Trade commodities with CFDs

-

Commodity markets

Gain exposure to geopolitical events through 25+ different commodities including gold, US crude, coffee and natural gas.

-

Spread pricing

We’re lowering the cost of trading, with spreads from just 0.06pts.

-

Futures contracts

Speculate on a range of commodities with fixed-date futures contracts.

CFD trading is a popular way to trade commodities. City Index offers a wide range of 25+ energy, grain and soft commodities futures.

-

Integrated Reuters news feedStay abreast of breaking stories impacting global commodity prices through our exclusive Reuters feed delivered in-platform.

-

Advanced chartingTake advantage of the industry-leading TradingView charting package to trade global commodity markets, with 80+ indicators and one-click trading.

-

A globally trusted providerTrade with a trusted market leader that's regulated in Australia since 2006.

Popular commodity markets

Competitive pricing

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Major commodity market news

Latest research

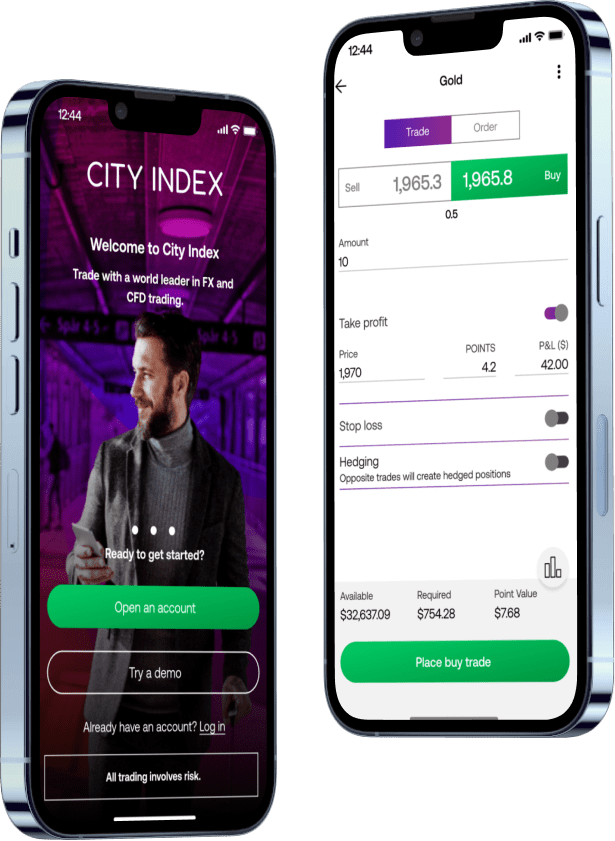

Trade commodities with CFDs using our award-winning trading platforms

Mobile trading app

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with in-chart trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful market data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade commodities?

Discover everything you need to know about commodity markets, such as gold, oil and natural gas, including both hard and soft commodities.

How to trade futures?

Master the basics of trading commodity futures contracts as CFDs, including practical examples.

What is gold and silver trading?

Learn how to trade precious metals and how they can help diversify your portfolio.

Frequently asked questions

How do you trade commodities with CFDs?

To trade commodities with CFDs, you’ll first of all need to learn how commodity CFDs work. Then, you can open a CFD account and use it to buy and sell oil, gold, silver and more.

Commodity CFDs work using contracts that track the live prices of commodity markets. Buying or selling one of these contracts is equivalent to trading a standard amount of the underlying commodity it tracks – and gives you the same exposure as trading the commodity in the open market.

However, you’ll never actually own the commodity or future that you’re trading, so you don’t need to worry about taking delivery or storage.

A City Index account enables you to trade our full range of commodity markets alongside indices, shares, forex and more. Open your trading account here.

What are the main drivers of commodity prices?

As with any financial market, commodity prices are driven by the laws of supply and demand. However, each commodity is different. The supply of oil is very different to that of gold, for example.

Oil is drilled around the world, then refined and transported in tankers, oil pipelines and more. Global supply can be fragile, with natural disasters or international conflict often seeing its price spike.

Demand, meanwhile, is driven by world industry. When the economy is growing, oil demand tends to rise. When the economy stalls, oil’s price might fall.

Gold is mined around the world, but unlike oil is very rarely consumed – so gold supply is constantly rising. Overall, the precious metal’s supply is less fragile than that of energy markets.

Its demand picture, too, is unique. Gold is prized for its ability to hold value and is stored by lots of central banks around the world. When volatility peaks, investors may try to buy gold as a ‘safe haven’, causing its price to rise.

Learn more about what drives gold and oil prices.

What are the most-traded commodities

The most-traded commodities tend to be gold, silver and oil. Gold is often used by traders as a hedge against volatility, as it’s seen to hold its value when other markets go awry. And as the resource that powers the global economy, oil markets can see some powerful volatility.

Here are the five top-traded commodity markets on the City Index platform:

- Gold

- Silver

- US crude oil

- UK crude oil

- Carbon emissions

Which way will they head next? Log in to take your position.