- US dollar index surges to two-month highs on bullish economic data

- Gold, copper reverse hard on dollar strength, delivering reversal signals

- Market focus will be on US core PCE inflation report for May released on Friday

- It may show continued disinflationary forces, adding to case for Fed rate cuts

One swallow does not a summer make

Gold and copper were looking good until late Friday, bouncing strongly following recent weakness, the former talking out key levels in the process. Then along came the latest US Composite PMI from S&P Global which suggested the vast bulk of information we’ve received recently is providing an inaccurate picture on the health of the US economy.

While rates markets largely ignored the reported strength in report, FX markets did the opposite, sending the US dollar index surging to the highest level since early May. That flowed through to commodity markets, delivering a key outside day for gold and bearish engulfing candle for copper, pointing to the possibility of continued selling in the early parts of this week.

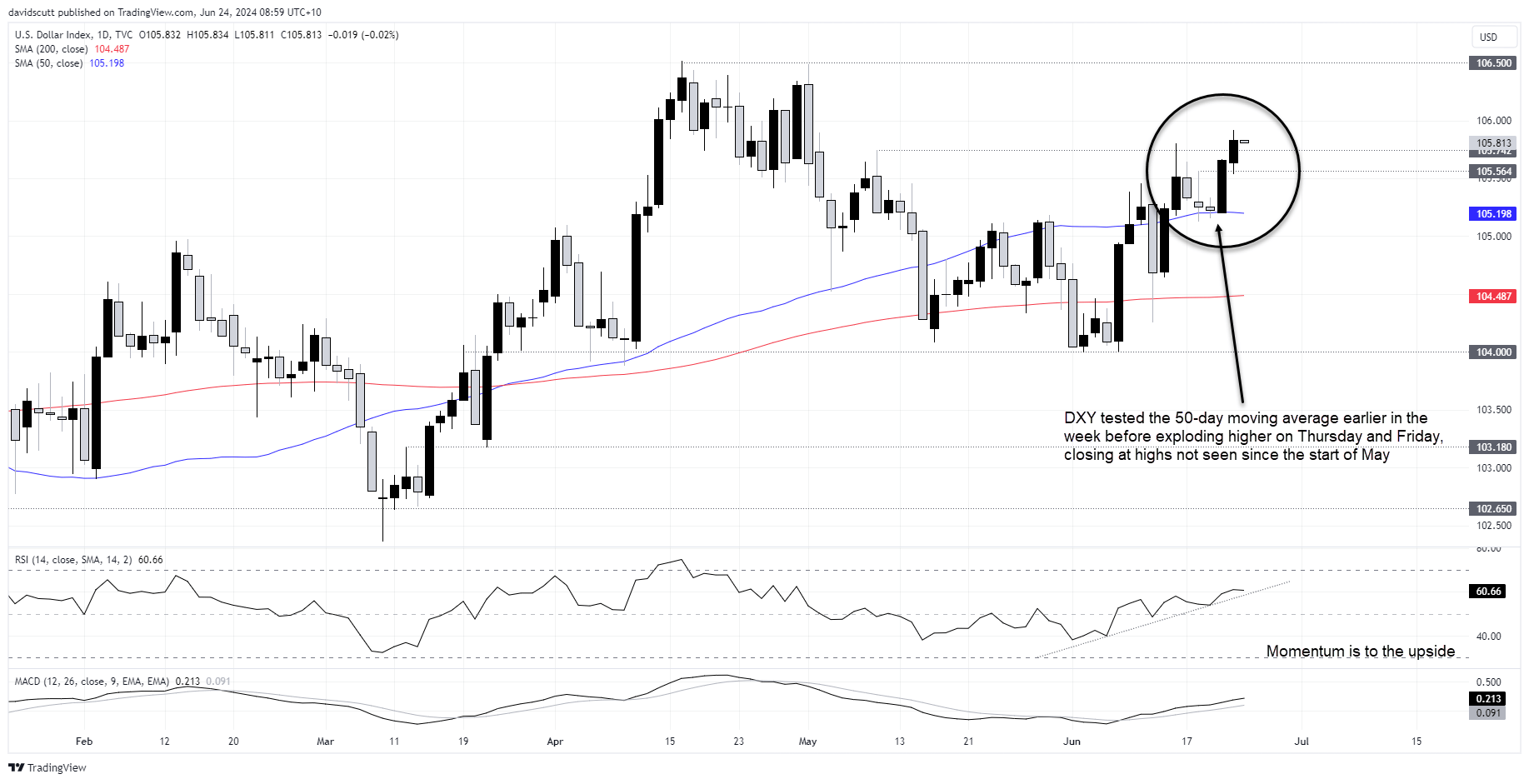

DXY breaks to multi-month highs

You can see the US dollar index (DXY) move on the daily, breaking above 105.742 on Friday, a level that had repelled previous advances in early May and mid-June. With MACD and RSI trending higher, momentum is with the bulls from a technical perspective, putting a potential retest of resistance at 106.50 in play.

But I’m not convinced it will get there.

When the DXY last visited those levels, it was on the back of a big unwind in Fed rate cut bets in 2024, the exact opposite to what we’re seeing right now. And while a large part of this move has been driven by heightened uncertainty over French elections that begin this weekend, that’s now arguably already in the price. Throw in the threat of intervention from the Bank of Japan to support the yen against the US dollar, and likely focus on ebbing US inflationary pressures in the week ahead with the release of the US core PCE deflator, and the backdrop does not point to easy upside for dollar bulls.

Given that assessment, it raises question marks over the price signals received last Friday in gold and copper markets.

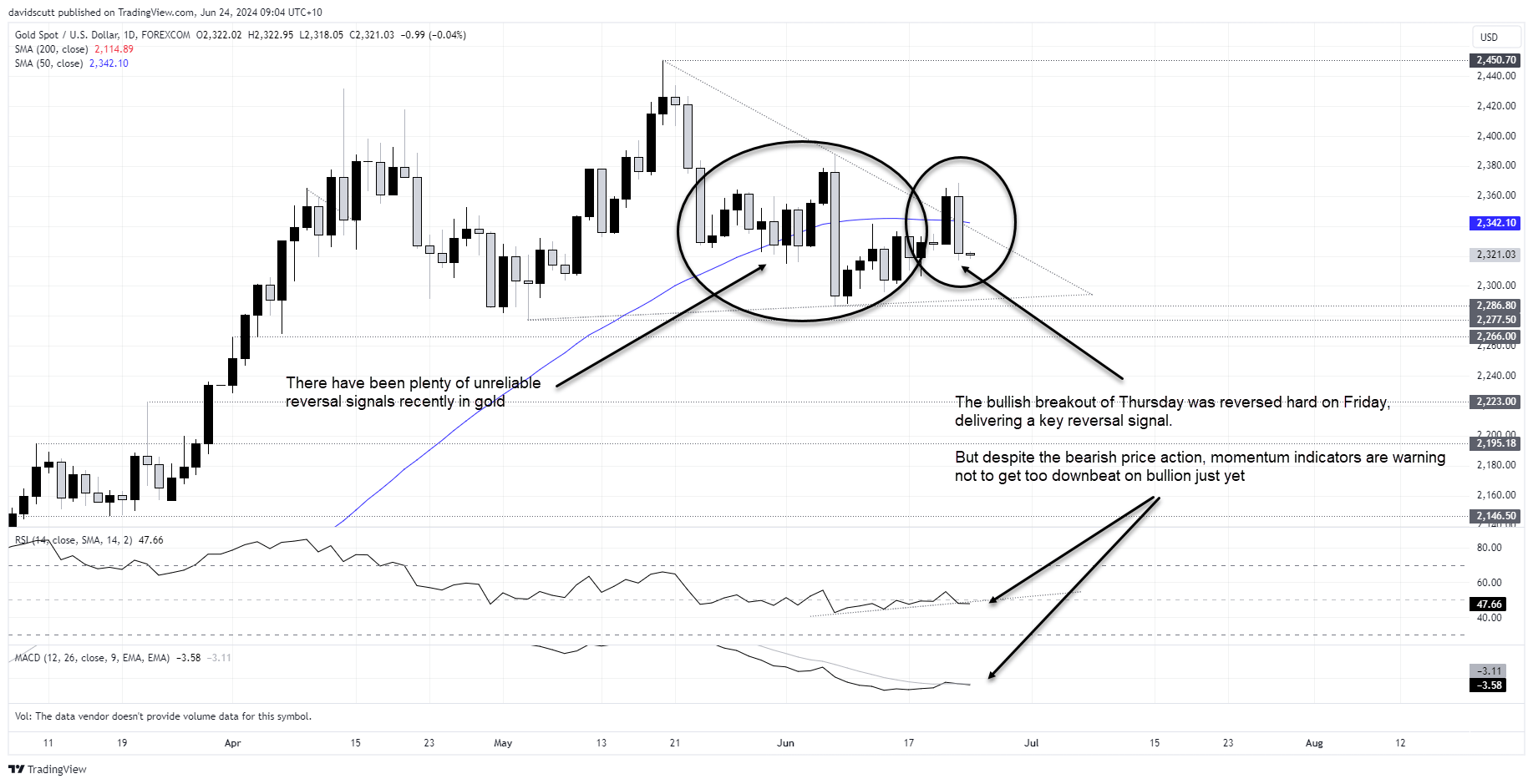

Gold delivers key reversal signal

The dramatic reversal in gold is easy to see, with a bullish break above the 50-day moving average and downtrend from the record highs on Thursday reversing hard late Friday, delivering a key outside day for bullion. While that points to downside risks, looking back over recent moves in gold shows there’s been numerous reversal signals recently that have ended up going nowhere. It’s been a messy tape.

Should prices dip towards $2300, there’s a decent chance we may see bids emerge considering the price action earlier in June. There’s also no definitive bearish signal from momentum indicators yet, adding extra need for caution. Support may be found at $2286 and again at $2266. On the topside, the 50-day moving average and Friday’s high of $2369 are the first levels to watch.

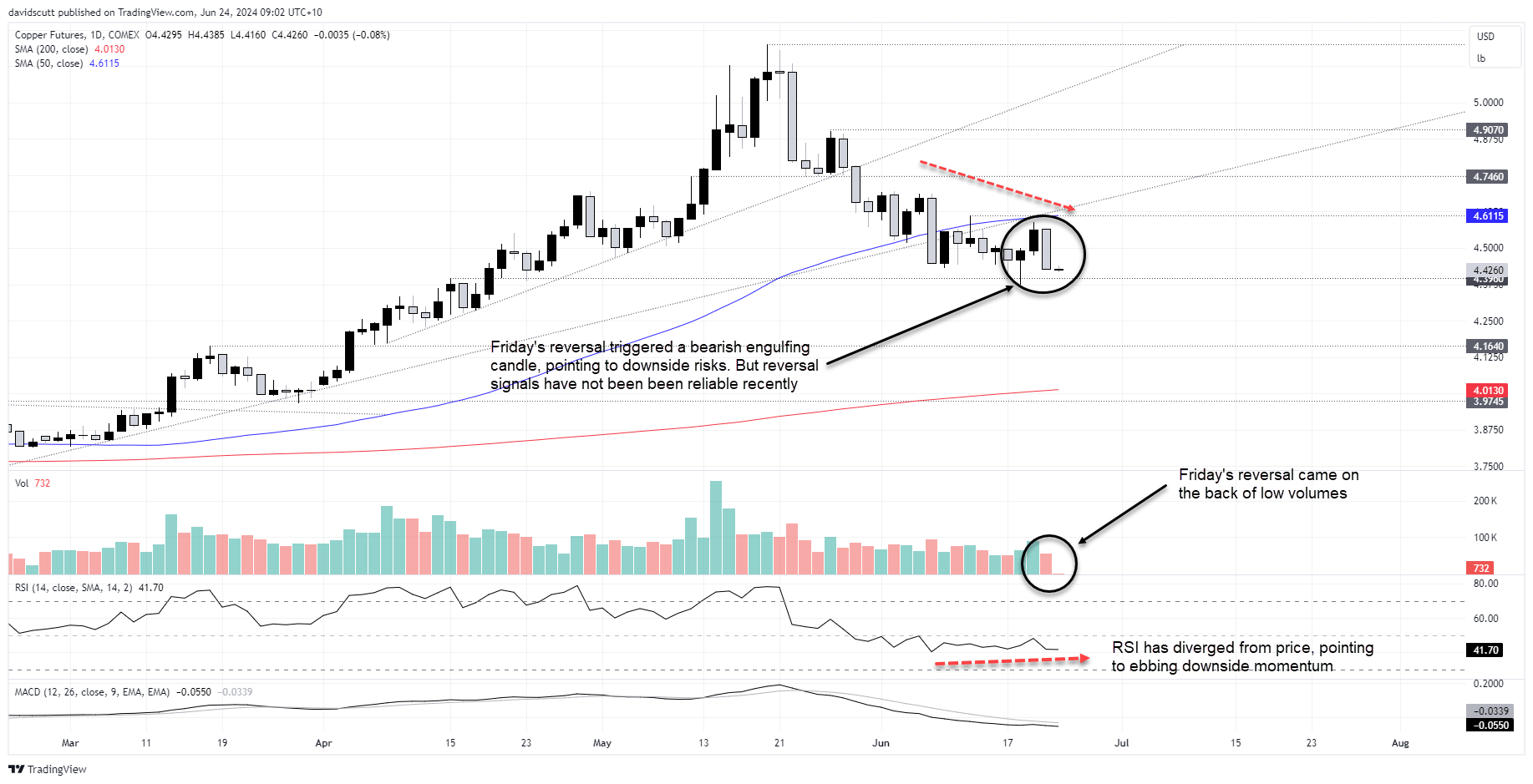

Copper reverses hard and remains choppy

Like gold, COMEX copper futures delivered a reversal signal on Friday, printing a bearish engulfing candle having failed to clear the 50-day moving average. But the reversal came on the back of tepid volumes. RSI has also diverged from price recently, printing higher lows which is another signal suggesting now is not the time to get too bearish.

The price bounced strongly after testing support at $4.396 on two occasions last week, making that the first downside level to watch. Below, bids may be found below $4.25 and $4.164. On the topside, the 50-day moving average, $4.6875 and $4.746 are possible upside targets for bulls.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade