Indices trading

-

Range of markets

Access over 20 major global indices with extended trading hours

-

Thematic indices

Take your position on the AI revolution, Big Tech and more

-

Ultra-tight spreads

Trade indices markets with variable spreads as low as 1 point

The benefits of indices trading

-

Gain exposure to global marketsInstead of investing your money in a single company, you can trade stock indices for exposure to entire sectors or economies, including energy, banking and mining.

-

Profit from falling marketsTake advantage of the volatility and benefit from both rising and falling markets.

-

Theme-specific tradingOur thematic indices are built to give you exposure to specific emerging trends – including AI companies, green stocks, cannabis shares and more.

Competitive pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Indices trading platforms at City Index

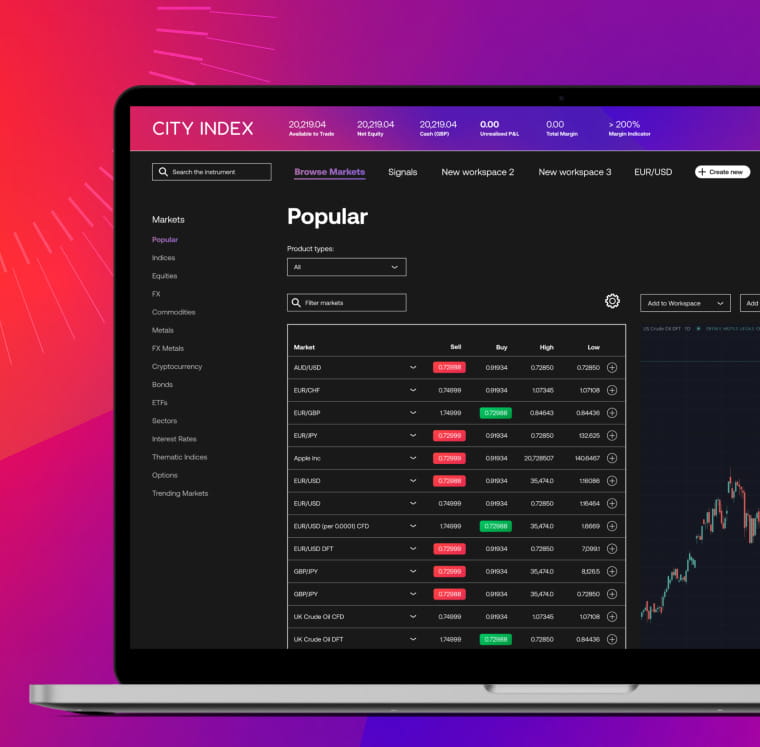

Web Trader

Trade over 6,300 markets on our easy-to-use, browser-based platform, complete with customisable workspaces, fast and reliable execution, and advanced charts.

Simplicity and speed

Simplify your deal ticket with our exclusive ‘one-click trading’ mode, so you don’t miss out on potential opportunities in fast-moving markets.

Performance Analytics

Gain deeper insight into your trading behaviour with the new Performance Analytics tool, designed to help you improve your trading across four key metrics.

Trading Central

Stay ahead of the curve with our technical analysis research portal from Trading Central, helping you to identify potential opportunities.

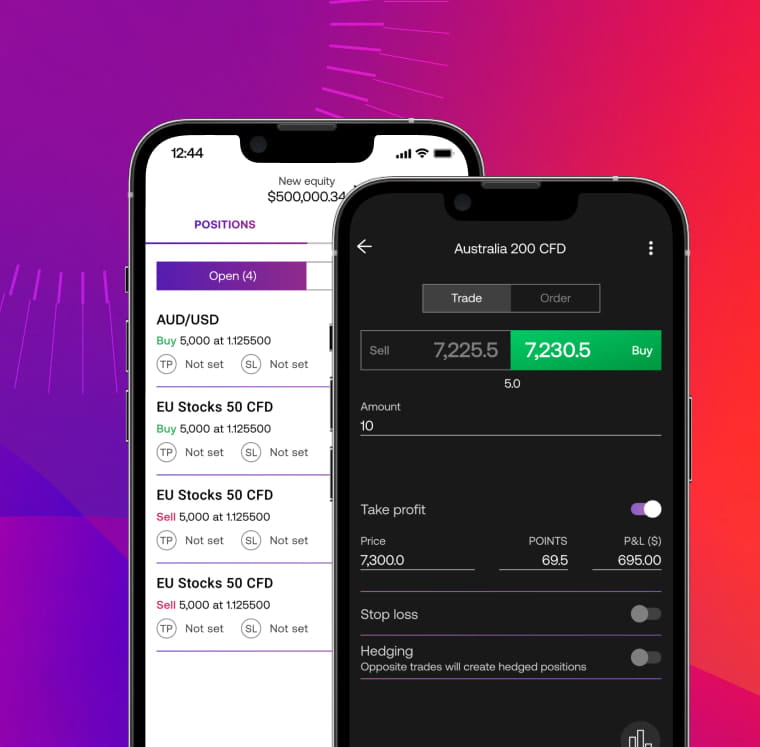

Powerful mobile apps

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with one-tap dealing, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful market data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

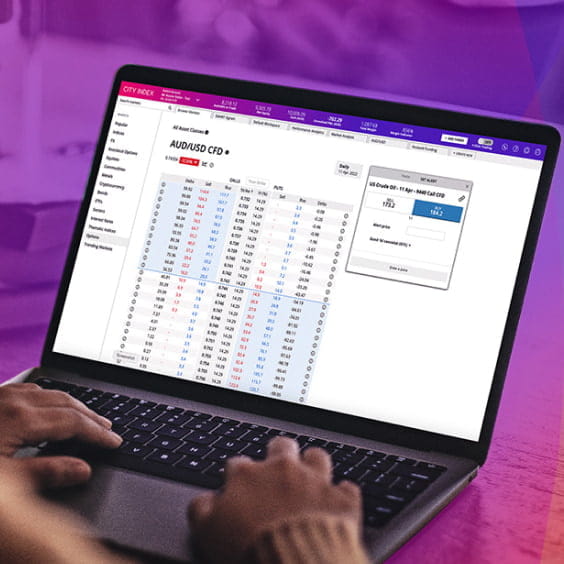

MetaTrader 4 (MT4) trading platform for indices trading

Expert Advisors (EAs)

Download and explore automated trading strategies via the MetaQuotes Language 4 (MQL4) or create your own Automated Trading System using MQL4.

Custom technical indicators

Analyse price movement and trends with technical indicators customised to your trading strategies.

Trade on all devices

Access your MetaTrader 4 account across all your devices with MT4 trading apps on iOS and Android. Open on desktop, close on a smartphone.

Latest indices trading news

Latest research

How to trade indices with City Index

Whether you’re a new or experienced trader, it’s easy to create a CFD trading account with City Index. Simply complete our short, secure online form and you could be trading stock indices in minutes.*

If you think an index is going to go up in value, you’d go long or ‘buy’. If you think an index is going to go down in value, you’d short or ‘sell’ it.

Ready to trade indices now? Get started with your application.

*Subject to review and approval

Margin and leverage in CFD trading

One of the key features of CFD trading is the ability to trade on margin and utilise leverage.

Trading indices

Learn how to trade global indices, what affects their price movements, and what to look out for on the economic calendar.

Guide to short selling

Learn how to take advantage of falling indices markets.

Frequently asked questions

What's the best way to trade indices?

There are multiple ways to trade indices, including via futures, options and CFDs. Each has its own benefits and drawbacks, so it’s worth doing your research to decide which works best for you.

Trading index CFDs with City Index, for example, enables you to go long or short on 21 major global indices. Trading index options, on the other hand, gives you access to advanced strategies such as straddles and strangles.

You can use your City Index account to trade CFDs on indices and index options. Open your trading account now.

What is a benchmark index?

A benchmark index is a group of stocks that is used as a measure of the market as a whole. Most of the major indices you’ve heard of are benchmarks: including the S&P 500 (US 500), Dow Jones (Wall Street) and FTSE 100 (UK 100).

Benchmark indices are useful to traders as a way to compare an individual security against the wider market. For example, say that you’ve found a US stock that has grown 20% over the past four years. You might compare that growth to the S&P 500 to see how it fares against 500 of the biggest US stocks.

If the S&P 500 has grown 40% over the past four years, then your stock has actually underperformed the wider market.

What are indices used for?

Indices are used in a variety of ways by traders. They can give an instant idea of how a country’s economy is performing, can provide a useful way of assessing multiple stocks at once and provide lots of powerful trading opportunities.

Indices were created for the purpose of evaluating the performance of a stock market. If an index is rising, it means that the stocks it represents are moving up overall, generally a sign that businesses are doing well and economic health is strong. A falling index, on the other hand, is a signal that stocks are struggling, which may hint at deeper problems within an economy.

Stock indices are still used for this purpose today, but they’re also a popular asset class in their own right. It isn’t hard to see why – they enable you to take your position of the biggest stocks in an economy with a single trade, as well as offering high volatility and liquidity.

Learn more about how indices work.