The US dollar fell for a second day after the Fed closed the door on any further hikes. And that places today’s nonfarm payroll report (NFP) into focus. But given NFP’s tendency to beat estimates in recent history, perhaps the US dollar could be setting itself up for a bounce.

Also note that the ISM services report is released after NFP, which could further support the US dollar if is expands at a faster pace, alongside higher new orders and prices paid. Such a scenario may not entice bets of any Fed hikes, but it could scare a few bears out of shorts who are anticipating the a solitary cut this year.

Nonfarm payroll (NFP) stats since June 2020:

- NFP actual has beaten the consensus estimate 69.6% of the time (34.4% were misses, 2.2% were on target)

- 54.3% of prior NFP prints have been upwards revised (41.3% revised lower, 6.5% unchanged)

- Current NFP figure has been below the prior read 52.2% of the time (47.8% above)

As it stands, around 238k jobs are expected to have been added in April, down from the 303k prior and unemployment is expected to remain flat. None of these figures which scream ‘rate cut’ to me any time soon. And with NFP’s tendency to outperform expectations, my bias is for a higher US dollar by the end of the day.

1-day implied volatility levels are elevated for several FX majors (relative to the 20-day average) with USD/CHF leading the way at 233%. IV levels for commodity pairs USD/CAD and AUD/USD are around 170%, with USD/JPY and GBP/USD coming in at 141% and 119% respectively with EUR/USD at 119%.

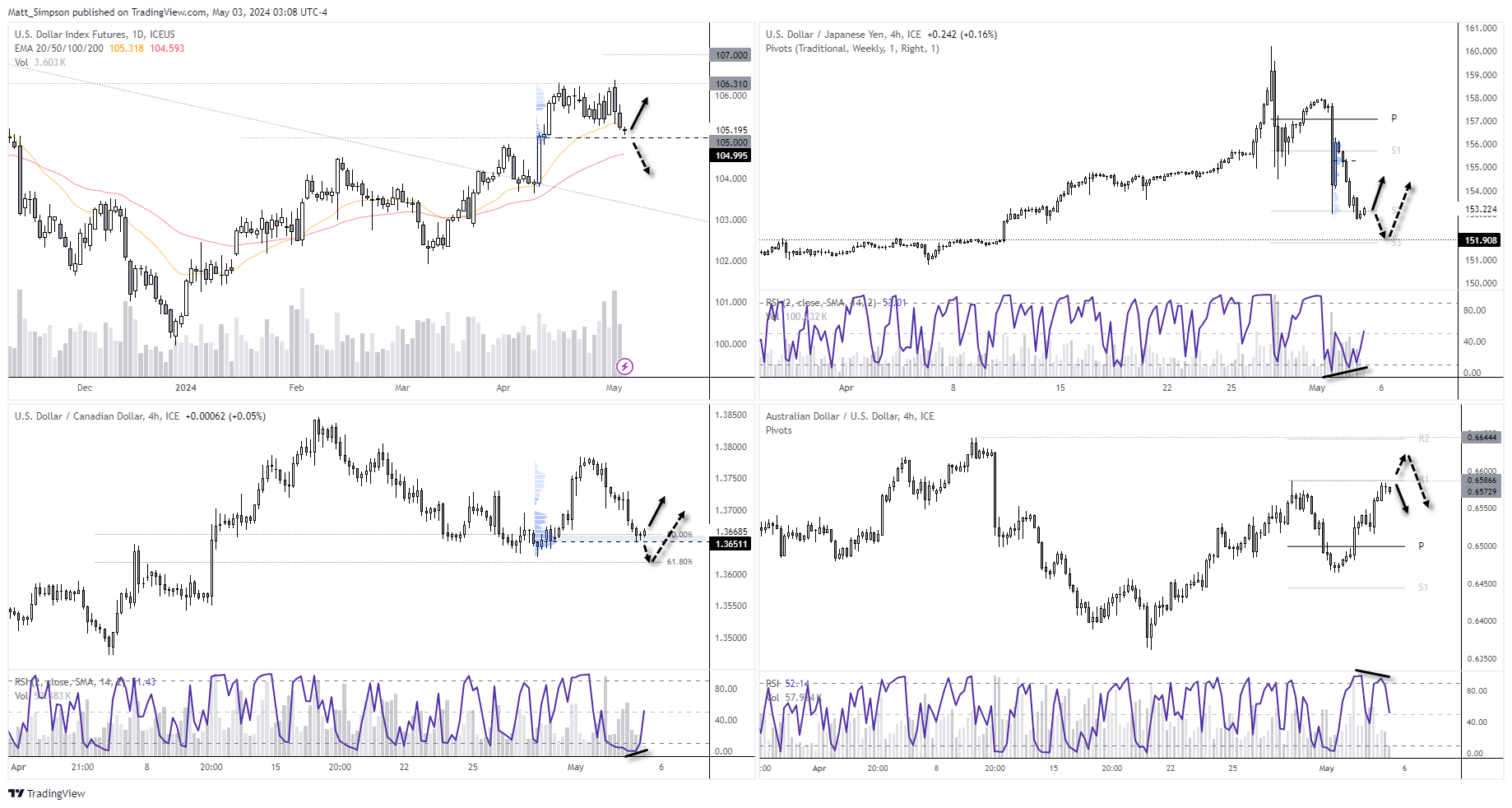

US dollar, USD/JPY, USD/CAD, AUD/USD technical analysis

Trading ranges were typically narrow in Friday’s Asian session, which tends to be the case on NFP day. Nevertheless, the US dollar is trading to trade lower for a third day. Yet the 105 handle is nearby for potential support, and Thursday’s volume was around 2/3rd of Wednesday’s to show bears losing steam. And whilst there may be some noise around this level as we head into the employment report, my suspicion is a stronger US dollar by the close. Should the US dollar index rally from support with yet another stronger-than-expected NFP report, it could provide opportunities for AUD/USD, USD/CAD and USD/JPY.

USD/JPY:

We’ve seen two sharp moves in excess of 400 pips lower this week on USD/JPY. Prices are meandering around the weekly S1 pivot and the second supposed intervention low. So perhaps some mean reversion higher is due. Trading volumes are also diminishing at these lows to suggest bears are losing steam, and a bullish RSI is forming on the RSI (2).

Should NFP surprise with a weak set of figures, the US dollar could move swiftly lower which would bring the 152 handle into focus, near the weekly S3 pivot.

USD/CAD:

The weaker US dollar has helped USD/CAD erase most of its pre-FOMC gains. It has also fallen in a relatively straight line with little in the way of mean reversion higher. Yet with prices stalling at a high-volume node and meandering around the 50% retracement level, perhaps a bounce is due from current levels. If not, perhaps bulls may have better luck around the 61.8% fibonacci level.

AUD/USD:

The Australian dollar is close to breaking above last week’s high, although with momentum now turning lower it seems AUD/USD is hesitant to test the key level ahead of NFP. The weekly R1 pivot also lands on that key high and a bearish divergence has formed on the RSI (2). A sight pullback lower may be in order, although its downside may be limited if traders continue to believe the RBA may consider another hike – and rally quite hard if this is coupled with a weak nonfarm payrolls report.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade