- Australian inflation overshot expectation by some distance in May

- We have seen three consecutive upside surprises from Australia’s inflation indicator

- Earlier this month, the RBA said it will do what is necessary to bring inflation back to target

- With inflation moving further away from its mandate, an August hike is deemed a line-ball call

- AUD/USD, Australian bond yields surge, ASX 200 tanks

RBA August meeting live for a hike

There is now little doubt underlying inflationary pressures in Australia are accelerating again, increasing the risk the Reserve Bank of Australia (RBA) will be forced to hike interest rates for the first time since November.

Three-peat of inflation overshoots

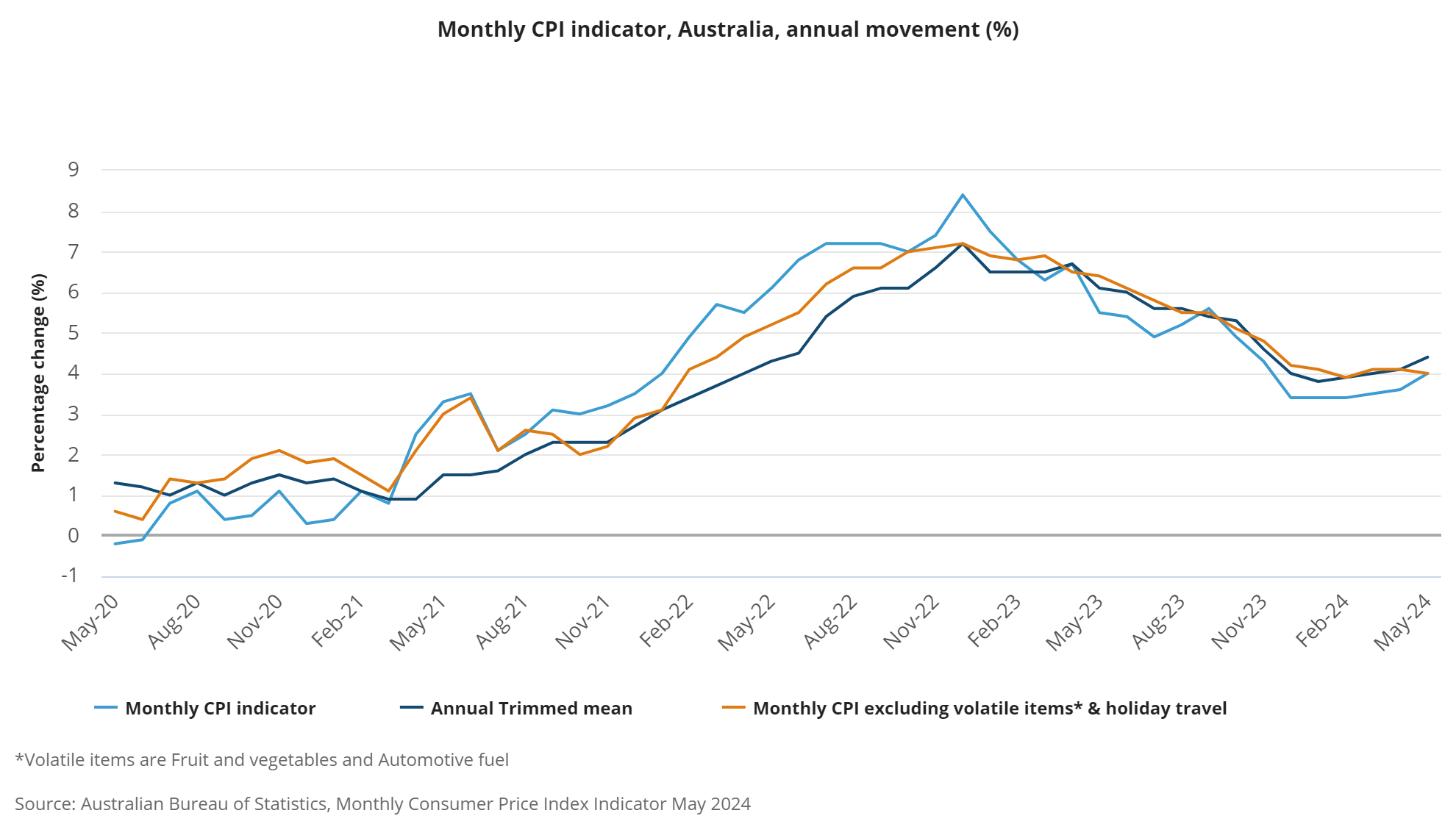

Australia’s May inflation report was uncomfortably hot, continuing the pattern seen in recent months. Headline inflation accelerated to 4.1% in the year to May, up from 3.8% in April and three tenths higher than expected.

The news on underlying inflation was even worse with the key trimmed mean measure lifting 4.4% over the year. Not only was that nearly two full percentage points above the midpoint of the RBA’s 2-3% inflation target band but a significant acceleration on the 4.1% pace seen in April. That's important as this is the RBA's preferred inflation gauge.

As shown in the chart below, there are now serious doubts about inflation not only returning to the RBA’s target band with a clear acceleration seen in both headline and underlying measures.

Source: ABS

RBA wriggle room is shrinking fast

For the RBA, the update has seen the upside inflation risks it flagged at its June monetary policy materialise, even before income tax cuts and a variety of energy and transportation subsidies hit the pockets of Australian households next week.

“The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out,” it wrote two weeks ago. “The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.”

Right now, markets believe the RBA may need to resume its tightening cycle to achieve its goal, deeming an increase in the cash rate to 4.6% on August 6 as a coin toss. Prior to the inflation report, the probability of such an outcome was priced around 10%.

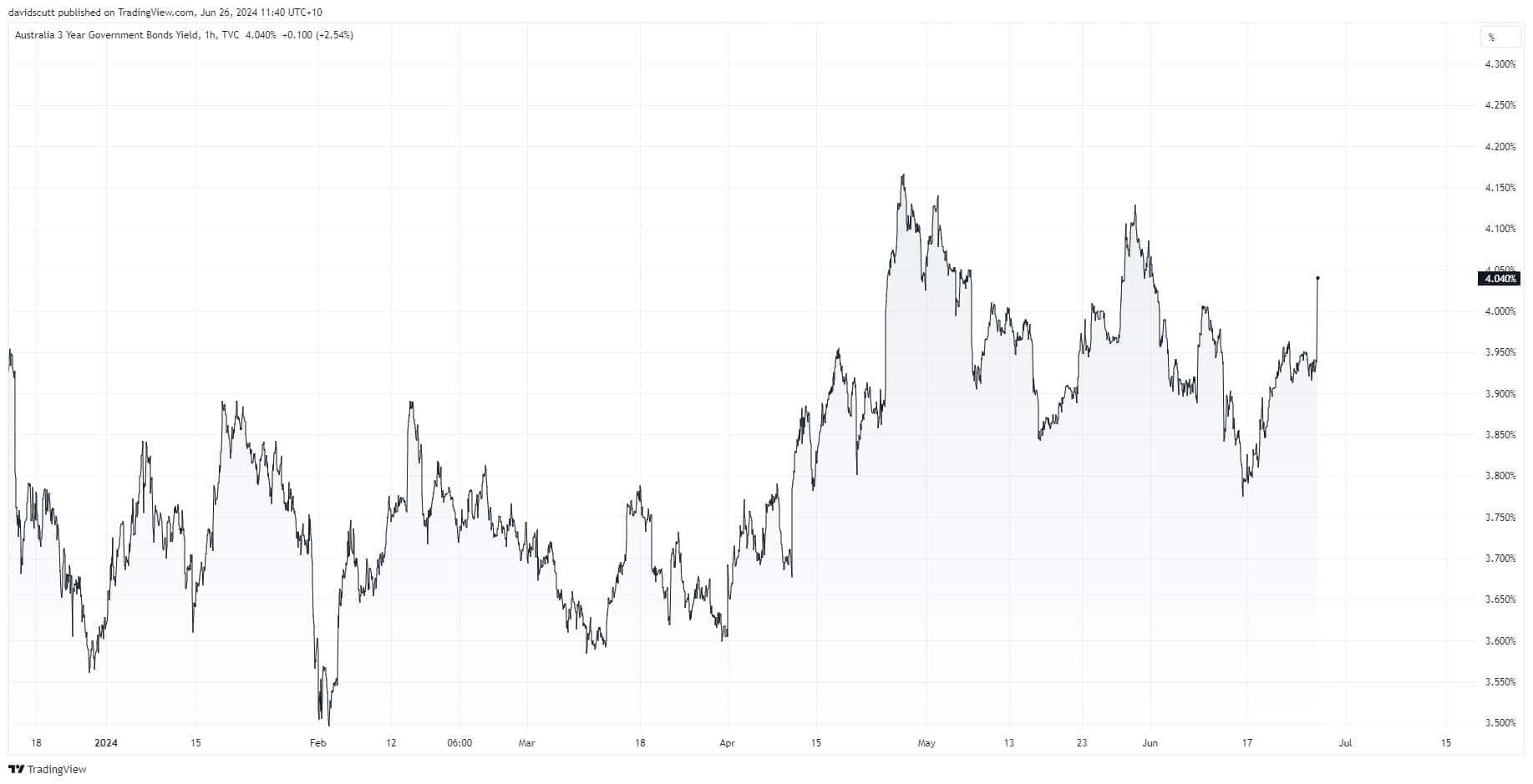

Three-year Australian yields surge

Australian three-year government bond yields – which are sensitive to changes in the interest rate outlook – surged around 14 basis points following the report, putting it on track for the largest increase since April.

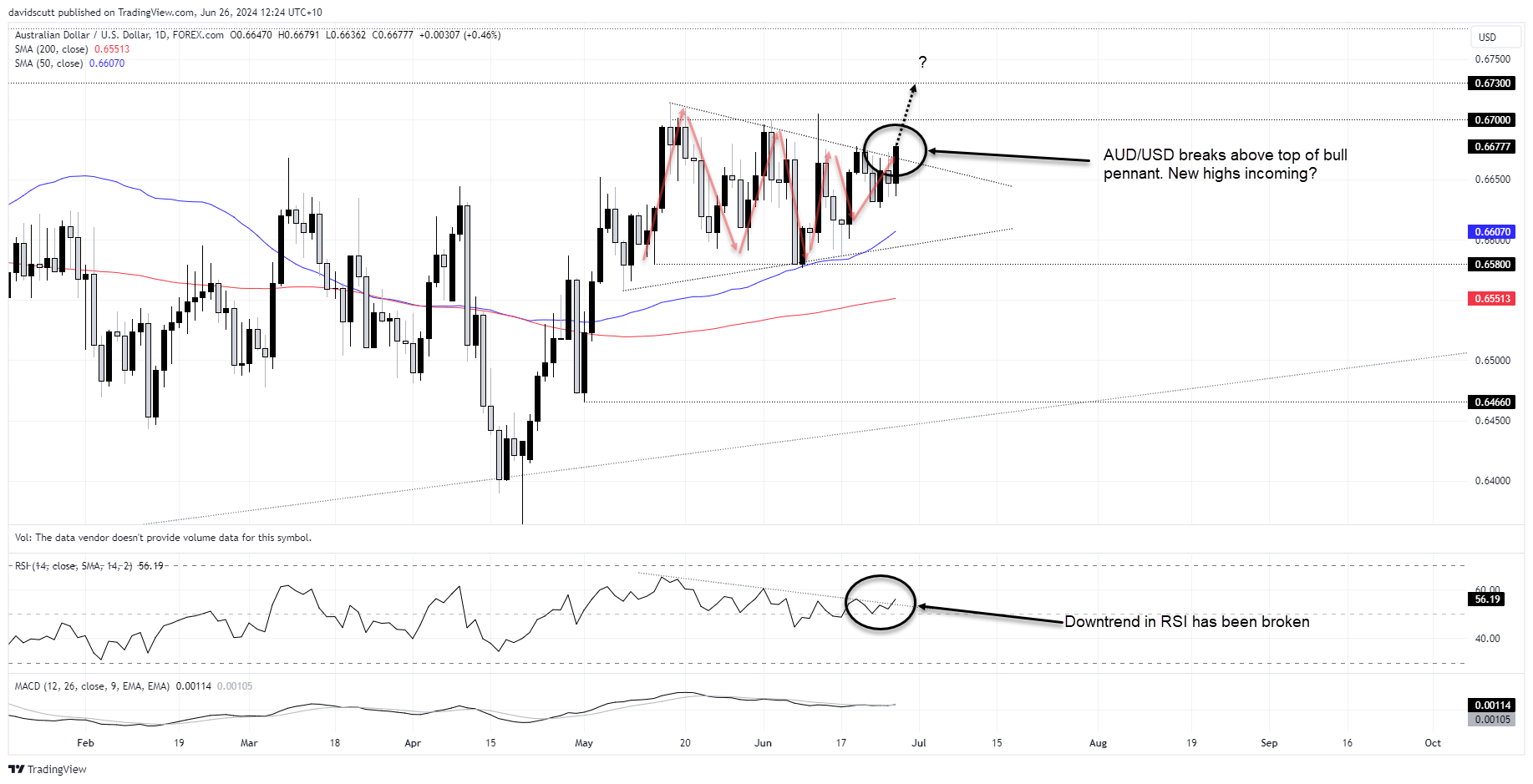

AUD/USD breaks pennant resistance

That contributed to AUD/USD lifting as much as 0.5%, seeing it break through the top of the bull pennant formation it had been sitting in since the middle of May. Should the breakout stick, it points to a possibility of AUD/USD testing the top of its range highs above .6700.

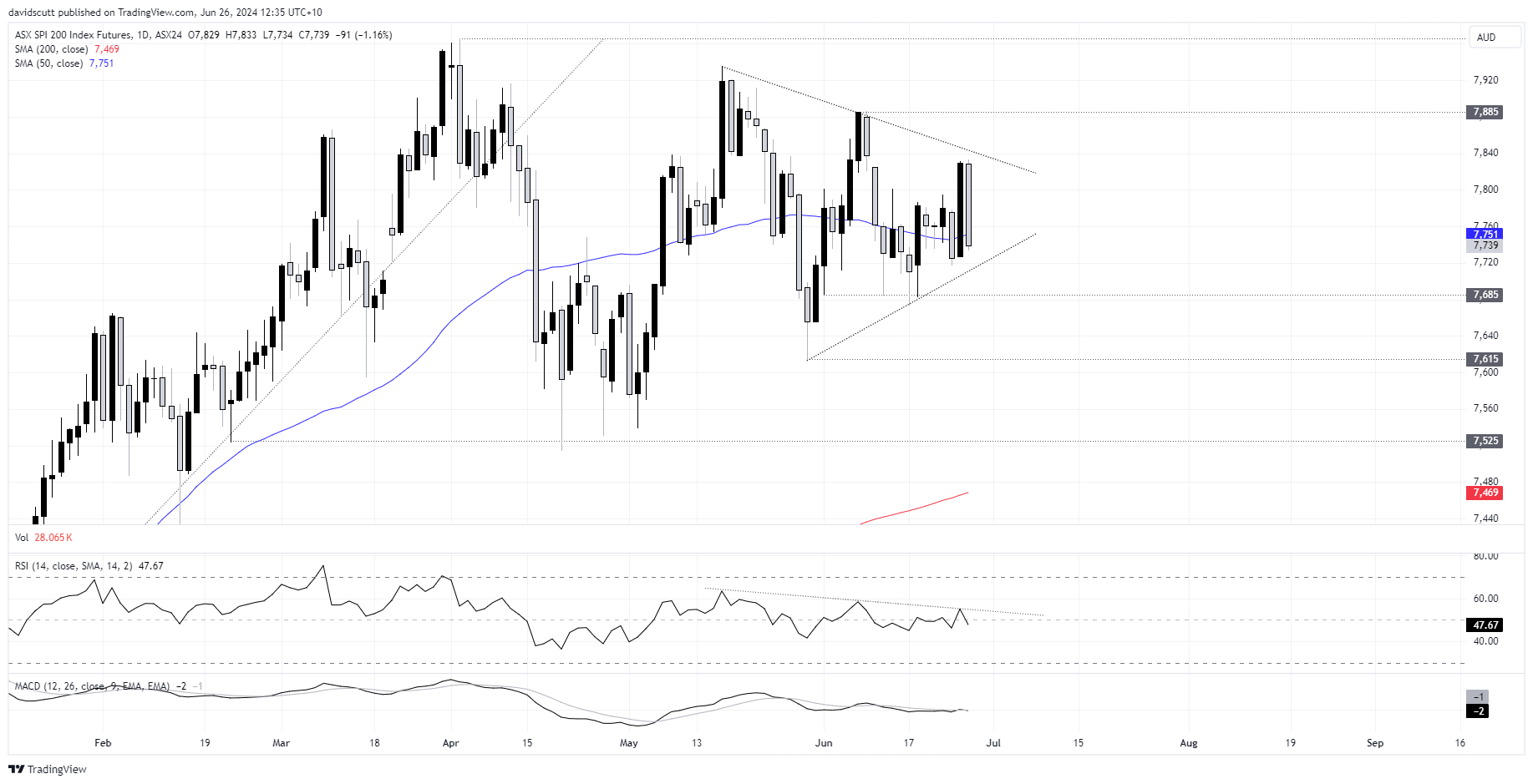

ASX 200 SPI futures reverse hard

With the risk of higher rates threatening to slow economic activity and reduce the yield appeal of equities over safer asset classes, Australian ASX 200 SPI futures were hammered, losing more than 1%, reversing the gains achieved on Tuesday.

For now, it remains comfortably within the bull pennant it’s been in over the past seven weeks May. Should we see a downside break, futures were well bid from 7685 earlier in June.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade