Gold is trading modestly higher in light electronic trade owing to the US Independence Day holiday. US stock markets and treasury markets are closed.

The precious metal rose to a monthly high on Wednesday after weak US economic data revived hopes that the Federal Reserve could start to cut interest rates sooner rather than later.

Jobless claims rose to the highest level since 2021, and the ISM services PMI contracted at the fastest pace in three years. US data suggests this is a turning point, showing a slowing economy and weakening labour demand.

Non-farm payroll data

Attention is now turning to tomorrow’s US non-farm payroll data, which is expected to show that jobs creation slowed considerably to 190k in June, down from 272k in May and the average hourly wage is also expected to ease to 0.3% MoM from 0.4%.

The market is currently pricing in a 69% chance of a September rate cut, up from 56% a week ago after the weaker data and a more dovish-sounding Federal Reserve Chair Powell when he spoke earlier in the week. Furthermore, the FOMC minutes also showed that policymakers acknowledged that price pressures were easing.

A softer US NFP report could raise rate cut expectations higher, which could bring the USD lower benefitting USD-denominated, non-yielding XAU/USD.

Central bank buying

Fed rate cut expectations are not the only driving force behind Gold. Central Bank purchases have played a key role in Gold’s ascent this year. Central banks buying record quantities of Gold have helped drive Gold to record levels with emerging markets seeing strong demand.

Data released earlier this week showed that central banks continued to buy Gold in May, but at a slower pace, and China is temporarily out of the picture. Central banks added 10 tons of Gold in May, despite the elevated price of the commodity, which shows a level of acceptance for the higher price.

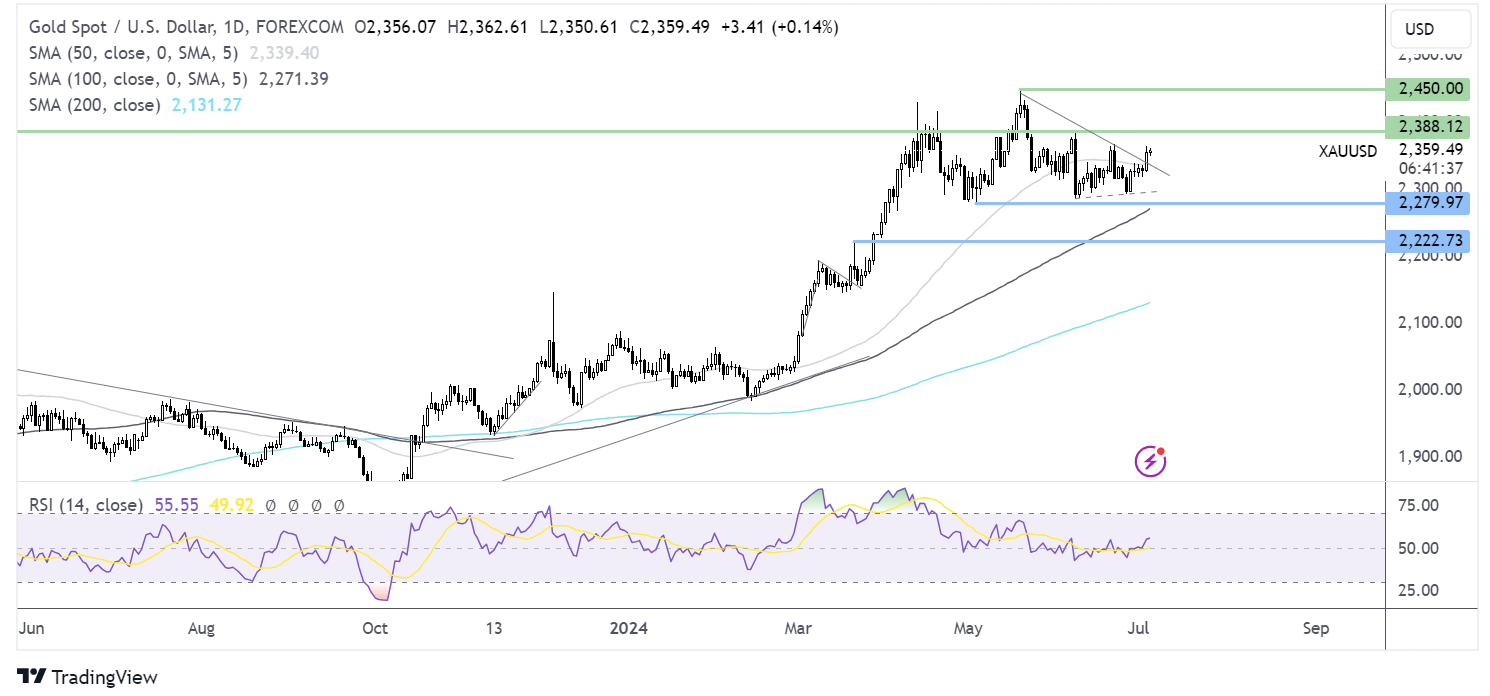

XAU/USD forecast – technical analysis

XAUUSD has recovered from last week’s lows of 2296, rising above the 50 SMA and the near-term falling trendline resistance to a peak of 2364.

Buyers will look to extend this bullish momentum to test 2388, the June high. A rise above here brings 2400, the round number, and 2450, the ATH.

On the downside, immediate support is at 2340, the falling trendline and 50 SMA; below there, 2300 and 2296 come into play ahead of the 2290 May low.