- US economic data surprises are increasingly negative

- While disinflationary forces are evident, the US jobs market remains strong. If it were to deteriorate, it would open the door for Fed rate cuts

- Higher rates and improved growth prospects have fueled US dollar strength. Take that away and it points to material downside dollar risks

- Friday’s June payrolls report is therefore particularly important

- USD/JPY, USD/CNH uptrends under threat?

Overview

US data continues to soften, pointing to downside risks for growth and upside risks for multiple rate cuts from the Fed this year. With recent inflation reports suggesting a return of the disinflation trend seen last year, you get the feeling it’s only the US jobs market standing in the way between the Fed and the next easing cycle. That makes this Friday’s nonfarm payrolls report even more important, especially markets heavily impacted by rate differentials such as USD/JPY and USD/CNH.

US dollar still the ‘least dirty shirt’?

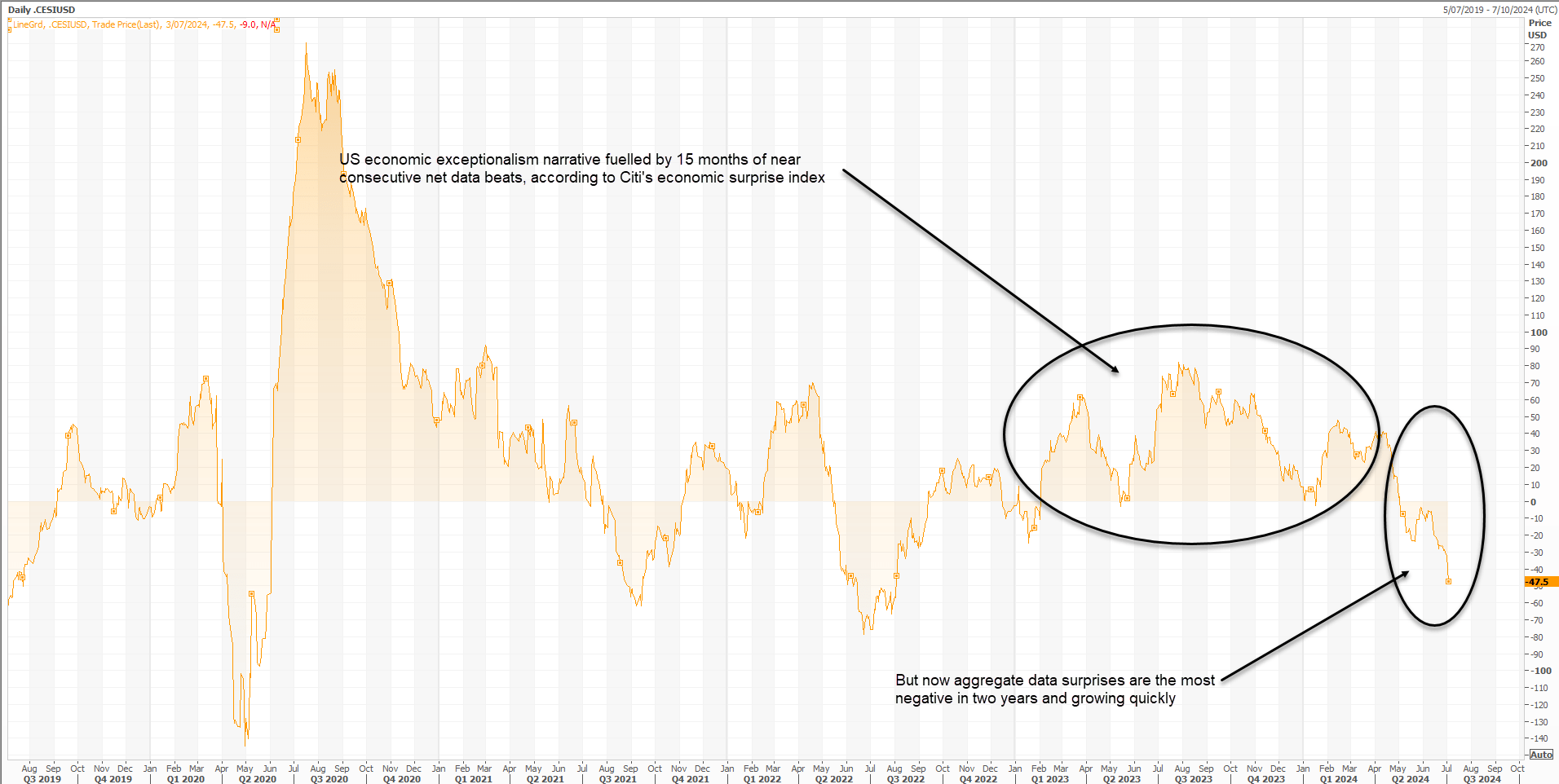

US economic exceptionalism has been hard to question in recent years, surprising to the upside relative not only to expectations but other developed nations. But that narrative now faces a major test. Data is undershooting at an increasing frequency, suggesting activity is not only slowing but potentially rolling over rapidly.

Source: Refinitiv

With disinflationary forces now apparent in the US economy, it feels like we’re only one bad unemployment print away from the Fed signaling the start of the next rate cut cycle. That makes Friday’s June nonfarm payrolls report arguably more important than usual, not only when it comes to the expected timing of rate cuts but how many we may see this cycle.

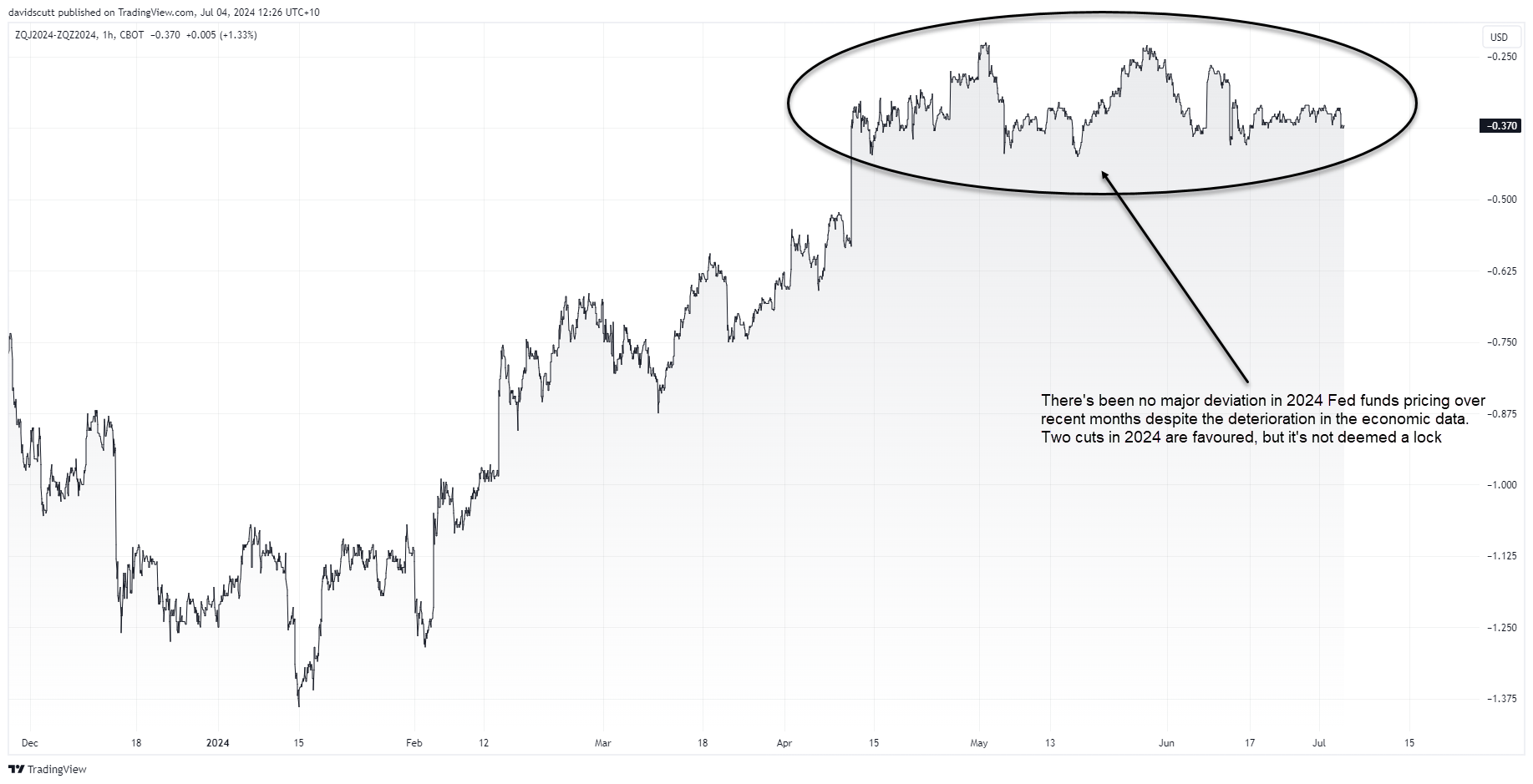

Source: TradingView

That matters for the US dollar which has been sucking capital from the rest of the world in recent years, enticing investors with by higher yields and stronger growth prospects. Take that away and it’s difficult to see the dollar remaining this strong without unexpected turmoil.

Payrolls preview

For the Fed, the payrolls figure doesn’t provide a meaningful signal on labour market tightness which feeds into wages expectations and eventually inflationary pressures. Yet, you can’t escape that markets tend to react initially to the payrolls number relative to expectations.

As my colleague Matt Simpson uncovered during a recent data dive, over the past year, the dollar has moved in the same direction as the miss or beat relative to expectations on 11 of 12 occasions. That’s despite multiple downward revisions to historical data and questions over its veracity.

But the signal that matters to the Fed, and therefore the US rates outlook, is found in the average hourly earnings and unemployment figures. Should they soften noticeably like so many other US economic indicators, yields on short-end rates markets could unwind sharply, likely dragging the US dollar along for the ride.

Markets expect payrolls to grow by 190,000 with average hourly earnings increasing 0.3%. The unemployment rate is tipped to remain steady at 4%.

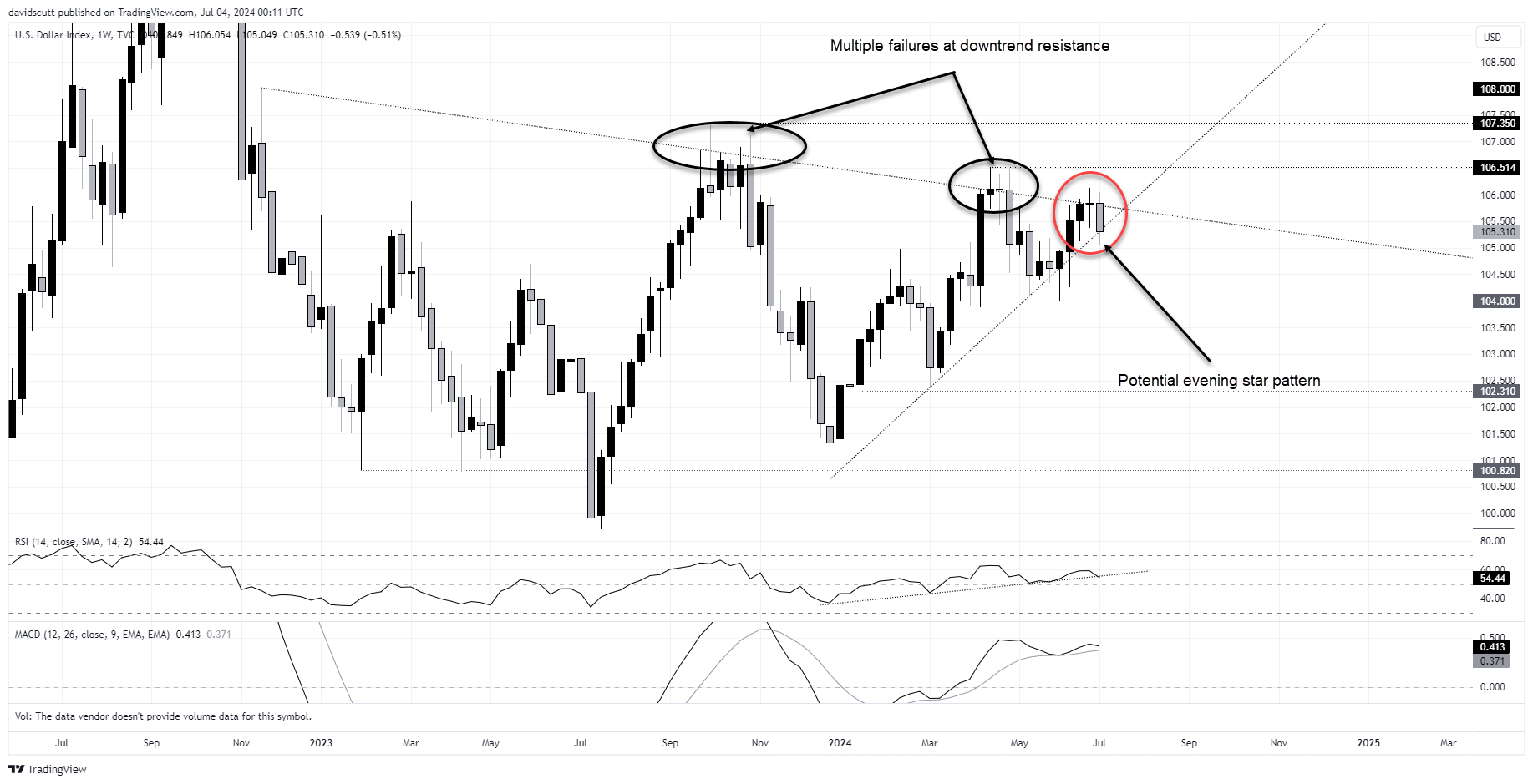

Downside risks evident on the DXY weekly chart

Bullish DXY breaks have constantly failed at downtrend resistance over the past 12 months. And when you look at the last three candles, it looks like a possible evening star formation, a pattern often seen around market tops. But it’s not complete yet. We need to see how it ends the week, emphasising why the payrolls report is not important from a fundamental but technical perspective.

Should we get a weak jobs report, the signal from the longer-term charts is one of growing downside risks. 104 is the first support level of note with 102.31 the next after that.

Source: TradingView

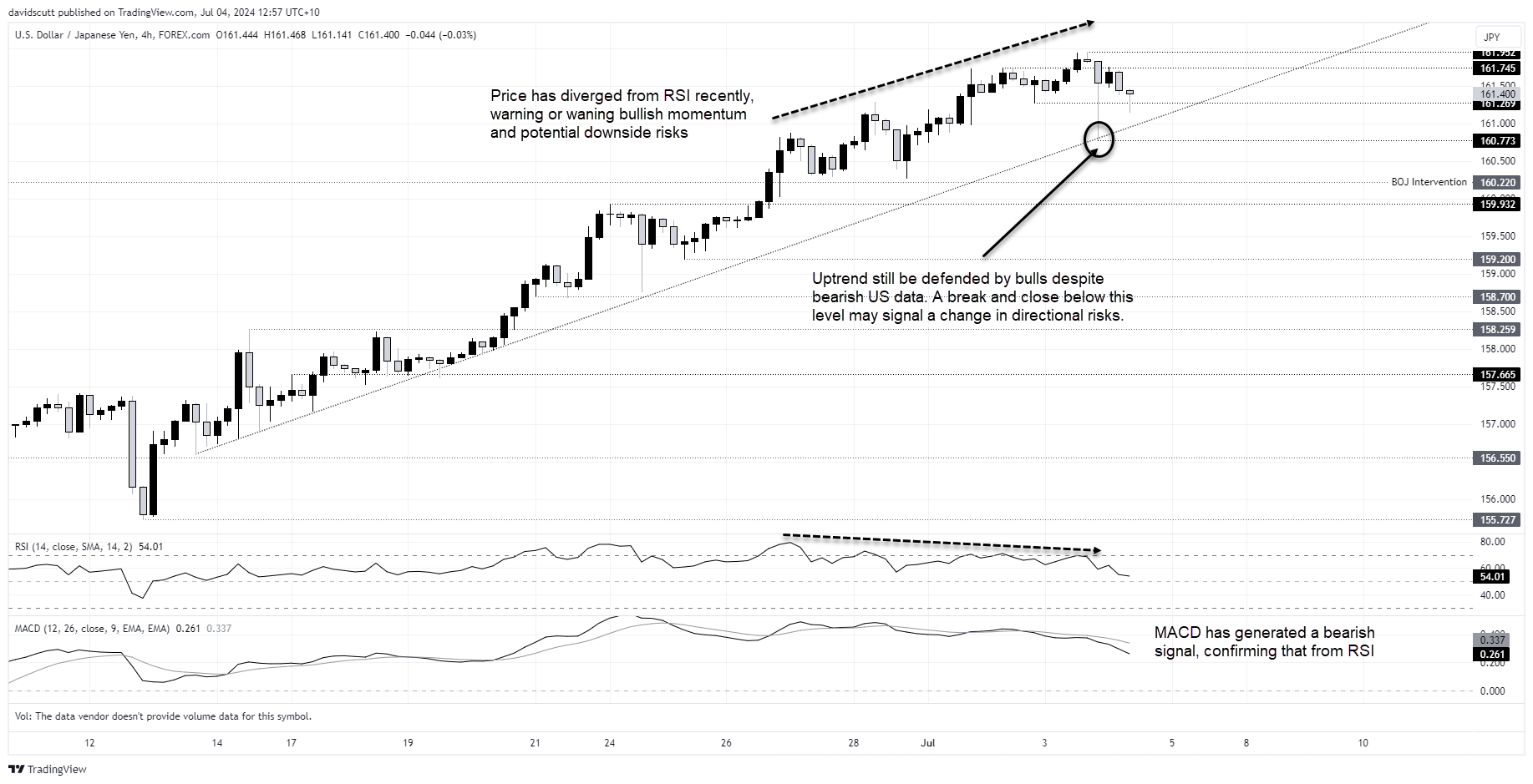

USD/JPY bulls defend uptrend

Taking the signals from the DXY weekly and zooming in on the USD/JPY 4H timeframe, a possible shift in the rates outlook could create some serious downside as seen in late 2023 as the Fed pivoted towards cuts. And now we have record JPY short speculative bets to contend with, as communicated in the latest COT report from the US CFTC. The market looks lopsided and vulnerable to a dovish Fed.

USD/JPY continues to attract buyers on dips towards uptrend support dating back to mid-June, bouncing strongly off it on Wednesday following the release of weak US jobless claims, ISM non-manufacturing PMI and factory orders.

Source: TradingView

Despite the price action, there are warning signs for bulls.

Price has diverged from RSI, pointing to waning topside momentum. MACD has also crossed from above, generating a bearish signal. Should the price break and close beneath the uptrend, it will signal shifting directional risks, likely encouraging bears to establish shorts with a stop above the trendline or cycle highs for protection.

Minor horizontal support is found at 160.773 with a more meaningful level below at 160.22, where the BOJ intervened in Q2. 158.25, 157.66 and 156.55 are other levels where the price did plenty of work earlier this year.

Chinese yuan may lead Japanese yen

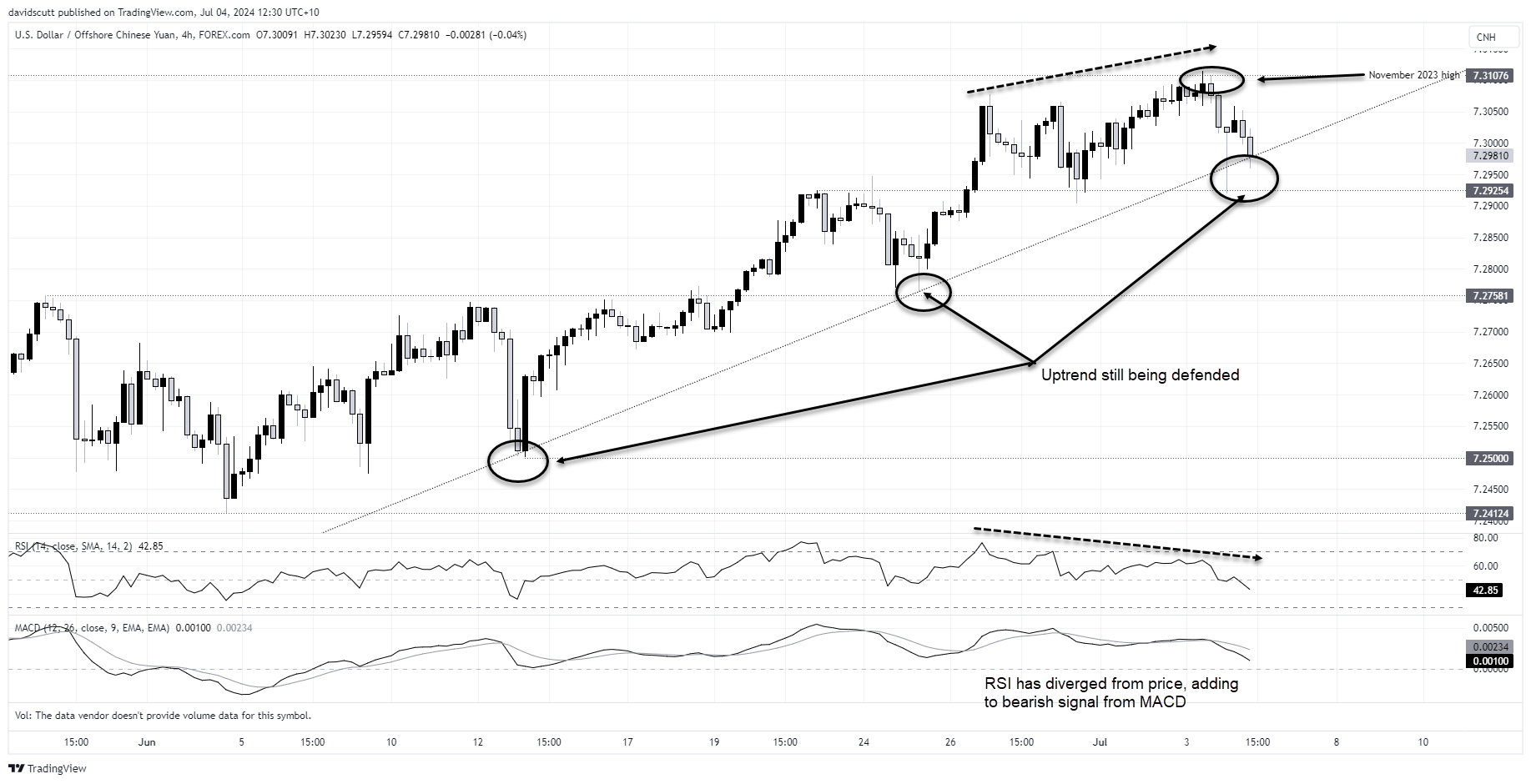

The setup in USD/JPY is almost identical for USD/CNH, sitting in an uptrend with bullish momentum rolling over. RSI has diverged from price, MACD has crossed over from above.

If the price were to close below the uptrend, traders could look to initiate shorts with a stop-loss order either above it or the cycle highs above 7.31. The rejection of the latter dating back to November last year earlier this week suggests it may be a good location for protection.

On the downside, initial support levels to watch include 7.29254, 7.27581, 7.2500 and 7.24124.

Source: TradingView

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade