This is an excerpt from our full Indices 2024 Outlook report, one of nine detailed reports about what to expect in the coming year. Click the banner at the bottom to download the full report.

Stocks Turn the Corner in a Major Way

The Nasdaq 100 set its yearly low in the first week of 2023 and only continued to scale higher as the year developed. There were some risks that were shrugged off along the way, such as the banking crisis in March or the flare in Treasury rates that ran from July through October. But as we move into the close of 2023 trade the index is working on its strongest yearly performance since 2009. And with rate cuts set to begin at some point in 2024, this could further add push behind the risk-on trade, although the way those cuts begin will likely have a determining factor on what the net impact will be and how it will play out.

With both Treasury Secretary Janet Yellen and FOMC Chair Jerome Powell declaring confidence behind the ‘soft landing’ scenario, equities are poised to continue gains into the New Year. This will not be without risk, however, as the start of rate cut cycles can create capital flows into bonds and away from stocks and if this happens abruptly, the impact could be sizable. But, if it happens in a smooth and orchestrated manner, such as we saw in 2019 when the Fed cut rates three times, the impact can potentially be moderated without significant disruption.

The bigger issue would be the rationale behind earlier or more sizable rate cuts, as the Fed responding to an emergency of some sort, combined with a forceful flow of capital into short-term debt, could create a headwind which equities may not be able to rally through. This could create a conundrum, but we’ve seen similar risks flare over the past couple of years and each has been offset by either the Federal Reserve or the Treasury department maneuvering, and with an election year coming in the United States there could be even more motivation for the US government to smooth volatility.

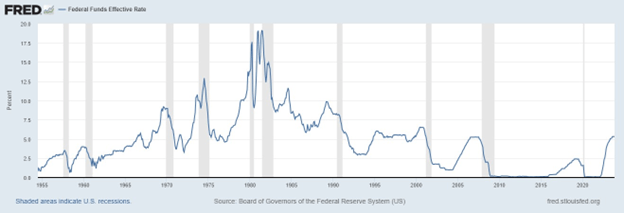

As illustration of the relationship between recessions and rate cuts, the below chart from the St. Louis Federal Reserve highlights the Fed Funds rate since 1955 along with recessions in the United States, which are represented in the shaded areas below. There are ten instances of recession that are denoted on the chart, and seven of those have started after the Fed had begun to cut rates. So rate cuts aren’t necessarily a panacea for stocks, or the economy.

Federal Funds Rate since 1955 with US Recessions Plotted with Shaded Areas

Data from FRED, St. Louis Federal Reserve, Fed Funds

What are the major technical levels to watch on indices next year? What about the tech-heavy Nasdaq 100? See our full guide to explore these themes and more!