After drifting off the market's radar during the second half of 2018, Bitcoin recaptured attention in early April with a rapid-fire 20% one day gain. Fortunate timing given just 24 hours earlier the bullish potential for Bitcoin had been flagged in the City Index Week Ahead video.

In an article we wrote immediately after the initial move, it was advised to retain a core long holding in Bitcoin based on the potential for Bitcoin to trade from its price at the time of 5100 towards 8000.

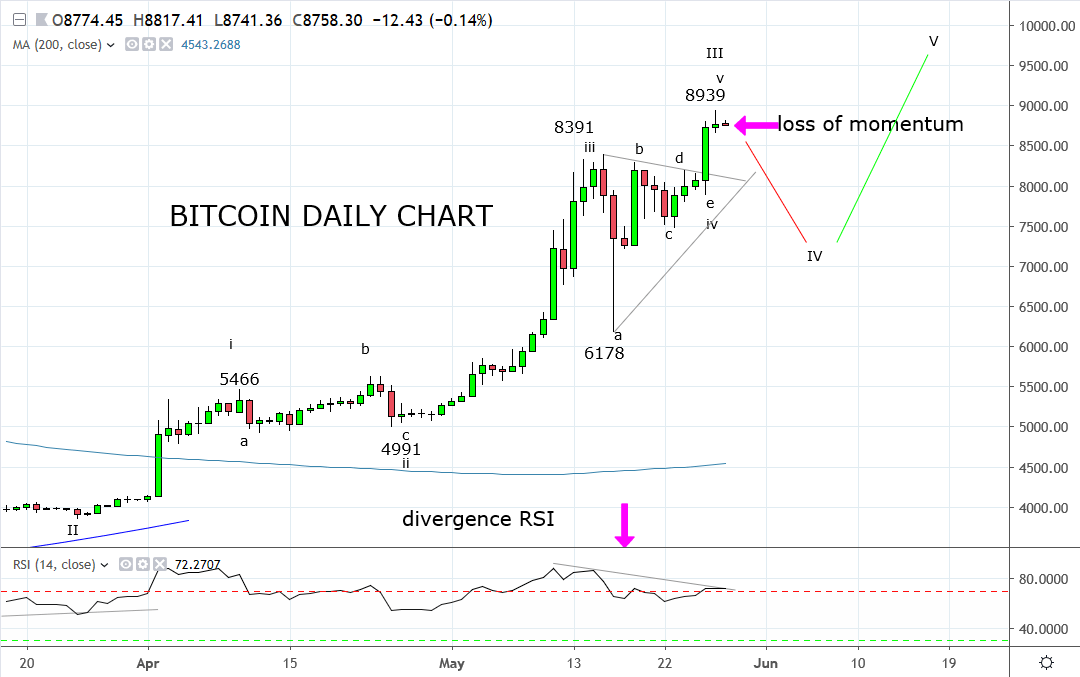

In a follow-up article, written five weeks later and after tuning into the logarithmic chart, it was suggested that the 8000 price target might prove to be a little too conservative in the longer term. To benefit from further upside, it was recommended adding to longs on a dip back towards 6000.

Just a two days later and during the weekend trading when volumes are considerably lighter, the price of Bitcoin fell 25% in only a few hours, reaching a low of 6178 before rebounding just as quickly as it had dropped. If you were out and about and enjoying the weekend like I was, it proved to be a missed opportunity to add to longs.

Before I proceed any further, I do wish to clarify that while I can see the longer term benefits of cryptocurrencies like Bitcoin, the lens through which I trade Bitcoin is predominantly technical rather than fundamental. Through the technical lens, developments in recent days suggest after the most recent surge higher the uptrend in Bitcoin in the near term is tiring and potentially shaping for a pullback.

Firstly yesterdays new high at 8939 was not confirmed by a new high via the RSI indicator. This is what is known as bearish divergence. Furthermore, a daily reversal/loss of momentum type candle has formed. While the combination of bearish divergence and a reversal candle does not guarantee a pullback, it does provide good reason to become a little more cautious, particularly for those chasing the Bitcoin rally higher.

For those that were able to get on the Bitcoin move in the earlier stages of the rally, I feel it prudent to raise the trailing stops on Bitcoin longs to 7780 and look for better levels to re-enter longs.

Source Tradingview. The figures stated are as of the 28th of May 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.