EUR/USD struggles amid USD strength; German inflation data up next

- USD rises after hawkish Fed comments & strong US consumer confidence

- German consumer confidence rises to -20.9 vs -24 previously

- German CPI is expected to rise to 2.4% YoY vs 2.2% previously

- EUR/USD struggles at 1.0850

EUR/USD is edging lower for a second day on USD strength and ahead of German inflation data.

The US dollar is rising against its major peers after stronger than expected consumer confidence data and following hawkish commentary from more Federal Reserve officials.

Yesterday Minneapolis Fed president Neel Kashkari said policymakers have not ruled out more rate hikes to combat inflation. His comments come just days ahead of the core PCE index which is the Federal Reserve's preferred gauge for inflation.

The US economic calendar is quiet today with attention and more Fed speakers and the Fed's Beige Book.

Meanwhile losses in the euro are being limited after stronger than expected German consumer sentiment. GfK consumer confidence rose its highest level since April 2022, improving for a fourth straight month. Confidence rose to -20.9 up from -24 and ahead of expectations of -22.4.

Falling inflation Right combined with wage and salary increases strengthen consumer purchasing power lifting confidence.

Attention now turns to German inflation figures which are expected to show a tick higher to 2.4% YoY in April up from 2.2% in March. Data is unlikely to knock the ECB off track from cutting interest rates in June. however hotter than expected inflation could raise questions over the path for interest rate cuts after June.

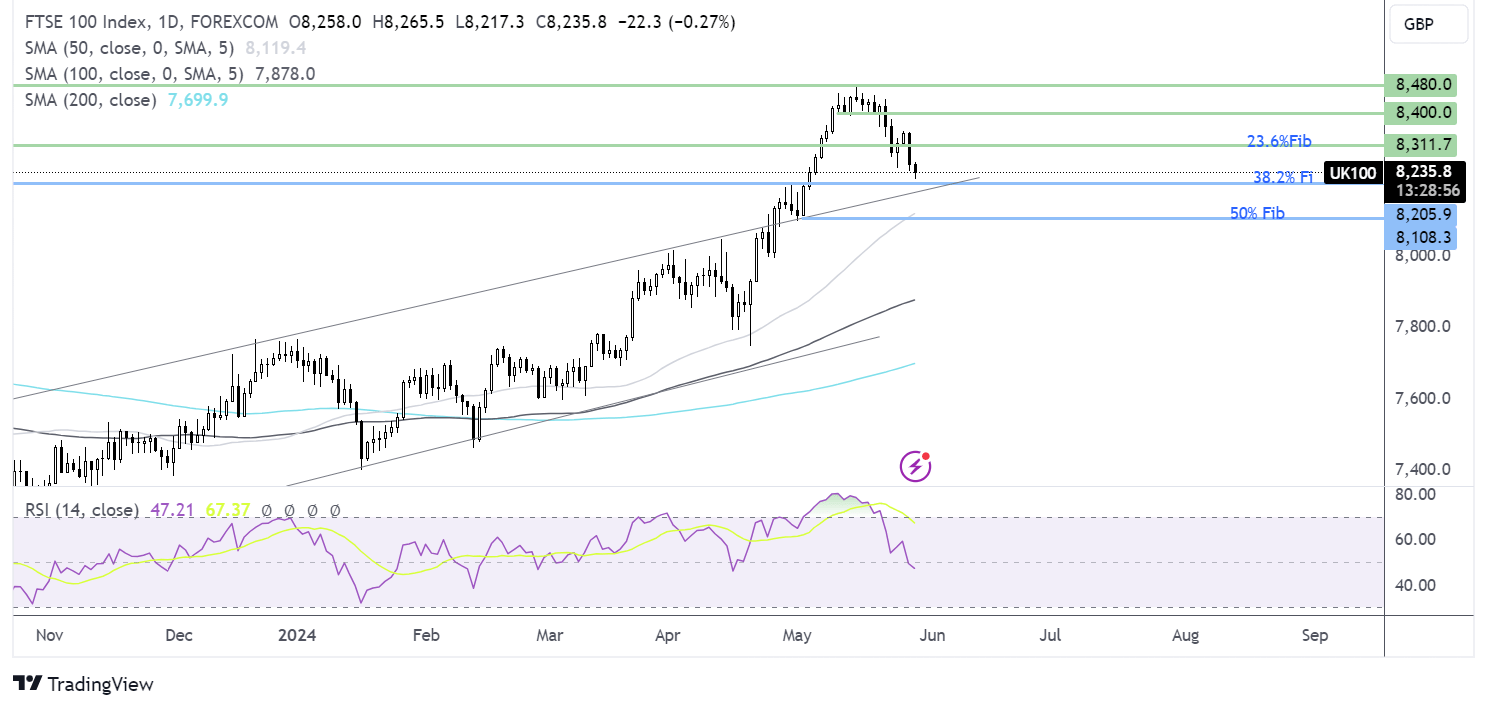

EUR/USD forecast – technical analysis

EUR/USD has corrected lower from 1.09, the May high, and is holding steady at around 1.0850. The pair continues to hold above the multi-month falling trendline and the 100 and 200 SMAs in a constructive pattern.

To extend the move higher, buyers will need to rise above 1.09, bringing 1.0980, the March high, into focus.

However, the long upper wick on yesterday’s candle suggests there wasn’t much buying demand at the higher prices.

Sellers will need to break below 1.0810, the 100 SMA, and 1.0785, the 200 SMA. Below here, sellers could gain momentum towards 1.0725.

FTSE falls, Royal Mail’s takeover is agreed

- FTSE falls as hawkish Fed comments hurt risk sentiment

- China’s IMF GDP upgrade fails to boost miners

- Royal Mail group IDS approves Daniel Kretinsky’s £3.5bn takeover

- FTSE extends decline from record high

The FTSE is falling in early trade, adding to losses from the previous session, as the UK index continues to retreat from its all-time high earlier this month.

Stronger-than-expected US data and hawkish Fed comments have hurt risk sentiment across the markets.

News that the IMF has upwardly revised China's growth forecast to 5% after a solid first quarter and recent supportive policy measures from Beijing have helped oil majors higher but have failed to boost the miners. Anglo-American is trading down 1.5% ahead of a key deadline today for a takeover deal with BHP.

BHP has called for an extension of Anglo-American takeover talks as the world's largest miner attempts to buy its smaller rival for £39 billion. Under UK takeover rules, the Australian firm has a deadline of 5:00 PM UK time today to make an offer for Anglo or walk away.

Also in focus will be IDS owners of the Royal Mail, as Czech billionaire Daniel Kretinsky confirmed a £3.5 billion Royal Mail takeover after the board approved the offer. The deal, including debt, values IDs at £5.28 billion but could still attract scrutiny on national security grounds.

Daniel Kretinsky has pledged not to make compulsory redundancies, to protect the Royal Mail brand, and to keep the company headquartered and tax resident in the UK, which could help to smooth the path for the UK government.

Meanwhile, the UK economic calendar is quiet. Attention will be on Fed speakers later today for further clarification on the likelihood of the Fed cutting rates.

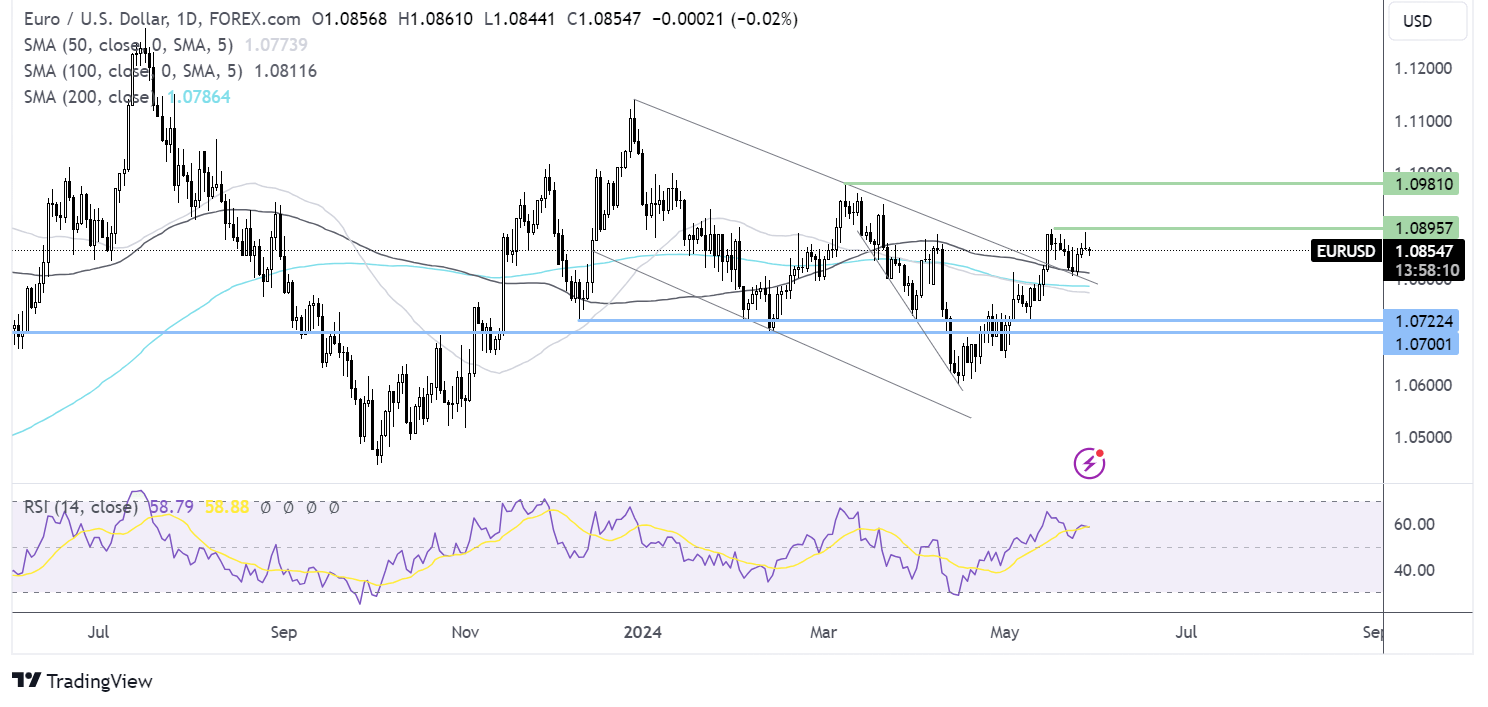

FTSE forecast – technical analysis

After reaching an all-time high of 8480, the FTSE has been trending lower, breaking below 8400 and several key Fib levels as the price heads towards the multi-month rising trendline.

The break below several key support levels and the RSI below 50 keep sellers hopeful of further downside. Immediate support can be seen at 8210, the 28.2% Fib level of the 7750 swing low and, 8480 high, and the April high. A break below here and the rising trendline could negate the recent uptrend. A break below 8100 would create a lower low.

On the upside, any recovery would look to retake 8310, the 23.6% Fib level. A rise above here brings 8400 into play.