Trading commodity CFDs with City Index

-

Range of markets

Gain exposure to geopolitical events through 40 different commodity markets including US crude, coffee and natural gas

-

Competitive pricing

We’re lowering the cost of trading, with spreads from just 0.06pts

-

Trade non-expiry spot contracts

Simplify your trading experience with our exclusive spot contracts

Why trade commodities with us?

-

Stay abreast of breaking stories impacting global commodity prices through our exclusive Reuters feed delivered in-platform.

-

Take advantage of the industry-leading TradingView charting package to trade global commodity markets, with 80+ indicators and one-click trading.

-

Trade with a trusted market leader, regulated in Australia since 2006.

Popular commodity markets

Competitive pricing

Major commodity market news

Latest research

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

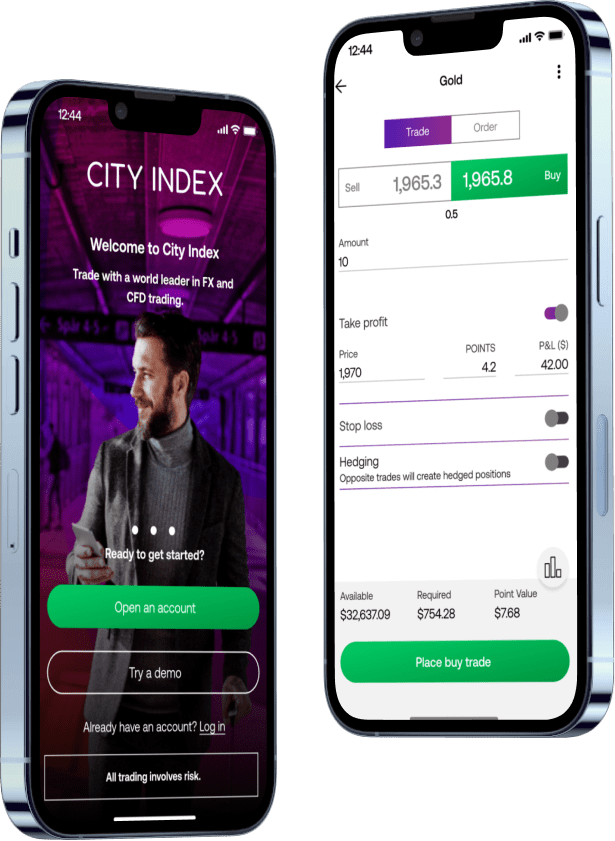

Mobile trading app

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with in-chart trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

What are spot commodities?

Spot commodity markets are non-expiring and are not subject to an expiry date or rollover charges. These markets are priced based on the Futures contract and offer the opportunity to trade these markets long-term without the need to roll your position on expiration of the current futures contract.

Continuous charting is available on these markets. This allows you to apply deeper levels of technical analysis to your commodity trading compared with traditional commodity market charting.

To find out how we price spot commodity markets, please visit our orders and positions page.

How to trade commodities

Discover everything you need to know about commodity markets, such as oil, coffee and natural gas, including both hard and soft commodities.

Commodity spot prices vs futures

Learn how to trade a range of commodity markets with CFDs and choose from spot markets or futures contracts.

What is gold and silver trading?

Learn how to trade precious metals and what they can do to diversify your portfolio.

Frequently asked questions

Is commodity trading good for beginners?

Commodity trading can be a good option for beginners, as long as you understand the risks involved and have a solid trading strategy in place. If you’re new to the markets, though, we’d recommend going through the City Index Academy and trying out trading risk-free in our free demo before opening a live account.

You can use your City Index demo to buy and sell our full range of markets, including commodities, with virtual capital. It’s a great way to see which asset classes are a good fit for you without risking any real capital.

Can anyone trade commodities?

Anyone can trade commodities, as long as they meet the requirements to open a City Index account. Commodity trading is leveraged, though, which means it’s riskier than traditional investing. Learn more about the risks of CFD trading.

With City Index, you can trade commodities alongside stocks, indices, forex and more – all on a single platform with one login. All City Index clients get access to our full range of markets, including 25+ commodities.

To get started, open your trading account.

How do I calculate how much margin I need to trade a commodity?

To work out how much margin you need to trade a commodity market, you divide the notional value of your position by its margin factor. Say, for example, that you want to open an oil position worth $5000 and oil has a margin factor of 10%. You’d need (10% of $5000) $500 as margin.

How you calculate the notional value of your trade depends on how you’re trading the commodity. With CFDs, it’s the number of contracts you’re trading multiplied by the value of each individual contract.

Learn more about how to trade commodities.