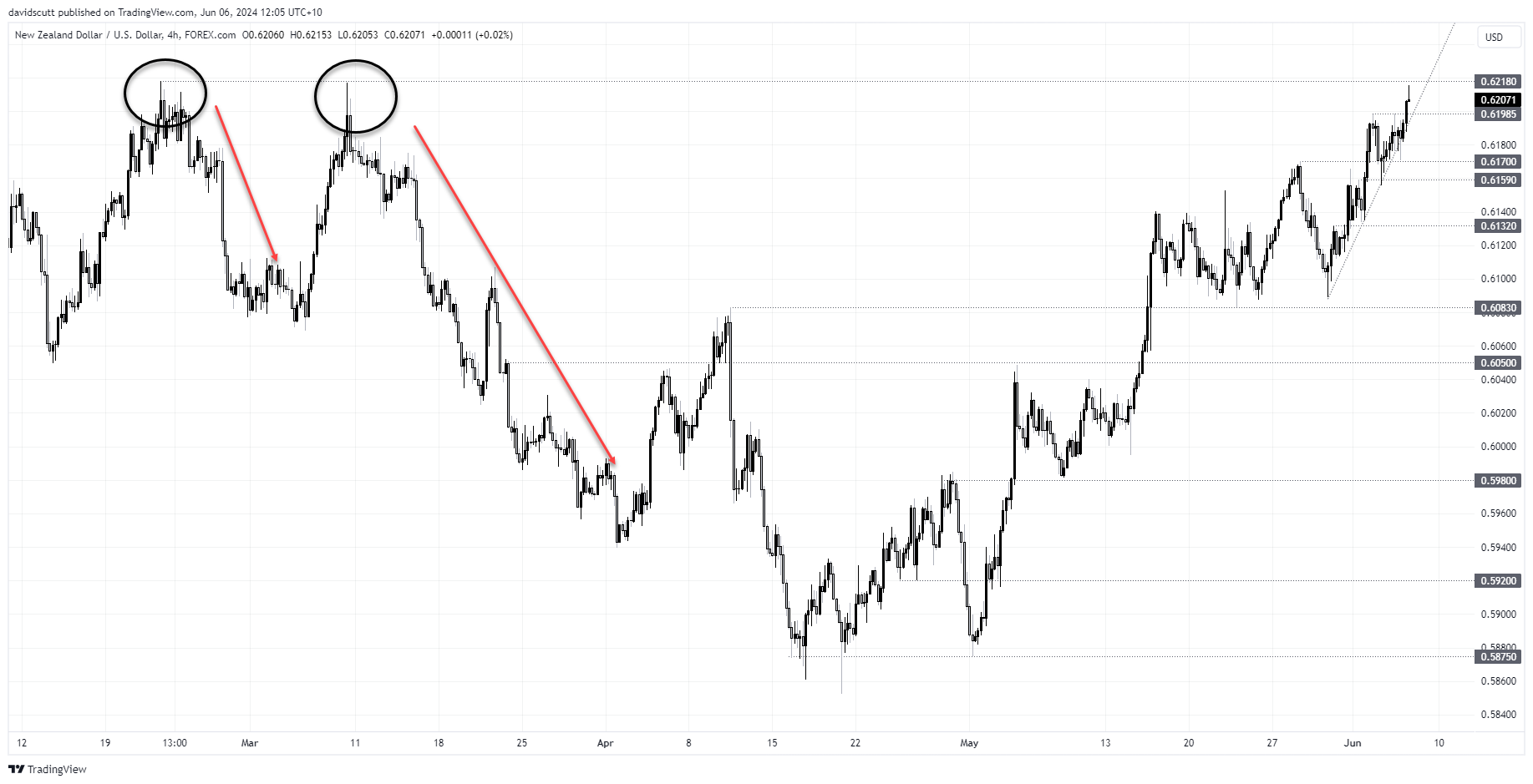

Zooming out first, you can see NZD/USD is rapidly closing in on .6218, a level where it topped out twice earlier this year before embarking on significant bearish unwinds. Given its proximity and history around this level, it looms as a perfect spot to build trades around, depending on how the price interacts with it.

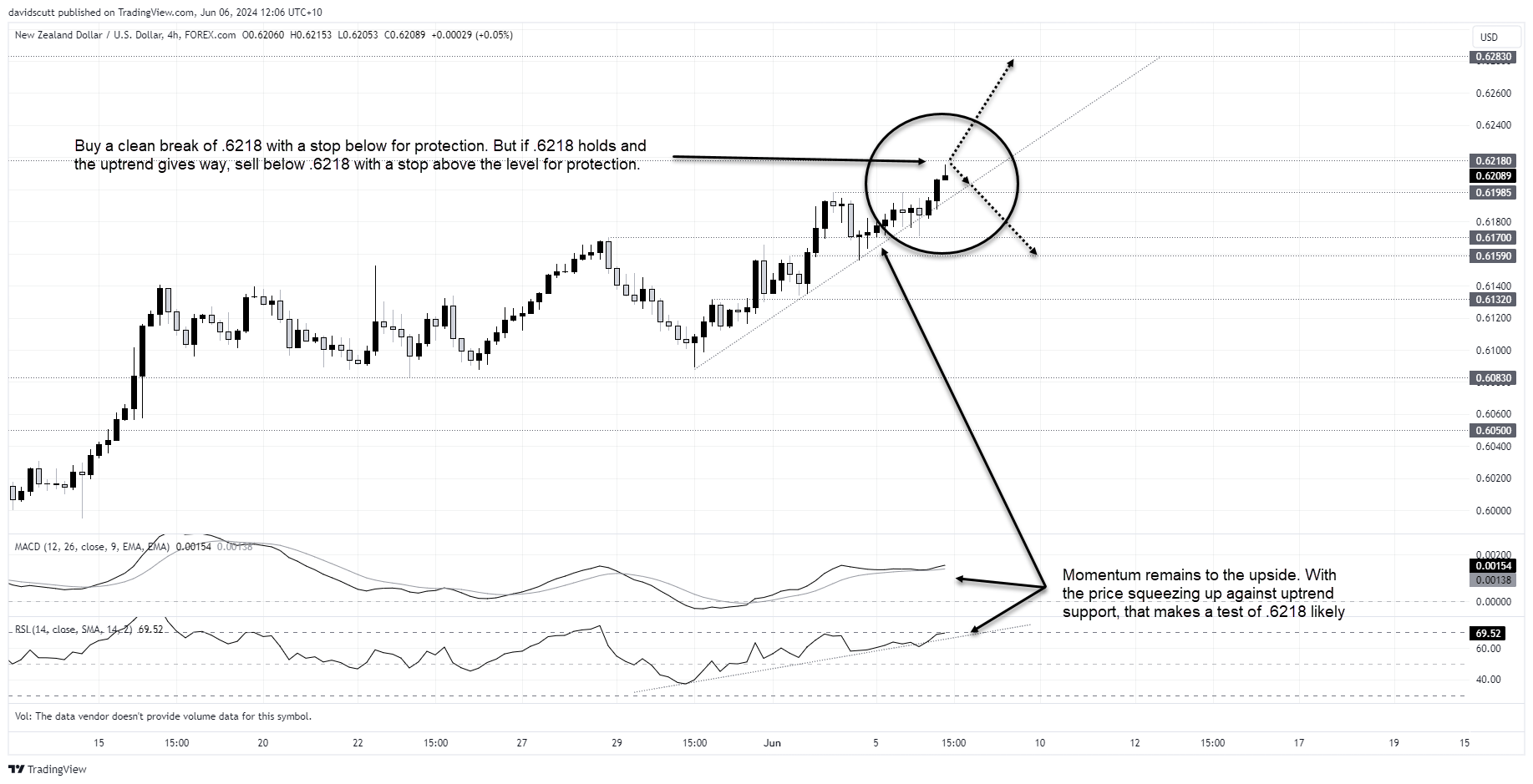

Zooming in and you can already see some apprehension among traders to take the level on. If the price ends this 4H period around these levels, the inverse hammer warns of potential pullback risks. But with the Kiwi squeezing against uptrend support, I suspect we’ll see a test at some point soon.

If NZD/USD manages to break and hold above .6218, buy the break with a stop below the level for protection. The initial trade target would be .6283 with the December 2023 high of .6385 the next after that. With momentum to the topside, the path of least resistance looks higher near-term.

But if NZD/USD is unsuccessful at .6218 and breaks its uptrend, consider flipping the trade around, selling below .6218 with a stop above for protection. .61985 is a minor support level located nearby with a greater test found between .6170 to .6155. .6132 and .6083 are the next downside levels after that.

ECB, US payrolls key risk events ahead

As for key risk events to watch, the ECB rate decision later Thursday looms as market mover. While a rate cut is a near-certainty, the guidance the ECB provides on what comes next will be key to how markets react. If the ECB leans more dovish than the near two rate cuts markets have priced this year, it will likely assist risk appetite, boosting NZD/USD.

Friday’s non-farm payrolls report is the other big event to consider. With markets pricing an increased likelihood of two Fed cuts this year, as long as the detail doesn’t diminish the risk of multiple cuts, it should be positive for risk assets.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade