- Crude Oil broke above its 7-day consolidation

- Crude Oil broke above its key 82 level ahead of the PCE result

- The monthly close is in sight ahead of FOMC Minutes Week

Crude oil's indecisive consolidation has finally taken an upturn, moving towards the upper end of its larger consolidation just before the monthly close.

What’s Leading Volatility in the Week Ahead?

Besides the insights from Fed Chair Powell on Tuesday along with the FOMC minutes on Wednesday, key U.S economic data are due to be released. The leading economic indicator, the ISM Manufacturing PMI, along with the leading employment indicator, the non-farm payrolls, meet again in the same week.

Despite negative crude oil inventory results and a strong U.S. Dollar Index, bullish demand anticipations remain strong on crude oil charts. The anticipation of easing monetary policies, coupled with an expected increase in oil demand during the summer season, is dominating the trend.

Here is the updated short-term analysis on the Crude Oil chart:

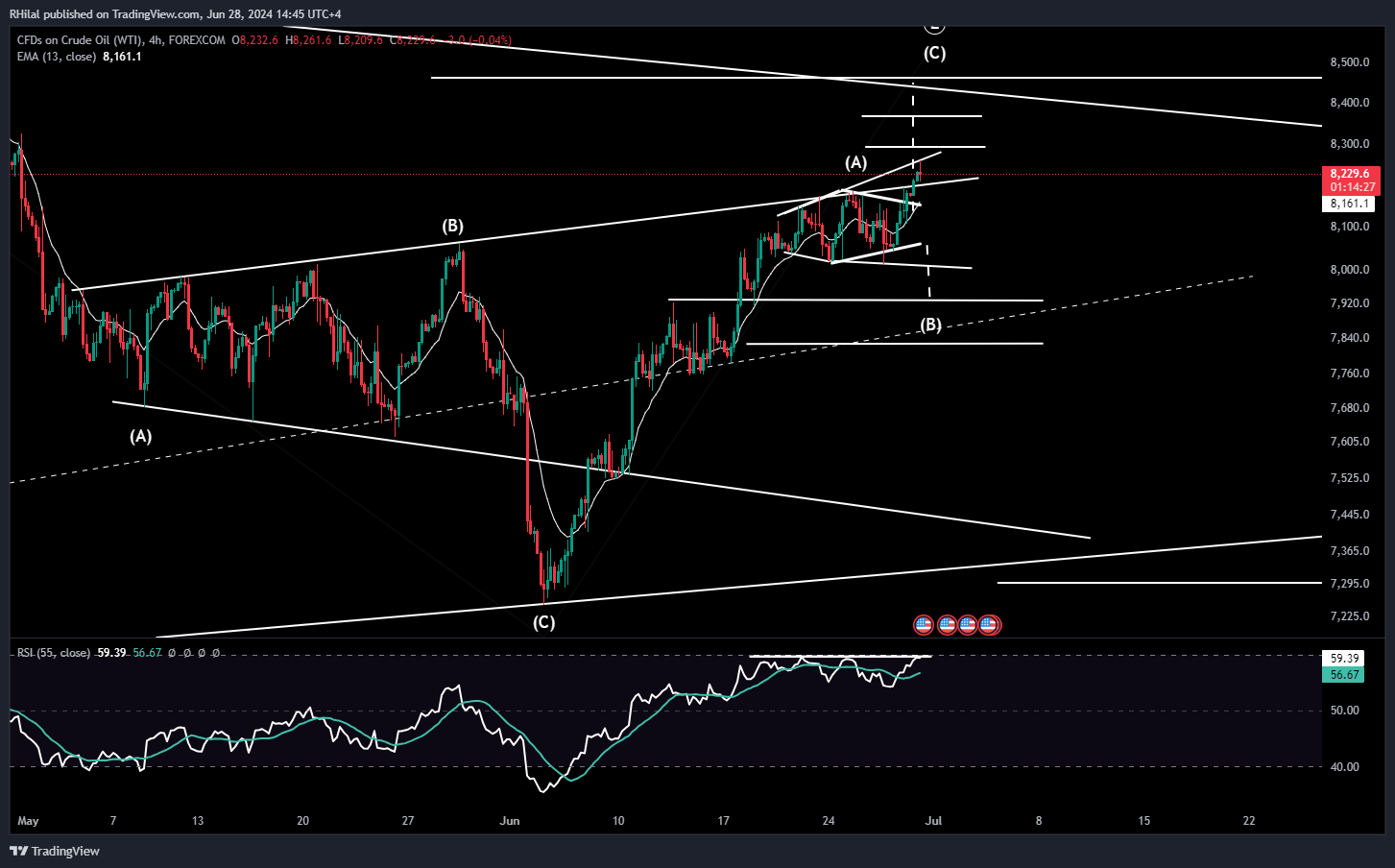

Crude Oil Forecast: USOIL – 4H Time Frame - Logarithmic Scale

The recent upward break in crude oil is accompanied by a diverging and overstretched smoothed Relative Strength Indicator (RSI), allowing a short-term forecast for the current uptrend. With the price trend now hovering at the upper border of the expanding pattern, the updated scenarios are as follows:

Bullish Scenario:

- If crude oil proceeds above the 83 psychological barrier, the next levels are still expected to be near the 84.50 – 85 price zone.

- A close above 85 is needed to establish a further bullish forecast.

Bearish Scenario:

- If crude oil breaks back below the key 80 level, it can pave the way to the expected support zone between 79.20 and 78.

- A close below 79 is needed to establish a further bearish forecast.

The market is generally looking for more easing data to support its risk-on appetite and bullish anticipations.

Priced-in effects can be watched out for with released data meeting expectations. As market expectations guide trends, a turnaround can be anticipated if results align.

--- Written by Razan Hilal, CMT