ETF trading

Trade a wide range of assets from a single position with our range of exchange traded funds (ETFs).

• How to trade ETFs

• Investing in lithium with ETFs

• How to trade on volatility

• How to invest in commodity ETFs

• How to invest in emerging markets with ETFs

What is ETF trading?

ETF trading is the act of speculating on an exchange traded fund – an instrument that tracks a basket of underlying assets, which could include shares, commodities or currencies.

When you buy an ETF, you get exposure to a range of assets from one single position, which are either physical assets or instruments that mimic the returns of a market. When you trade an ETF, you receive the same exposure but without owning the underlying market – you’re simply speculating on whether the price of an ETF will rise or fall in value.

ETF trading works by tracking the price of an ETF, which in itself will replicate the returns of the underlying asset (or assets) they contain. Like shares, ETFs are bought and sold on stock exchanges – this means the price of an ETF fluctuates throughout the day. Your profit or loss would be determined by how much the ETF’s value has increased between the point you bought the ETF and the point you choose to sell the ETF.

You can also short an ETF using the same investment strategy as shorting a stock. For example, say you thought the price of an ETF was going to fall and you opened a short trade of 5 CFDs. If the market fell by 20 points and you closed your trade, your profit would be $100 – that’s the 20-point difference multiplied by the 5 contracts you bought. But if the ETF’s value rose by 20 points, you’d lose $100.

ETFs are usually passively managed, so once the fund has been established, there are very few alterations to its composition. However, you can find actively managed ETFs that are regularly adjusted by fund managers.

How to trade ETFs

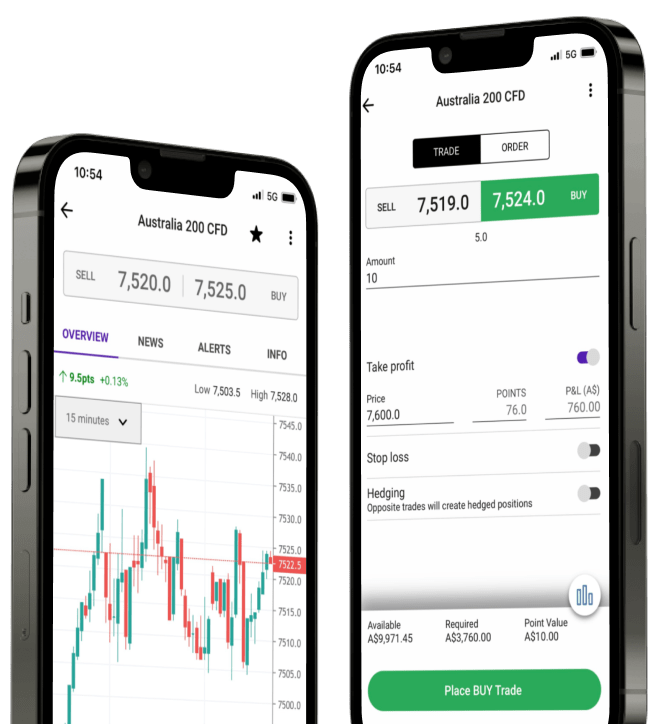

You can speculate on the price of ETFs using CFDs – start trading now by following these easy steps:

- 1. Learn how to trade CFDs

Find out how CFDs work and the benefits of trading derivatives

- 2. Create an account with City Index

Get started trading on live markets, or practise trading in a risk-free demo account first

- 3. Search for the ETF you want to trade

Decide which ETF you’re interested in and find it on our award-winning platform

- 4. Decide whether you want to go long or short

Click ‘buy’ if you think the market will rise in price, and ‘sell’ if you think it will fall

- 5. Open your position

Enter the market by clicking ‘place a trade’, you may want to consider adding a stop loss to your trade to manage your risk

- 6. Monitor and close your trade

Use analysis to stay up to date with any price movements and identify an exit point for your position

Want to trade a particular ETF but can’t find it on our platform? Get in touch with a member of our team and you might be able to trade it with us soon.

Investing in lithium with ETFs

Lithium has turned into one of the most valuable commodities around, fueled by the rising global demand for electric vehicles. This surge in interest has focused attention on the companies that unearth this precious mineral and beyond.

Many companies quoted on stock markets are big in lithium without being involved in extracting or refining the ore. Some companies develop batteries, others concentrate on extracting the mineral while others are involved in the research and development side.

All of this makes lithium stocks a popular choice for traders – but how should you trade them?

ETFs vs futures

A futures contract is an alternative way to trade lithium stocks. In its traditional form, it is an agreement by one party to take delivery of something – lithium in this case – at a specified future date for a pre-determined price.

ETFs are more suited to long-term investors. While they may not always be cheaper every quarter than futures, the cost of an ETF is generally more predictable as futures prices are more reactive to supply and demand. When you factor in the complexities of calculating a rolling contract, investing in lithium stocks with ETFs is a more accessible option over the long term.

How to trade on volatility

Market volatility is the rate at which an asset’s price fluctuates over a period of time. It’s used to describe short-term, rapid price movements. While most financial markets experience intraday movements, volatility is defined by the speed and degree of change. Volatility is seen as an indicator of the level of fear in the market. When there is uncertainty, price movements can become erratic and unpredictable as even the smallest piece of news can cause outsized price movements.

As no market condition is guaranteed, you’ll want to ensure you have strategies for both high and low volatility. Your strategy will very much depend on your risk appetite. During periods of low volatility, it’s still possible to seek out assets that are still ‘in play’ and moving because of news, data releases, earnings, and so on. You especially don’t want to be opening lots of trades to try and counteract the lack of volatility and end up entering markets you’re not familiar with.

Traders looking to take advantage of high volatility may look to a couple of our most popular global ETFs:

• ProShares Ultra VIX ST – this ETF provides leveraged exposure to the S&P 500 VIX short-term futures index, which rises when there’s an increase in the expected volatility of the S&P 500. It seeks a return that is 1.5x the return of its underlying benchmark for a single day

• ProShares VIX ST – the non-leveraged ProShares VIX ST provides standard long exposure to the S&P 500 VIX short-term futures index; it rises when there’s an increase in the expected volatility of the S&P 500

How to invest in commodity ETFs

Commodity ETFs usually hold a physical commodity in storage or are invested in futures contracts. They can hold a range of commodities, including agricultural goods, precious metals, energies and natural resources.

These ETFs are particularly popular among less-experienced traders as they provide the opportunity to trade commodities without having to learn the intricacies of futures contracts.

Commodity ETFs can also refer to commodity index ETFs or sector ETFs, which track companies within the supply chain.

Learn how to trade commodities.

How to invest in emerging markets with ETFs

ETFs offer an easy, cost-efficient way to invest in emerging markets worldwide. There are many index ETFs to choose from – here are a few notable examples to help you choose your investment.

• Vanguard FTSE All World ex-US Small-Cap ETF. This fund follows the FTSE Global Small Cap ex-US index, which includes smaller stocks listed in both developed and emerging markets in any country that isn’t the United States

• iShares India 50 ETF. Indices aren’t only found in developed economies. The iShares India 50 ETF holds 50 of the biggest companies in India

• VanEck Russia ETF. This ETF enables you to invest in the MVIS Russia Index, which holds some of the biggest companies incorporated in Russia, or that derive at least 50% of their revenues from Russia

Ready to trade your first ETFs? Follow these three steps to get started:

- Open your City Index trading account and add some funds

- Browse our range of ETFs, plus 1000s of other funds and stocks

- Choose your ETFs and add them to your portfolio

You can close your position by selling your shares in the fund. If it has gone up in value, you’ll earn a profit – but if it has fallen, you’ll earn a loss.

Open a City Index account and benefit from competitive spreads and fast, reliable execution.

- Award-winning platforms and apps

- Exclusive trading tools like Guaranteed Stop Loss Orders and Performance Analytics

- Fast, secure deposits and withdrawals