GBP/USD rises after UK GDP rises but recession risks remain

- UK GDP +0.3% MoM in Nov

- US PPI forecast to rise 1.3% vs 0.9% prev.

- GBP/USD heads towards 1.28 guided by 20 SMA

GBP/USD is rising for a third straight day and trade at a two-week high as investors digest UK GDP data and look ahead to. US PPI figures later.

The UK economy grew by 0.3% MoM in November, marking a modest rebound, although the strength of the rebound is not sufficient to rule out the prospect of a technical recession in the second half of 2023. Economists had expected an increase of 0.2%.

The data means that GDP for December would need to be flat in order to avoid a contraction in the final quarter of the year.

While GDP data was better than expected, the economic outlook remains gloomy. Even if the economy does avoid a recession, it's expected to remain stagnated.

Meanwhile, the US dollar is edging lower despite yesterday's hotter-than-expected CPI print. Instead, it appears that the market has increased bets of a March rate cut, ignoring comments from Cleveland Fed president Loretta Mester. Mester said the CPI print shows that the Federal Reserve's work is not done and added that it is too early to talk about rate cuts in March, although she also acknowledged that inflation is expected to continue cooling.

Attention now turns to US PPI data, which is expected to show that BPI ticked higher to 1.3%, up from 0.9%. Hotter than forecast PPI data could test March rate cut bets.

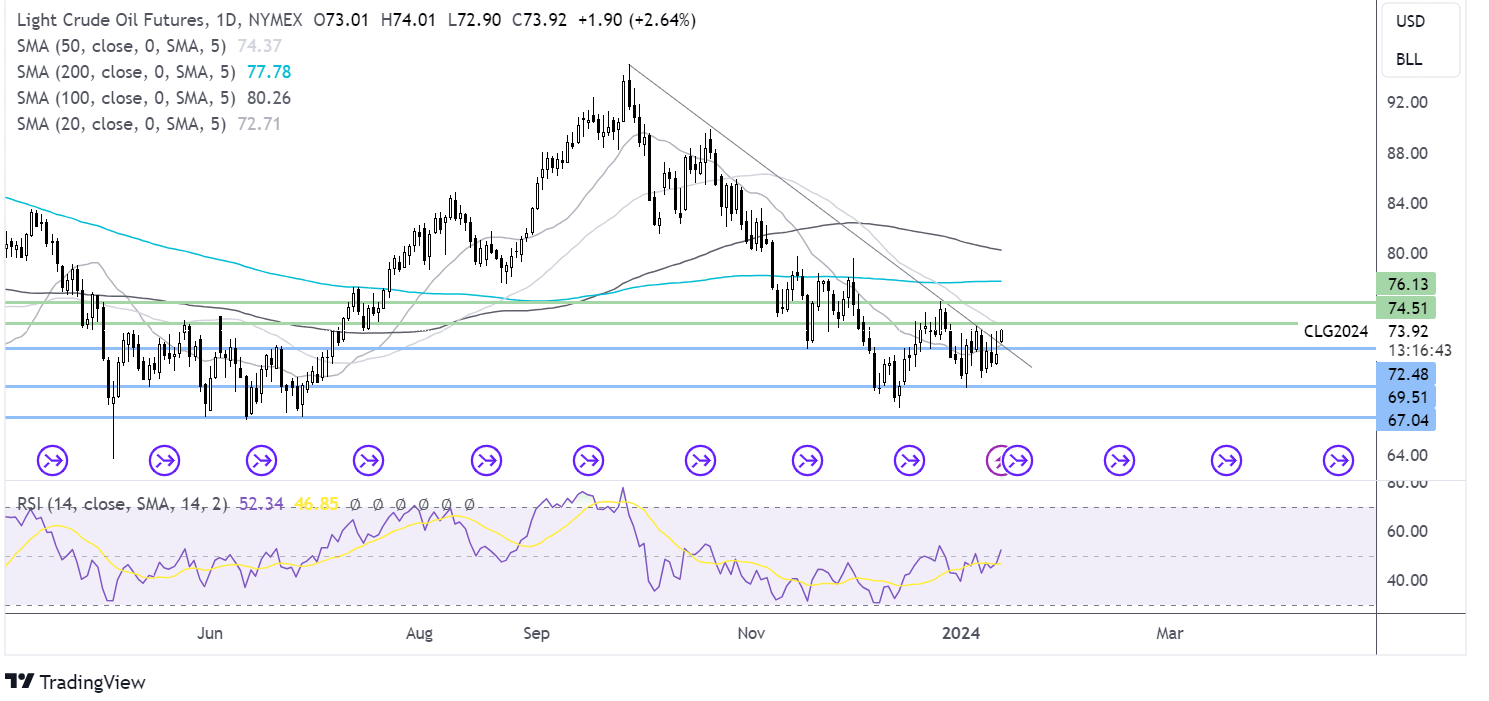

GBP/USD forecast – technical analysis

GBP/USD is being guided higher by the 20 SMA and supported by the RSI over 50. Buyers are looking towards 1.28 as the next hurdle, with a rise above here bringing 1.2830 into play. A rise above here creates a higher high.

On the downside, a break below the 20 SMA at 1.2710 is needed for a retest of 1.2610, the January low.

Oil rises, geopolitical tensions deepen.

- US, UK launched attacks on Houthi targets in Yemen

- Oil on track to end the week flat

- Oil looks to 74.50, last week’s high

Oil prices are rising for a second straight session after a deepening geopolitical crisis in the Middle East puts a risk premium on oil prices.

Yesterday, Iran captured an oil tanker off the coast of Oman. This was then followed by the US-led coalition launching multiple attacks on Houthi targets in Yemen as the militant group disrupted trade in the Red Sea.

Oil prices are on track to end the week little changed after sharp declines at the start of the week after Saudi Arabia slashed its selling prices to Asian importers to a 27-month low. The move highlighted demand concerns.

Stronger-than-expected trade data from China overnight is also supporting the price, showing some signs of recovery.

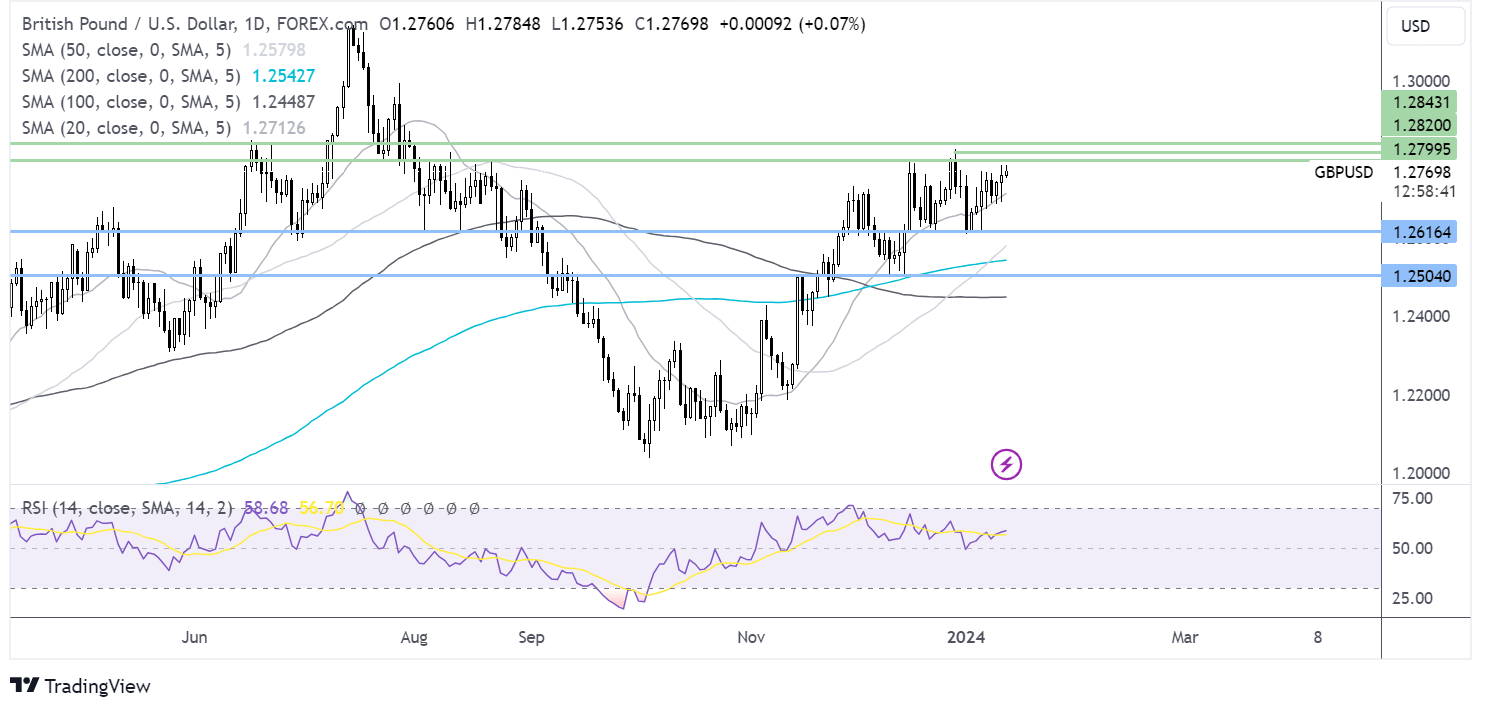

Oil forecast - technical analysis

Oil prices have rebounded from 69.30, the January low, rising above resistance at 72.50. Bulls supported by a rise above 50 on the RSI could look to rise above 74.50, last week’s high, before bringing 76.20, the December high, into focus. A rise above here exposes the 200 SMA.

Meanwhile, support can be seen at 72.40, the falling trendline support and the November low. A break below here brings 69.50 back into focus.