US futures

Dow future -0.26% at 39000

S&P futures -0.2% at 5458

Nasdaq futures -0.18% at 19665

In Europe

FTSE -0.48% at 8218

Dax -0.45% at 18079

Fed Governor Michelle Bowman warned that rates may not be cut this year

Nvidia extends its recovery after 6% gains yesterday

Oil hovers at a 2-month high

Hawkish Fed comments keep stocks under pressure

U.S. stocks are set to open lower, giving back gains from the previous session, as investors digest federal reserve officials' comments and await fresh catalysts later in the week.

Treasury yields are climbing as investors and investors weigh up Federal Reserve official's comments regarding monetary policy. Fed governor Michelle Bowman said that the central bank was not ready to cut rates and suggested that the central bank may not even cut rates this year. Furthermore, she said an interest rate hike was still on the table. However, she added that she sees inflation slowing more sharply next year.

Her comments come as the market is still trading pricing into interest rate cuts this year, although the Federal Reserve projected one rate cut at its June meeting.

Inflation data later in the week could provide more clarity on the health of the US economy and the timeline for potential interest rate cuts.

Today the economic calendar is relatively quiet with just US home sales in focus.

Corporate news

Nvidia is set to rise again on the open as the rollercoaster ride for its share price and AI-related stocks continues. After falling sharply at the end of last week and at the start of this week, Nvidia rebounded by over 6% yesterday and is set to rise a further 2% on the open as investors' concerns eased that the AI revolution may be cooling.

Rivian is set to open over 38% higher after German automaker Volkswagen announced a significant investment plan in the American high-end electric truck group. The deal could be worth $5 billion in investments.

FedEx is set to open over 14% higher after the shipping giant forecast profit ahead of Wall Street's expectations and also revealed plans for a $2.5 billion share buyback over the coming year. The upbeat outlook points to signs that the plans to re-organise and cut costs is working.

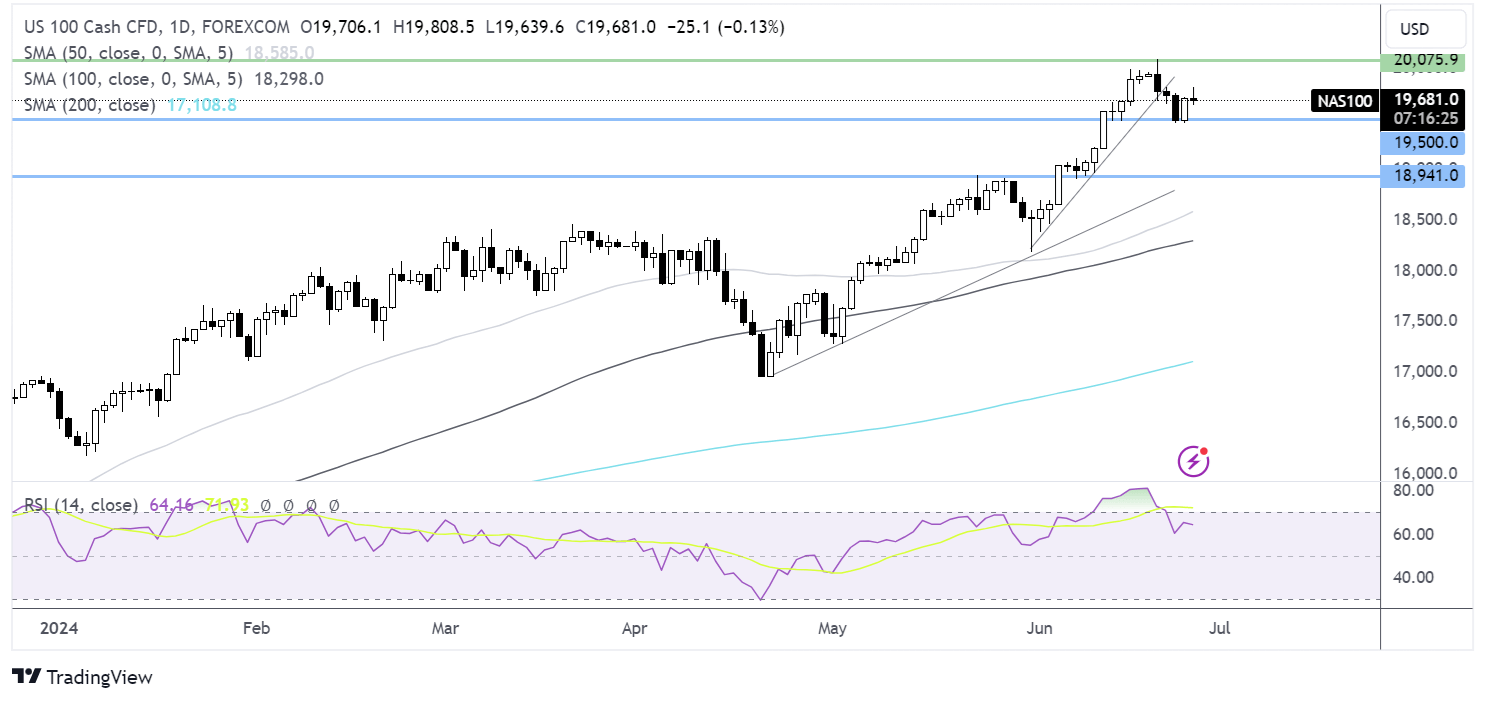

Nasdaq 10 forecast – technical analysis.

The Nasdaq fell below the short-term trendline before finding support around 19500. The recovery from here has run out of steam around 19650. That said, the price remains in an uptrend, still some distance from the 19000 round number and the 50 SMA at 18,800. Buyers will look to rise towards 20,000.

FX markets – USD rises, GBP/USD falls

The USD is has risen to an almost two-month high, tracking yields higher after hawkish comments from Federal Reserve official Michelle Bowman. She warned that there might not be any need for the Fed to raise interest rates in 2024.

EUR/USD is falling after German consumer confidence was weaker than forecast, unexpectedly deteriorating to -21.6, down from a downwardly revised -21. The data comes after a weaker business climate index at the start of the week and raises doubts over the strength of the recovery in the eurozone’s largest economy. Meanwhile, jitters ahead of the French elections are also weighing on the euro.

GBP/USD is falling towards 1.2650 after data from the Confederation of British Industry revealed that retail sales softened following a recovery in May. Retail sales, which measure volumes compared to a year ago, fell -24 in June from +8 in May. The data comes as average wages are rising faster than inflation and after consumer sentiment recovered in June. However, unseasonably cold weather hurt sales.

Oil hovers around a 2-month high

Oil prices are hovering around a two-month high, supported by an upbeat demand outlook despite rising near-term inventories.

The American Petroleum Institute page reported a rise in crude oil stockpiles by 914,000 barrels, defying expectations of a decline of almost 3,000,000 barrels. However, the market remains convinced that demand will increase across the summer driving months. Shrugging off demand worries, at least for now, geopolitical tensions are also supportive of oil prices.

Houthi attacks on shipping in the Red Sea, along with the mounting Israel-Hezbollah tensions, keep the oil price supported.

However, a strong dollar is capping gains, making oil more expensive for buyers holding other company currencies. The dollar is trading at a two-month high against its major peers and is one of the less dovish major central banks.

EIA stockpile data is due shortly.