CFD shares trading

-

Commission from $5 on Australian shares

-

Trade with leverage, margins from 20%

-

Regulated in Australia since 2006

Live share CFD prices

CFD prices vs stock prices

Share CFD prices are usually extremely close to the prices of the shares they track. You pay a commission when you trade CFDs, so there’s no additional spread on either side of the market price – which helps keeps the two in parallel.

Learn more about CFD fees.

Competitive share CFD pricing

| Market Name | CFD Spread | CFD Comission | Margin from* |

|---|---|---|---|

| Australian shares | Market | 0.09% ($5 AUD minimum) | 20% |

| Singapore shares | Market | 0.08% ($10 SGD minimum) | 20% |

| FTSE 100 shares | Market | 0.1% (£10 minimum) | 20% |

| Other UK shares | Market | 0.1% (£10 minimum) | 20% |

| European shares | Market | 0.1% (€10 minimum) | 20% |

| US shares | Market | 2 cents per share ($8 USD minimum) | 20% |

For full market details, please consult our in-platform market information sheet. Don’t have access? Try a CFD demo account.

Benefits of share CFDs

City Index offers a choice of over 4,500 global shares from companies listed on US, UK, Europe, Australia, New Zealand, Singapore and Hong Kong stock exchanges.

-

Utilise leverage to control larger positions with a small deposit

-

Use CFDs to hedge your investment portfolio

-

Trade falling markets as well as rising ones

-

Trading opportunities over shorter time periods; minutes, days, or weeks

Share CFD trading details

Share CFDs are ideal for shorter-term trading on technical levels and market news.

| SHARES CASH CFDS |

|---|

| Spreads

Market spread only |

| Commission

From $5 per trade on Australian shares |

| Rollover

Positions roll over automatically to next trading day |

| Financing charge

Incurs a finance charge for positions held overnight |

| Adjustments

A dividend adjustment may be applicable to shares |

| Profit and loss

P&L crystallised only when positions are closed or partially closed |

| SHARES CASH CFDS |

|---|

| Spreads

Market spread only |

| Commission

From $5 per trade on Australian shares |

| Rollover

Positions roll over automatically to next trading day |

| Financing charge

Incurs a finance charge for positions held overnight |

| Adjustments

A dividend adjustment may be applicable to shares |

| Profit and loss

P&L crystallised only when positions are closed or partially closed |

What is CFD stock trading?

CFD stock trading is the process of buying and selling contracts for difference on shares markets. It works similarly to traditional share trading, except instead of investing in the stocks themselves you’re trading contracts that mimic their price movements.

This brings several unique benefits to CFDs, including leverage and the ability to go short as well as long.

Learn what CFD trading is.

What’s the difference between CFD and share trading?

CFDs and share trading each have their own key benefits. To help you choose which is right for you, here’s a quick recap:

| CFDs might be for you if you want: | Share dealing might be for you if you: |

|---|---|

|

|

Learn more about CFDs vs share trading.

How to buy share CFDs

To buy share CFDs, you’ll need an account with a trading provider. Then, you can choose your market, set how many CFDs to trade, choose to go long or short and execute your order. You can also add any stops or limits to aid with risk management.

This process may be familiar if you’re used to investing in equities – except you deal in contracts instead of shares. There are some key differences though, so it’s worth understanding each step before you get started.

Learn more about how to trade CFDs.

We’re backed by Nasdaq-listed StoneX, a Fortune 100 company with over a century in the financial markets. Combined with our four decades of heritage, you’re in good hands.

With 24/5 dedicated client support, we are always on hand to help – and 99.99% of all valid trades are executed by our market-leading trading technology.

From personalised performance analytics to advanced risk management tools, you have a wealth of exclusive tools at your disposal to maximise your trading potential.

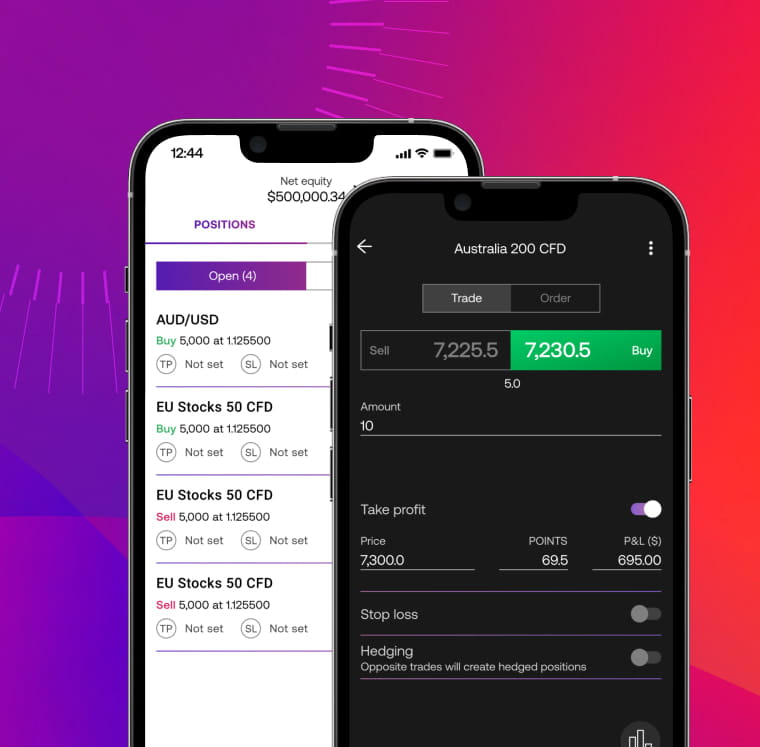

Powerful mobile apps

Seize trading opportunities with our easy-to-use mobile app, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Access the industry-leading charting package, complete with one-click dealing, 80+ custom indicators, alerts and drawing tools.

Actionable market analysis

Get insightful market data from Trading Central plus receive expert market commentary direct from Reuters in-app.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Multi-device dealing

Manage your trading account across desktop, mobile and tablet without interruption.

Share CFD trading FAQs

What is the difference between a CFD and a share?

A share is a single unit of ownership in a publicly traded company. A CFD is a contract that enables you to trade on the price movements of shares – alongside lots of other markets including indices, forex and commodities – without ever owning the underlying asset.

When you buy a single share CFD, it gives you the same exposure as buying one share. Buying one Apple CFD, for example, is the equivalent of buying an Apple share. However, the key difference is that with the CFD you never take ownership of the share itself. Instead, you’re trading a contract in which you agree to exchange the difference in the stock’s price from when you open your position to when you close it.

Learn more about CFDs vs shares.

Do I pay commission with share CFDs?

Yes, you’ll pay commission to trade any share CFD markets with City Index – unlike all other asset classes, where you’ll pay via the spread instead. This makes the process of buying share CFDs fairly similar to the underlying market.

Our commission rates are just 0.09% on AU markets, 0.1% on European and UK markets or 2 cents per share on US ones. There’s a minimum commission of AU$5 on Australian stocks, £10 on UK stocks, €10 on EU stocks and US$8 on US stocks.

To see the process in detail, take a look at our CFD examples.

What happens when you trade a share CFD?

When you trade a share CFD, you’re entering into a contract in which you and your CFD provider agree to exchange the difference in an asset’s price from when your position is opened to when it is closed.

Say, for example, that you buy 100 Coca-Cola CFDs at $55, then close your position at $60. You’d exchange the difference between $60 and $55, earning you a profit of $5 for each CFD you bought – or $500 overall. If Coca-Cola had fallen to $52 instead, you’d lose $300.

Learn more about how to trade CFDs.

What is stock CFD leverage?

Stock CFD leverage is a tool that helps your capital go further when you trade stock CFDs. With leverage, you don’t have to put up the full value of your position in order to open a trade – instead, you only need a deposit known as your margin.

With City Index, for example, you can open a share CFD position with just 20% of its total value in your account. However, your profit or loss will be based on the trade’s total value. So while leverage can magnify profits, it will do the same to any losses.

Learn more about CFD leverage.