Popular instruments

Forex explained

When is the forex market open for trading?

The forex market is open for trading 24 hours a day, five days a week. That means with FX, you can build your trading strategy around your schedule, instead of having to conform to when a stock exchange is open.

However, there are times when the market is much more active, and times when it is comparatively dormant. To learn the best times to trade forex, read our FX market hours page.

Where is forex traded?

Forex is traded via a global network of banks in what’s known as an over-the-counter market – unlike shares and commodities, which are bought and sold on exchanges. Because of this, you can trade forex 24-hours a day five days a week.

FX trading is split across four main ‘hubs’ in London, Tokyo, New York and Sydney. When banks in one of these areas close, those in another open, which is what facilitates round-the-clock trading.

However, there’s no physical location where these banks and individuals trade with each other. Instead, it is entirely online.

Learn more about how to trade forex.

Why do people trade currencies?

People trade currencies for lots of different reasons. You’ve probably traded a currency if you’ve ever bought goods overseas, for example, or gone on a foreign holiday. However, the vast majority of FX trading is done for profit.

Currencies are constantly moving in value against each other. On any given day, the pound might be rising against the dollar, while the euro falls against the Swiss franc. Forex traders buy and sell currency pairs to try and take advantage of this volatility and earn a return.

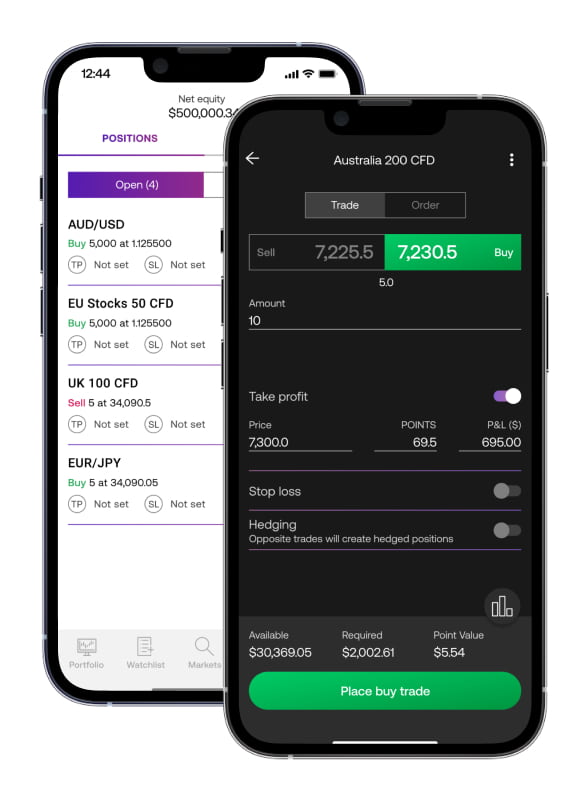

For instance, if the Australian dollar is rising against the US dollar, you might buy AUD/USD. When you buy this pair, you’re buying Australian dollars (AUD) by selling the US dollar (USD). Then, if Australian dollars continue to outpace US dollars, you can sell the pair to exchange your AUD back for USD and keep the difference as profit.

Confused? See more examples of how FX trading works.