A quick review of the minutes reveals the familiar ‘ifs and buts’ we’ve grown accustomed to from a central bank that remains hesitant to adjust rates. On the international front, the RBA sees upside risks to growth and notes that services inflation has remained higher than expected. Domestic demand has continued to exceed aggregate supply but at a diminishing rate, and wages have likely peaked for the cycle. While some firms continued to report upward pressure on costs, consumer-facing firms encountered difficulties in raising prices, which was impacting margins.

But when it comes to inflation, they concede that “there had been limited information about market services price inflation since the May meeting”, which makes the upcoming quarterly inflation report all the more important. We know that monthly CPI figures delivered after the meeting are uncomfortably high, so we may need to see quite a strong drop in services inflation to fully reverse expectations of a hike. Because anything less than a decent miss simply backs up the monthly figures and paves the way for the RBA to hike by 25bp to 4.6%.

RBA minutes: “Inflation remained above the target range and had been a little higher than expected in prior months. The monthly CPI indicator for April had exceeded expectations because of stronger-than-expected durable goods price inflation. However, there had been limited information about market services price inflation since the May meeting. Members acknowledged that these (limited) inflation data had increased the risk that sustainable progress towards the inflation target may be slower than forecast.”

The RBA’s concerns that the employment market was weaker than headline figures suggested ultimately helped them side with a hold over a 25bp cut in June, but unless incoming inflation figures behave then a hike seems like a genuine risk.

RBA minutes: “Members noted that the August forecast round would provide an opportunity for the staff to carefully review the extent of spare capacity in the labour market and the economy more broadly.”

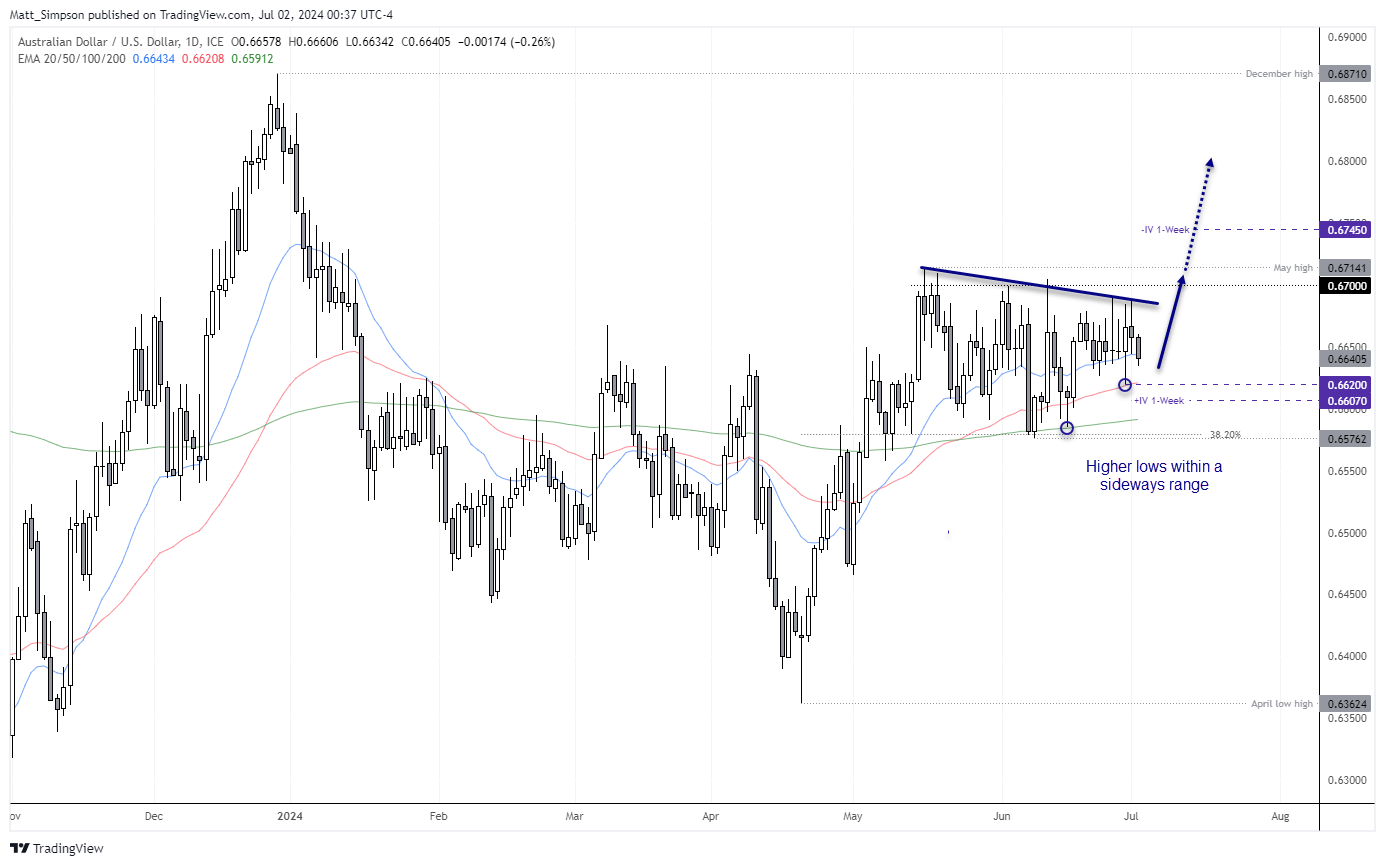

AUD/USD technical analysis:

With a hike not yet a full-drawn conclusion, AUD/USD retraced lower to a 2-day low. Yet it does little to change the analysis outlined in our AUD/USD weekly outlook. The Aussie remains in the upper half of a sideways range with an eventual upside breakout favoured, due to the strong rally heading into the consolidation and the potential for the US dollar to weaken alongside incoming economic data. Therefore, AUD/USD remains in my ‘dip’ watchlist in anticipation of an eventual upside break of 0.6700.

The daily chart shows a strong rally from the April low to May high, and the current consolidation has formed two higher lows to shows bullish pressure is building. Prices have just dipped beneath the 20-day average, but I’m now looking for a higher low to form above Friday’s low of 0.6620 near the 50-day EMA.

Take note that the JOLTS job opening report is released later today, with a soft print potentially helped AUD/USD move higher.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade