Debt ceiling talks were the key motivation for gold and silver price slipping this week. After an intraday high of $2,048 per ounce on 10 May, gold fell below the $1,980-$2,000 support level to stand at $1,960 at the time of writing. The technical position is weakening for gold and silver. Professional and physical market players are not currently prepared to take directional views.

For more detailed market commentary go to StoneX Market Intelligence, https://my.stonex.com/.

- ETF investment activity shows signs of waning interest in gold and mixed views on silver

- China is still reporting adding to reserves

- Amongst major physical buyers, India’s withdrawal of its high denomination 2,000-rupee notes has reportedly been linked to greater interest in physical gold (of which we are skeptical.

Debt deal dilemma for Gold, Silver

As we write, President Biden and House Speaker McCarthy are meeting later today to negotiate directly on the debt ceiling. The debt ceiling is a Congressionally-imposed limit on the amount that the Government can borrow and once reached, there is the possibility of default, which would be – in the words of Treasury Secretary Janet Yellen, “catastrophic”.

Two proposals have polarized the debate: Biden wants a “clean” debt ceiling rise; McCarthy is calling for spending cuts. Both sides are still a long way apart, but after some movement markets are now thinking in terms of an agreement by the end of this week. Aside from the rancorous political debate, it’s believed that a compromise will be reached.

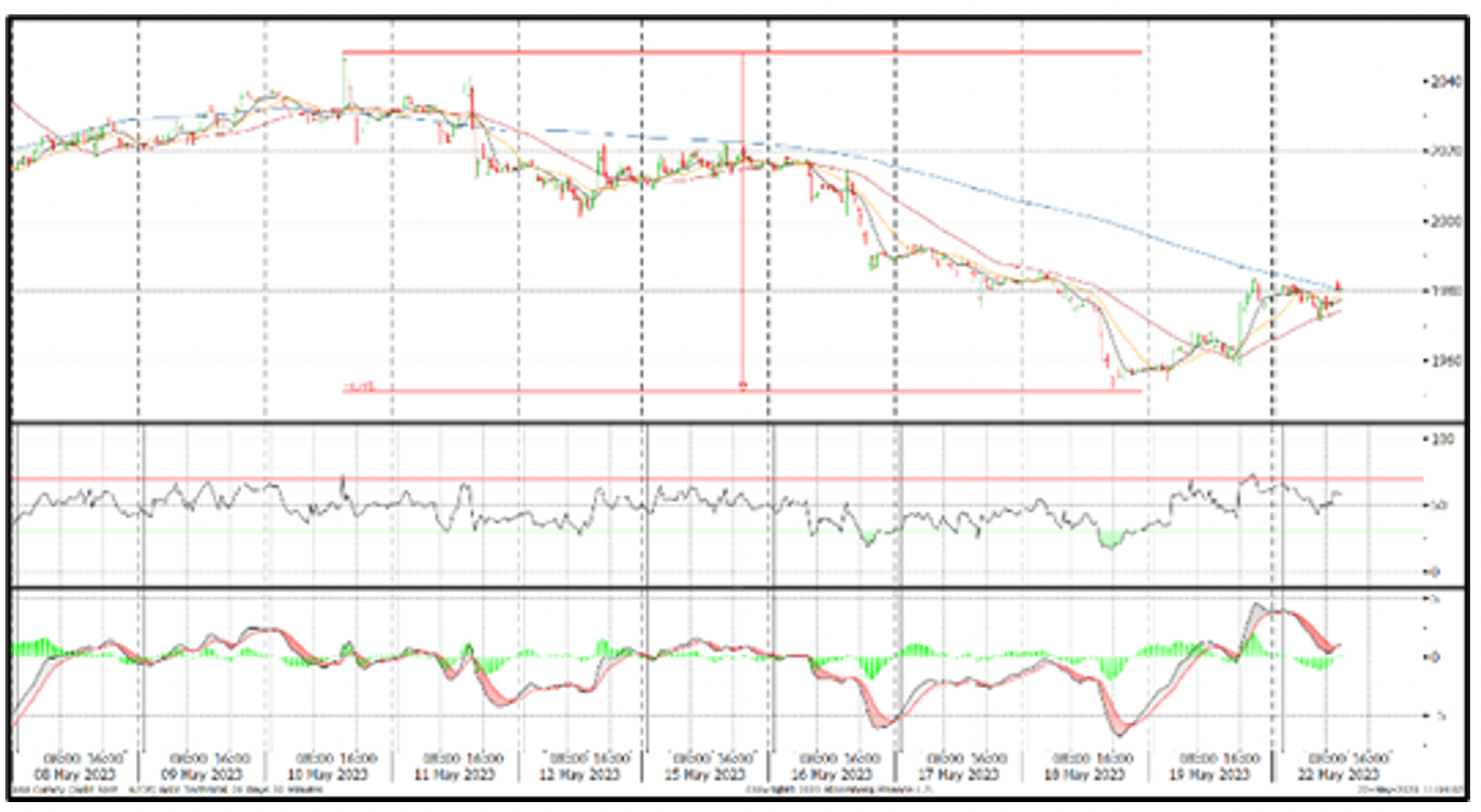

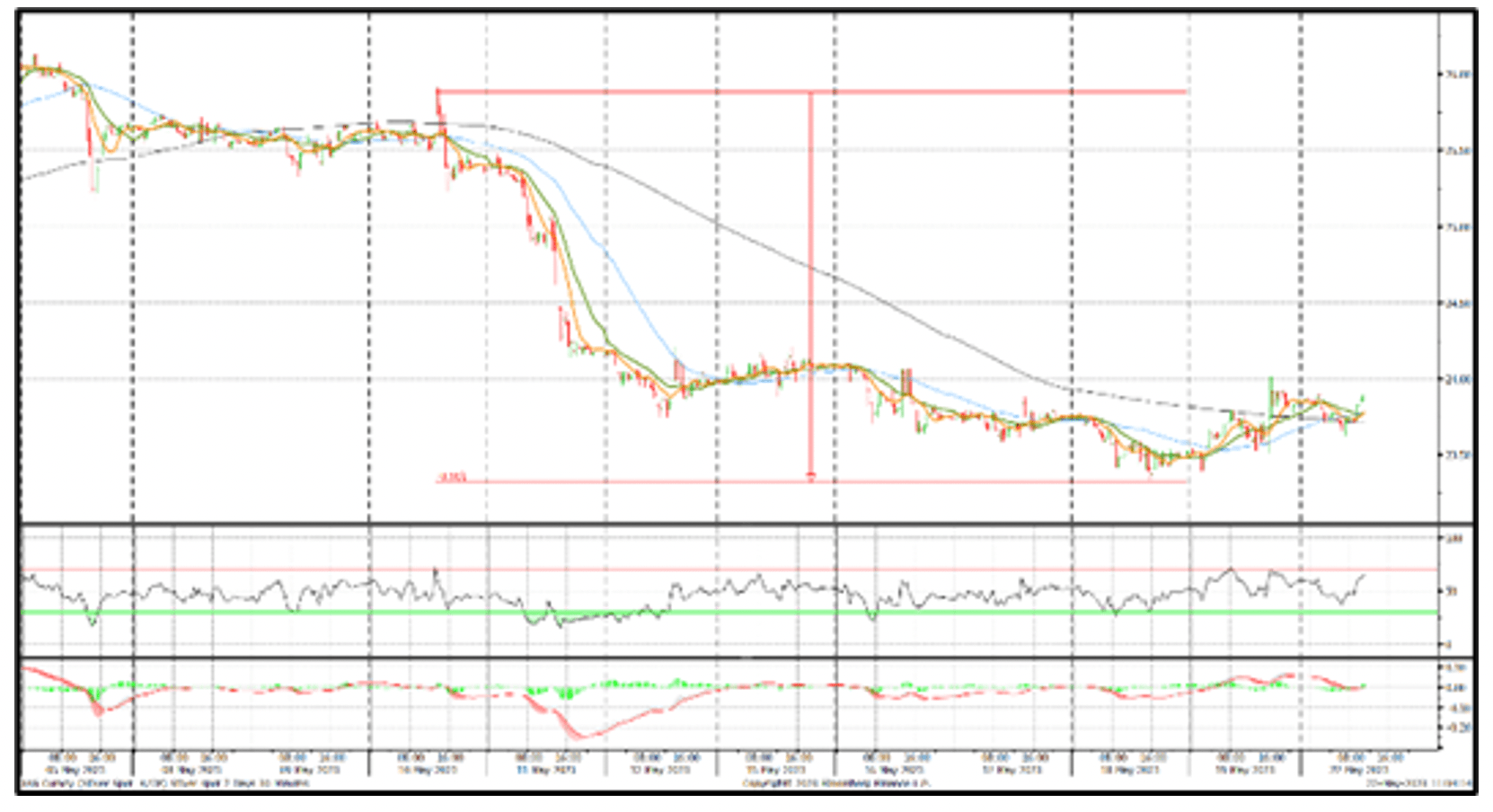

All of this uncertainty took some heat out of the gold market’s recent rally. Spot prices dipped below the support band of $1,980-$2,000 at the end of last week, until interest took gold back towards the $1,980 level over the weekend, with support briefly established above the $1,981 200-day moving average, but which subsequently gave way as relations over the ceiling seemed to be warming. Silver reacted to the movement in gold, with a Beta of between 2 and 2-1/2 times the change in the gold price. The intraday high-to-low fall over the week was 5% for gold, and 10%, for silver.

These price movements in gold and silver have also been driven by currency movements, with the US Dollar edging higher on the markets’ cautious optimism for a debt ceiling deal and hawkish comments on the need for further rates rises from some Fed officials.

Gold in major currencies, short-term

Source: Bloomberg, StoneX

Gold, technical indicators; improving but not yet conclusive

Source: Bloomberg, StoneX

Silver, technical indicators improving with spot now above all the key levels

Source: Bloomberg, StoneX

China builds gold reserves, India might see domestic buying

China reported an increase in gold reserves for the sixth month in succession. Gold holdings were reportedly unchanged at 1,948 tonnes (62.64 million ounces) from the third quarter of 2019 until October 2022, since when they have reportedly increased by almost 7%, to 2,077 tonnes. Despite this, China’s gold holdings are low. The Bank of China’s gold holdings now amount to 4% of combined gold and currency reserves, well below a global average of 14-15% (itself a high figure skewed by large legacy gold holdings in the US and Europe). Excluding large gold holdings by a few nations which used to be on the Gold Standard, the global average is more like 9%.

The Reserve Bank of India announced on 19 May that it would be withdrawing the high denomination 2,000 rupee note (currently worth $24.15). Private holdings must all held in bank accounts or switched into other denominations by 30 September. Some Indian observers have argued that this would that this would spur bond prices, consumer spending and investment in gold. However, we think the impact would be limited as these notes are less than 12% of the total, and are rarely used in domestic transactions.

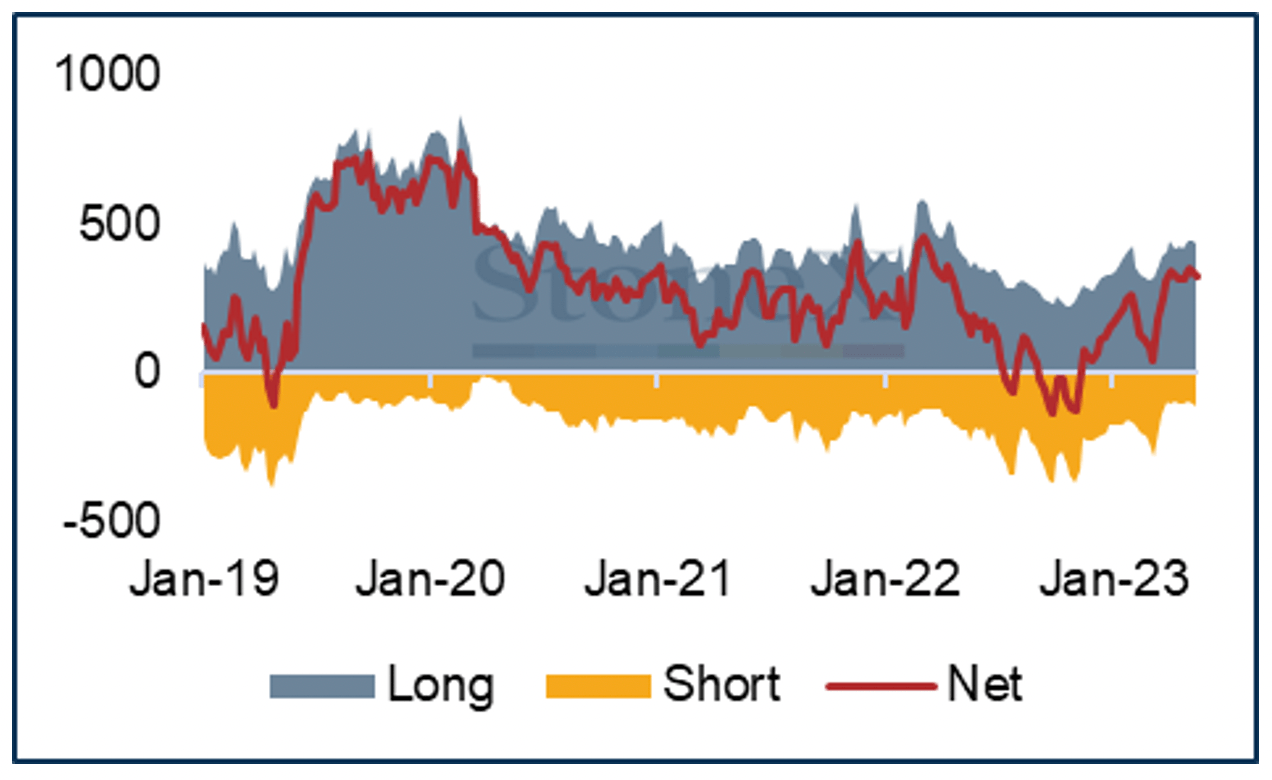

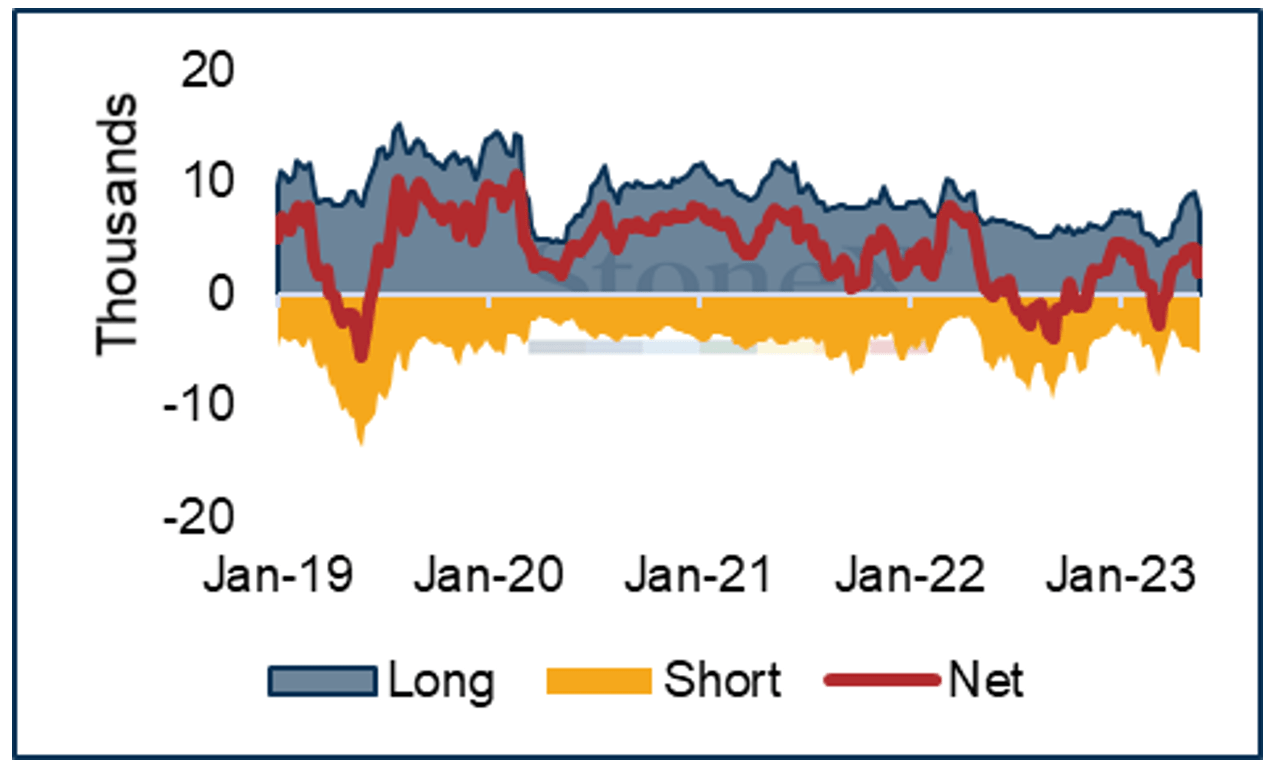

Gold and silver COMEX positions (tonnes)

Physical investment action to 16 May saw a persistent speculative overhang which has now been reduced.

- Physical gold investment to 16 May saw a small fall (11 tonnes) in Managed Money gold long positions, and a small rise (10 tonnes) in short positions, leaving the net position unchanged.

- Physical silver investment saw a big change in sentiment, with a 20% fall (1,781 tonnes) in outright longs, and a 5% fall in outright shorts, reducing the net long position to 2,046 tonnes from 4,081 tonnes in the previous week.

Gold COMEX Positions

Source: COMEX, StoneX

Silver COMEX Positions

Source: COMEX, StoneX

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia, StoneX Financial Ltd.

Contact: Rhona.Oconnell@stonex.com.