- GBP/USD outlook: US dollar remains in bullish trend amid strong data and a hawkish Fed

- UK economic outlook remains highly uncertain with high inflation and interest rates

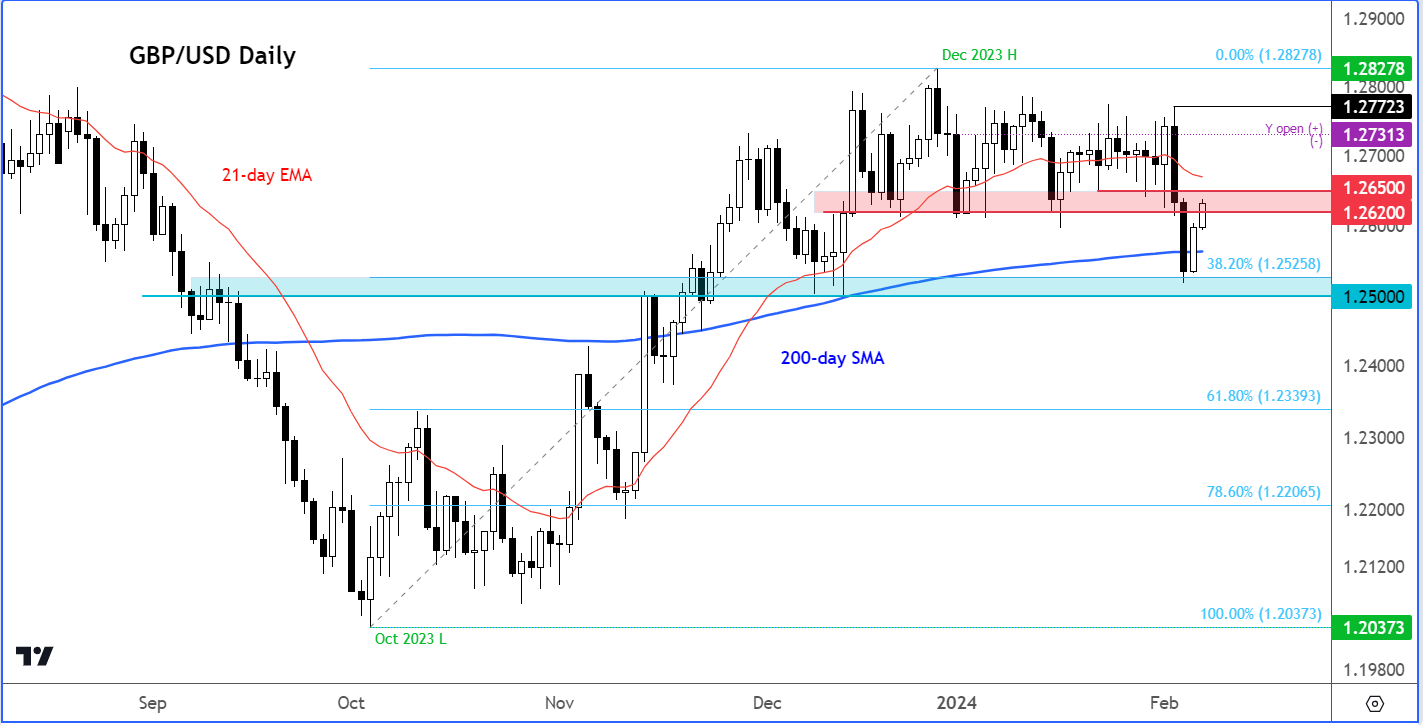

- GBP/USD technical analysis shows cable is now testing a key resistance zone around 1.2620-1.2650 area

The GBP/USD was up for the second day, after finding decent support on Tuesday following a two-day slide. It remains to be seen, however, whether the recovery can last, as expectations of early easing from the Fed fluctuates, but largely, gets pushed out further and further amid a resilient economy and hawkish Fed speak. In the UK, high inflation and interest rates continue to threaten the stagnant economy. Annual CPI inflation has reached 4%, widening divisions among Bank of England rate setters. If you recall, one MPC member voted for a surprise hike last week, while those advocating for a rate cut decreased to 2 from 3. This exacerbates uncertainty about the timing of the first BoE rate cut, supporting the pound in the short-term but raising questions about the longer-term impact on the economy. So, the risks to the GBP/USD outlook are skewed to the downside, I reckon.

GBP/USD outlook: US dollar remains in bullish trend amid hawkish Fed

There was a slight relief in the upward momentum of the dollar on Tuesday as bond yields declined, albeit lacking significant fundamental reasoning. This pullback occurred after the dollar had further strengthened on Monday, following a robust ISM services PMI report, reinforcing the belief that the Federal Reserve would not hastily implement policy easing, especially after Friday's strong jobs report.

Furthermore, there has been an increase in hawkish rhetoric from Fed officials recently, including Cleveland Fed President Loretta Mester and Fed Chairman Jerome Powell, both acknowledging the Fed's caution regarding premature interest rate cuts. That employment report for the month of January has effectively dispelled talks of an immediate reduction in interest rates.

Therefore, I anticipate the dollar will continue to attract buyers during brief declines until there is a fundamental shift. This ongoing dynamic is likely to exert pressure on the GBP/USD pair, despite its rebound.

UK outlook remains highly uncertain

Meanwhile, from the UK’s side of things, there isn’t a lot on the agenda either, to get overly excited about. High inflation and interest rates are continuing to pose a threat to the economy, which has been stagnant for several quarters now. With annual CPI inflation rising back to 4%, the split between the Bank of England’s rate setters widened last week. One of the MPC members voted for a surprise hike, while those in the dovish camp calling for a rate cut fell to 2 from 3. The split means there is now even greater uncertainty over the timing of the first rate cut. While this has provided the pound support as it makes UK interest rates more appealing for yield seekers, the prospects of higher rates for longer means the economic recovery will probably take even longer to resume. This longer-term view is slowly starting to outweigh the benefits the pound is receiving from higher yields in the short term.

GBP/USD technical analysis

Source: TradingView.com

The recovery in the GBP/USD makes a lot of sense, but one that could potentially now fade. After a sharp two-day drop, rates bounced right where they should have – near the 1.25 handle. Here, we had the 38.2% Fibonacci retracement level (1.2525) and 200-day average (1.2562) converging in close proximity to the psychological level (i.e., 1.2500). But now the GBP/USD is testing broken support in the range between 1.2620 to 1.2650. If this area is not reclaimed on a daily closing basis, then we could see the resumption of the downward move and a potential revisit of the 1.25 handle later in the week. But a close above this range would probably lead to a short squeeze back towards 1.27 handle. The bearish trend would become invalidated if Friday’s high ay 1.2772 is taken out.

Video analysis on major FX pairs

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade