This week, AI optimism helped the S&P 500 and the Nasdaq rise to record highs. Stocks continued to hover around these peaks even after US non-farm payrolls came in stronger than expected, resulting in investors pushing back rate cut expectations.

Looking ahead, this week sees the release of US CPI data, just hours ahead of the FOMCE rate decision. The Fed is not expected to cut rates, so the market will be looking for clues about when the Fed may start to cut rates. Hints regarding a September rate cut could help lift stocks higher. However, hotter inflation and a hawkish Fed could pull stocks lower.

Apple’s developer conference

Apple will be in focus at the start of next week as the annual Worldwide Developer Conference (WWDC) returns on June 10th. Investors hope that it will inject some optimism into Apple’s share price after the iPhone maker has had a rough start to the year and after Nvidia leapfrogged Apple to become the second most valuable company on the US stock market.

Nvidia’s surge contrasts with Apple’s lackluster performance, highlighting the growing difference between firms with AI plans and those without. The market will hope that chief executive Tim Cook will use this platform to outline the company's plans for integrating generative AI features into its product.

Apple is being left behind in the AI race, which has boosted the share sales of its major peers. Still, it has been in talks with Google and OpenAI about licensing their models, and Apple does tend to be late to market but with a superior model. Investors will need to have a greater understanding of Apple's AI strategy for shares to rise further and remove the uncertainty that has been clouding its future. This is especially the case given disappointing iPhone sales.

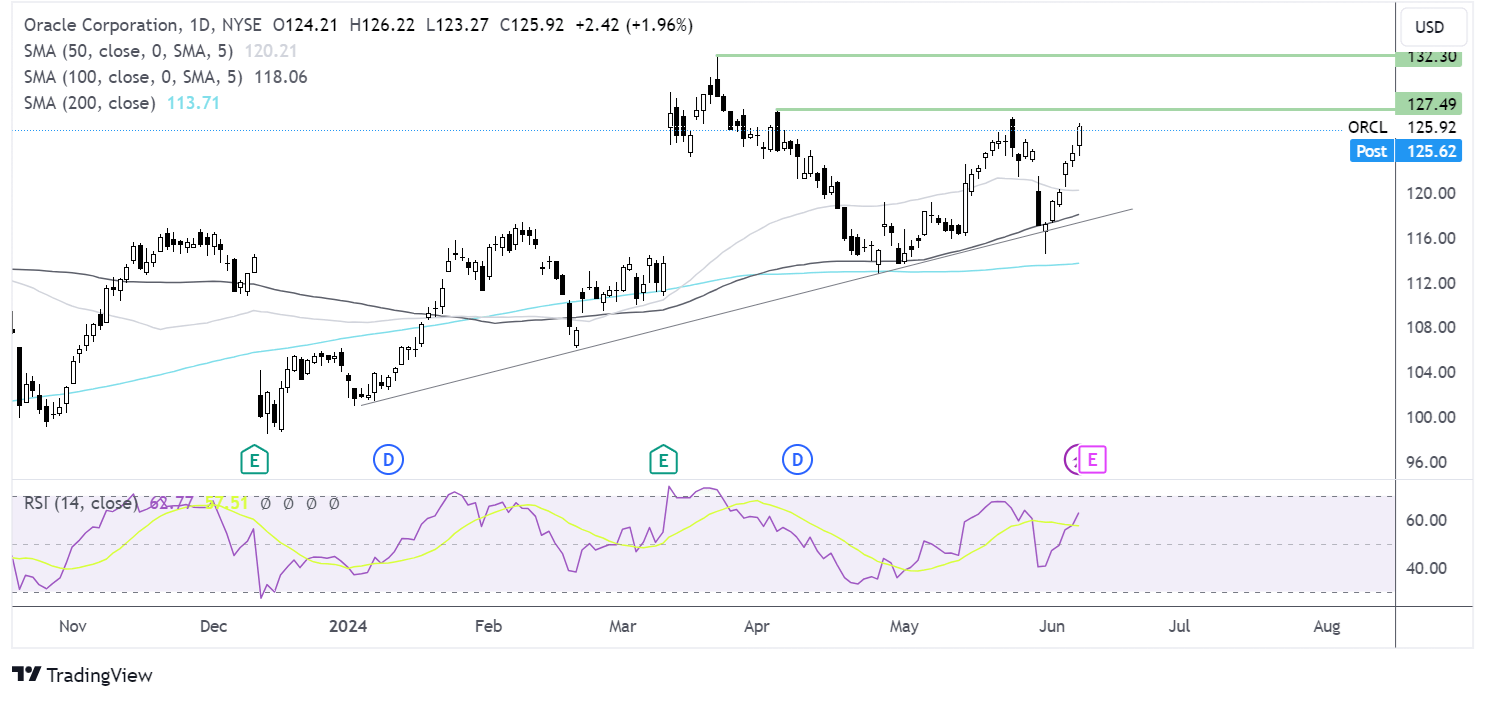

Apple technical analysis

After jumping back above the 200 SMA in May, Apple is trading at a 2024 high just below $200. However, the RSI is on the brink of overbought territory, so buyers should be cautious. A period of consolidation or a pullback could be on the cards.

Above 186.00, the outlook is still constructive. Buyers will look to rise above 200.00 and head towards fresh all-time highs.

Below 186.00, the 200 SMA comes into play at 182.00.

Broadcom Q2 earnings preview

Broadcom, the third-largest US semiconductor company, will report its fiscal Q2 earnings on Wednesday, June 12th. Investors will examine revenue growth driven by AI and updates surrounding AI chip production for its large tech company customers.

Broadcom's revenue is expected to be $12.04 billion, up from $8.73 billion in the same period in 2023. This comes after a 34% increase in revenue in Q1. Revenue from its semiconductor unit rose 4% to $7.39 billion; this figure will be in focus again this quarter, given that its semiconductor can be used in AI data centres. The company has said it expects to generate $1$0 billion in AI-related sales in 2024.

Meanwhile, net income is expected to be $2.22 billion, down from $3.48 billion in the second quarter of 2023.

At the end of May, Nvidia's earnings showed that AI demand remains strong.

The results come as Broadcom trades up 27% since the start of the year and helped power the S&P 500 and the NASDAQ to fresh record highs this week.

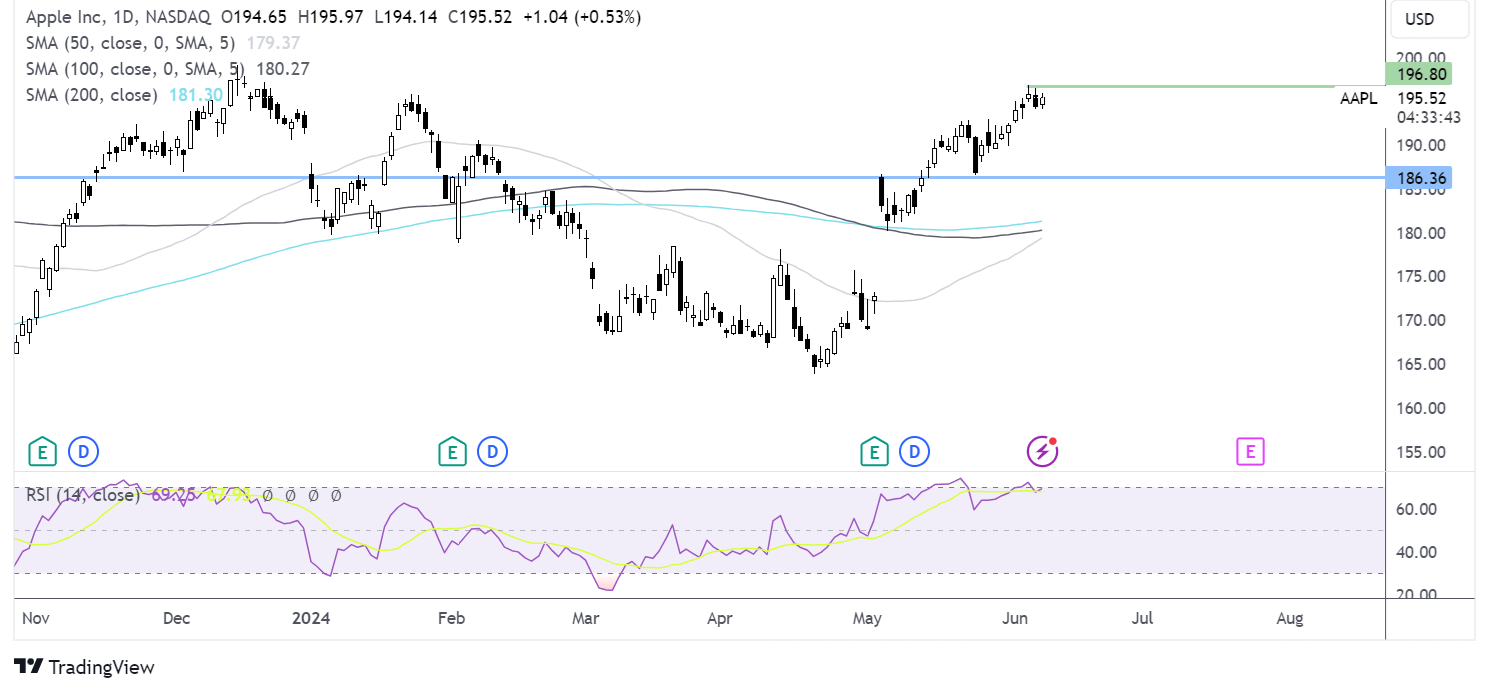

Broadcom technical analysis

Broadcom has been guided higher by the 100 SMA. A recent pullback towards the 100 SMA was short-lived and resulted in a rebound back up towards the ATH at 1445. The bullish engulfing candle, combined with the RSI above 50, keeps buyers hopeful of further gains. 1445 is the target on the upside. On the downside, the 100 SMA at 1300p, which is also the late May low offers support.

Oracle Q4 earnings preview

Oracle is expected to report fiscal Q4 and full-year results on Tuesday, June 11th. The results come as the stocks gained 14% year to date compared to an 11% increase in the S&P 500, while sector peer Salesforce was up 10% across the same period.

Wall Street expects EPS of $1.64, which would mark a 1.8% year-on-year decline, while revenues are expected to be $14.56 billion, up 5.2% from the year-ago quarter.

AI has been one of the biggest boosts to the tech sector right now. A growth opportunity in AI is data centres, where Oracle could be quietly emerging as a major force.

Oracle's March financial results for fiscal Q3 showed company revenue growing 7% year over year; however, almost more importantly, Oracle also recorded an $80 billion order backlog, marking a 29% increase driven by new cloud infrastructure contacts. CEO Safra Catz forecast that 43% of that backlog would be recognized as revenue within a year and also forecasts that the company's cloud infrastructure business could remain in a hyper-growth phase for the foreseeable future.

The market will look for evidence that the backlog was converted into revenue and will also watch closely for signs that AI demand remains robust.

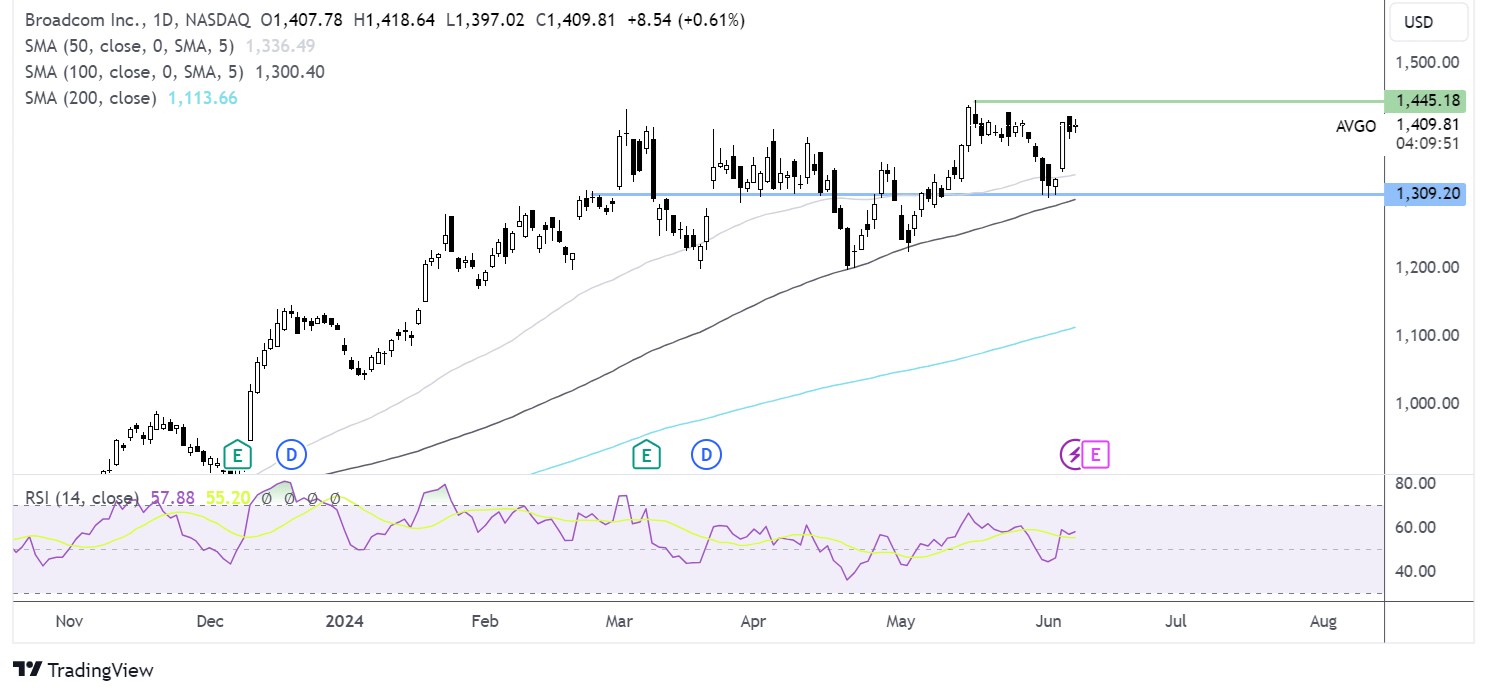

Oracle technical analysis

The Oracle share price briefly spiked below the 100 SMA, finding support just above the 200 SMA before correcting higher. It has risen for the past six consecutive sessions to a high of 126.00.

Buyers, supported by the RSI above 50, will look to test 127.00, the April high, ahead of 132.00 and fresh ATHs. Meanwhile, support can be seen at the 50 sma at 120.00, ahead of the 100 SMA at 118.00.