- AUD/USD may be in the early stages of a longer bullish trend

- A strong US payrolls report could spark a meaningful reversal, creating a false price signal

Zoom out if in doubt

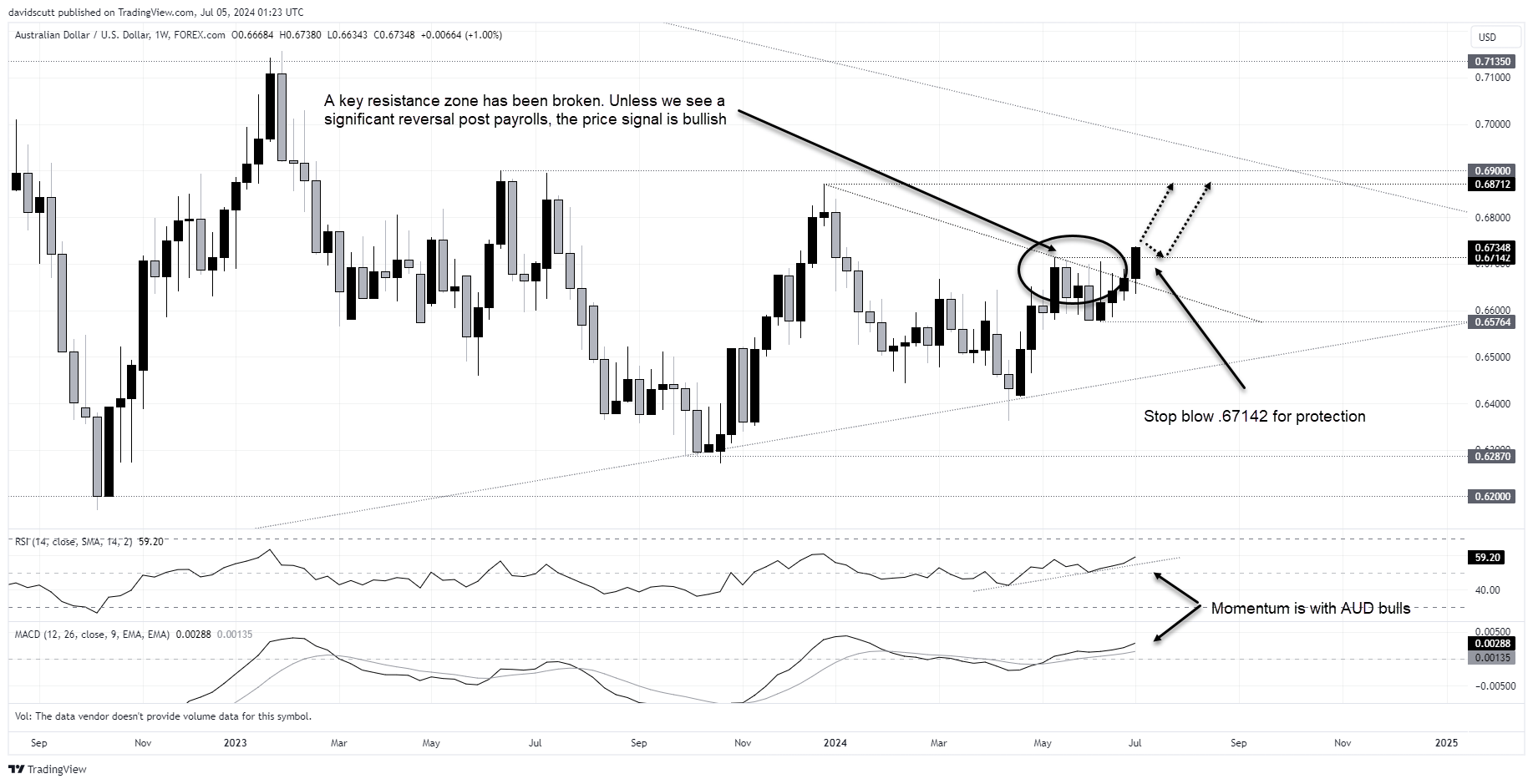

It’s an old saying in trading but so often very true, helping to reduce noise to provide a more definitive price signal. You can’t miss that in the weekly AUD/USD chart with a bullish breakout clearly playing out, unless the US jobs report is a stunner.

AUD/USD stages bullish breakout

Having been constantly thwarted at the downtrend dating back to late 2023, AUD/USD has not only broken out this week but done away with resistance layered above .6700, touching levels not seen since early January. With MACD and RSI providing bullish signals on price momentum, buying dips feels far easier than selling rallies right now.

Having taken out April's high of .67142, traders could consider buying the break with a stop below this level for protection. One potential target could be the December high of .68712. There’s little else on the charts to speak of when it comes to known resistance levels in between.

Payrolls could present a problem

From a fundamental perspective, it would likely take a strong US nonfarm payrolls report for June to initiate a meaningful market reversal, putting the breakout at risk of becoming a false one. I’m talking payrolls exceeding expectations for a 190,000 increase with unemployment remaining unchanged or below 4% with an upside beat for earnings of more than 0.3%.

But if we were to get the opposite outcome, with a clear deterioration mirroring so many other data series recently, it could deliver a hammer-blow to the US dollar which is already looking shaky on the daily and weekly timeframes.

Event risk ahead

Should AUD/USD hold above .67142, it will likely mean there’s been no significant hawkish shift in the US interest rate outlook from payrolls, opening the door for Jerome Powell to remain dovish when he appears before Congress early next week. Such an outcome should assist AUD/USD upside if recent form from the Fed chair is maintained.

Thursday’s US consumer price inflation report is the main binary risk event next week, especially given upside surprises in other developed nations recently, but such an outcome would be at odds with deteriorating activity and likely limited by persistent US dollar strength.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade