- Average Japanese worker pay grew 0.2% in the year to November, the slowest pace in nearly two years

- To foster an inflationary environment, Japan needs to see sustained wage pressures

- Data this week revealed consumer price inflation in Tokyo continued to ease while household spending slumped.

If the Bank of Japan (BoJ) was looking for evidence of growing wage pressures to justify abandoning negative interest rates, it wasn’t found in the latest government report for November. It was a shocker with nominal worker earnings rising by the lowest level in nearly two years. But as is often the case with market events in Japan aside from rate decisions, USD/JPY was unmoved on the news. But surely the odds of the BOJ moving to normalise monetary policy are diminishing with a raft of economic indicators suggesting sustainable wage pressure may be difficult to achieve.

BOJ won’t like the latest set of wage numbers

According to the government, average nominal pay rose 0.2% in the year to November, a steep deceleration from the 1.5% pace registered in October. Base salaries rose 1.2% from a year earlier, down from 1.3% in the previous month, while overtime pay increased 0.9%, the first increase in three months. But a 13.2% year-on-year drop in special payments, which some use as a guide to broader bonus payments, ensured that overall earnings were almost unchanged over the year.

With inflation remaining above the BoJ’s 2% target, for now, real worker wages went backwards for a 20th straight month, falling 3% over the year, accelerating from the 2.3% decline reported in October. That reduced purchasing power is weighing on household spending, the largest part of the Japanese economy at just over 50%. A separate report on Tuesday revealed household spending slumped 1% in November, leaving total outlays down 2.9% from a year earlier. That was worse than the 2.3% decline expected, generating renewed concerns about the ability for the economy to generate enough activity to sustain inflationary pressures, especially with consumer price inflation in Tokyo continuing to ease last month, according to government data.

Combined, it suggests prior optimism from BOJ officials surrounding shunto wage negotiations, which conclude at the end of Japan’s fiscal year in March, may be misplaced, as are market expectations that the BOJ will scrap its negative interest rate policy when it meets in April. Right now, that seems the risk rather than the BOJ moving preemptively to abandon the near decade-long stance.

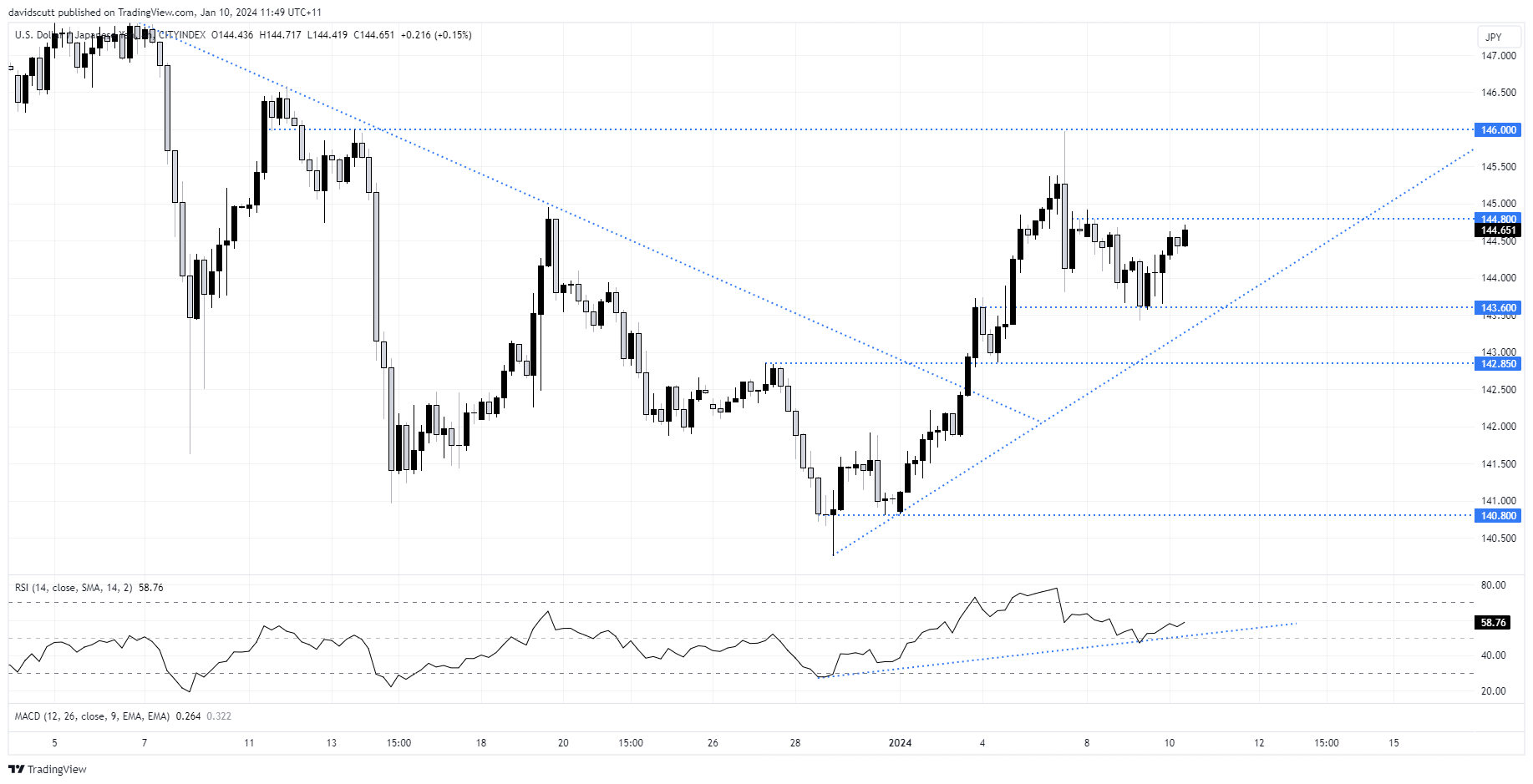

USD/JPY grinding higher following late 2023 swoon

For a pair such as USD/JPY which is heavily influenced by interest rate differentials, any sign of the BOJ stepping back from policy normalisation could spark renewed upside, especially if expectations for as much as six rate cuts from the Fed this year are scaled back by any meaningful degree. Thursday’s US consumer price inflation report looms as the most likely candidate to do so this week, outside of remarks from Fed officials themselves. A 0.3% increase in the core figure is eyed by economists, a result that would see the annual rate drop to 3.8% without revisions to prior data.

For the moment, the path of least resistance for USD/JPYK appears to be higher, continuing to retrace some of the falls seen late last year. Resistance is found at 144.80 and again at 146.00. On the downside, support kicks in at 143.60 and 142.85.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade