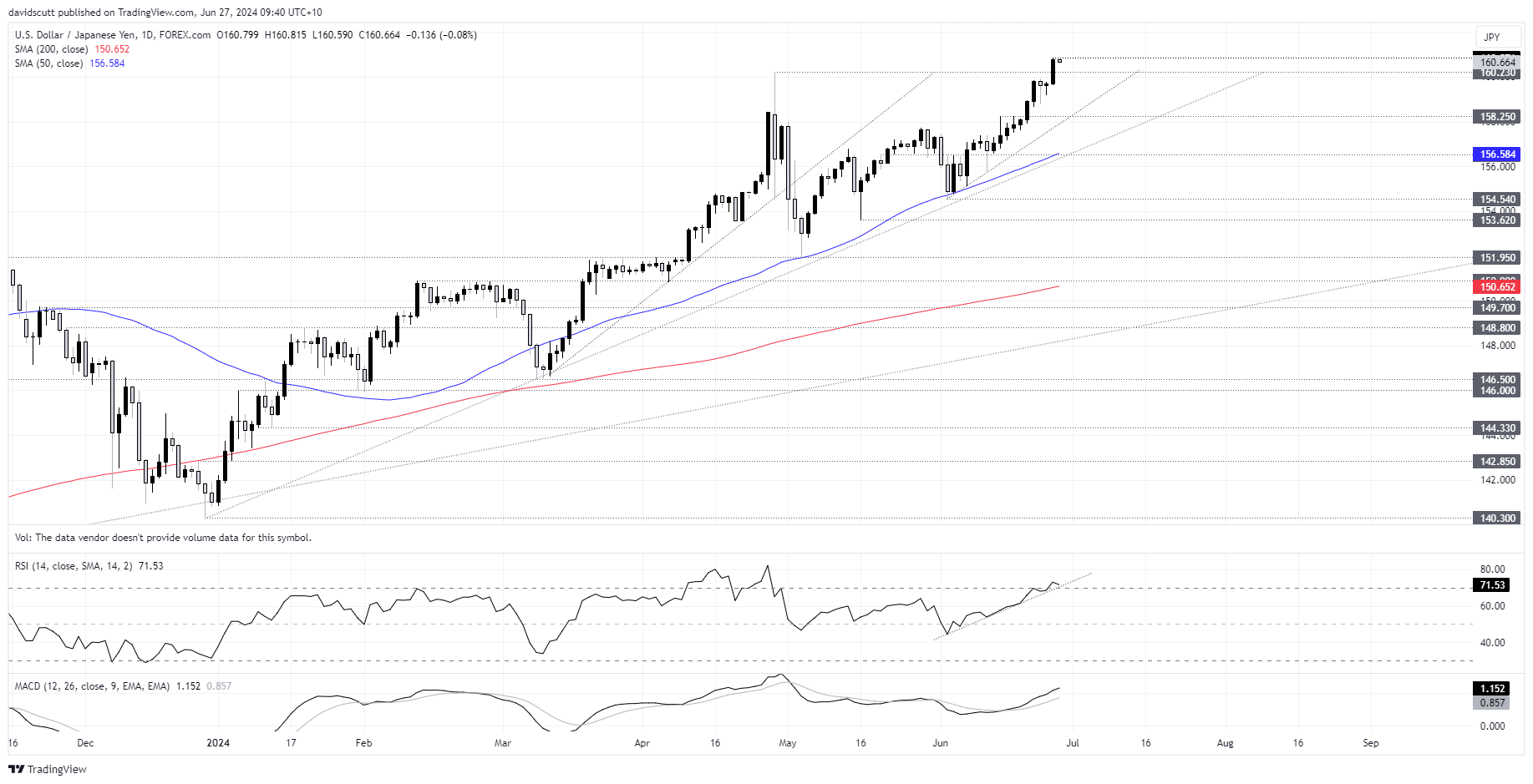

- USD/JPY surged to 34-year highs on Wednesday

- Move was preceded by weakening in the CNH against USD

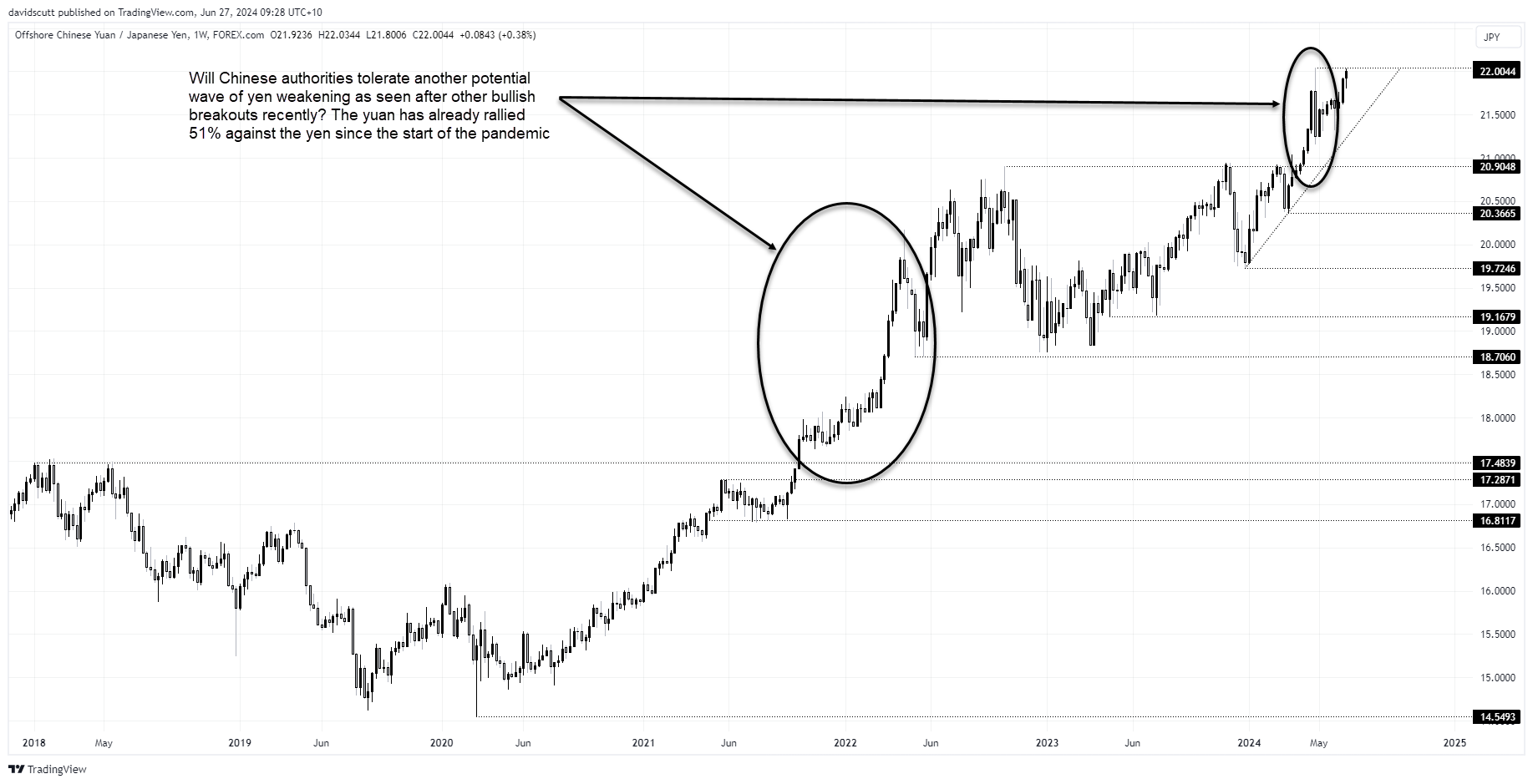

- Chinese yuan has strengthened 51% against the Japanese yen in four years

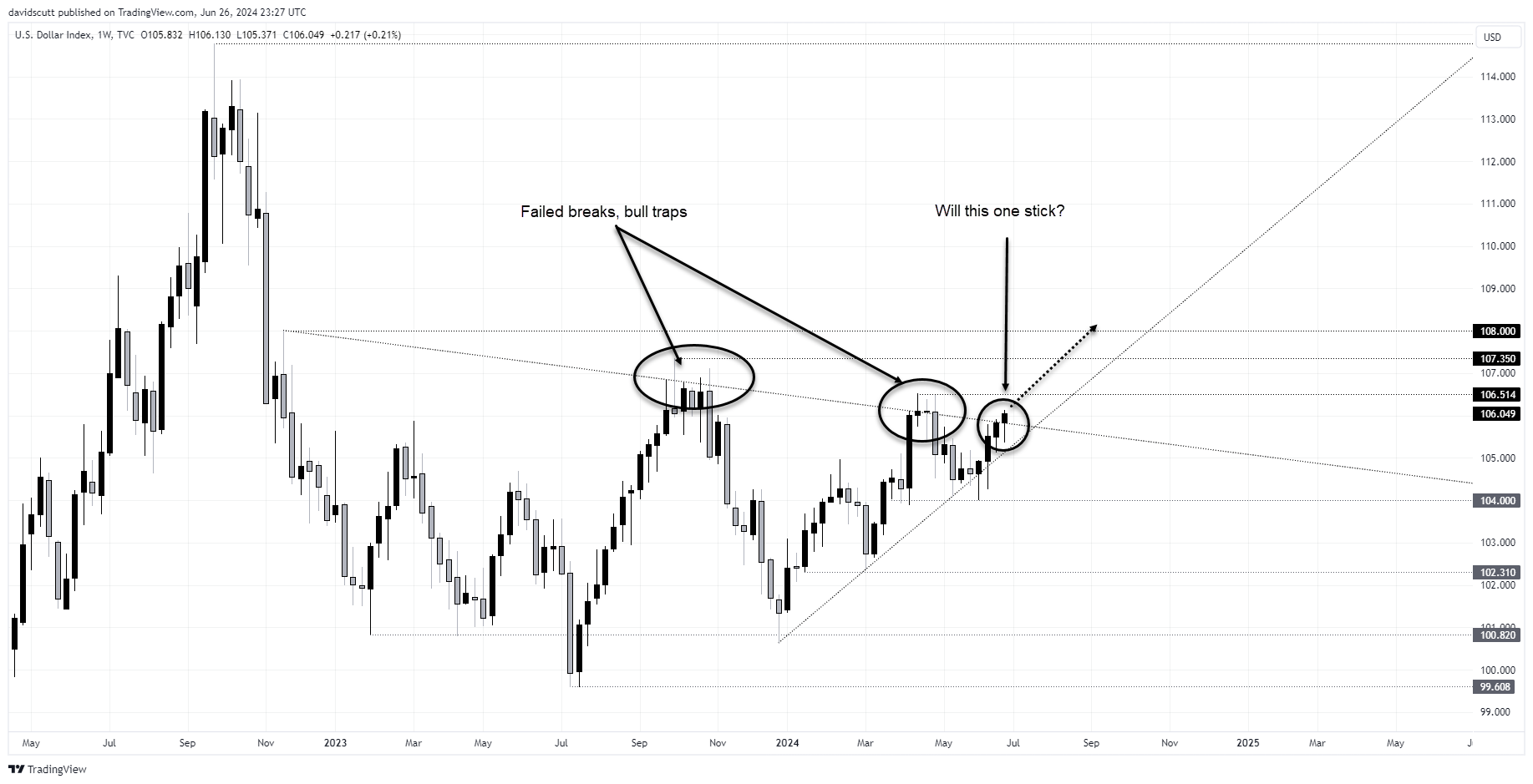

- US dollar index (DXY) attempts bullish break from long-running downtrend

- Traders should be on alert to risk of abrupt intervention from central banks

CNH leading JPY?

If you want insight as to what direction USD/JPY may head next, there are worse indicators out there than USD/CNH right now. Because rather than the Japanese yen leading broader moves against the US dollar, evidence suggests it’s the Chinese yuan that’s the catalyst, at least in recent times.

Look at the one-minute chart tracking movements in USD/CNH, shown in yellow, against USD/JPY in grey on Wednesday. Well before USD/JPY pushed through 160 during the European session, it was USD/CNH that was taking off, breaking above the 2024 highs set earlier this week. USD/JPY followed suit hours later, taking out the 34-year peak of 160.17 set in late April.

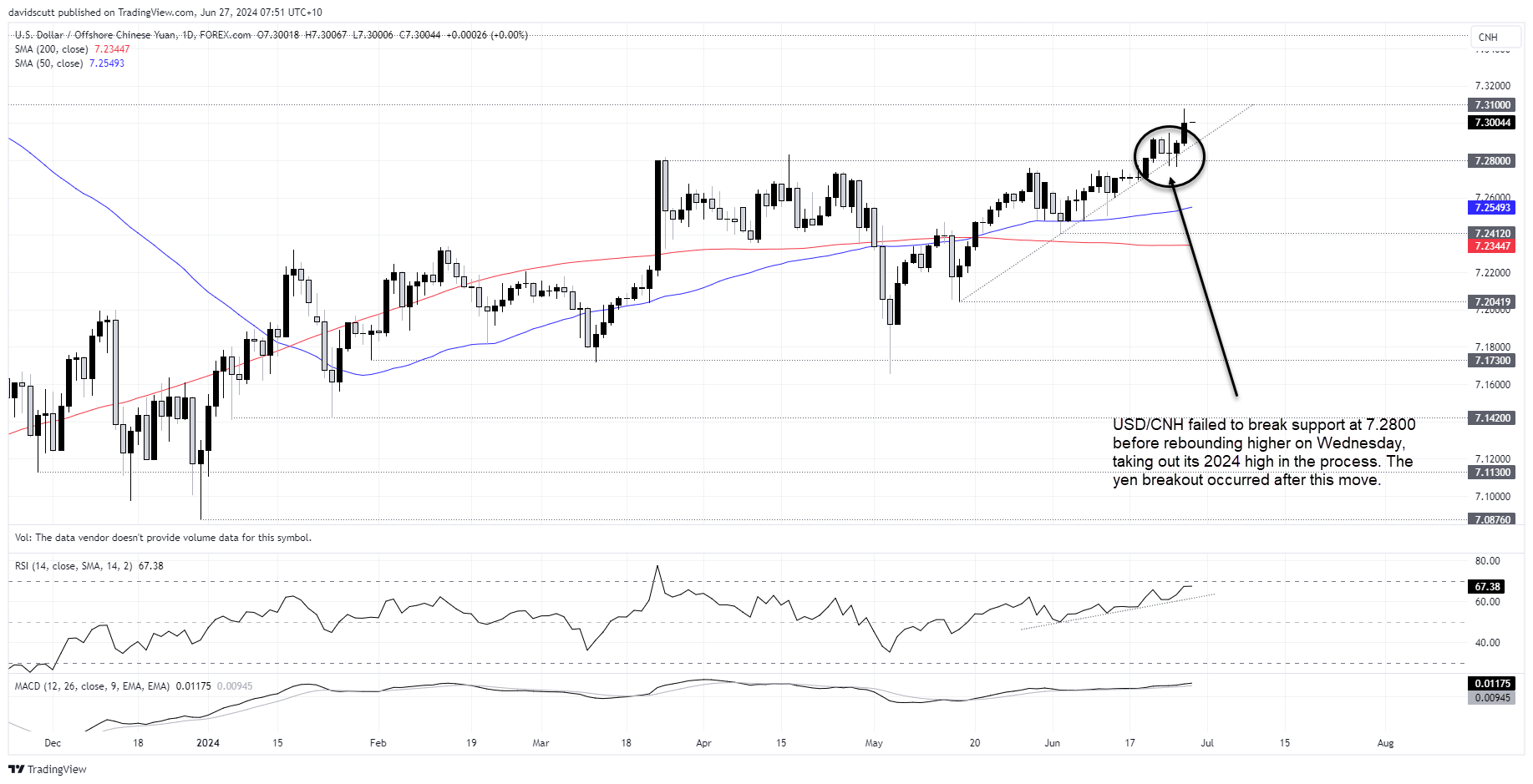

USD/CNH uptrend defended aggressively

When you zoom out and look at the USD/CNH chart, technicals explain a lot of Wednesday’s moves with two attempts to break and close below support at 7.2800 failing earlier this week, resulting in the price squeezing back above uptrend support before going on with the move on Wednesday.

While USD/CNH remains below the record set in October 2022, the price action was similar to that in USD/JPY on Wednesday. It too broke above high set earlier in the week before going on with the move, taking out the prior highs. But it happened after the move in USD/CNH.

Yen at rt risk of further slide against yuan

Though moves in relative interest rates remain important for these pairs, events such as the daily CNY fix from the People’s Bank of China (PBOC) have taken on greater significance given it sets the starting point for onshore trade in the yuan each day, especially when you look at the CNH/JPY cross rate since the onset of the pandemic.

Over that period, the offshore traded yuan has surged over 51% against the Japanese yen, including nearly 12% in 2024. As manufacturing powerhouses to the rest of the world, this makes Japanese goods far more competitive internationally than those from China, placing even more pressure on the Chinese economy at a time when domestic demand is tepid.

When you look at the weekly chart, it shows CNH/JPY sits at a potentially important level, squeezing up against the record highs set in April just before the Bank of Japan (BOJ) was ordered to intervene on behalf of the Japanese government.

Whenever the pair has taken out a meaningful resistance level in the recent past, it’s often kicked on with the move, pointing to the potential for another wave of yen depreciation against the yuan. If that eventuates, how will the PBOC respond?

To date, it’s defended the yuan when market forces have become particularly acute, likely spurred on by concern that further weakness may exacerbate risks of capital flight from within China. But will it keep this approach as it watches a major competitor sit back and allow its currency to spiral down the gurgler? It’s debatable. And the PBOC has form when push has come to shove, as those who have been around for a while found out in 2015.

DXY adds to pain with bullish breakout

The other factor to consider when contemplating what happens next for the yuan and yen is what happens with the US dollar. Its continued strength has defied almost everyone this year, including this scribe. And I was adamant the risk of a no landing scenario was elevated earlier this year. Every time the buck has looked destined for the bin it found a way to rally, including this week.

Combined with weakness in major Asian currencies and election uncertainty in France which has undermined the euro, the US dollar index has broken through the downtrend dating back to November 2022. Having failed to break uptrend support in May and June, you get the sense that should this move stick, we could easily see a run through resistance up to 108.

Assessing intervention risks

Should we see a bullish buck breakout, attention will naturally turn to whether other central banks will attempt to push back against it? We know the PBOC has been fighting dollar strength, so until proven otherwise, that’s the likely course of action. As for the BOJ, it has grounds to suggest the latest leg higher has been highly speculative in nature, as I discussed earlier this week. And the speed of the yen’s decline is also similar to what was seen prior to the intervention episodes earlier this year.

But it is quarter-end and we have major US data on tap in the form of the core PCE deflator on Friday, which is expected to print weak and potentially boost Fed rate cut expectations and lower US bond yields and dollar. If that scenario were to eventuate, the BOJ may hold off. But if we see USD/JPY ignore moves in rates in favour of other riskier asset classes, you’d want to be careful being short yen late in the US session on Friday or early Asian trade Monday...

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade