- Australian ASX 200 SPI futures have broken several technical supports, but will that deter dip-buyers?

- AUD/USD reverses hard despite higher RBA rate hike risk. Range low retest incoming?

Australia’s ugly inflation report for May continues to impact markets 24 hours after its release, and not just those in Australia. But the initial reaction, and price action since, continues to provide signals and setups in ASX 200 SPI futures and AUD/USD.

We look at two ideas below.

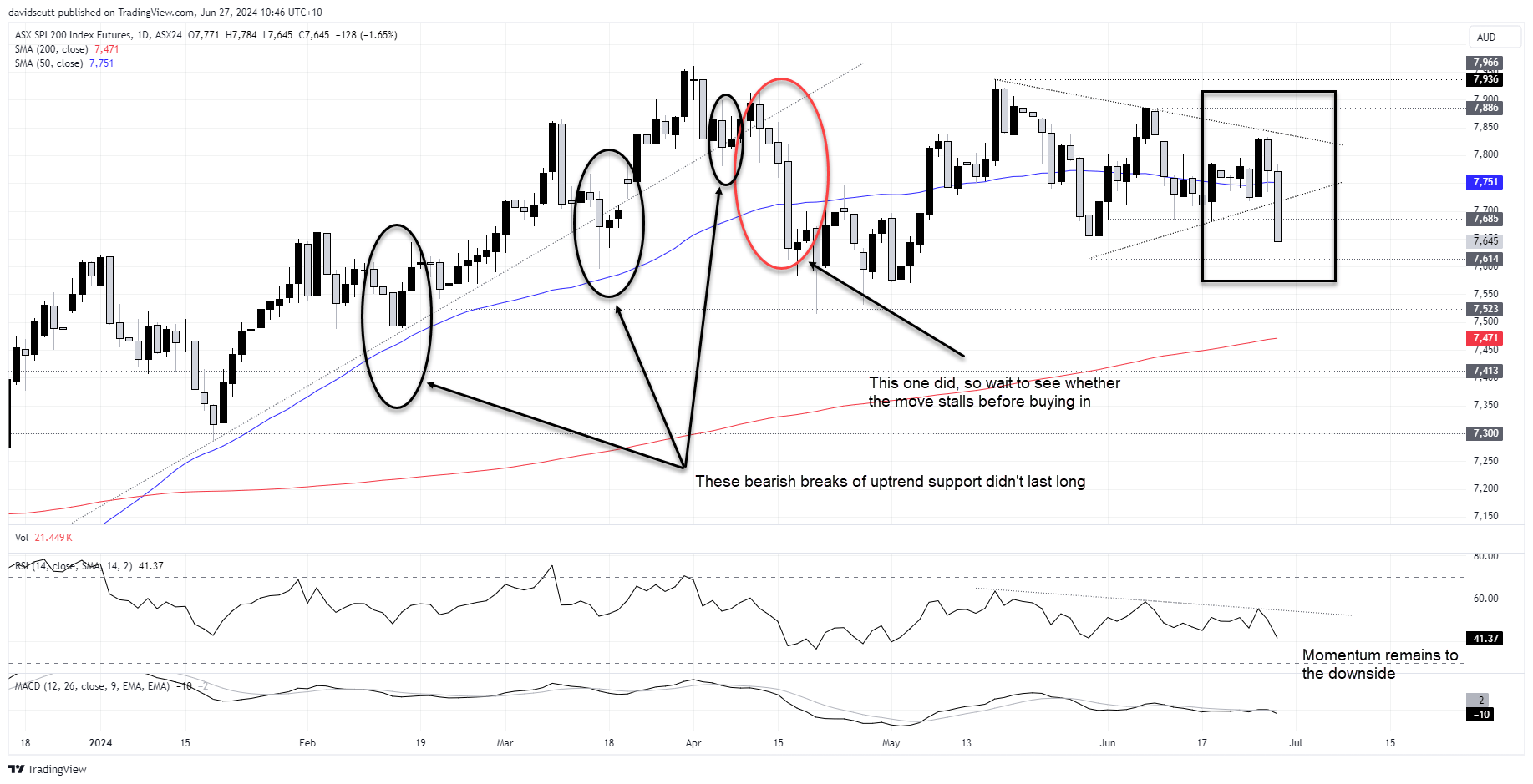

ASX 200 SPI futures: Ugly, but does it matter?

Dips below 7685 in Australian ASX 200 SPI futures have made for good buying in June. Will the latest be any different even with the increased threat of a RBA rate hike following Wednesday’s inflation update?

Yes, the price action looks terrible having broken out of the pennant in the overnight session, so I’m not rushing the buy the dip. But if we see the move stall during the session, there are grounds for a cheeky long with a stop below the lows for protection. I expect Chinese stock indices may be influential today given the quiet data calendar.

7685 would be the initial target with the 50-day moving average the next after that. If the trade were to move in your favour, consider lifting your stop to entry level to provide a free shot on upside.

Selling the break right now comes across as a low probability setup. But if SPI were to sink back to 7615, that will provide far better setups depending on how the price interacts with the level.

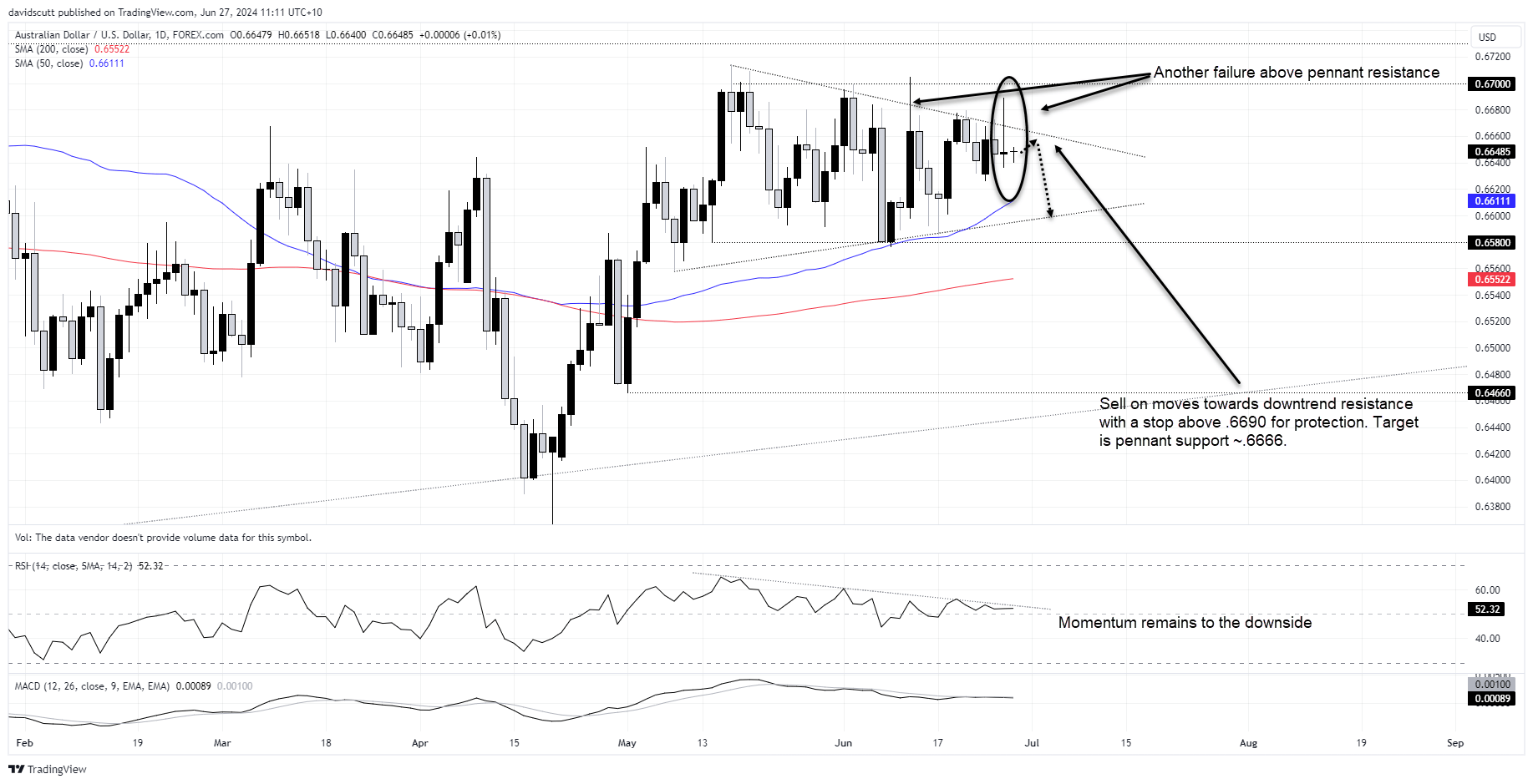

AUD/USD: tombstone doji, downside retest?

The bullish break in AUD/USD proved no match for a higher US Treasury yields and quarter-end demand for dollars during the North American and European sessions, delivering big reversal on Wednesday.

The tombstone doji on the daily warns of downside risks, particularly as it started at levels where the Aussie has struggled in the recent past. While there’s the opportunity to go short around these levels, it would be preferable to see if the price pushes back towards downtrend resistance located around .6666.

If that were to eventuate, consider selling with a stop above Wednesday’s high of .6690 for protection. .6595, the lower support of the pennant formation, is one potential trade target.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade