- USD/JPY analysis: FX intervention causes big moves in popular trading pair

- FOMC, NFP and PMI data among key macro highlights this week for US dollar

- USD/JPY technical levels to watch include 155.00 support

USD/JPY analysis video and insights on precious metals

USD/JPY analysis: Yen upsurge signals Japanese intervention

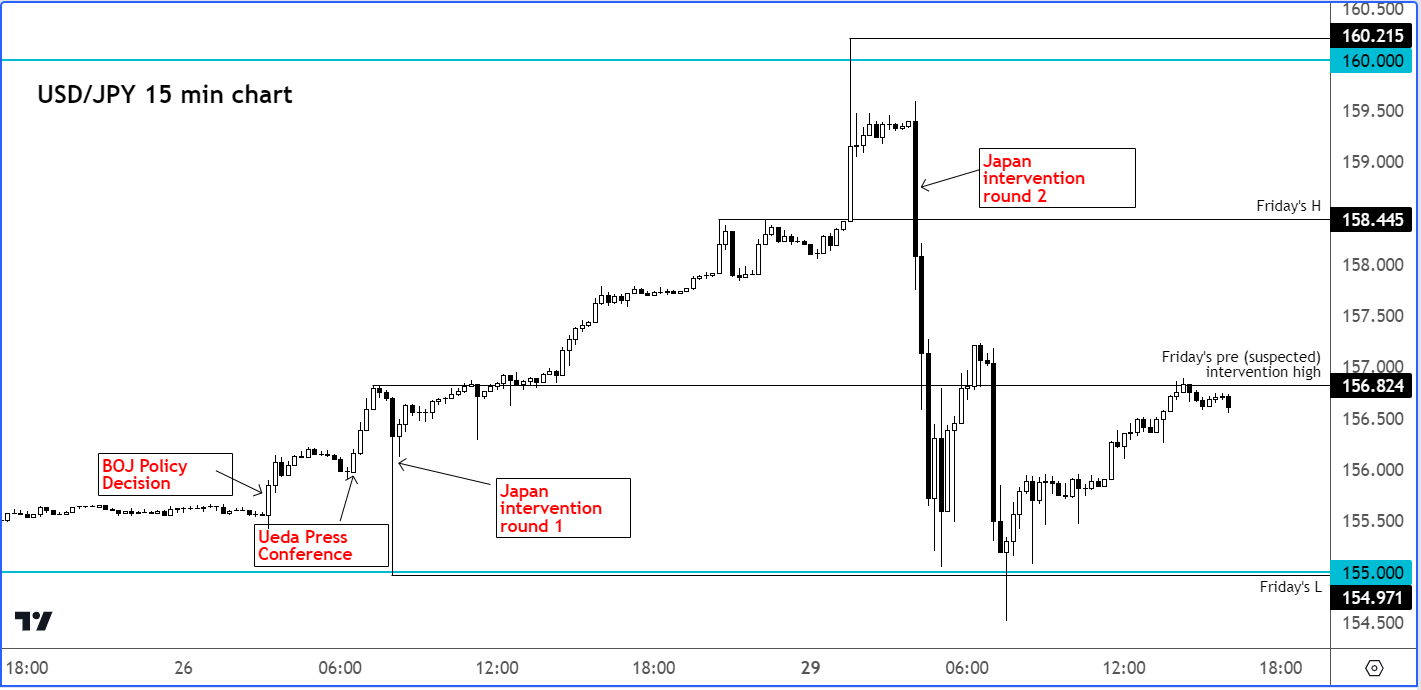

I'm sure you've already seen what's happened overnight in the USD/JPY. Prior to the suspected intervention by the Japanese finance ministry/BoJ, the USD/JPY had initially surged some 500 pips from its low point on Friday to rise above 160.00, before dropping more than 500 pips to below 155.00 and then bouncing back. So, it's been a very volatile session, and may remain that way heading deeper in the week. In this article I will highlight the importance of some key intra-day levels to potentially use as reference points in your trading and analysis.

While we have plenty of macro events from the US to provide the dollar lots of volatility, the focus for the USD/JPY and yen crosses will be on what further steps the Japanese government will take to defend its currency.

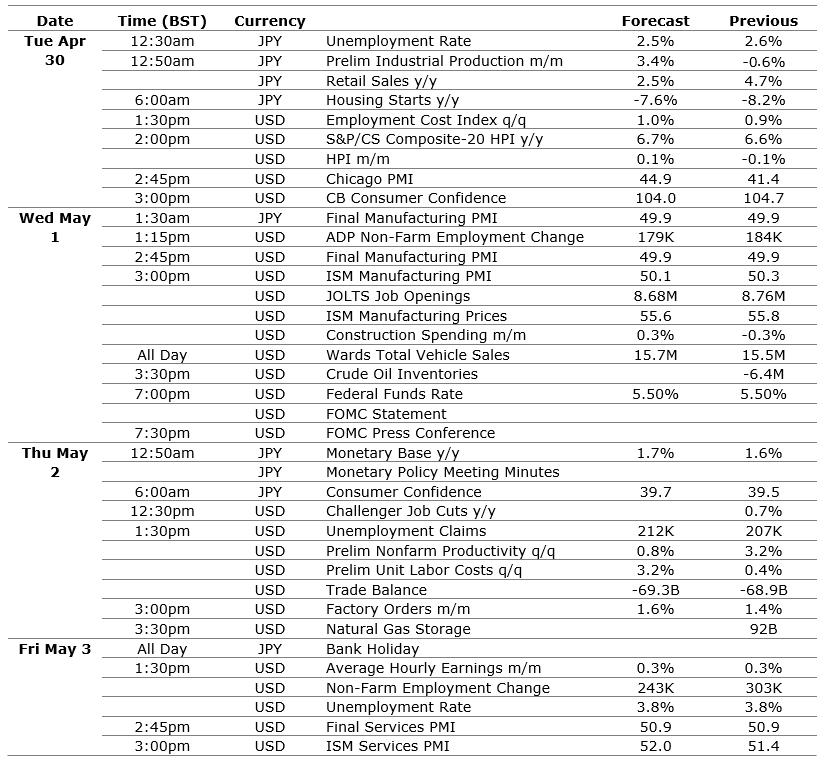

Before discussing the key levels to watch on the USD/JPY, let’s quickly take a look at the data highlights calendar for the USD/JPY this week…

USD/JPY analysis: key macro highlights to watch

Here is a list of all the key data highlights for the USD/JPY this week:

USD/JPY analysis: technical factors and levels to watch

The trend on the USD/JPY is still arguably bullish, despite the suspected intervention from the Japanese finance ministry. I say “suspected” because they haven’t confirmed it. Well, nothing else would have caused such a big move, would it? So, it's got to be intervention from them.

Anyway, the USD/JPY is going to remain quite volatile. Watch out for further intervention. We now know where the line in the sand is for the Japanese authorities. It's at 160.00 or thereabouts. Previously, analysts were thinking it's at 155.00. Incidentally, the latter has now turned into short-term support, and we have seen a big reaction from this level on a couple of occasions already today.

Source: TradingView.com

Moving forward, if we see a recovery in the USD/JPY, do watch out for further big reaction at around the 160.00 level again, should we get there at some point later in the week.

Ahead of 160.00, though, there is another important level that needs to be monitored closely.

On Friday, you may recall that the USD/JPY dropped aggressively at around 8:00am London time, and that looked like the initial round of intervention from the Japanese authorities, although there wasn't any confirmation of that. Friday’s post BOJ-high prior to that drop was around 156.82.

Interestingly, that 156.82 level has served as an important intraday zone during much of Monday’s session. After the USD/JPY bounced off the 155.00 support level on a couple of occasions, rates were consolidating at around that 156.82 at the time of writing. Earlier during the early European trade, the USD/JPY had failed to hold above this level, which then paved the way for a drop to below 155.00 before it bounced again.

So, 156.82 is going to be a pivotal level in the next couple of days, and I wouldn’t be surprised if this now turns into resistance on any recovery attempts.

Meanwhile, a decisive break below the 155.00 support level is still needed to tip the balance in the bears’ favour, who now look like have the BOJ to provide a backstop on any adverse yen movements.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade