US futures

Dow future 0.51% at 39370

S&P futures 0.26% at 5499

Nasdaq futures 0.171% at 19825

In Europe

FTSE 0.28% at 8203

Dax 0.38% at 18269

- Core PCE cools to 2.6% YoY vs 2.8% previously

- Data supports the view the Fed will cut this year

- Trump-Biden debate lifts Trump Media & Technology

- Oil on track for a weekly rise

Core PCE cools as expected

U.S. stocks are pointing to a stronger start after the Federal Reserve's preferred gauge from inflation slowed in May, supporting the case for a rate cut this year.

The core PCE index rose just 0.1%. MoM marking is the smallest advance in six months. On an annual basis, core PCE rose 2.6%, the smallest gain since 2021.

Meanwhile, inflation-adjusted consumer spending increased by 0.3%, lower than expected.

The report will likely be welcome news for the Federal Reserve as it assesses when to start cutting interest rates. While the Fed recently dialed back projections for rate cuts this year after hotter-than-expected inflation in the first quarter, progress now appears to be being made.

Household demand has also been resilient so far, even as borrowing costs have remained high; however, there are some signs that spending is now cooling.

In addition to the US core PCE data, the markets are digesting Biden's disastrous debate, raising questions about his ability to lead the country for four more years.

This was Biden's opportunity to prove to the American people that he had the energy and stamina to continue leading, but he failed to achieve that. His appearance did more harm than good. Trump was not without his own problems, delivering responses that were sometimes lies and exaggerations.

Corporate news

Trump Media and Technology are expected to open higher after the former president's victory in the first round of the presidential debates. Polls point to a clear win by President Trump amid a lack of confidence in Biden's ability to lead the country as he ages.

Nike is set to open 15% lower after the sportswear retailer forecast revenue to fall by 10% in the current quarter. Sales in the current fiscal year are also seen as decreasing by the mid-single digits.

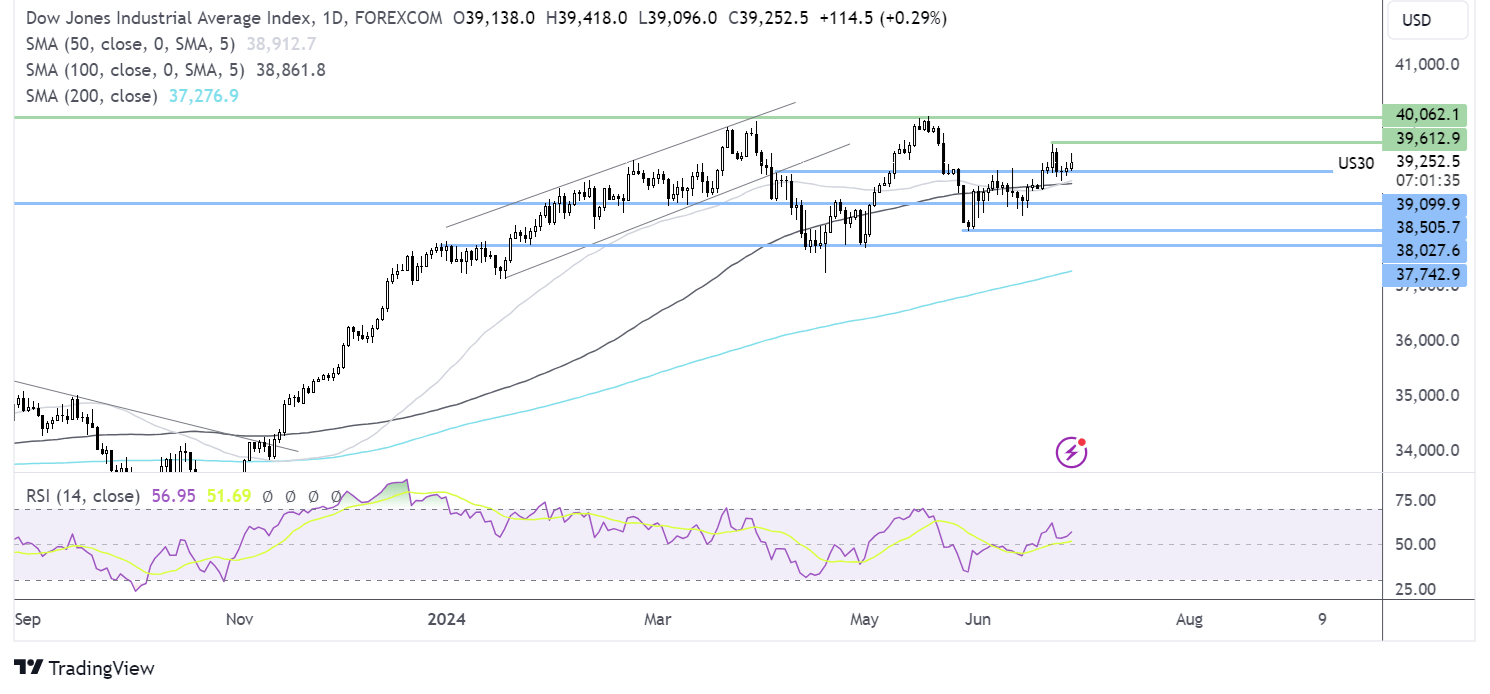

Dow Jones forecast – technical analysis.

The Dow Jones trades just above the 39000 support for another day. The price will need to rise above 39,615 to extend gains towards 40,000. Sellers must break below 39000 to expose the 100 SMA at 38,800, bringing 38,500 into focus.

FX markets – USD flat, EUR/USD falls

The USD is flat as inflation cools, supporting the view that the Fed could cut rates soon.

EUR/USD is falling and is set for its worst monthly performance since January as the market looks nervous. I had to the first round of French elections on Sunday. The far-right euro-sceptic national rally party is expected to win. While they're no longer campaigning for a full withdrawal from the euro from the European Union, they stand ready to negotiate for several exceptions, so from rules and kids, considerably slow progress for the European Union and the coming years.

GBP/USD is holding steady after the economy grew at a faster pace than initially expected in Q1. Q1 GDP was absolutely revised to 0.7% QoQ from 0.6%, and the idea reading hand up from a contraction of 0.2% at the end of 2024. Still, gains in the pound are likely to be limited ahead of next week's election and on expectations that the Bank of England could start cutting interest rates as soon as August

Oil hovers around a 2-month high

Oil prices are edging higher and on track for the third straight week of gains, buoyed by expectations that the US Federal Reserve will start cutting interest rates.

A lower interest rate environment benefits economic growth, boosting the demand outlook for oil. The weaker U.S. dollar is also making oil cheaper for buyers of other currencies.

Looking ahead, Chinese manufacturing data early next week will be in focus and could provide further clarity on the demand picture in the world's second-largest economy.