CFD trading on Bitcoin

Trade CFDs on Bitcoin price movements with a City Index account, regulated in Australia since 2006.

-

Spreads from 90 points

-

Margin from 50%

-

Award-winning tools

Trade Bitcoin with CFDs

Enjoy tight spreads and low margins when you trade CFDs on Bitcoin with City Index.

If you’re not ready to trade with real money, why not open a demo trading account and practise risk free.

Competitive spreads

Bitcoin market information

† May change due to market conditions.

‡ trading hours on cryptocurrencies are 08:00 Mon - 08:00 Sat (AEDT)

* Please note margin requirements can vary depending on the risks associated with the underlying market. For details of the exact margin requirements on all of our markets, please view the market information sheet in the platform.

Speculate on the Bitcoin price without the need to own the cryptocurrency – or a virtual wallet

Trade Bitcoin CFDs the same way you would trade commodities, shares or indices

Experience this asset with a trusted broker, regulated in Australia since 2006

Get Bitcoin insight and the latest news from our Reuters feed

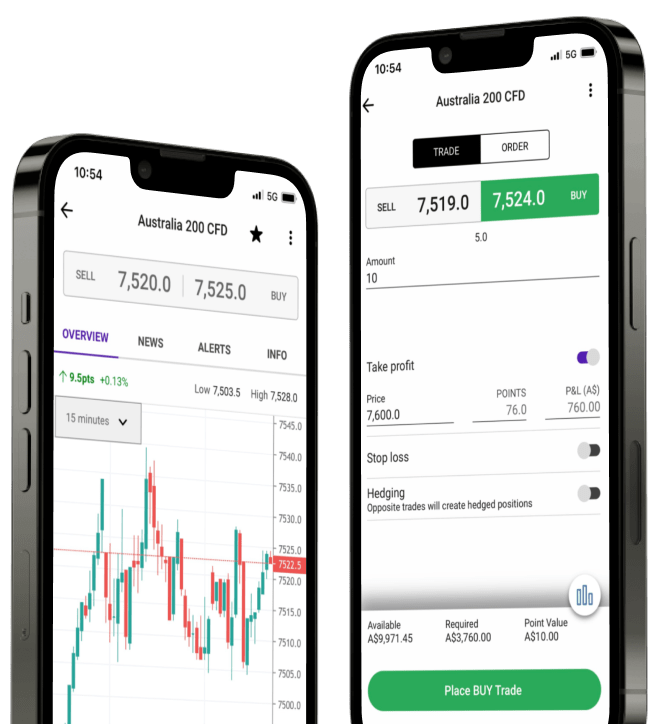

Customisable charts

16 chart types and 80+ indicators to boost your technical skills

Award-winning platforms

Technology designed to suit you, whatever your level of expertise

Trading strategies

Elevate your insight with our fundamental and technical trading techniques

From cryptocurrencies to indices, shares, forex and beyond, discover the latest news and trade ideas from our team of expert analysts and market writers.

New to trading? Start with a risk-free demo account.

Bitcoin CFD trading FAQs

What are cryptocurrencies?

Cryptocurrencies are digital tokens based on blockchain technology that act as a virtual currency. Many cryptocurrencies are mined into existence through the ‘Proof of Work’ system, involving the solving of complicated mathematical puzzles by high-powered computing software, with a cryptocurrency token made available to the owner as a reward.

However, a newer system known as ‘Proof of Stake’ involves contributors staking their own cryptocurrency in exchange for a chance to validate new transactions, update the blockchain, and earn a reward. Ethereum, for example, is expected to move to the Proof of Stake model in 2022.

The majority of cryptocurrencies are decentralised, which means that they are not connected to or affected by an authority such as a government or central bank.

How old is Bitcoin?

Bitcoin was introduced in January 2009 as the first cryptocurrency. The author of the initial Bitcoin whitepaper was Satoshi Nakamoto; however, this is believed to be a pseudonym.

Do I have to trade a whole Bitcoin?

No, one of the main benefits of Bitcoin CFDs is that you can trade fractional amounts and not an entire Bitcoin per transaction.

Can I trade other cryptocurrencies with City Index?

Yes, you can trade a range of cryptocurrencies with City Index, such as Ethereum, Ripple and Litecoin, available at a margin rate of 50%. Find out more about the cryptocurrencies we offer.