Interest rates trading

-

Tight spreads

Trade interest rate markets from just 0.02pts

-

Range of markets

Speculate on Eurodollar and Euribor rates

-

Go long or short

Profit from both rising and falling interest rates

Why trade interest rates with City Index?

-

No commissions on CFD tradingTrade interest rates commission-free and trade with margin from just 20% on interest rate markets.

-

Trade on leverageTake advantage of leveraged trading products to speculate on future interest rates.

-

Diversify your portfolioTrading on price movements in interest rates allows you to diversify your investment portfolio.

-

ASIC regulatedCity Index is regulated by the Australian Securities and Investment Commission.

Interest rates news and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

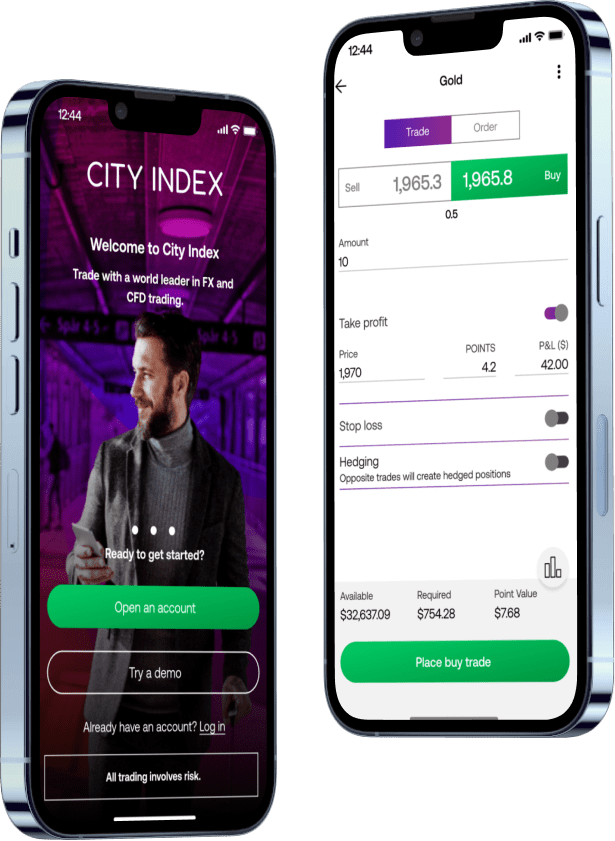

Mobile trading app

Seize trading opportunities with our easy to use mobile apps, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

Portable TradingView charts

Access the industry leading TradingView charting package, complete with 80+ custom indicators, drawing tools and trading through charts.

Multi-device dealing

Manage your trading account across desktop, mobile and tablet without interruption.

Actionable market analysis

Receive all the latest market news and expert commentary direct from Reuters in-app.

Frequently asked questions

What interest rate markets can I trade?

With your City Index account, you can trade CFDs on three short-term interest rate markets: short sterling, Eurodollar and Euribor. All come with margin of 20% and spreads starting at just 0.02 points.

Learn more about interest rate CFDs.

What does it mean to trade interest rates?

Trading interest rates means opening a short or medium-term position that makes money if rates rise (if you’re long) or fall (if you’re short). Interest rate trading is based on the prices of interest rate futures, which reflect where the markets expect rates to head next.

As with any form of trading, you’ll earn a profit if the underlying market moves in your favour, and a loss if it moves against you. Many traders use interest rates as a ‘safe haven’ market to protect their portfolios against volatility.

Learn more about how to trade interest rates.

How do you trade interest rates?

To trade interest rates, you need to follow these five steps.

- Open a trading account. Getting a City Index account is free and usually takes minutes

- Add some funds, so you can start trading interest rates immediately

- Choose the interest rate market that you want to trade and whether to go long or short

- Decide how much you want to risk on your position and set up your stop loss and take profit orders accordingly

- Execute your order

If the interest rate market moves in your chosen direction, you’ll make a profit. If not, you’ll make a loss. You can also trade interest rates with zero risk using our free trading demo.